9th ed Chapter 1 Financial Statements

advertisement

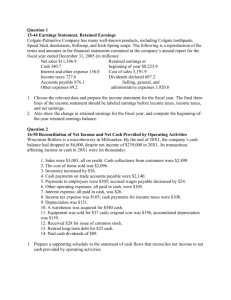

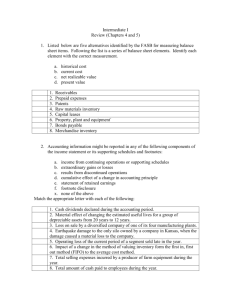

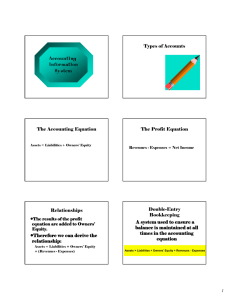

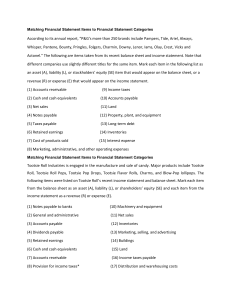

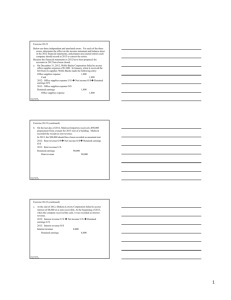

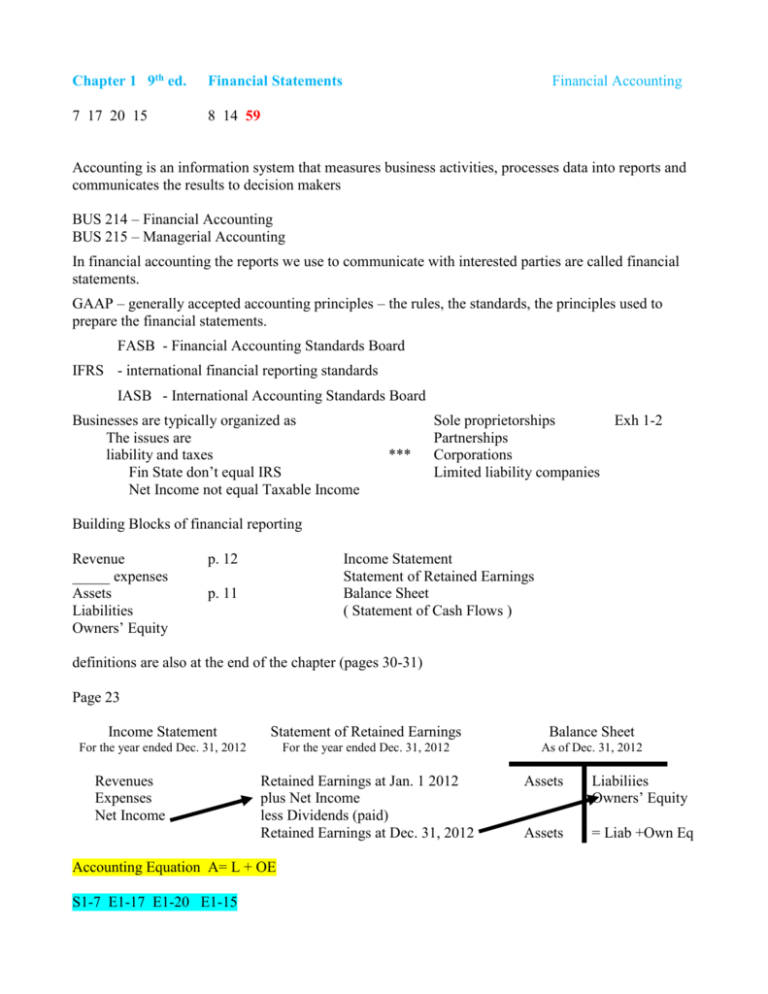

Chapter 1 9th ed. Financial Statements 7 17 20 15 8 14 59 Financial Accounting Accounting is an information system that measures business activities, processes data into reports and communicates the results to decision makers BUS 214 – Financial Accounting BUS 215 – Managerial Accounting In financial accounting the reports we use to communicate with interested parties are called financial statements. GAAP – generally accepted accounting principles – the rules, the standards, the principles used to prepare the financial statements. FASB - Financial Accounting Standards Board IFRS - international financial reporting standards IASB - International Accounting Standards Board Businesses are typically organized as The issues are liability and taxes Fin State don’t equal IRS Net Income not equal Taxable Income *** Sole proprietorships Exh 1-2 Partnerships Corporations Limited liability companies Building Blocks of financial reporting Revenue _____ expenses Assets Liabilities Owners’ Equity p. 12 Income Statement Statement of Retained Earnings Balance Sheet ( Statement of Cash Flows ) p. 11 definitions are also at the end of the chapter (pages 30-31) Page 23 Income Statement Statement of Retained Earnings Balance Sheet For the year ended Dec. 31, 2012 For the year ended Dec. 31, 2012 As of Dec. 31, 2012 Revenues Expenses Net Income Retained Earnings at Jan. 1 2012 plus Net Income less Dividends (paid) Retained Earnings at Dec. 31, 2012 Accounting Equation A= L + OE S1-7 E1-17 E1-20 E1-15 Assets Liabiliies Owners’ Equity Assets = Liab +Own Eq Income Statement Sales (a type of revenue) Expenses (Net Income) Statement of Retained Earnings Balance Sheet page 1 Net Income Dividends (paid) Cash Short-term investments Accounts Receivable Notes Receivable Merchandise Inventory Prepaid (expenses) Assets define p. 30 Current Assets define p. 30 (long-term) Investments Property, Plant & Equipment Intangible Assets Other Assets Statement of Cash Flows Accounts Payable Income Tax Payable Wages Payable Notes Payable Short-term Borrowings Current Liabilities – define p. 30 Common Stock Retained Earnings Owners’ Equity Operating Activities Investing Activities Financing Activities S1-8 S1-14 P1-59 Characteristics that will make Financial Statements useful (vocabulary words) Prinicples that guide the formulation of generally accepted accounting principles Relevant Faithful representation Comparable Entity Cost Going Concern p. 6-9