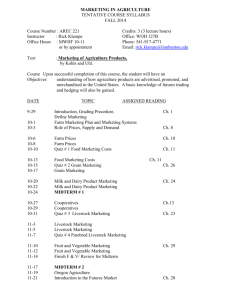

B. Empirical analysis on optimal hedging ratio

advertisement

Hedging Based Price Decline Risk Management of Refined Oil Inventory Xing Bi1, Yao-long Zhang1, Yan-wei Liu2 1 College of Management and Economics, University of Tianjin, Tianjin, China Office of International Cooperation, Peking University Health Science Center, Beijing, China (bistar@126.com) 2 Abstract - Nowadays oil has become an important energy source with both political and economic attributes. Frequent fluctuation of oil demand and price in the international market confronts enterprises with many uncertainties in refined oil inventory management. In order to prevent the risk of oil price decline brought up by those uncertainties, this article analyzed the inventory methods of different refined oil, chose hedging as the method to manage price decline risks of oil inventory, compared the different optimal hedge ratio models, and made empirical analysis to gasoline hedging. Keywords- hedging, risk management, OLS I. INTRODUCTION Uncertainty of demand or price usually causes risk in inventory management to enterprises. Inventory management, especially inventory price management of refined oil, is of great influence on enterprise operations. Although the rise of inventory value in price-increasing period can absolutely create extra profit for the enterprises, the decline of inventory value will bring huge losses when the oil price goes down if the enterprises cannot reasonably avoid the risks. Therefore, price decline risk is an important inventory risk that enterprises are faced with. In the future, the government is likely to further adjust the pricing mechanism of refined oil. Therefore, the oil price may be more frequently regulated, the correlation between oil prices domestic and abroad strengthened, the price of refined oil further marketed, and the risk of inventory price fluctuation increased. For this reason, study on price decline risk management of refined oil inventory is of great significance to enhance enterprise operation efficiency, avoid financial risks, and ensure the smooth running of daily sales. II. METHODOLOGY A. Methods of Refined Oil Inventory Management There are already some advanced management ideas and management tools on an international level about inventory management and effective inventory risk control, such as insurance stock quota, lead-time, Activity Based Classification, VMI (vendor-managed inventory) theory, JIT (just-in-time) purchasing system, hedging, and etc. Insurance stock quota is a quantity criterion of the necessary material reserve for regular production when the supplier delays the supply for enterprises or when some other accidents occur [1]. Usually these inventories will not be used unless the stocks are overused or the supplies are delayed. For some enterprises, their products have seasonality or the transportation of their products is affected by seasons, so seasonal stocks are needed. Lead-time is the period from the start of ordering to receiving order quantity [2]. Strictly speaking, lead-time is random and indeterminate. But it is often regarded as a determined constant in application. Sometimes enterprises need to order products to replenish stocks. With the delivery of cargo from storage, the inventory level will gradually decrease to a point, and then replenishment is required, or stockout appears, thus seriously affecting the regular enterprise operations. This point is called “order point”. When the inventory level reaches the “order point”, ordering will start. Activity Based Classification is a key control method, which classifies the analyzing objects into three different categories (A, B, and C) according to their main technology economic characteristics, in order to distinguish between important objects and general ones and to focus on the management of decisive A-category objects [3]. ABC classification management of inventory is to classify the inventories of enterprises into A, B, and C categories in accordance with certain criteria. The most important inventories belong to A category, general inventories B category, and the unimportant ones C category. Commonly, there are two classification criteria: amount standard and standard number of varieties, among which amount standard is the most fundamental criterion, while the other one is only a reference. VMI means that the upstream enterprises, such as the suppliers, manage and regulate the inventories of downstream customers on the basis of the production, operation and inventory information of their downstream customers [4]. It is an inventory operation mode in the supply chain environment. In essence, it is a method that turns the problem of multi-stage supply chain into that of single-stage inventory management, compared with the traditional method of replenishing products according to the ordering of traditional costumers. VMI is a solution that utilizes the actual or predicted consumption demand and inventory as market demand forecast and inventory replenishment, which means the suppliers can get the information for consumption