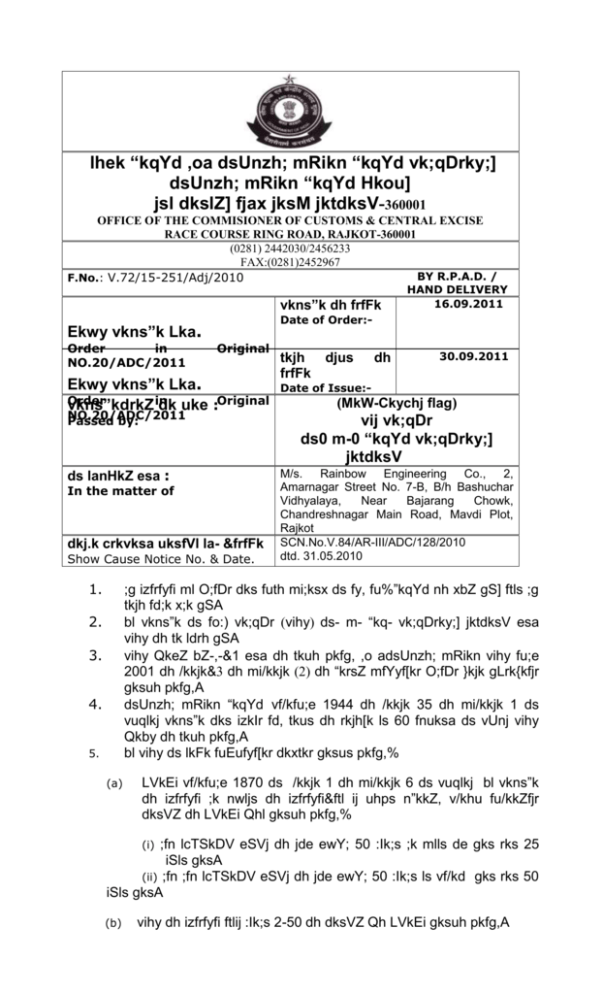

OIO 20 ADC 2011 - Central Excise

advertisement

lhek “kqYd ,oa dsUnzh; mRikn “kqYd vk;qDrky;]

dsUnzh; mRikn “kqYd Hkou]

jsl dkslZ] fjax jksM jktdksV-360001

OFFICE OF THE COMMISIONER OF CUSTOMS & CENTRAL EXCISE

RACE COURSE RING ROAD, RAJKOT-360001

(0281) 2442030/2456233

FAX:(0281)2452967

BY R.P.A.D. /

F.No.: V.72/15-251/Adj/2010

vkns”k dh frfFk

Date of Order:-

Ekwy vkns”k Lka.

Order

in

NO.20/ADC/2011

Original

Ekwy vkns”k Lka.

Order

vkns”kdrkZ in

dk uke :Original

NO.20/ADC/2011

Passed by:

ds lanHkZ esa :

In the matter of

dkj.k crkvksa uksfVl la- &frfFk

Show Cause Notice No. & Date.

1.

HAND DELIVERY

16.09.2011

tkjh

frfFk

djus

dh

30.09.2011

Date of Issue:-

(MkW-Ckychj flag)

vij vk;qDr

ds0 m-0 “kqYd vk;qDrky;]

jktdksV

M/s. Rainbow Engineering Co., 2,

Amarnagar Street No. 7-B, B/h Bashuchar

Vidhyalaya,

Near

Bajarang

Chowk,

Chandreshnagar Main Road, Mavdi Plot,

Rajkot

SCN.No.V.84/AR-III/ADC/128/2010

dtd. 31.05.2010

;g izfrfyfi ml O;fDr dks futh mi;ksx ds fy, fu%”kqYd nh xbZ gS] ftls ;g

tkjh fd;k x;k gSA

bl vkns”k ds fo:) vk;qDr (vihy) ds- m- “kq- vk;qDrky;] jktdksV esa

vihy dh tk ldrh gSA

vihy QkeZ bZ-,-&1 esa dh tkuh pkfg, ,o adsUnzh; mRikn vihy fu;e

2001 dh /kkjk&3 dh mi/kkjk (2) dh “krsZ mfYyf[kr O;fDr }kjk gLrk{kfjr

gksuh pkfg,A

dsUnzh; mRikn “kqYd vf/kfu;e 1944 dh /kkjk 35 dh mi/kkjk 1 ds

vuqlkj vkns”k dks izkIr fd, tkus dh rkjh[k ls 60 fnuksa ds vUnj vihy

Qkby dh tkuh pkfg,A

bl vihy ds lkFk fuEufyf[kr dkxtkr gksus pkfg,%

2.

3.

4.

5.

(a)

LVkEi vf/kfu;e 1870 ds /kkjk 1 dh mi/kkjk 6 ds vuqlkj bl vkns”k

dh izfrfyfi ;k nwljs dh izfrfyfi&ftl ij uhps n”kkZ, v/khu fu/kkZfjr

dksVZ dh LVkEi Qhl gksuh pkfg,%

(i)

;fn lcTSkDV eSVj dh jde ewY; 50 :Ik;s ;k mlls de gks rks 25

iSls gksA

(ii) ;fn ;fn lcTSkDV eSVj dh jde ewY; 50 :Ik;s ls vf/kd gks rks 50

iSls gksA

(b)

vihy dh izfrfyfi ftlij :Ik;s 2-50 dh dksVZ Qh LVkEi gksuh pkfg,A

6- vihy QkZe ds lkFk M~;wVh@isUkYVh vkfn ds Hkqxrku dk ewyHkwr

izek.ki= layfXur gksuh pkfg,

Notes: - [These notes are for broad general guidance only. The original text of the Central Excise

Act, 1944 and the Rules framed there under may be referred to before taking any action in terms of these

Notes.]

