5 - Bournemouth University Research Online [BURO]

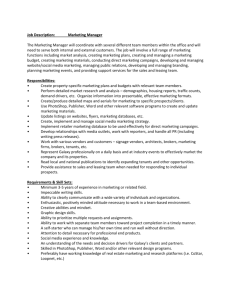

advertisement

![5 - Bournemouth University Research Online [BURO]](http://s3.studylib.net/store/data/008494426_1-253dda47d3837d7d8048f1829d11133c-768x994.png)