110

Research Digest

January 25, 2005

Research Associate: Rohit E. Pandey, CA, B. Comm.

Editor: Ian Madsen, MBA, CFA

imadsen@zacks.com

Tel- 1-800-767-3771,

ext. 417

ckallos@zacks.com

www.zackspro.com

155 North Wacker Drive

Chicago, IL 60606

(PRXL - NASDAQ)

www.parexel.com

All new material since last update is highlighted, otherwise there are no changes.

Parexel International Corp.

$22.53

Overview

Industry conditions for Contract Research Organizations (CROs), including Parexel International Corp.

(PRXL), continue to improve steadily following a host of disruptions including SARS-related travel

moratoriums, and contract cancellations arising from the Pfizer/Pharmacia merger in early 2003. At the

company level, PRXL overcame three volatile years characterized by a failed merger to Covance, loss of

major client Novartis (due to pipeline reprioritization), and various restructurings since 1999, to achieve

significant organic growth reporting sales growth of 14.6% in FY02. Nonetheless, PRXL’s operational

performance remains mixed with margins substantially below industry averages and well under

management’s stated target of 10% EBIT by end of FY05.

Strengths/Opportunities

Weaknesses/Threats

Extensive international infrastructure

Lower than industry average operating margins

Intensifying cost and pipeline pressures in the

pharmaceutical sector is increasing attraction of CROs

Significant industry wide risk factors such as lumpy

business wins and volatile cancellation rates.

Relatively strong balance sheet with minimal debt.

Currency risk is significant given the company’s

substantial international presence.

Massachusetts-based PRXL is a global pharmaceutical service provider. PRXL is the third largest pureplay CRO and a leading provider of late-stage biopharmaceutical testing services, including Phase I

through Phase IV human clinical trial management, data management, biostatistical analysis, medical

writing, and pharmacovigilance capabilities. Outside its core clinical trials management business, PRXL

also provides drug development and regulatory consulting services, medical marketing and

communications, training and various technology services, including web-based clinical trial management

software. PRXL is differentiated from competitors by its global scale and scope (second only to

Quintiles), consulting capabilities (heavy regulatory consulting, industry publishing, and training/CME

footprint), clinical trial technology capabilities (Perceptive Informatics), and late-stage development and

periapproval focus (PRXL does little non-clinical work). PRXL’s 4,935 employees provide

bio/pharmaceutical research services in 36 countries, competing with firms such as Quintiles, Covance,

PPD, ICON, Inveresk, Kendle, and SFBC.

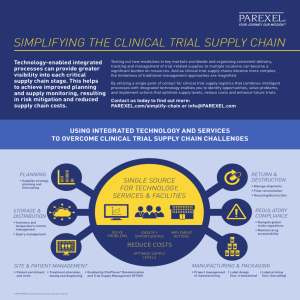

CROs remain an attractive alternative to certain in-house drug development functions by providing an

evolving array of services designed to enhance drug manufacturer productivity, increase efficient use of

resources, spread risk, reduce costs, and improve R&D timeliness. However, industry consolidation is

widely expected to add to the inherent volatility of contract work and dramatic shifts in market share at

service provider level. While some analysts suggest that more mature CROs can better handle this

inherent volatility, most remain cautious on the overall sector given the CRO industry-wide risks and the

prevailing sentiment that further M&A activity is very likely in the pharmaceutical industry.

© Copyright 2003, Zacks Investment Research. All Rights Reserved.

Sales

PRXL is a global provider of drug development outsourcing services to the pharmaceutical and

biotechnology industry operating out of four divisions: Clinical Research Services, PAREXEL Consulting

Group, product launch services in its Medical Marketing Services segment, and technology solutions

from its Perceptive Informatics subsidiary.

PRXL’s Clinical Research Services (CRS) division is the third largest provider of global Phase II-IV

clinical trial management & support services. The Clinical Research Services (CRS) segment constitutes

the core development outsourcing offering. PRXL offers a full suite of clinical trial support services,

including patient and investigator recruitment, data management, biostatics analysis, medical writing and

regulatory affairs and periapproval services. PRXL’s data management group provides case report form

design, tracking and audit trail documentation, data entry and verification, adverse event reporting, and

medication coding. The company’s biostatisticians aid study design, conduct meta-analysis and data

mining studies, and provide representation at FDA or other key regulatory meetings, among other

services. It also provides medical services such as medical consultation, project team leadership,

therapeutic area training, and SAE (serious adverse event) reporting as well as medical writing services.

