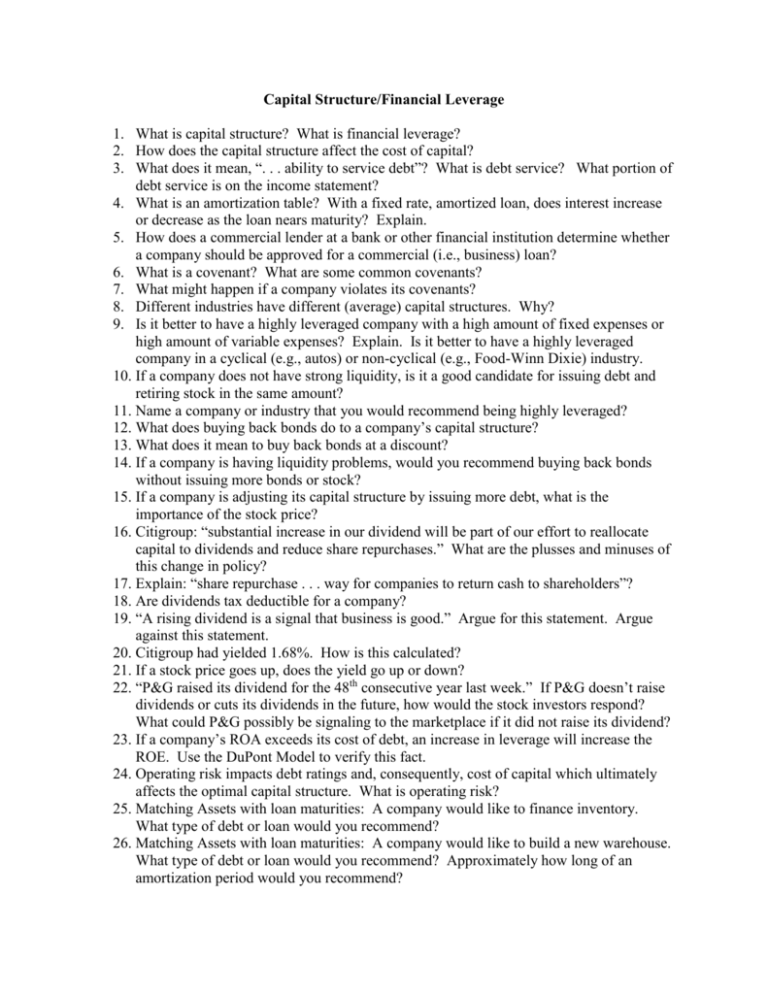

Capital Structure/Financial Leverage

advertisement

Capital Structure/Financial Leverage 1. What is capital structure? What is financial leverage? 2. How does the capital structure affect the cost of capital? 3. What does it mean, “. . . ability to service debt”? What is debt service? What portion of debt service is on the income statement? 4. What is an amortization table? With a fixed rate, amortized loan, does interest increase or decrease as the loan nears maturity? Explain. 5. How does a commercial lender at a bank or other financial institution determine whether a company should be approved for a commercial (i.e., business) loan? 6. What is a covenant? What are some common covenants? 7. What might happen if a company violates its covenants? 8. Different industries have different (average) capital structures. Why? 9. Is it better to have a highly leveraged company with a high amount of fixed expenses or high amount of variable expenses? Explain. Is it better to have a highly leveraged company in a cyclical (e.g., autos) or non-cyclical (e.g., Food-Winn Dixie) industry. 10. If a company does not have strong liquidity, is it a good candidate for issuing debt and retiring stock in the same amount? 11. Name a company or industry that you would recommend being highly leveraged? 12. What does buying back bonds do to a company’s capital structure? 13. What does it mean to buy back bonds at a discount? 14. If a company is having liquidity problems, would you recommend buying back bonds without issuing more bonds or stock? 15. If a company is adjusting its capital structure by issuing more debt, what is the importance of the stock price? 16. Citigroup: “substantial increase in our dividend will be part of our effort to reallocate capital to dividends and reduce share repurchases.” What are the plusses and minuses of this change in policy? 17. Explain: “share repurchase . . . way for companies to return cash to shareholders”? 18. Are dividends tax deductible for a company? 19. “A rising dividend is a signal that business is good.” Argue for this statement. Argue against this statement. 20. Citigroup had yielded 1.68%. How is this calculated? 21. If a stock price goes up, does the yield go up or down? 22. “P&G raised its dividend for the 48th consecutive year last week.” If P&G doesn’t raise dividends or cuts its dividends in the future, how would the stock investors respond? What could P&G possibly be signaling to the marketplace if it did not raise its dividend? 23. If a company’s ROA exceeds its cost of debt, an increase in leverage will increase the ROE. Use the DuPont Model to verify this fact. 24. Operating risk impacts debt ratings and, consequently, cost of capital which ultimately affects the optimal capital structure. What is operating risk? 25. Matching Assets with loan maturities: A company would like to finance inventory. What type of debt or loan would you recommend? 26. Matching Assets with loan maturities: A company would like to build a new warehouse. What type of debt or loan would you recommend? Approximately how long of an amortization period would you recommend?