demand through sales data, and more effectively plan and more quickly respond to market change and consumption demand. JIT purchase, also called Just In Time purchase, is evolved from the idea of Just In Time production management [5]. Its fundamental idea is to provide appropriate products with appropriate quantity and quality at the appropriate place and time. JIT purchase includes the support and collaboration of suppliers, the process of producing, freight transportation systems, and etc, which can not only draw down inventories, but also speed up inventory turnover, shorten lead time, improve shopping quality, and achieve results of satisfactory delivery. The above theoretical methods all reduce enterprise inventories, speed up inventory turnover and reach the goal of inventory risk control from the perspective of minimizing inventory cost and maximizing service standard. However, the common practice for many large multinational petroleum companies is to hedge against oil futures, which can help lock the cost and prevent drastic fluctuation of profit due to the fluctuation of market prices, thus guaranteeing the smooth operation of enterprises. Hedging is a trading that insures the price of goods that is needed to buy in the future or is bought to sell in the future, making use of futures contract as the temporary substituent of goods that will be traded in spot market of the future. In normal market conditions, the trends of spot market and futures market are similar. Since the two markets are affected by the identical supply and demand relation, the prices of the two markets rise together and fall together; however, the operations of the two markets are the opposite, so one gains profit when the other gets a loss, meaning that profit in futures market can cover the loss in spot market or the otherwise. B. Optimal hedging ratio model comparison Modern hedging theory includes three topics: the scale of hedging, the effectiveness of hedging and the cost of hedging. The scale of hedging is described by the hedging ratio; the effectiveness of hedging is measured by the degree that hedging helps reduce the price risk the hedgers are faced with; the cost of hedging means the degree that hedging reduces the expected profit of hedgers. The effectiveness of hedging and the cost of hedging combined together decide the efficiency of hedging. Effective hedging can reduce the maximum amount of risks relative to each unit cost. The so-called optimal hedging method is to choose a method from a series of available efficient hedging methods to reach the maximum utility. At present, there are mainly two kinds of hedging ratio calculation methods in domestic and international literatures: risk minimization based and revenue maximization based. 1) Optimal hedging ratio model based on risk minimization: Keynes (1930) [6] indicated that with the futures price and spot price completely correlated, in order to get the best hedging effect, the optimal hedging ratio should be 1, and it is recommended to buy futures contract in futures market with the equal number and opposite direction of goods in spot market futures contract. But the assumption does not coincide with the actual situation, because the futures price and spot price interact with each other, but are not completely correlated. Now scholars focus on risk minimization and regard it as the optimization objective. Ederington (1973) [7] measured risks with hedging intraclass variance, and got the optimal hedging ratio by using the least squares method with risk minimization as the optimization objective. Lien and Luo (1993) [8], Viswanath (1993) [9], Ghosh (1993) [10], Holmes (1996) [11], Sim (2001) [12] all found that there exists cointegration relationship between the futures price sequence and spot price sequence. In view of the above, Ghosh put forward the VAR model (Vector Autoregression Model) and the ECM model (Error Correction Model) to calculate optimal hedging ratio. The characteristic of risk minimization based static optimal hedging ratio models is that they truly reflect the hedgers’ desire of avoiding risk in the futures market while the disadvantages are: ignorance of hedging profit issue; no consideration for the influence of dynamic change factors in futures trading on hedging effect. 2) Optimal hedging ratio model based on revenue maximization: Optimal hedging ratio decision models based on revenue maximization are rare, mainly because the primary function of futures market is to avoid price risk instead of purely pursuing best interests. Cecchetti, Cumby and Figlewski (1998) [13] calculated the optimal hedging ratio from data with the hedging portfolio wealth maximization as the objective function. Chang-Zheng Huang (2004) [14] got the optimal hedging ratio through setting up a hedging model with the optimization objective of maximizing profit. Yu-Chia Hsu and An-Pin Chen (2008) [15] determined the optimal hedging ratio with the optimization goal of expected revenue on condition that negative yields would be normally distributed. The characteristic of revenue maximization based static optimal hedging