PRXL pharmacovigilance teams monitor the safety, quality and efficacy of marketed drugs and other latestage services including patient, physician and disease registries, health economics research and

expanded access programs. PRXL’s competitors in Phase II-IV services include Quintiles, PPD,

Covance, ICON and Kendle, among many others.

PRXL’s Consulting Group (PCG) division includes Phase I clinical development, bioanalytical and

consulting services. PRXL maintains Phase I facilities in Berlin, Germany; Poitiers, France; Bloemfontein,

South Africa; Northwick Park, London, UK; and Baltimore, Maryland, USA. These facilities provide

access to over 250 beds, as well as over 500 validated methods through associated bioanalytical groups.

Phase I facilities house healthy study volunteers for intense, short-term testing of compounds previously

untried in humans or to determine generic bioequivalence. These tests often focus on pharmacokinetics

or ADME&T (absorption, distribution, metabolism, excretion, and toxicity) characteristics of novel

compounds, including dosage variance, concomitant use, and bioequivalence and bioavailability studies.

Bioanalytical labs provide biological fluid analysis, such as chromatographic support, analytical method

development, validation and clinical study support. PRXL also provides a wide variety of consulting

services, with a focus on training, drug development, regulatory affairs, validation and compliance.

Services geared toward Biotech companies include project management, training, quality assurance,

legal guidance, and contract personnel services, among others. PRXL’s Barnett International unit

provides education, training and consulting services to pharmaceutical, biotechnology and medical

device companies. Educational offerings include conferences, on-site training, seminars, and regulatory

publications. Consulting services include clinical process optimization, SOP (standard operating

procedure) development, outsourcing management, employee performance assessment and

management, and clinical training. PRXL’s Worldwide Regulatory Affairs group focuses more on the drug

approval process, with services such as GMP and GCP validation and compliance, regulatory strategy

development, dossier and submissions, regulatory liaison, and labeling consulting services. PRXL’s

Phase I competitors include SFBC International, MDS and Covance, while consulting competitors include

Quintiles, ICON, Kendle and IMS Health, among others.

PRXL’s Medical Marketing Services (MMS) is one of the larger medical communications providers.

Through MMS, the company provides medical marketing and communications for products in the preand post-launch phases of development. Medical capabilities include medical communications planning,

meetings and events planning, medical publishing, and continuing medical education. PRXL also

provides reimbursement services such as payer and provider market research, reimbursement plans,

post-launch payment monitoring and advocacy, and policy issues monitoring services. PRXL also

manages telecommunication centers to handle incoming calls, process data, and direct inquiries on large

commercialization support programs. The MMS Telecommunications group provides patient

reimbursement and payment program support, reimbursement hotlines, and patient access programs.

Zacks Investment Research

Page 2

www.zacks.com

Finally, PRXL provides managed care services, such as early planning to build payer needs into clinical

development and formulary communications strategies and presentations to help manufacturers increase

their chances of managed care formulary acceptance. PRXL’s competitors in these fields include

Quintiles, Cardinal Health, Covance, PPD, and Kendle.

PRXL’s Perceptive Informatics Technology Services (PI) provides technology products and services

internally as part of broader clinical trial services and externally to clients as a stand-alone offering. Its

offerings include web-based solutions that speed up the clinical trial process, electronic data capture

solutions that eliminate the need for data transcription, interactive voice response systems (IVRS) aiding

patient enrollment, screening and diary information collection, and medical diagnostic imaging. We

believe that PRXL is unique among CROs in having in-house imaging capabilities. PRXL’s competitors

either rolled their "e-clinical trials" units back into their core CRO operations (Covance and Quintiles) or

they never formally broke them out for reporting purposes (PPD, Kendle). PRXL has spent significant

internal resources and partnered with companies such as PhaseForward and PHT to develop its

Perceptive Informatics offerings. Perceptive’s main competitors include eResearch Technology, the inhouse technology capabilities of other public CROs and Bio-Imaging Technologies.

