Exercise 11-26 (Continued)

advertisement

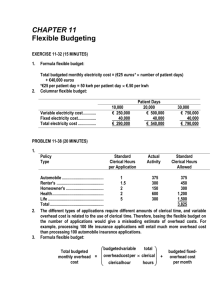

Select solutions to Chapter 11: 11-16 The conceptual problem in applying fixed manufacturing overhead as a product cost is that this procedure treats fixed overhead as though it were a variable cost. Fixed overhead is applied as a product cost by multiplying the fixed overhead rate by the standard allowed amount of the cost driver used to apply fixed overhead. For example, fixed overhead might be applied to Work-in-Process Inventory by multiplying the fixed-overhead rate by the standard allowed machine hours. As the number of standard allowed machine hours increases, the amount of fixed overhead applied increases proportionately. This situation is conceptually unappealing, because fixed overhead, although it is a fixed cost, appears variable in the way that it is applied to work in process. EXERCISE 11-26 (40 MINUTES) 1. Variable overhead variances: VARIABLE-OVERHEAD SPENDING AND EFFICIENCY VARIANCES (1) (2) (3) ACTUAL VARIABLE OVERHEAD Actual Hours (AH) x 50,000 hours x Actual Rate (AVR) Actual Hours (AH) x $19.20 per hour* 50,000 hours x $960,000 Standard Rate (SVR) $18.00 per hour FLEXIBLE BUDGET: VARIABLE OVERHEAD Standard Standard Allowed x Rate Hours (SVR) (SH) 40,000 hours $900,000 $18.00 per hour 40,000 hours $720,000 $60,000 Unfavorable $180,000 Unfavorable Variable-overhead spending variance Variable-overhead efficiency variance *Actual variable-overhead rate (AVR) x (4)† VARIABLE OVERHEAD APPLIED TO WORK-IN-PROCESS Standard Standard Allowed x Rate Hours (SVR) (SH) x $18.00 per hour $720,000 No difference actual variable overhead cost $960,000 $19.20 per hour actual hours 50,000 EXERCISE 11-26 (CONTINUED) 2. Fixed-overhead variances: FIXED-OVERHEAD BUDGET AND VOLUME VARIANCES (1) ACTUAL FIXED OVERHEAD (2) BUDGETED FIXED OVERHEAD (3) FIXED OVERHEAD APPLIED TO WORK IN PROCESS Standard Allowed Hours 40,000 hours $291,000 $300,000 † $240,000 $9,000 Favorable $60,000 Unfavorable† Fixed-overhead budget variance Fixed-overhead volume variance *Fixed overhead rate = $6.00 per hour = Standard FixedOverhead Rate $6.00 per hour* $300,000 (25,000)(2hrs per unit) Some accountants would designate a positive volume variance as "unfavorable." EXERCISE 11-31 (45 MINUTES) Budgeted fixed overhead ........................................................................................ $ 25,000 Actual fixed overhead ............................................................................................. $ 32,500a Budgeted production in units ................................................................................. 12,500 Actual production in units ...................................................................................... 12,000c Standard machine hours per unit of output ........................................................... 4 hours Standard variable-overhead rate per machine hour .............................................. $8.00 Actual variable-overhead rate per machine hour .................................................. $9.00b Actual machine hours per unit of output ............................................................... 3d Variable-overhead spending variance ................................................................... $ 36,000 U Variable-overhead efficiency variance ................................................................... $ 96,000 F Fixed-overhead budget variance ............................................................................ $ 7,500 U Fixed-overhead variance ......................................................................................... $ 1,000g U* Total actual overhead .............................................................................................. $356,500 Total budgeted overhead (flexible budget) ............................................................ $409,000e Total budgeted overhead (static budget) ............................................................... $425,000f Total applied overhead ............................................................................................ $408,000 *Some accountants would designate a positive fixed-overhead volume variance as unfavorable. EXERCISE 11-31 (CONTINUED) Explanatory Notes: a. Fixed-overhead budget variance = actual fixed overhead – budgeted fixed overhead $7,500 U = X – $25,000 X = $32,500 = actual fixed overhead b. Total actual overhead = actual variable overhead + actual fixed overhead $356,500 = X + $32,500 X = $324,000 = actual variable overhead Variable-overhead spending variance = actual variable overhead – (AH SR) $36,000 U = $324,000 – (AH $8) $8AH = $288,000 AH = 36,000 Actual variable-overhead rate per machine hour = actual variable overhead actual hours = $324,000 $9 per hour 36,000 EXERCISE 11-31 (CONTINUED) c. Fixed-overhead rate = budgeted fixed overhead budgetedmachine hours = $25,000 (12,500 units)(4 hrs. per unit) = $.50 per hr. Total standard overhead rate = standard variable overhead rate + fixed-overhead rate $8.50 = $8.00 + $.50 Total applied overhead = total standard hours total standard overhead rate $408,000 = X $8.50 X = 48,000 = total standard hrs. Actual production = total standardhrs. standardhrs. per unit = d. e. 48,000 12,000 units 4 Actual machine hrs. per unit of output = total actual machine hrs. actual production = 36,000 hrs. 3 hrs. per unit 12,000 units Total budgeted overhead (flexible budget) = budgeted fixed overhead + (SVR SH) = $25,000 + ($8.00 12,000 units 4 hrs. per unit) = $409,000 EXERCISE 11-31 (CONTINUED) f. Total budgeted overhead (static budget) = total standard budgeted standardhrs. overheadrate production per unit = ($8.50)(12,500)(4) = $425,000 g. Fixed overhead volume variance = budgeted fixed overhead – applied fixed overhead = $25,000 – ($.50)(12,000 4) = $1,000 U* * Some accountants would designate a positive volume variance as "unfavorable." PROBLEM 11-45 (45 MINUTES) Missing amounts for case A: 2. $21.00a per hour 3. $28.50b per hour 6. $294,150c 9. $7,500 Ud 10. $9,000 Fe 11. $(126,000) (Negative)f (The negative sign means that applied fixed overhead exceeded budgeted fixed overhead.) 12. $24,150 underappliedg 13. $135,000 overappliedh 16. 6,000 unitsi 19. $270,000j 20. $756,000k Explanatory notes for case A: aBudgeted direct-labor hours = budgeted production standard direct-labor hours per unit = 5,000 units 6 hrs. = 30,000 hrs. Fixed overhead rate = = budgeted fixed overhead budgeteddirect-labor hours $630,000 $21per hr. 30,000 hrs. PROBLEM 11-45 (CONTINUED) bTotal standard overhead rate = variable overhead rate + fixed overhead rate = $7.50 + $21.00 = $28.50 cVariable-overhead spending variance = actual variable overhead – (actual direct-labor hours standard variable overhead rate) $16,650 U = actual variable overhead – (37,000 $7.50) Actual variable overhead = $294,150 dVariable-overhead efficiency variance = SVR(AH – SH) = $7.50(37,000 – 36,000) = $7,500 U eFixed-overhead budget variance = actual fixed overhead – budgeted fixed overhead = $621,000 – $630,000 = $9,000 F fFixed-overhead volume variance = budgeted fixed overhead – applied fixed overhead = $630,000 – (36,000 $21) = $126,000 F (Some accountants would designate a negative volume variance as “favorable.”) gUnderapplied variable overhead = actual variable overhead – applied variable overhead = $294,150 – (36,000 $7.50) = $24,150 underapplied PROBLEM 11-45 (CONTINUED) hOverapplied fixed overhead = actual fixed overhead – applied fixed overhead = $621,000 – (36,000 $21) = $135,000 overapplied iActual production jApplied = standardallowed direct-labor hours standardhrs. per unit = 36,000 6,000 units 6 variable overhead = SH SVR = 36,000 $7.50 = $270,000 kApplied fixed overhead = SH fixed overhead rate = 36,000 $21 = $756,000 PROBLEM 11-47 (60 MINUTES) 1. Standard machine hours per unit = budgetedmachine hours budgetedproduction = 30,000 6,000 = 5 hours per unit 2. Actual cost of direct material per unit = $540,000 $166,000 6,200 units = $113.87 per unit (rounded) 3. Standard direct-material cost per machine hour = $504,000 $156,000 30,000 = $22 per machine hour = $546,000 $468,000 $169.00 per unit 6,000 units 4. Standard direct-labor cost per unit 5. Standard variable-overhead rate per machine hour = $1,294,400 - $1,254,000 $40,400 = $20.20 per machine hour 32,000 - 30,000 2,000 hours 6. First, continue using the high-low method to determine total budgeted fixed overhead as follows: Total budgeted overhead at 30,000 hours ................................................. Total budgeted variable overhead at 30,000 hours (30,000 $20.20) ..... Total budgeted fixed overhead ................................................................... $1,254,000 606,000 $ 648,000 The key is to realize that fixed overhead includes not only insurance and depreciation, but also the fixed component of the semivariable-overhead costs (supervision and inspection). (Note that maintenance and supplies are true variable costs.) Now, we can compute the standard fixed-overhead rate per machine hour, as follows: Standard fixed-overhead rate per machine hour = $648,000 30,000 hours = $21.60 per hour PROBLEM 11-47 (CONTINUED) 7. First, compute actual variable overhead as follows: Total actual overhead .................................................................................. Total fixed overhead (given) ....................................................................... Total variable overhead ............................................................................... Variable-overhead spending variance $1,266,000 