BRIEF FACTS OF CASE:

M/s. Rainbow Engineering Co., 2, Amarnagar Street No.-7-B, B/h Bahuchar

Vidhalaya, Near Bajrang Chowk, Chandreshnagar Main Road, Mavdi Plot, Rajkot,

(hereinafter referred to as “noticee No.1”), is engaged in the manufacture of

power driven Borewell pumps (submersible pumps), Open well pumps & Turbine

Pumps primarily designed for handling water and falling under CETSH 8413 710

and 8413 7094 of the Central Excise Tariff Act, 1982, and was not registered with

the Central Excise department.

2. On receipt of

information that the noticee No.1 was engaged in the

manufacture and clearance of power driven pumps, which do not conform to the

Bureau of Indian Standards (BIS) and therefore, said goods were not eligible for

exemption under Notification No. 8/2003-CE dated 1.03.2003; however the noticee

was clearing the said pumps without payment of Central Excise duty, a team of the

officers of the Head Quarters Preventive Unit of Central Excise, Rajkot, visited and

searched the factory premises of the noticee No.1 on 07.12.2009. During the

course of panchnama proceedings, Shri Sureshbhai Babubhai Vasani, Proprietor of

noticee No.1, explained that since last five years, they were manufacturing V-3, V4, V-6 bore sized submersible pumps and Open well pumps of different capacities,

from the premises of noticee No.1 and that they had not obtained ISI certificate for

any of their products. During the search of premises of noticee No.1, various

chits/challan, transport receipts and two pen-drives were recovered. Regarding

these pen drives, Shri Sureshbhai Vasani informed that these belong to the

accountant of noticee No.1 and he did not know the data contained in them. Both

the pen drives and other incriminating documents/records, as per Annexure A,

were resumed for futher investigation under Panchnama dtd. 7.12.2009. During

the search of the factory premises of noticee No.1, 10 Open well Pumps (5HP

3phase), 10 submersible pumps of V3 bore size (0.5HP 1phase) and 6 Submersible

pumps of V4 bore size (2 each of 0.5HP, 0.75HP & 1.5 HP, single phase), were

found in finished condition. Total 26 pumps valued at Rs.1,12,600/-, not

conforming to BIS standards were found from the premises of noticee No.1. The

said 26 power driven pumps, as listed in the panchnama dated 07.12.2009, were

placed under seizure under the reasonable belief that the same were manufactured

with intent to clear them without payment of excise duty by the noticee No.1. The

seized goods were then handed over to Shri Sureshbhai B. Vasani, Proprietor of

noticee No.1, under supratnama dated 07.12.2009, for safe custody. Shri

Sureshbhai Vasani, Proprietor, was explained that the pumps produced by noticee

No.1 were used for drawing water and if ISI certificate is not obtained thereof, they

were not eligible for SSI exemption and he was required to pay Central Excise duty

on sale thereof after 1.1.2007.

3. Statement of Shri Sureshbhai B. Vasani, Proprietor of the noticee No.1, was

recorded under Section 14 of the Central Excise Act, 1944 on 07.12.2009, wherein

he, inter alia, stated that the noticee No.1 was engaged in the manufacture of

series of V-3, V-4 and V6 bore size of submersible pumps and V-8 bore size Open

well pumps and sale thereof since last five years; that their products were used for

drawing ground water; that they had applied for ISI certificate, but the same was

not issued in respect of any of their series of submersible pumps or open well

pumps; that they were manufacturing and clearing around 150 submersible and

open well pumps per month; that they were affixing “Rainbow”, “S.K.” and “Boss”

brands on their pumps, out of which the first two were their registered brands; that

for manufacture of submersible and open well pumps, first, finishing process is

carried out on casted parts, then stampings are set in the steel pipe; then after

processes of machining, Copper wiring and fitting is carried out, and then the

assembled pumps are tested; that sometimes the finishing of the casted parts is

getting done on job work basis; that they had applied for ISI certificate for their

products, but, as the testing facilities were situated in the premises located

opposite the premises of noticee No.1, the certificate was not issued; that he

admitted that, by not obtaining the ISI certificate and by not paying the dues of the