Effective from the September 2004 reporting period, certain components of the Company’s strategic

business units were reorganized to better align services offered to clients and to ensure a more

integrated selling effort. Specifically, the Company’s clinical operations were consolidated by moving

Clinical Pharmacology (Phase I) from the PAREXEL Consulting Group (PCG) to Clinical Research

Services (CRS), and Phase IV clinical operations from Medical Marketing Services (MMS) to CRS. The

remaining businesses of PCG and MMS were then combined to form the new PAREXEL Consulting

and Marketing Services (PCMS) business segment. These changes resulted in various reclassifications

to the historical financials, but had no impact on the Company’s total revenue, expenses, operating

income, net income, or balance sheet. According to one analyst (RW Baird), the aforementioned

segment classifications suggest that PRXL's combined Phase I and IV clinical businesses accounted for

roughly $72M in FY04 revenue, up over 30% from roughly $55M in FY03 revenue. Reclassifications also

suggest that PRXL's combined Phase I and IV clinical businesses, while faster growing, have operated at

gross margins lower than that of the historical CRS businesses, and below other CROs in similar

businesses. The analyst believes the combined Phase I and IV operations had a roughly 22% gross

margin in FY03 and 24% gross margin in FY04. While PAREXEL does not disclose segment operating

margins, management suggests that the operating expenses associated with these businesses are lower

than that of core Phase II-III clinical operations leading to similar operating margins as Phase II-III clinical

and the overall CRS business. However, the analyst believes the company should break out operating

profit by segment, as gross margin analysis alone is of limited value to investors.

Margin

PAREXEL announced F2Q05 results on January 20, 2005, with consolidated service revenue reported at

$137.9M, up 280 basis points y/y ($134.1M in F2Q04) and 490 basis points sequentially ($131.5M in

F1Q05). On a constant dollar, same-store basis, however, revenue was actually down 3.9% y/y. Client

concentration continues to come down. PRXL’s top client accounted for 9% of FQ2 revenue while its top5 and top-20 clients contributed 28% and 54% respectively. An interesting thing to note is this quarter’s

geographic revenue mix. The U.S. represented 38% (down from 48% last year), Europe represented

57% (up from 48% last year), and Asia represented 5% (up from 4% last year). The decrease in U.S.

revenue is a combination of both the large project cancellation, as well as growing clinical trial activity

outside the United States. However, the U.S. revenue is expected to bounce back as PRXL indicated that

demand for U.S. services has recently picked up.

Clinical Research Services (CRS) revenue was $94.9M (68.8% of total revenues), up 0.1% y/y and

5.5% sequentially. On a same-store, constant dollar basis, CRS revenue was actually down 8.1% y/y

(F/X contributed $7.9M during the quarter). Management attributed this primarily to the large contract

cancellation earlier in the fiscal year. The segment accounted for 68.8% of total revenue compared to

Zacks Investment Research

Page 3

www.zacks.com

68.4% last quarter. Gross margin of 37% was up 30 basis points over FQ1 and 150 basis points y/y. This

was slightly better than management’s earlier expectation that CRS gross margin would remain at FQ1

levels or go down slightly in FQ2.

PAREXEL Consulting and Marketing Services (PCMS) reported revenue of $32.3M (23.4% of total

revenues), up 5.7% y/y but down 0.1% sequentially. On a same store, constant dollar basis, segment

revenue grew 2.9% y/y (acquisitions and F/X contributed $1.1M and $0.5M respectively for FQ2, while

disposition of a business contributed $0.7M in the last year). All but one unit in this segment posted y/y

revenue increases. GMP Consulting saw heightened activity. Overall demand for marketing services was

also strong. Medical education programs at both pre- and post-product-approval stages form the core of

PRXL’s marketing services. The 29.1% gross margin in the PCMS segment, down 4.5% sequentially, is

one area which management intends to focus on, as they believe that this can at least match gross

margin in the CRS segment. As a result, management projects an improvement in PCMS gross margin

for FQ3.

Perceptive Informatics (PI) posted revenues of $10.7M (7.8% of total revenues) that was up 22.1% y/y

and 16.1% sequentially. Robust demand for medical imaging services drove performance in this

segment. The Clinical Trials Management Services (CTMS) unit in this segment performed slightly below

the company’s internal forecast, but management cited a good hit rate in the CTMS unit as a consolation.

Segment gross margin was 42.8%, up 20 basis points sequentially though not quite up to the 46.4% last

year. Management views this segment as consisting of business units differentiated along product and

service lines. The product units (CTMS) afford higher gross margin than the services units (Imaging) in

this segment. Management stated that a shift in mix from products to services caused the y/y drop in

margin for Perceptive.

Consolidated gross margin for the quarter at 35.6% was up 250 basis points y/y but was down 80 basis

points sequentially. Management projects that consolidated gross margin will increase going forward.

Operating margin of 7.0% was up 90 basis points y/y but was down 30 basis points sequentially.