648,000 $ 618,000 = Actual variable overhead – (AH SVR) = $618,000 – (32,000 $20.20) = $28,400 Favorable 8. Variable-overhead efficiency variance = (AH SVR) – (SH SVR) = (32,000 $20.20) – (31,000* $20.20) = $20,200 Unfavorable *Standard allowed machine hours = 6,200 units 5 hours per unit 9. Fixed-overhead budget variance = actual fixed overhead – budgeted fixed overhead = $648,000 – $648,000 = 0 10. Fixed-overhead volume variance = budgeted fixed overhead – applied fixed overhead = $648,000 – (31,000 $21.60) = $21,600 F* * Some accountants would designate a negative volume variance as "favorable." PROBLEM 11-47 (CONTINUED) 11. Flexible budget formula, using the high-low method of cost estimation: Variable cost per machine hour = $3,080,000 $2,928,000 $76 per hour 32,000 30,000 Total budgeted cost at 30,000 hours .......................................................... Total variable cost at 30,000 hours (30,000 $76) .................................... Fixed overhead cost .................................................................................... Thus, the flexible budget formula is as follows: Total production cost = $76X + $648,000 where X = number of machine hours allowed. Therefore, the total budgeted production cost for 6,050 units is: ($76 30,250*) + $648,000 = $2,947,000 *Standard allowed machine hours = 6,050 units 5 hours per unit $2,928,000 2,280,000 $ 648,000 PROBLEM 11-48 (40 MINUTES) 1. a. Three weaknesses in Albuquerque Wood Crafts, Inc.'s monthly Bookcase Production Performance Report are as follows: The report is based on a static budget. Management should use a flexible budget that compares the same level of activity, calculating variances between the actual results and the flexible budget. Also, management might consider implementing an activity-based costing system. Costs over which the supervisors have no control, such as fixed production costs and allocated overhead costs, are included in the report. The report uses a single plant-wide rate to allocate fixed production costs. Square footage may not drive the fixed production costs, and there may be a more appropriate base such as number of units produced. It may be more appropriate to use different cost drivers for each of the different product lines. b. Due to Sara McKinley's remarks Steve Clark is likely to: Feel tense and apprehensive. The timing of McKinley's remarks, immediately before the meeting, without an opportunity for discussion and feedback, will leave Clark feeling tense and probably inattentive throughout the meeting. Be frustrated and confused by the conflicting signals of the report and what is occurring in his department and in the market. This confusion about the department's results and, consequently, the uncertainty of his job will lead to stress which may negatively affect his performance. 2. a. To improve the monthly performance report, management should: Use a flexible budget. Hold supervisors responsible for only those costs over which they have control by using a contribution approach. Include footnotes to make the report more understandable. PROBLEM 11-48 (CONTINUED) A revised monthly performance report based on a flexible budget is as follows: ALBUQUERQUE WOOD CRAFTS, INC. BOOKCASE PRODUCTION PERFORMANCE REPORT FOR NOVEMBER Units ....................................................................... Revenue ................................................................. Variable production costs: ................................... Direct material ................................................... Direct labor ........................................................ Machine time ..................................................... Manufacturing overhead .................................. Total variable costs .......................................... Contribution margin .............................................. Actual 3,000 $483,000 Flexible Budget 3,000 $495,000a $ 69,300 54,900 57,600 123,000 $304,800 $178,200 $ 72,000b 54,000c 58,500d 126,000e $310,500 $184,500 Variance $12,000 U $ 2,700 F 900 U 900 F 3,000 F $ 5,700 F $ 6,300 U budget ÷ 2,500 budgeted units) 3,000 actual units 60,000 budget ÷ 2,500 budgeted units) 3,000 actual units c($ 45,000 budget ÷ 2,500 budgeted units) 3,000 actual units d($ 48,750 budget ÷ 2,500 budgeted units) 3,000 actual units e($105,000 budget ÷ 2,500 budgeted units) 3,000 actual units a($412,500 b($ b. Steve Clark should be more motivated by the revised report since it clearly shows that the variable cost variances for his product line were better than Sara McKinley had thought, despite the fact that there is an unfavorable contribution margin variance. Clark is not responsible for the revenue variance which resulted from a decrease in the sales price. In addition, the separation