ratio models is that they reflect the hedgers’ desire of pursing maximum benefit in futures trading. But their biggest drawback is to ignore that there also exists great risks in futures trading. Besides, those models lack consideration for the dynamic changes of the risk factors. III. RESULTS&DISCUSSION When people hedge against futures market, the main problem is to choose a hedging ratio, that is to say the ratio of futures trading volume to spot transactions. At present, there are mainly two kinds of hedging ratio calculation methods in literatures at home and abroad: risk minimization based and revenue maximization based. Since the main concern of futures market is avoiding price risks, which can be completely fulfilled in practical application by risk-minimization-based ordinary least squares (OLS), the OLS model is chosen to determine the optimal hedging ratio in gasoline hedging empirical analysis. The chosen hedging objects are Shanghai fuel oil futures, WTI futures of NYMEX and Brent futures of ICE; selected data sample interval is between January 2nd, 2009 and June 1st, 2011; data sources are gasoline factory price of National Development and Reform Committee, fuel oil futures price of Shanghai Futures Exchange, WTI futures price of NYMEX Futures Exchange, and Brent futures price of ICE Futures Exchange. Since the unit of the first two prices is Yuan a ton, while the unit of the latter two is dollar a barrel, dollar a barrel is chosen as the price unit in empirical analysis, conversion between RMB and US dollars being done with current exchange rate, 1 ton gasoline equaling to 8.51 barrel gasoline and 1 ton fuel oil equaling to 7.25 barrel fuel oil. Correlation analysis and cointegration test to spot price and futures price with the introduction of correlation coefficient index and the use of Eviews software indicates that gasoline market is highly correlated with Shanghai fuel oil futures market, WTI futures market and Brent futures market. Therefore we can hedge against gasoline with these futures markets. The essential issue of hedging against gasoline spot with futures is to establish the optimal hedging ratio. In order to reduce the inventory risks of refined oil and minimize the income risk, the risk minimization hedging model is chosen. A. Model specification R refers to the change of hedging value; h(t) refers to the hedging ratio; S1 and S2 respectively refer to spot prices at time t1 and t2; F1 and F2 respectively refer to futures prices at time t1 and t2; S h(t )F stands for the eventually change of short hedging, and h(t )F S stands for the eventually change of long hedging. Then: VAR( R) VAR(S h(t )F ) s2 h(t ) 2f 2h(t ) s f (1) And s2 VAR(S ), 2f VAR(F ), COV (S , F ) / s f , to get the optimal hedging ratio which equals to minimizing the variance of R( VAR ( R ) ), furthermore: COV (S , F ) h(t ) s f 2f Formula (3) gets the optimal hedging ratio. * And is the intercept of regression equation; (2) (3) t is random error; slope coefficient is estimated for the value of the hedging ratio: (5) COV ( ln St , ln Ft ) / VAR( ln Ft ) h B. Empirical analysis on optimal hedging ratio For hedging strategies, we respectively construct the price change sequences for time interval of 30, 60 and 90 days according to spot price and the corresponding futures closing price during a certain period, to estimate the optimal hedging ratio under different hedging deadlines. Taking the 30-day interval as an example, its statistical characteristics of trend can be described in Table I. Table I demonstrates that the average rate of spot price and futures price changes are all positive, which means both the spot and futures price have a rising overall trend. In a point view of price volatility, the prices of WTI futures and Brent futures have showed stronger volatility than the spot price of gasoline, and the price of Shanghai fuel oil futures. With regard to the price sequences of different time period, we can get regression results as follows according to the regression equation formula (4): (see Table II) Table II shows that different hedging subjects with the identical hedging time limit would have different optimal hedging ratios. Taking the 30-day interval as an example, the hedging ratio is 0.2715 when hedging against fuel oil futures, while the hedging ratio is just 0.1615 and 0.1737 against the WTI and Brent. Identical hedging subjects with different hedging time limit would also have different optimal hedging ratios. Taking the WTI futures as an example, the hedging ratio of 30-day futures is 0.1615, 0.2116 for 60-day and 0.2623 for 90-day. TABLE I PRICE CHANGE SEQUENCE CHARACTERISTICS DESCRIPTION OF 30-DAY INTERVAL 30 days dV 2h(t ) 2f 2 s f 0 dh(t ) dV 2 2 2f 0 dh(t ) 2 Build regression equation according to minimum risk based hedging ratio as follows: ln St ln Ft t (4) lnGAS ln SHFUEL lnWTI ln BRENT Mean value Standard deviation 0.016654 0.022735 0.026623 0.030780 0.031930 0.037248 0.091746 0.087323 Kurtosis Skewness 2.709309 4.268926 3.523253 3.969592 0.694197 29 0.716683 29 0.063010 29 -0.226190 29 Observations TABLE II THE REGRESSION RESULTS Durations