Management had earlier projected an EBIT margin range of 7.0%-7.5% for the quarter. In keeping with

management’s expectations, SG&A as a percentage of revenue at 23.7% was down sequentially by 50

basis points. However, SG&A increased by 130 basis points y/y, driven by unfavorable currency

movements and acquisition expenses. Furthermore, increased costs related to Sarbanes-Oxley

requirements have impacted this line and are expected to do the same in the next several quarters

(PRXL is expected to spend $2.1M to comply with the Act). Depreciation and amortization came in at

4.9% of consolidated revenue and management expects this percentage to decrease in FQ3. PRXL

ended the quarter with a strong balance sheet position consisting of $108.7M in cash and equivalents,

compared to $93.4M at the end of F1Q05.

For the next quarter, management targets an EBIT range of 7.5%-8.0% and continues to target a 10%

EBIT margin by FY05 year-end. This implies a mammoth jump of about 200 to 250 basis points in F4Q –

something that analysts believe is going to be a challenge for the company to achieve. One analyst

(William Blair) is not fully convinced PRXL will reach this 10% target but believes the company can take

large strides towards the goal. With its F2Q margin at 7.0% that was down by 30 points sequentially, a

300-point improvement is needed over the next two quarters to end FY05 with the desired target of 10%.

Going by its EBIT trend, if one studies the table given below, it reflects PRXL has been twice able to

generate margin improvements of 200 basis points or better from the second quarter to the fourth

quarter, while the average change is a loss of 47 points. If the two years of extreme margin decline are

excluded, the average change reflects an increase of a mere 100 basis points. While this falls short of the

desired improvement by 200 points, one could nevertheless expect double-digit growth even if the 10%

goal s not achieved by year-end.

FY

1996

1997

1998

1999

2000

2001

2002

2003

2004

EBIT margin change

from F2Q to F4Q

(in basis points)

+100

+50

-20

-540

-580

+200

+360

-110

+120

Zacks Investment Research

Page 4

www.zacks.com

Average 1996-2004

-47 basis points

Average, excluding 1999-2000

+100 basis points

Going forward, management gave new FY05 revenue guidance of $570M-$580M (vs. earlier guidance of

$565M-$585M). For F3Q05, guidance is $145M-$150M for revenue and 7.5%-8.0% in operating margin.

New CY05 guidance for revenue is $600M-$620M. The following table lists the average estimates for

FY05 from our digest group.

FY2005E Data:

Digest Average

Direct costs

$364.0M

SG&A Exp

$133.3M

Operating Inc.

$44.8M

Earnings per Share

For the three months ended December 31, 2004, Parexel reported net income of $6.1M and earnings of

$0.23 per share that was one cent higher than consensus. EPS for the same period last year was

reported at $0.19 (on net income of $5.0M), reflecting an increase of 22.2% y/y. Sequentially, EPS was

up 7.2% ($0.21 per share on net income of $5.7M). However, one analyst (Advest) observes a lower than

anticipated tax rate (34.4% vs. the previous guidance and investor expectation of 39.0%) contributed

about a penny and a half. As such, the analyst chose to term the quarter EPS result as an in-line one.

Management indicated it was able to reduce tax valuation reserves as certain operations in lower tax

jurisdictions are growing faster than operations in higher tax jurisdictions.

Parexel believes its continued diligent focus on improving productivity enabled it to achieve year-overyear gross margin improvements in Clinical Research Services and PAREXEL Consulting and Marketing

Services, despite a tough, competitive marketplace. This drove diluted earnings per share growth to over

20% in the period. Given the strength of its backlog and its new business momentum, management

anticipates revenue growth will accelerate during the remaining six months of the fiscal year. This

revenue growth, in combination with management’s expectations for operating margin expansion, gives it

confidence that year-over-year EPS growth will continue to be solid throughout the remainder of Fiscal

and Calendar 2005.

Management recently narrowed EPS guidance for FY05 from $0.99-$1.07 to $0.99-$1.05, with the third

quarter EPS expected to be in the range of $0.25-$0.27. Our current digest analyst estimates for FY05

EPS range between $0.98 (Bear Stearns) and $1.04 (Advest) with the average estimate for the year

pegged at $1.01. EPS estimate for FY06 averages at $1.21 and for FY07 at $1.37. The following table

lists the digest estimates for FY05 and FY06:

Company Guidance

Low Estimate

High Estimate

Digest Average

FY-2005

0.99-$1.05

$0.98

$1.04

$1.01

FY-2006

$1.15

$1.28

$1.21

Long-Term Growth

Drug development is characterized by low success rates, with many clients changing course mid stream.