of costs into controllable and noncontrollable categories allows Clark to devote full effort to those costs which he can influence. Clark will probably exhibit a positive attitude and will continue looking for ways to improve his operation. PROBLEM 11-49 (35 MINUTES) 1. Calculation of variances: Direct-material price variance = PQ(AP – SP) = 15,000($2.20* – $2.00) = $3,000 Unfavorable *$2.20 = $33,000 15,000 Direct-material quantity variance = SP(AQ – SQ) = $2.00(15,000 – 14,500*) = $1,000 Unfavorable *14,500 lbs. = 725 20 lbs. per unit Direct-labor rate variance = AH(AR – SR) = 4,000($18.90* – $18.00) = $3,600 Unfavorable *$18.90 = $75,600 4,000 Direct-labor efficiency variance = SR(AH – SH) = $18.00(4,000 – 3,625*) = $6,750 Unfavorable *3,625 hours = 725 units 5 hours per unit Variable-overhead spending variance = actual variable overhead – (AH SVR) = $5,500 – (4,000)($1.50) = $500 Favorable Variable-overhead efficiency variance = SVR(AH – SH) = $1.50(4,000 – 3,625) = $562.50 Unfavorable PROBLEM 11-49 (CONTINUED) Fixed-overhead budget variance = actual fixed overhead – budgeted fixed overhead = $13,000 – $12,500* = $500 Unfavorable *$12,500 = $150,000 (annual) 12 months Fixed-overhead volume variance = budgeted fixed overhead – applied fixed overhead = $12,500 – $10,875* = $1,625 U† *$10,875 = 725 units $15.00 per unit † Some accountants would designate a positive volume variance as "unfavorable." PROBLEM 11-52 (20 MINUTES) 1. Sales price variance = (Actual sales price – budgeted sales price) actual sales volume = ($48* – $50†) 7,500 = $15,000 Unfavorable *Actual sales price = $360,000/7,500 †Budgeted 2. sales price = $450,000/9,000 Sales volume variance = (Actual sales volume – budgeted sales volume) budgeted sales price = (7,500 – 9,000) $50** = $75,000 Unfavorable **Budgeted sales price = $450,000/9,000 CASE 11-55 (50 MINUTES) 1. New contribution report for February based on a flexible budget: Flexible Budget* Actual Variance ______________________________________ Units (in pounds)……………….. 225,000 225,000 -Revenue…………………………... Direct material…………………… $1,800,000 326,250 $1,777,500 432,500 $ 22,500 U 106,250 U Direct labor………………………. Variable overhead………………. Total variable costs…………. Contribution margin…………….. 189,000 364,500 $ 879,750 $ 920,250 174,000 375,000 $ 981,500 $ 796,000 15,000 F 10,500 U $101,750 U $124,250 U *Each dollar number in the flexible budget column is equal to the static budget number given in the problem multiplied by 1.125 (225,000/200,000). This reflects the increase in the volume of sales from 200,000 units to 225,000 units. 2. The total contribution margin on the flexible budget is $920,250. See requirement (1). Alternatively, multiply the static budget contribution margin of $818,000 by 1.125 (225,000/200,000), as explained in requirement (1). CASE 11-55 (CONTINUED) 3. The interpretation of the contribution margin on the flexible budget, $920,250, is as follows: If the unit sales price and unit variable costs had all remained at their budgeted levels, and sales volume increased from 200,000 units to 225,000 units, the contribution margin would have been $920,250. 4. The variance between the flexible budget contribution margin and the actual contribution margin, from requirement (1) is $124,250 U. This $124,250 unfavorable variance between the flexible budget and actual contribution margin for the chocolate nut supreme cookie product line during April is explained by the following variances: a. Direct-material price variance: Type of Material PQ*(AP+ SP) Cookie mix .......................... 2,325,000($.02$.02) ............ Milk chocolate ..................... 1,330,000($.20$.15) ............ Almonds .............................. 240,000($.50$.50) ............... Total ........................................................................................... Variance $ 0 66,500 U 0 $66,500 U *PQ = AQ, because all materials were used during the month of purchase. +AP = actual total cost (given) actual quantity b. Direct-material quantity variance: Type of Material SP(AQ SQ*) Cookie mix .......................... $.02(2,325,0002,250,000) ... Milk chocolate ..................... $.15(1,330,0001,125,000) ... Almonds .............................. $.50(240,000225,000) ......... Total ........................................................................................... Variance $ 1,500 U 30,750 U 7,500 U $39,750 U *SQ = standard ounces of input per pound of cookies actual pounds of cookies produced. c. Direct-labor rate variance = AH(AR SR) = 0. Dividing the total actual labor cost by the actual labor time used, for each type of labor, shows that the actual rate and the standard rate are the same (i.e., AR = SR). Thus, this variance is zero. CASE 11-55 (CONTINUED) d. Direct-labor efficiency variance: Type of Labor SR*(AH SH+) Mixing .................................. $.24(225,000225,000) ......... Baking ................................. $.30(400,000450,000) ......... Total ........................................................................................... Variance $ 0 15,000 F $15,000 F *Standard rate per minute = standard rate per hour 60 minutes +Standard minutes per unit (pound) actual units (pounds) produced e. Variable-overhead spending variance = actual variable overhead (AH SVR) = $375,000 [(625,000*/60) $32.40] = $37,500 U *Total actual minutes of direct labor. f. Variable-overhead efficiency variance = SVR(AH SH*) 625,000 3 225,000 = $32.40 60 60 = $27,000 F *SH = (3 minutes per unit, or pound 225,000 units, or pounds) 60 minutes g. actual budgeted actual Sales-price variance = sales price sales price sales volume = ($7.90* $8.00) 225,000 = $22,500 U *Actual sales price = $1,777,500 225,000 units sold CASE 11-55 (CONTINUED) Summary of variances: Direct-material price variance ......................................................... Direct-material quantity variance.................................................... Direct-labor rate variance ................................................................ Direct-labor efficiency variance ...................................................... Variable-overhead spending variance ............................................ Variable-overhead efficiency variance ........................................... Sales-price variance ........................................................................ Total .................................................................................................. 5. $ 66,500 U 39,750 U 0 15,000 F 37,500 U 27,000 F 22,500 U $124,250 U a. One problem may be that direct labor is not an appropriate cost driver for Colonial Cookies, Inc. because it may not be the activity that drives variable overhead. A good indication of this situation is shown in the variance analysis. The direct-labor efficiency variance is favorable, while the variable-overhead spending variable is unfavorable. Another problem is that baking requires considerably more power than mixing does; this difference could distort product costs. b. Activity-based costing (ABC) may solve the problems described in requirement 5(a) and therefore is an alternative that management should consider. Since direct labor does not seem to have a direct cause-andeffect relationship with variable overhead, the company should try to identify the activity or activities that drive variable overhead. If the same proportion of these activities is used in all of Colonial’s products, then ABC may not be beneficial. However, if the products require a different mix of these activities, then ABC could be beneficial. FOCUS ON ETHICS (See page 476 in the text.) In this situation, misstated standards are affecting the accuracy of accounting reports. Cleverly is misusing the standard costing system at Shrood to manage its relationship with the parent company, Gigantic. By overestimating direct-labor hours, too much overhead is routinely applied to products, artificially inflating cost of goods sold (CGS) during the year. This accounting fudge is ‘corrected’ in the fourth quarter of each year by means of a variance adjustment, which serves to instantly reduce CGS and thus boost profits. It is possible that Cleverly and his staff are sufficiently knowledgeable about the real costs of production that the artificial direct-labor hour estimates do not impede their decision making (although this is not certain). However, it is unlikely that the managers at the parent company are in the same position. The information which is being passed to them is distorted, and thus provides a poor basis for managerial decision making. That is, the distorted data may have a negative impact on the business, leading to loss of enterprise value and perhaps jobs. Hence it is unethical for Cleverly to provide this distorted quarterly information to Gigantic, knowing that the company uses the data to make management decisions. A further ethical dilemma occurs because the quarterly numbers from Shrood are provided to analysts and stockholders as a basis on which to judge the financial performance of Gigantic. The management of Gigantic is thus in contravention of its ethical and legal obligations to market regulators, since it is knowingly providing false information to investors. Because of these ethical and legal concerns, it is imperative that Shrood provide accurate information to Gigantic henceforth. Note, however, that this does not necessarily mean that Shrood needs to change its internal cost accounting standards, although it would be preferable to manage according to the most accurate cost numbers available.