Additional case studies

advertisement

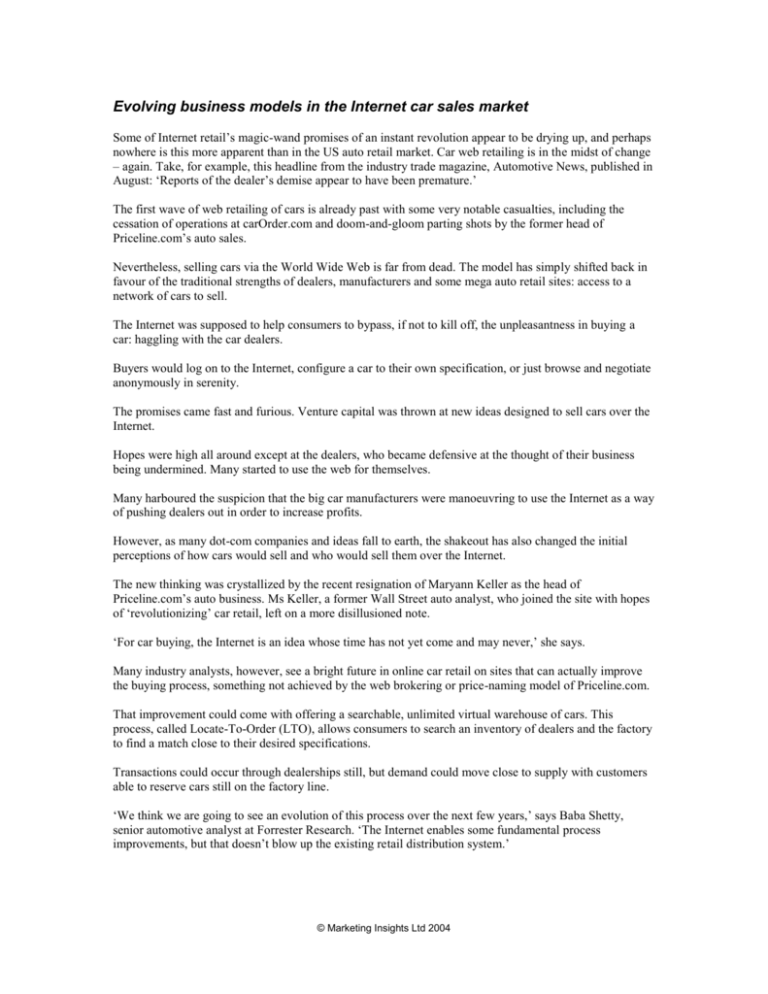

Evolving business models in the Internet car sales market Some of Internet retail’s magic-wand promises of an instant revolution appear to be drying up, and perhaps nowhere is this more apparent than in the US auto retail market. Car web retailing is in the midst of change – again. Take, for example, this headline from the industry trade magazine, Automotive News, published in August: ‘Reports of the dealer’s demise appear to have been premature.’ The first wave of web retailing of cars is already past with some very notable casualties, including the cessation of operations at carOrder.com and doom-and-gloom parting shots by the former head of Priceline.com’s auto sales. Nevertheless, selling cars via the World Wide Web is far from dead. The model has simply shifted back in favour of the traditional strengths of dealers, manufacturers and some mega auto retail sites: access to a network of cars to sell. The Internet was supposed to help consumers to bypass, if not to kill off, the unpleasantness in buying a car: haggling with the car dealers. Buyers would log on to the Internet, configure a car to their own specification, or just browse and negotiate anonymously in serenity. The promises came fast and furious. Venture capital was thrown at new ideas designed to sell cars over the Internet. Hopes were high all around except at the dealers, who became defensive at the thought of their business being undermined. Many started to use the web for themselves. Many harboured the suspicion that the big car manufacturers were manoeuvring to use the Internet as a way of pushing dealers out in order to increase profits. However, as many dot-com companies and ideas fall to earth, the shakeout has also changed the initial perceptions of how cars would sell and who would sell them over the Internet. The new thinking was crystallized by the recent resignation of Maryann Keller as the head of Priceline.com’s auto business. Ms Keller, a former Wall Street auto analyst, who joined the site with hopes of ‘revolutionizing’ car retail, left on a more disillusioned note. ‘For car buying, the Internet is an idea whose time has not yet come and may never,’ she says. Many industry analysts, however, see a bright future in online car retail on sites that can actually improve the buying process, something not achieved by the web brokering or price-naming model of Priceline.com. That improvement could come with offering a searchable, unlimited virtual warehouse of cars. This process, called Locate-To-Order (LTO), allows consumers to search an inventory of dealers and the factory to find a match close to their desired specifications. Transactions could occur through dealerships still, but demand could move close to supply with customers able to reserve cars still on the factory line. ‘We think we are going to see an evolution of this process over the next few years,’ says Baba Shetty, senior automotive analyst at Forrester Research. ‘The Internet enables some fundamental process improvements, but that doesn’t blow up the existing retail distribution system.’ © Marketing Insights Ltd 2004 Both General Motors and Ford have offered dealers an olive branch and started to build systems heading in this direction. GM’s BuyPower.com launched in October a Minneapolis pilot programme, where it linked Oldsmobile dealerships and offered e-prices. It plans to expand its testing of this system. Ford has launched a site, FordDirect.com, in which its dealers own an 80 per cent stake and offer combined inventories with e-prices that vary according to region. Other early leaders include AutoNation.com, and its AOL partnership, and Microsoft’s auto portal, CarPoint.com. AutoNation, the US’s largest dealer holding group, says it will sell $1.5 bn in new cars online this year, and is now running a system that could be considered a prototype for the larger-scale LTO. CarPoint.com has established 3000 dealer links with a relationship with Ford and has the highest traffic of car sites to date. Right now it only refers customers to dealers, but is likely to change early next year. Another big referral site, Autobytel.com, is thought likely to struggle if it does not change, while direct sellers, such as Greenlight.com – which is linked with Amazon.com and finds cars for buyers – also could gravitate to this model to compete. In five years, Forrester Research estimates that 6.5 per cent of new vehicle sales, or $33 bn, will happen over the Internet, compared with about 1 per cent, or $2.8 bn, currently. Also, by 2005, Internet research is expected to influence 55 per cent of car sales, with 40 per cent of buyers at least visiting an online selling site. In the meantime, data about vehicles being sold on the Internet should be more detailed. Source: Christopher Bowe, Financial Times, 8 December 2000. © Financial Times. Questions 1. Evaluate the overall success of the Internet as a mechanism for car sales. 2. Which business models and revenue models appear to be effective on the Internet? Can other success factors be identified? 3. Summarize the approach taken by the car manufacturers to the Internet marketplace. © Marketing Insights Ltd 2004