As a result, CROs exhibit lumpy business wins and volatile cancellation rates. Nonetheless, the

encouraging results posted by the CRO industry overall for the quarter ending September 30, 2003 point

to increased R&D spending by Big Pharma. Given that the top 15 pharmaceutical companies represent

Zacks Investment Research

Page 5

www.zacks.com

70% of total global R&D spending, and about 75% of CRO industry revenue, the capacity of the

pharmaceutical industry to sustain revenue growth remains the critical issue for CRO’s, PRXL included.

The critical issues underpinning medium to long-term growth listed by analysts include increasing

pressure from aggressive generic competitors on Big Pharma to seek innovative products; the need for

product differentiation in crowded therapeutic classes adding to clinical developments costs; the

anticipated increase in project failures as companies target less understood medical conditions; and the

increased focus on preclinical testing in order to limit failure rates at the more expensive Phase III stage.

Outsourcing represents a cost effective method of approaching drug development with many analysts

anticipating the combined effect of the above factors to be positive for the CRO industry. That said, the

implications for PRXL are mixed. PRXL has a high exposure to late-stage, periapproval and postapproval offerings and not meaningfully involved in lab-based preclinical R&D. Alternatively, some

analysts (Jefferies) argue that despite encouraging signs, the pharmaceutical industry environment is

similar to that seen 4-5 years ago that triggered the M&A activity, which resulted in the 1999-2000 trough

in CRO demand. The same analyst suggests that despite pharmaceutical industry consolidation, the

basic problem of declining research lab productivity has not been solved. At present, less than 25% of

clinical trials are managed by CROs, so there is ample room for expansion and growth. It remains to be

seen whether Big Pharma will alter established practices, and their approach to drug development and

further outsource key processes to CROs.

Quick take: - The LTG rate, as reported by analysts, range from 15% (Bear Stearns, Thomas Weisel) to

22% (Advest) with the digest average pegged at 17.5%.

Target Price/Valuation

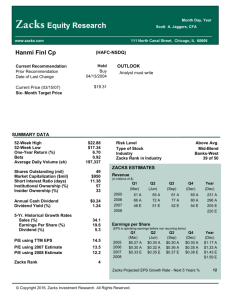

Overall, analysts’ outlook remains unchanged for the stock with the majority of our digest group giving

PRXL a neutral rating. Price targets range between $22 (Jefferies) and $27 (RW Baird) with the average

pegged at $23.25. Most analysts employ a forward earnings discount method to calculate their respective

price targets. The highest price target of $27 was derived using the weighted average of three valuation

methods, namely: 1) P/E analysis 2) EV/EBITDA analysis and 3) discounted cash flow (DCF). The lowest

price target of $22 is based on in-line multiples to the current group averages for both ’05 and ’06

(calendarized), which implies a 12% discount to the analyst’s target multiples.

At current levels, four out of seven analysts remain neutral on the stock, with one analyst (Goldman

Sachs) having a negative view and two (RW Baird, William Blair) choosing a positive stance.

Additional Conversation

Bookings and Backlog: New business awards for the last six months were $291.2M, down 2% from a

year ago. The decrease from a year ago is a reflection of the large cancellation announced, but never

quantified, in the September ‘04 quarter. The net new business figure yields a book-to-bill ratio of 1.08

times. Over the past 12 months, the company’s book-to-bill ratio is 1.18 times, which should comfortably

support revenue acceleration from the current low single-digit level. Seventy percent of the new business

wins were from pharmaceutical clients while the remaining 30% of the wins were from biotech customers.

Parexel noted that the second half of the six-month reported period was better than the first, that demand

has continued into CY05, and that it has experienced a noticeable increase in later-stage demand

(perhaps signaling that the recent strength in preclinical and phase 1 may be beginning to filter into laterstage trials).

Zacks Investment Research

Page 6

www.zacks.com

Growth in backlog was a bright spot for Parexel. Period ending backlog grew 16%. Furthermore, the

company indicated that late stage activity increased during the end of the period that suggests improving

industry trends. However, the company noted that the burn rate on the backlog is growing as

manufacturers award contracts earlier in the cycle. With this factor in mind, one analyst (Thomas Weisel)

considers it safe to assume that revenue growth is likely to be below backlog growth for the foreseeable

future.