Hedging subject ln SHFUEL lnWTI 0.2715 0.1615 T p R2 F 1.7350 0.0941 0.1003 3.0103 0.0112 0.2152 7.4055 2.7213 30 days 60 days 90 days ln BRENT 0.1737 2.8044 0.0092 0.2256 7.8650 ln SHFUEL 0.2549 2.1753 0.0389 0.1540 4.7320 lnWTI 0.2116 4.2141 0.0003 0.4058 17.7583 ln BRENT 0.2115 4.2967 0.0002 0.4152 18.4618 ln SHFUEL 0.3386 3.3422 0.0026 0.3088 11.1700 lnWTI 0.2623 5.5693 0.0000 0.5638 31.0171 ln BRENT 0.2566 5.8219 0.0000 0.5855 33.8942 C. Hedging efficiency comparison and analysis The calculation of hedging ratio is conducted in risk minimization principle, and the hedging efficiency is measured by the decline degree of risk. According to Johnson (1960) [16] who defined the hedging performance as the decline degree of variance after hedging, income variance of hedging and nohedging can be described as: (6) VAR(U t ) VAR( ln St ) (7) VAR( H t ) VAR( ln St ln Ft ) Then hedging efficiency index can be calculated: (8) H e [VAR(Ut ) VAR( Ht )]/ VAR(Ut ) index reflects the decline degree of risk of hedging to no-hedging, that is to say the effectiveness of hedging. After hedging with some contracts, the degree of risk for spot price change could be reduced; the more the risk reduction is, the stronger the effectiveness of futures contract is. Comparing different futures hedging efficiency through formula (8), we get the results shown in Table III: risk management, in order to avoid price decline risk in gasoline spot market. ACKNOWLEDGMENT I would like to extend my sincere thanks to my mentor, Associate Professor Xing Bi. I am deeply inspired by his meticulous scholarship, concentration on academic studies and visionary guidance to students, from which I benefited a lot. Meanwhile, I would also like to thank my girlfriend, who gives me endless energy and great support to study. TABLE III HEDGING EFFICIENCY COMPARISON He Durations He ln SHFUEL 0.1003 lnWTI 0.2152 ln BRENT 0.2256 ln SHFUEL 0.1540 lnWTI 0.4058 ln BRENT 0.4152 ln SHFUEL 0.3088 lnWTI 0.5638 ln BRENT 0.5855 30 days 60 days IV. CONCLUSION Hedging efficiency comparison in Table III shows that under the measure of risk minimization index and with the same futures contract time limit, the hedging effect of Brent futures is the best, WTI futures taking the second place, and Shanghai fuel oil futures is the least efficient in hedging. Taking Brent futures as an example, 30-day futures contract will reduce 22.56 percent of risk, 60-day contract reducing 41.52% and 90-day contract reducing 58.55%. By this token, Brent futures with 90day contract work better than the other Brent futures. Consequently, it is recommended to buy 90-day Brent futures contract in futures market in refined oil inventory Hedging subject matter 90 days REFERENCES [1] Chenggen Yan, Jiangru Hong, Modern Enterprise Administration [M]. Beijing: Tsinghua University Press, 2005. [2] Minggui Sun, Sales Logistics Management [M]. Beijing: China Society Science Press, 2005-5-25. [3] Xili Wang, “ABC classification in the application of enterprise inventory management” [J]. Journal of Modern Business Trade Industry, 2009, (5). [4] Junxu Chen, An introduction to modern logistics [M]. Beijing: Beijing University of Posts and Telecommunications Press, 2008-12. [5] Fuquan Nie, Wenli Yang, “The principle and process of JIT purchasing pattern” [J]. Journal of Mechanical and Electrical Information, 2005, 89(5): 11-13. [6] J. M. Keynes, A Treatise on Money [M]. 2 Vols, C.W, Macmillan,London,1930,Vol. V,VI. [7] L. H. Ederington “The hedging performance of the new futures markets” [J]. Journal of Finance, 1979, 34, 157170. [8] D. Lien, X. Luo, “Estimating multi-period hedge ratios in cointegrated markets” [J]. Journal of Futures Markets, 1993, 13, (8): 909-920. [9] P. V. Viswanath, “Efficient use of information, convergence adjustments, and regression estimates of hedge ratios” [J]. Journal of Futures Markets. 1993, (13): 43-53. [10] A. Ghosh, “Cointegration and error correction models: intertemporal causality between index and futures prices” [J]. Journal of Futures Markets, 1993b, 13, 193-198. [11] P. Holmes, “Stock index futures hedging: hedge ratio estimation, duration effects, expiration effects and hedge ratio stability” [J]. Journal of Business and Accounting, 1996, 23(1): 63-78. [12] A. B. Sim, R. Zurbruegg, “Optimal hedge ratios and alternative hedging strategies in the presence of cointegrated time-varying risks” [J]. The European Journal of Finance, 2001, 7(3): 269-283. [13] S. G. Cecchetti, R. E. Cumby, S. Figlewski, “Estimation of the optimal futures hedge” [J]. Review of Economies and Statistics, 1998, (70): 623-630 [14] Changzheng Huang, “Research on futures hedging decision-making model” [J]. Journal of Quantitative and Technical Economics, 2004, 7: 623-630. [15] An-Pin Chen, Yu-Chia Hsu, “Applying the extended classifier system to trade interest rate futures based on technical analysis” [C], in 2008 Eighth International Conference on Intelligent Systems Design and Applications, isda, vol. 3, pp. 598-603. [16] L. Johnson, “The theory of hedging and speculation in commodity futures” [J]. Review of Economic Studies, 1960, 27, pp. 139-151