Central Excise duties on submersible pumps and openwell pumps manufactured by

them, he had evaded Central Excise duties; that they had not prepared bills, for

the clearances made under LRs and ‘kachha’ chits, recovered during the search of

noticee No.1; that the reasons for their clearances, without preparing bills were

that, no customer was ready to purchase goods from them with bills and that he

also wanted to avoid the Central Excise duty liability; that their main customers

were, M/s Amar Motor Rewinding, Chamardi, Babra, M/s Maruti Motor Rewinding,

Babra, M/s Shyam Agro, Amreli, M/s Shakti Motor Rewinding, Derdi, M/s Murlidhar

Motor Rewinding and M/s Ganesh Traders, Ratlam; that the sale proceeds for their

sale without bills were received by him through “angadiyas” and sometimes, he

was collecting cash payments by arranging personal visits; that they were utilizing

the services of M/s Jalaram Transport, Mochi Bazar, Rajkot and M/s National

Transport, Kaisar-e-Hind Bridge, Rajkot for transportation of their products to

Amreli district and M/s Girnar Transport for their sale outside Gujarat state; that

they were purchasing raw materials without bills on cash payments from M/s

Dinesh Casting, Umakant Pandit Udhyognagar, Street No.4, Rajkot, M/s Satyam

Steel Pipe, Samrat Main Road, Rajkot, M/s Perfect Stamping, 1, Amulnagar, Rajkot,

M/s Mittal Copper, Rajkot, M/s Shiv Traders (Jadavbhai) Rajkot. Admitting the duty

liability, he voluntarily handed over two cheques each of Rs. 2.5 Lakh, drawn on

Rajkot Peoples Co-Op. Bank Ltd, which were deposited in the government account.

4. Further statement of Shri Sureshbhai B. Vasani, Proprietor of noticee No.1,

was recorded under section 14 of the Central Excise Act, 1944 on 14.12.2009,

wherein he, inter alia, stated that the noticee No.1 was engaged in manufacture of

Turbine pumps, submersible kits, bore well and open well pumps of different sizes

and selling them under their “S.K” and “Rainbow” brands; regarding manufacturing

process, he explained that they assemble the various parts of pump viz., SS Pipe,

‘Pawala’, Stampings, Shafting, Bushing, Casting (Channel Housing casing), Copper

etc.; then the assembled pumps are tested, painted, labeled and packed for sale;

that the processes were same for each of their products for V-3, V-4, V-6 bore

sizes submersible kit and open well pump kits of 0.5HP to 7.5HP capacities as well

as the turbine pumps of the bore sizes V-6 and V-8; that the noticee No.1 was

having lathe machine, press machine, balancing machine, grinder and drill machine

on which, different parts of pumps were machined or sized by the workers before

assembling into pumps; that he had not obtained ISI certificate for any of the

products manufactured by noticee No.1; that his products were used in drawing

water in which turbine pumps and open well pumps were used to draw water from

wells, in which the turbine pumps operates at ground level/above well and openwell

is being operated under water; that the bore well submersible pumps of V-3, V-4 ,

V-6 etc. boresizes were used in drawing water from different sized bores; that he

was using only “SK” and “Rainbow” brands for his products, since year 2003, and

he had not used any other brands; that he had not sold any of his products without

brand names; that as he was not having ISI certification for any of the pumps

manufactured by noticee No.1, he was effecting most of the clearances without

preparing bills and only preparing chits or delivery challan for booking the same

with transporters; that after receipt of payments, he was destroying the chits and

transport receipts; that the different transport receipts, guarantee cards, summary

slips and delivery challans/chits recovered from the premises of noticee No.1

reflected sale of their pumps without bills; that such sale did not show the

consignor’s name, and the consignee’s name were mostly shown in codeword; that

they were also carrying out the repairing of old pumps brought from nearby

villages; that the kits manufactured by them were the pumps without windings and

their values would be around Rs.1500/- lesser than that of normal pump; that he

was shown the descriptions of the pumps which were cleared on bills shown them

as kits; that they have sold turbine pumps to different farmers within Gujarat

state.

5.

The submersible pumps and open well pumps were sold, mostly to M/s

Kasama Pump, Hyderabad, M/s J.T. Indore, M/s Sai Shreenivasa traders,

Secunderabad, M/s Dildar Machinery, Aurangabad, M/s Gupta Machinery, Gwaliar

and M/s Shree Geetha Enterprise, Secundrabad; that he could not say from the

transport receipts (LR) as to which pumps were sold to these firms, but, if the

same were shown in summary list of that date, he could explain the clearance of

the said pumps under that transport receipt (LR); that all the financial transactions

of such clearances were made in cash and

during his personal visit, after

realization of the due amounts, the chits were destroyed; that he was purchasing

required raw materials from the parties of Rajkot viz. Impeller castings from M/s

Popular Foundry, Bhaktinagar, Rajkot, Winding wire form M/s Anmol Wire, Samrat

Industrial Area, Rajkot or M/s High Tech Wire, Patel agar, Copper Rods, SS Pipes

from M/s Western Pipe, Gondal Road, Rajkot, Panel Boards from M/s Mahadev

Panel, Atika, Housing castings from M/s Somnath Castings, Vavdi; that mostly the

raw materials were purchased on chits and payments thereof were made in cash;

that the chits/challan resumed from noticee No.1 on 07.12.2009, and shown in file

No. 2,3,5 & 7 of the panchnama, reflected their raw material purchases without

bills; that the pen drives resumed from noticee No.1 belonged to Shri Shaileshbhai

Savaliya, accountant of noticee No.1, who would be available after next three-four

days.