Balance Sheet and Cash Flow: For F2Q05, DSOs came in at 38 days, up 5 days y/y but down 3 days

sequentially. Management continues to target 35-40 days. Cash flow from operations was $12.1M for the

quarter. Capital expenditures amounted to $8.2M, leading to free cash flow of $3.9M. Management

showed a preference for accretive acquisitions as a use of cash compared to stock buyback. The

company has a share repurchase program in place, but activity along this line was negligible during

F2Q05.

Upcoming Events

Date

F4Q05

Event

Management aims to reach 10% EBIT margin

Comments

Analysts remain skeptical given past inconsistent

performance.

Individual Analyst Opinions

POSITIVE RATINGS

RW Baird – Outperform ($27): RWB remains positive on PRXL stock with a price target of $27 (up from

$25). Despite the disappointing recent performance on an absolute basis, the analyst believes Parexel’s

better than expected relative performance, positive business development, and management

commentary reflect an attractive long term outlook. The analyst believes PRXL’s shares are inexpensive

with low expectations risk and advocates a buy. That said, the analyst does continue to believe the

company’s 10% EBIT target remains a challenge. The $27 price target is based on three valuation

methods: 1) P/E analysis 2) EV/EBITDA analysis and 3) DCF analysis. (Report date: 1/21/2005)

William Blair – Outperform: WB maintains an Outperform rating for the stock, given its belief that PRXL

can deliver margin improvements. The analyst continues to believe given the healthy industry

environment, revenue growth should rebound from current levels. Following the 3Q call and given the

company’s potential for earnings upside, the analyst believes the company could show significant

advance towards achieving its 10% EBIT target. Nonetheless, the analyst continues to believe that this

target may fall just out of reach. (Report date: 1/21/2005)

NEUTRAL RATINGS

Advest – Neutral: Advest maintains its Neutral rating on PRXL’s shares. With the management being

able to cut expenses and realign its businesses to position PRXL for growth, and given the new business

bookings, the analyst expects revenue to start reaccelerating. However, PRXL has failed to retain market

share. As such, the analyst does not rely on management’s ability to drive EPS growth. The analyst

believes much of the anticipated improvement in results is already priced into the stock and as such,

finds contentment in his Neutral rating. (Report date: 1/21/2005)

Bear Stearns – Peer Perform ($24): BS maintains a Peer Perform rating on the stock with a $24 price

target, which was recently raised by $2 to reflect the analyst’s belief that investors will maintain faith in

Zacks Investment Research

Page 7

www.zacks.com

PRXL being able to achieve a 10% EBIT margin. Considering the company has been able to meet the

Street’s quarterly EPS expectations, despite poor revenue growth over the past several quarters, the

analyst believes PRXL could manage to achieve the 10% target but also believes this is not sustainable

in F1Q06 or re-achievable in FY06. Given the limited demonstrated progress over the last four quarters in

improving overall profitability, the analyst continues to see increased risk of a near-term EPS shortfall.

(Report date: 1/21/2005)

Jefferies & Co – Hold ($22): Jefferies continues to rate PRXL a Hold with a price target of $22, up from

$19, which the analyst believes is generous valuation in the near term. The analyst believes Parexel

continues to suffer from relatively short visibility compared to peers, lower backlog coverage, book-to-bills

that trail the industry averages, and resource inefficiencies that increasingly need real revenue growth to

correct. Though the 3Q EPS target looks achievable, the analyst believes the 4Q target, as well as the

revenue target for CY05 looks somewhat far fetched, and that does not advocate a premium rating.

(Report date: 1/21/2005)

Thomas Weisel – Peer Perform ($20): TW rates PRXL Peer Perform with a price target of $20, and

believes the shares, currently trading at 10.5x CY05 EPS estimate of $1.11, are fairly valued. The analyst

believes the valuation is reflective of improving industry trends and accordingly, multiple expansion

appears unlikely especially with the analyst’s belief that the company will be hard pressed in achieving its

10% EBIT target. The $20 price target is based on about 18x CY05 EPS estimate of $1.11. (Report

date: 1/20/2005)

NEGATIVE RATINGS

Goldman Sachs – Underperform: GS continues to rate PRXL with an Underperform recommendation.

Following 2Q results and management’s revised guidance, the analyst lowered his EPS estimate for the

third quarter from $0.27 to $0.26 but made up for the lost cent by raising his fourth quarter estimate from

$0.29 to $0.30, thereby leaving the FY05 estimate of $1.00 unchanged. (Report date: 1/20/2005)

Zacks Investment Research

Page 8

www.zacks.com