guide_to_wc_insurance_from_big

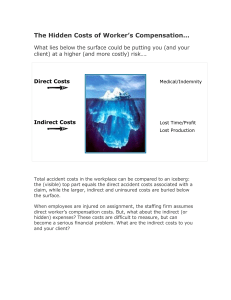

advertisement