6. The sealed cover, containing two pen drives resumed from the noticee No.1,

serially numbered as “19” in the annexure-“A” to the panchnama dated

07.12.2009, was opened under panchnama on 18.1.210, in presence of two

panchas, Shri Sureshbhai Vasani, Proprietor of noticee No.1 and Shri Shaileshbhai

Savaliya, Accountant of noticee No.1. During the panchanama, Shri Shaileshbhai,

accountant, intimated that the files were in “Tally” programme and can be accessed

to only if that software was installed in the system. Hence, the tally software was

installed in the system and the white pen drive was accessed. On being asked

about the data displayed on computer from white pen drive, Shri Shaileshbhai,

accountant, informed that the details reflected sale without bills by M/s Rainbow

Engineering Co., Rajkot, during year 2008-09, which he had entered, on directions

of Shri Sureshbhai, from the chits; that the printouts of such sale were taken and

were serially numbered as page number 1 to 47, in a made up file. In the same

manner, on assessing the black pen drive, the sale details of February 2009 and

March 2009 were obtained, which were given page numbers 49 to 87, in the same

made up file. Apart from the above accounts, a scanned page was also found while

assessing the the pen drive, for which, Shri Sureshbhai informed that, it reflects

the total sales to his customer M/s Kasama Pump, Hyderabad, during month of

February 2009 and the sale proceeds received by him against it.

7. A Statement of Shri Shaileshbhai Manjibhai Savaliya, accountant of the

noticee No.1, was recorded on 18.1.210, under section 14 of the Central Excise

Act, 1944, wherein he, inter alia, stated that the two pen drives resumed from

noticee No.1, under panchanama dated 07.12.2009, belongs to him; that he was

handling the accounting work of noticee No.1 since last five years; that his work

was to take the chits/records from the noticee No.1 to his office, and, after

entering the same on his computer he used to return the chits and printouts to Shri

Sureshbhai, Proprietor of noticee No.1; that he was not having any data saved

anywhere else other than the two pen drives or any records in his possession; that

the printouts obtained from these pen drives reflected the sale of different pump

sets by noticee No.1 to their different customers, during the period from December

2008 to March 2009; that the chits and lists, from which this data was prepared,

were given by Shri Sureshbhai; that after entering the details in computer, he had

returned the chits/lists along with the printouts, to Shri Sureshbhai; that the chits

were having the details like dates, name of customers, types of pumps and the

amounts of sale values, which were shown under the debit side in ledger accounts;

that the lists were showing recoveries from those customers against whose names

the dates and amounts were written; that he had handled the entry work for the

noticee No.1 only for the period December 2008 to March 2009 ; that the data of

clearances for four months saved in pen drives for back up, on instructions from

Shri Sureshbhai, on completion of financial year 2008-09.

8. Further statement of Shri Sureshbhai B. Vasani, Proprietor of noticee No.1,

was recorded on 18.1.210, under Section 14 of the Central Excise Act, 1944,

wherein he, inter alia stated that he agreed to the panchnama dated 18.1.210, as

well as the file containing page number 1 to 87, having the data of printouts

obtained from the two pen drives in his presence; that he had also read the

translation of the statement dated 18.1.210 of Shri Shaileshbhai Savaliya,

Accountant of noticee No.1, and agreed to the contents thereof; that the reason for

preparing computerized data of their sale was for frequent revision/change in the

sale values of their products; that in case of return of pumps within guarantee

periods, if the replacements were made without considering the subsequent

revisions and without collecting the differential amounts, their profit margins would

wipe away; that for this purpose only, he had got the computerized entries for the

period from December 2008 to March-2009; that after getting the details, entered

in pen drives, he had destroyed the chits and had not preserved the hardcopies of

printouts; that he had not got the details of earlier periods entered in soft form,

and for the subsequent period, the chits/challans had already been seized by the

department; that apart from the seized records, he had not preserved any other

records; that he had not shown the full details and sale prices of the pumps in the

summary lists/chits recovered from noticee No.1; that the persons coming from

nearby villages are coming with their own vehicles and purchase pumps on cash

payments, hence no amounts has been shown against those pumps and no entry

was made anywhere else, in this regard, but the particulars of the pumps sold were

as shown in the respective chits; that sometimes, the pumps within warranty

periods, were returned to the noticee No.1 for repairing, which were returned back

to customers after repairs, hence no particulars were available for several LRs,

where only “sub pumps” or “water pump” or “open well pump” and “number of

packages” were shown; that the main sale of submersible pumps was of V-4 bore

sized pumps and in open well category, major sale was of their mini-open well type

pumps.

9. Statement of Shri Pravinbhai Bhikhabhai Ranparia, Manager and authorized

person of Shri Dhanjibhai Bhikhabhai Ranparia, Partner of M/s P.I.Manufacturing

Co., 2- Laxminagar, Mavadi Plot, B/h Valand Samaj Wadi, Rajkot (hereinafter

referred to as the Noticee No.2) was recorded on 02.02.210, under Section 14 of

the Central Excise Act, 1944,

wherein he, inter alia

stated that M/s P.I.

