Referred to Committee on

advertisement

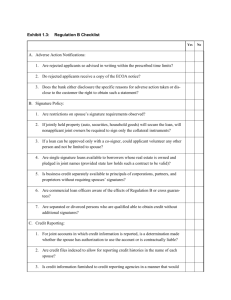

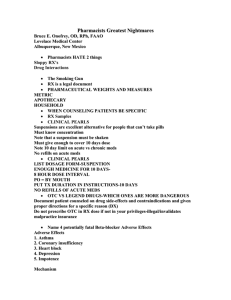

BILL AS INTRODUCED 2007 1 2 H.329 Page 1 H.329 Introduced by Representatives Keenan of St. Albans City, Acinapura of 3 Brandon, Bostic of St. Johnsbury, Heath of Westford, Hunt of 4 Essex, Hutchinson of Randolph, Johnson of South Hero, Larson 5 of Burlington, Miller of Shaftsbury and Morley of Barton 6 Referred to Committee on 7 Date: 8 Subject: Banking and insurance; use of credit history 9 Statement of purpose: This bill proposes to require insurers to notify 10 applicants when the insurer takes an adverse action as a result of the applicant's 11 credit score. 12 13 AN ACT RELATING TO USE OF CREDIT INFORMATION IN PERSONAL INSURANCE 14 It is hereby enacted by the General Assembly of the State of Vermont: 15 Sec. 1. 8 V.S.A. § 4724a is added to read: 16 § 4724a. USE OF CREDIT HISTORY 17 (a) When used in this section: 18 (1) “Adverse action” means a denial or cancellation of, an increase in 19 any charge for, or a reduction or other adverse or unfavorable change in the www.leg.state.vt.us BILL AS INTRODUCED 2007 H.329 Page 2 1 terms of coverage or amount of any insurance, existing or applied for, in 2 connection with the underwriting of personal insurance. 3 4 5 6 (2) “Affiliate” means any company that controls, is controlled by, or is under common control with another company. (3) “Applicant” means an individual who has applied to be covered by a personal insurance policy with an insurer. 7 (4) “Consumer” means an insured or an applicant for a personal 8 insurance policy whose credit information is used or whose insurance score is 9 calculated in the underwriting or rating of a personal insurance policy. 10 (5) “Consumer reporting agency” means any person that, for monetary 11 fees or dues or on a cooperative nonprofit basis, regularly engages in whole or 12 in part in the practice of assembling or evaluating consumer credit information 13 or other information about consumers for the purpose of furnishing consumer 14 reports to third parties. 15 (6) “Credit information” means any credit-related information derived 16 from a credit report, found on a credit report itself, or provided on an 17 application for personal insurance. Information that is not credit-related shall 18 not be considered “credit information,” regardless of whether it is contained in 19 a credit report or in an application or is used to calculate an insurance score. 20 21 (7) “Credit report” means any written, oral, or other communication of information by a consumer reporting agency bearing on a consumer’s credit www.leg.state.vt.us BILL AS INTRODUCED 2007 H.329 Page 3 1 worthiness, credit standing, or credit capacity that is used or expected to be 2 used or collected in whole or in part for the purpose of serving as a factor to 3 determine personal insurance premiums, eligibility for coverage, or tier 4 placement. 5 (8) “Insurance score” means a number or rating that is derived from an 6 algorithm, computer application, model, or other process that is based in whole 7 or in part on credit information for the purposes of predicting the future 8 insurance loss exposure of an individual applicant or insured. 9 (9) “Personal insurance” means private passenger automobile, 10 homeowners’, motorcycle, mobile-homeowners’ and noncommercial dwelling 11 fire insurance policies, and boat, personal watercraft, snowmobile, and 12 recreational vehicle policies. Such policies must be individually underwritten 13 for personal, family, or household use. No other type of insurance shall be 14 included as personal insurance for the purpose of this section. 15 (b) Adverse action notification. If an insurer takes an adverse action based 16 upon credit information, the insurer must meet all of the notice requirements of 17 this section. The insurer shall: 18 (1) Provide notification to the consumer that an adverse action has been 19 taken in accordance with the requirements of the federal Fair Credit Reporting 20 Act, 15 U.S.C. § 1681m(a). www.leg.state.vt.us BILL AS INTRODUCED 2007 1 H.329 Page 4 (2) Provide notification to the consumer explaining the reason for the 2 adverse action. The reasons must be provided in sufficiently clear and specific 3 language so that a person can identify the basis for the insurer’s decision to 4 take an adverse action. The notification shall include a description of up to 5 four factors that were the primary influences of the adverse action. The use of 6 generalized terms such as “poor credit history,” “poor credit rating,” or “poor 7 insurance score” does not meet the explanation requirements of this section. 8 Standardized credit explanations provided by consumer reporting agencies or 9 other third party vendors are deemed to comply with this section. 10 (c) A violation of this section is defined as an unfair method of competition 11 or unfair or deceptive act or practice in the business of insurance. 12 Sec. 2. EFFECTIVE DATE 13 This act shall take effect on October 1, 2007. www.leg.state.vt.us