JacobsEtAl_CorrelationForecasting_Dec07

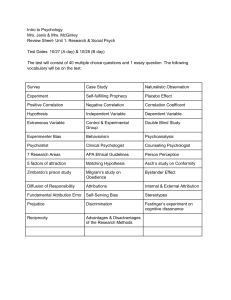

advertisement