Manufacturing Co. was a partnership firm of Shri Dhanjibhai Bhikhabhai Ranparia

and Shri Bharatbhai Bhikhabhai Ranpariya, who were his brothers; that he was

handling all work of that firm in capacity of manager; that they are manufacturing

copper winding wire under the brand of “Hi-Tech” since last four years from their

firm; that he was handling the work related to purchase, sale and collection of sale

proceeds and his elder brothers are handling production and quality related works

at the factory; that their products, winding wires of different sizes are used in

manufacture of electric motors and submersible pumps; that his main customers

were M/s Rainbow Engineering. Co., Rajkot and M/s Krishna Industries, Rajkot;

that he had also cleared some of their production under “Hi-Tech” brand without

preparing bills on requirement of his customers; that the sale proceeds against

such sale was collected in cash only; that he had cleared winding wires to the

noticee No.1. However, he has not preserved any records thereof neither he

remember the exact details of such clearances; that as per his knowledge, “HiTech’ brand was not the registered brandname of any firm; that he knows Shri

Sureshbhai B. Vasani, proprietor of noticee No.1, since last three years and most of

their transactions were dealt with him only; that he had seen the page No.153 to

159 of file No.2, page No. 139 to 147 of file No.5 and page No.157 of file No.7, all

resumed from noticee No.1, under panchnama dated 07.12.2009, and the entries

reflecting “Hi-Tech Wire”, “Hi-Tech Wire (Pravin) or “Hi-Tech A/c (Pravinbhai)”

referred to his firm, namely M/s P.I. Manufacturing Co., Rajkot, only; that the

respective pages of file No.5 were reflecting the sale value of goods, sold to noticee

No.1, by them, without preparing any bills and the amounts payable to them, for

the period from April-09 to September-09; that the page No.157 of file No.7, was

not about their sale to noticee No.1, as from the applied rate of Rs.360/- per Kg.

shown therein, it must be for copper purchase; that in same file No.7, at page 329,

the chit dated 06.11.2009 reflected their sale, in which, the rates of Rs.530 per Kg.

or Rs.495 per Kg., are shown for different sized winding wires, sold to noticee

No.1; that after perusing the file No.2, resumed during panchnama dated

07.12.2009, he stated that the page Nos.153 to 159 thereof reflects the sale of

copper winding wire to noticee No.1, and the amount paid by Shri Sureshbhai,

proprietor of noticee No.1; that the amount therein has been shown by deleting

last two zeros of the actual amount in the ledger book(rojmel) numbered 12, of the

panchnama dated 07.12.2009; that he agreed to the statement dated 07.12.2009

of Shri Sureshbhai B. Vasani, in which their sale was referred to as the “purchase

from M/s Hitech Wire or M/s Hitech Industries” and in token thereof he put his

dated signature.

10. Summons were issued to the proprietor/partner/authorized persons of major

customers of noticee No.1, viz. M/s Kasama Pump, Shop No.18/1, 350/A-1, near

Omar restaurant, DRDI Main Road, Hyderabad (herein after referred to as “the

noticee No.3”), M/s Sai Srinivasa Traders, 5-1-529/E, Murthi Building, Ist Floor,

Nr. Indian Bank Secundrabad(herein after referred to as “the noticee No.4”), M/s

Sri Geeta Enterprises, 5-1-529/B, Murthy Building, Ist Floor, Opp. Indian Bank

Lane, Hill Street, Secundrabad (herein after referred to as “the noticee No.5”),

M/s Gupta Machinery Stores, A.B.Road, Gole Pahariya (Lathe Machine Workshop),

Lashkar, Gwaliar (M.P.) (herein after referred to as “the noticee No.6”), and M/s

Dildar Machinery, Near Maruti Mandir, Garkheda, Aurangabad (herein after referred

to as “ “noticee No.7”), for giving evidences and producing all the records for

purchase of pumps from noticee No.1 since 1.1.07. In response to the first

summons dated 22.04.210, the noticee Nos.3 to 6 forwarded letters, through Shri

Sureshbhai B. Vasani, to the effect that statement(s) of Shri Sureshbhai Vasani, on

their behalf would be binding to them. Further, in their letters, they expressed their

inability to remain present on scheduled dates, for giving evidences, with reasons.

The noticee No.3 cited unavoidable circumstances and also stated that he is not

having any record regarding business transactions with noticee No.1. The noticee

No.4 stated that he was busy with some social work on the given date and that

their firm was not maintaining any record of business transactions with noticee

No.1. The noticee No.5 stated that it was not possible for him to remain present on

the date and time given in the said summons, as well as, he was having little

transactions with noticee No.1. The noticee No.6 showed his inability to attend

SUMMONS on scheduled date due to some pre-commitments and had very rare

transactions with noticee No.1. The noticee No.7 did not respond to the summons.

11. Subsequent summons were issued to noticee Nos. 3 to 7, on 05.05.210, calling

for all the records related to their purchase from the noticee No.1, and to give

evidence. However, all the noticees failed to turn up for giving evidence and put up

their case. It appears that, they have also abetted the noticee No.1 in the entire act

of duty evasion, by way of purchasing the pumps not conforming to BIS standards,

without proper duty paying documents and obstructing investigation, refrain to give

response to the summons. It is admitted by the proprietor of noticee No.1, that he

has affected such clearances to their regular customers for continuous period of

time. The noticee no. 3 to 7 could have turned up on the scheduled dates of

summons, with the records called for; however they choose not to respond to the

summons. These acts, on their part have rendered each of these five noticees, liable

for personal penalties, under rule 26 of the Central Excise Rules, 2002.

