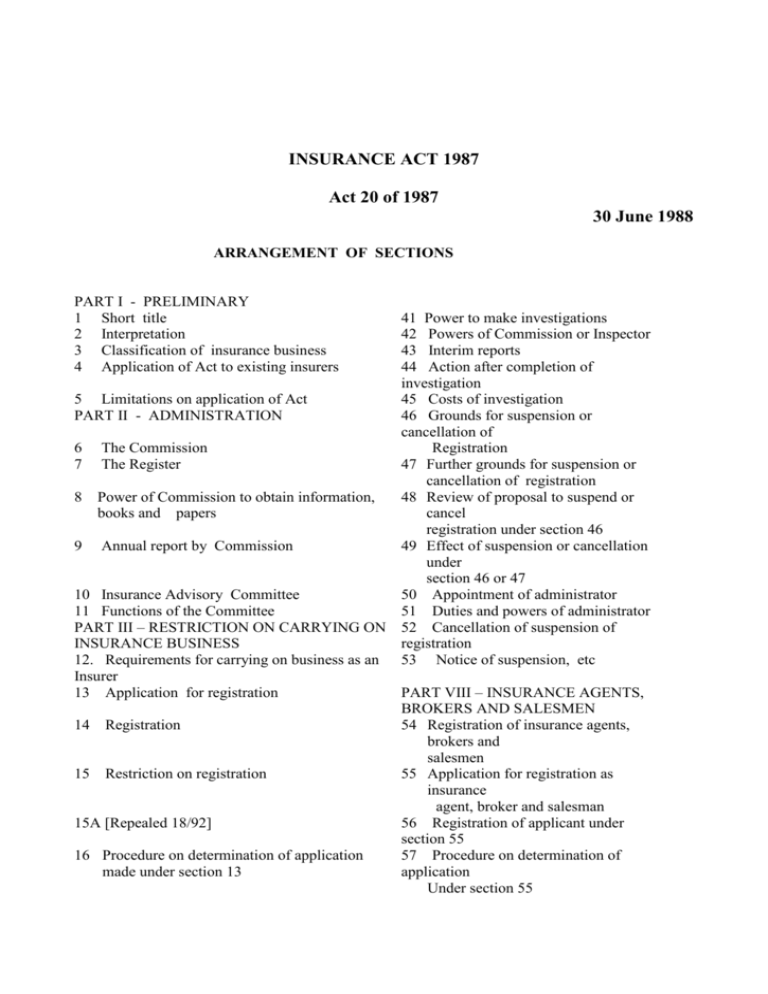

Mauritius Laws 1996 Vol 3 INSURANCE ACT 1987 Act 20 of 1987

advertisement