12.

Further statement of Shri Sureshbhai B. Vasani, Proprietor of noticee No.1,

was recorded on 14.05.210, under section 14 of the Central Excise Act, 1944,

wherein he, inter alia, stated that he agreed with the records resumed during search

as well as with his earlier statements dated 07.12.2009, 14.12.2009 and 18.1.210;

that he agreed to the stated facts in the statement dated 02.02.210 of Shri

Pravinbhai Bhikhabhai Ranparia, on behalf of noticee No.2; that they had purchased

required raw materials for their productions on challan/chits, as seen in the

documents placed in file No.2,5 and 7 of panchnama, and effected cash payments to

the respective suppliers including the noticee No.2; that he had carried out majority

of sale of products of noticee No.1, by not preparing any bills/invoices and on

strength of chits/challans only; that the turbine pumps, they had manufactured,

were capable of drawing groundwater from depths of upto 200 feet; that turbine

pumps were mostly sold to local farmers and sold with warranties and these were

adaptible to be run either by diesel engine or by electrical motor of sufficient

horsepower; that he had seen the details of computerized printouts, as shown under

Annexure-A, Annexure-B and Annexure-C, showing the clearances of noticee

No.1 and prepared from the particulars of (i) the two pen-drives, (ii) the bills/

Warranty cards and (iii) the chits/challans/LRs, respectively, resumed from noticee

No.1; that he had destroyed all the remaining records related with their clearances of

pumps during the period from 1.1.2007 to 07.12.2009; that he agreed to the fact

that their mini-open well pumps and V-4 bore sized submersible pumps were much

in demand as compared to their other pumps; that for the prices of products/pumps

not reflected on the corresponding chits/slips and LRs, as listed in Annexure-C, the

prices shown were as per his price lists; that they were giving discounts of 7% to

20% on the rates shown in the pricelists, to their customers; that as after 1.1.2007,

his products became dutiable under Central Excise and, as they had not obtained ISI

certification for any of their products, he had cleared very few pumps on bills, by

showing them either under “repairing bills” or as “submersible kits”, but these

referred to the pumps manufactured and sold by them, in finished condition only;

that in fact, the prices of kits shown on bills and those of pumps were equal when

compared with their bills for pumps; that he had received the letters of four of his

main customers (noticee No.3 to 6), by post, and submitted them on 12.05.210, to

the department; that his major customers were the noticee No. 3 to 7, to whom he

had effected clearances without bills; that he had cleared most of his production

without preparing bills on strength of chits and/or challans only so that Central

Excise duty can be avoided; that he had checked and agreed with the computerized

lists- i.e Annexure A,B & C, of their clearances, prepared from the records and pen

drives resumed from the premises of noticee No.1, and signed the same in token of

having agreed; that as his sale was mostly without bills, he was purchasing raw

materials without bills, for which cash payments were given, which are shown in the

purchase chits/summaries and ledger accounts seized from noticee No.1; that the

daily cash book(rojmel), resumed from his factory premises, was showing the

transactions in cash, with his customers as well as suppliers; that no

bills were

available for most of the transactions shown therein; that the entries of daybook

were written by not showing the final two zeros of the actual amounts, to show the

amounts in thousands and lakhs to appear as if they were in tens and thousands

respectively.

13. The scrutiny of all the records resumed from the Noticee No.1 and produced

during different statements, was taken up wherein it was established that,

(i)

The Noticee No.1 was engaged in manufacture and clearance of V-3, V-4, V6, bore size of submersible pumps, V-6 & V-8 bore size Turbine pumps and

various models of open well pumps from 1.1.2007 to 07.12.2009, for which

they had neither obtained BIS certification nor prepared bills at the time of

clearance.

(ii)

All the products of noticee No.1 were power driven pumps primarily designed

for handling water and classified under CETH 8413 of the Central Excise

Tariff Act, 1985.

(iii)

None of the products manufactured by noticee No.1 were conforming to the

standards specified by the BIS and in light of Notifications 08/2003-C.E

dated 1.03.2003(as amended), read with Notification No.39/2006-C.E. dated

10.08.06, were not eligible for SSI exemption, after 31.12.2006.

(iv)

The comparative demand in market, for their models of V-4 type

submersible pumps and mini open well pumps, was higher as compared to

their remaining pumps.

(v)

The clearances of their above pumps not conforming to the BIS

specifications, the proprietor had cleared them on chits and had received the

payments in cash against such sale and had also destroyed the related

records.

(vi)

The Noticee No.1 has maintained exhaustive price list covering most sizes of

submersible pumps, Turbine Pumps and Open well pumps of different models

manufactured by them.

(vii)

For the period after date 31.12.2006, when SSI exemption was not available

to their products, the Noticee No.1 had effected sale of some of the pumps

by showing them on record as “submersible kits” or by raising “repairing

bills” only;

(viii) For computing the total clearance of pumps, the records of their clearances

were trifurcated as (i) ‘Annexure-A’-i.e. clearance details obtained from the

two pen drives; (ii)‘Annexure-B’-showing the clearance details from

bills/challans raised as well as the Warranty Cards(for turbine Pumps) and

the records where sale values were available, and (iii) ‘Annexure-C’showing clearance details on records i.e. LRs, chits, slips etc. where only

description of pumps as “submersible pump” or “open well pump” was

available, with the dates of bookings and the customer’s name/destination.

(ix)

For calculation of value of pumps, for which no corresponding particulars viz.

bore size, stages, phases and HP were available on records, the submersible

pumps were considered as V-4 bore size submersible pumps and openwell

pumps were considered as mini-openwell pumps and respective prices were

considered, after allowing the highest discount of 20%.

(x)

Some of the pumps were sold (i)to retail customers without bills for which

pump specification and cash received for the same only is mentioned on

records (ii) by referring them as either “submersible kit/motor kit” on sale

bills.

(xi)

Noticee No.1 had cleared about 282 numbers of pumps to noticee No.3,

125 numbers of pumps to the noticee No.4, 25 numbers of pumps to the

noticee No.5, 75 numbers of pumps to noticee No.7, out of total 513

pumps, for which records were recovered/produced.

14. On computation of total clearances from the records resumed, it appears that

the noticee No.1 has effected clearances aggregating to Rs.1,30,490/- during

1.1.2007 to 31.03.2007 (Annex-B), Rs.4,1,750/- during financial year 2007-08

(Annex-B), Rs. 1,07,42,321/- during F.Y. 2008-09 (Annex-A & Annex-B) and Rs.

96,89,945/- during 2009-10 (up to December 2009) (Annexure-B & Annexure-C).

The Central Excise duty to the tune of Rs. 9,14,212/- with Education Cess of Rs.

18,283/- and Sec. & Higher Edu. Cess of Rs. 9059/- appears to have been evaded

by the noticee No.1, as calculated, at Annex.” A”, Annex.-“B” & Annexure “C”, of this

SCN. Thus, the Central Excise duty totaling Rs. 9,41,554/- (Rupees Nine lakh Fortyone thousand five hundred and Fifty- Four only), has been evaded by the Noticee

No.1, as detailed in annexure “A”, “B” & “C” to this SCN.

15. The Noticee No.1 had, on 22.12.2009, applied for provisional release of seized

pumps from their factory premises. The Additional Commissioner(AE), Rajkot

ordered on 1.1.210 for provisional release of the seized goods on furnishing B-11

bond of Rs. 1,12,600/-, supported with a security of 25% of the value of the bond

amount. The Noticee No.1 executed the B-11 bond and furnished proportionate fixed

deposit to the Assistant Commissioner, Central Excise, Division– I, Rajkot, which

were accepted. Accordingly, the seized goods were ordered for provisional release on

28.1.210.

16.

From the above facts, it appears that the noticee No.1 was engaged in the

manufacture of power driven pumps primarily designed for handling water and falling

under CETSH 8413 710 and 8413 7094 of the Central Excise Tariff Act, 1985; that

the noticee No.1 has manufactured and cleared at least 513 pumps, not conforming

to BIS standards, from 1.1.2007 to 07.12.2009. The duty demand is as per annexure

“A”, “B” & “C”, according to which the Noticee No.1 has evaded the Central Excise

duty to the tune of Rs.9,41,554/-, during this period. Further, on 07.12.2009, it was

found that they had manufactured and stored 26 pumps, totally valued at

Rs.1,12,600/-, with an intent to clear them clandestinely, as the benefit of the SSI

notification was not available to the noticee No.1, as the same were not conforming

to the standards specified by the BIS.

17. In view of the above facts, it appears that the said noticee No.1 has

contravened the provisions of –

(i)

(ii)

(iii)

(iv)

(v)

(vi)

(vii)

Rule 4 read with Rule 8 of Central Excise Rules, 2002 inasmuch as they have

removed the excisable goods without discharging the Central Excise duty in

the manner prescribed under the said Rules.

Rule 6 of the Central Excise Rules, 2002 in as much as they failed to assess

the duty payable on the clearance made by them.

Rule 9 of the Central Excise Rules, 2002 in as much as they have failed to

obtain Central Excise registration with the Department;

Rule 10 of the Central Excise Rules, 2002 in as much as they have failed to

maintain true and correct account of the manufacture and clearance of their

finished products.

Rule 11 of the said Rules in as much as they failed to issue the proper invoices

for clearance in respect of the said finished goods cleared from their factory.

Rule 12 of the said Rules in as much as they failed to correctly file the

Monthly returns regarding manufacture and clearance of finished goods with

the Central Excise department.

Failed to file a declaration with the department as provided under notification

36/201-CE (NT) dated 26.06.201, for the financial year 2008-09 &2009-10,

when their clearances had crossed the specified limit of Rs.90 Lakhs.

Therefore, all these acts of contravention on the part of the noticee No.1

appear to have been committed with the sole intention to evade payment of duty.

The noticee No.1 has suppressed the fact of the manufacture of pumps which did not

conform to the standards specified by the Bureau of Indian Standards(BIS) from the

department and cleared the said pumps without payment of duty through fraud,

willful misstatement and by suppression of the material facts and therefore duty not

paid is required to be demanded and recovered from them under the proviso to

Section 11A (1) of the Central Excise Act, 1944, by invoking extended period of

limitation of five years along with interest under Section 11AB of the said Act.

Further, the noticee No.1 has rendered himself liable to penalty under Section 11AC

of the said Act for the acts and omissions as described above. The noticee No.1, by

his acts of manufacturing, keeping and storage of the excisable goods without

obtaining Central Excise registration and without maintaining proper records, has

rendered himself liable for penal action under Rule 25 of the Central Excise Rules,

2002.

18. It also appears that the noticee No. 2, Shri Dhanjibhai Bhikhabhai Ranparia,

partner of M/s P.I. Manufacturing Co., 2, Laxminagar, B/h Valand Samajwadi,

Rajkot-2, had supplied their finished goods, i.e. winding wires of different sizes to

the noticee No.1, without preparing any bill/invoices and received payments in cash;

that no record of any type, was preserved by them, evidencing such supply. When

confronted with the delivery challans and accounts, the authorised person and

manager of noticee No.2, admitted their transactions with noticee No.1. Hence, the

noticee No.2 is knowingly concerned in the act of supply of the raw materials without

bills, which were used in manufacture of excisable goods for which he knew or had

reasons to believe that the same were liable to confiscation, under the said Act or

the rules framed there under. These acts, on his part, have made him liable for

personal penalty under Rule 26 of the Central Excise Rules, 2002

19. It appears that noticee No.3, Proprietor, M/s Kasama Pump, Shop No.18/1,

350/A-1, near Omar restaurant, DRDI Main Road, Hyderabad; noticee No.4,

Proprietor, M/s Sai Srinivasa Traders, 5-1-529/E, Murthi Building, Ist Floor, Nr.

Indian Bank Secundrabad, noticee No.5, Proprietor of M/s Sri Geeta Enterprises, 5-1529/B, Murthy Building, Ist Floor, Opp. Indian Bank Lane, Hill Street, Secundrabad,

noticee No.6, proprietor of M/s Gupta Machinery Stores, A.B.Road, Gole Pahariya

(Lathe Machine Workshop), Lashkar, Gwaliar (M.P.) and noticee No.7, Propreitor of

M/s Dildar Machinery, Near Maruti Mandir, Garkheda, Aurangabad are knowingly

concerned in the acts of transporting, procuring, purchasing etc. of the excisable

goods for which they knew or had reasons to believe that the same were liable to

confiscation under the said Act or the rules framed there under. Further, noticee

No.3 to 6 appear to have actively abetted the acts of duty evasion by Noticee No.1,

by destroying the relevant documents and accounts for purchase of pumps from

Noticee No.1. They have further abetted the act of duty evasion and by not cooperating and turning up for giving evidence during the investigation. These acts on

their part have made each of them liable for personal penalties under Rule 26 of the

Central Excise Rules, 2002.

20.

In view of above facts and documentary evidences the Noticee No.1, i.e.

M/s Rainbow Engineering Co., 2, Amarnagar Street No.-7-B, B/h Bahuchar

Vidhalaya, Near Bajrang Chowk, Chandreshnagar Main Road, Mavdi Plot, Rajkot, was

served with show cause No.SCN NO.V.84/ARIII/ADC/128/210 dated 31/05/210., as

to why:-

(i)

the 26 power driven pumps, not conforming to the BIS standards,

totally valued at Rs.1,12,600/-, placed under seizure, under the

panchnama dated 07.12.2009, should not be confiscated under Rule 25

of the Central Excise Act, 2002; as the said goods are provisionally

released, why the Bond and security furnished should not be enforced;

Central Excise duty of Rs.9, 41,554/- (including Education Cess and H.E. Cess)

(Rupees Nine Lakh Forty One Thousand Five hundred and Fifty Four only), as

detailed in the “Annexure – A, B & C” to this notice, should not be recovered from

them, under the proviso to Section 11A (1) of the said Act. As they have paid an

amount of Rs.5,00,000/- (Rupees Five Lakh only) voluntarily, why the said amount

should not be appropriated against the abovementioned duty amount; interest at

appropriate rate, on the aforesaid duty amount, should not be recovered from them,

under Section 11AB of the said Act, the penalty, under Section 11AC of the said Act,

should not be imposed upon them, penalty under Rule 25 of the Central Excise

Rules, 2002 should not be imposed upon them. The noticee No. 2, Shri Dhanjibhai

Bhikhabhai Ranparia, Partner of M/s P.I. Manufacturing Co., 2, Laxminagar, B/h

Valand Samajwadi, Rajkot-2, the noticee No.3, Proprietor, M/s Kasama Pump, Shop

No.18/1, 350/A-1, near Omar restaurant, DRDI Main Road, Hyderabad; noticee

No.4, Proprietor, M/s Sai Srinivasa Traders, 5-1-529/E, Murthi Building, Ist Floor,

Nr. Indian Bank Secundrabad, noticee No.5, Proprietor of M/s Sri Geeta

Enterprises, 5-1-529/B, Murthy Building, Ist Floor, Opp. Indian Bank Lane, Hill

Street, Secundrabad, noticee No.6, proprietor of M/s Gupta Machinery Stores,

A.B.Road, Gole Pahariya (Lathe Machine Workshop), Lashkar, Gwaliar (M.P.) and

noticee No.7, Proprietor of M/s Dildar Machinery, Near Maruti Mandir, Garkheda,

Aurangabad were also called upon to show cause as to why the personal penalty

should not be imposed upon each of them under Rule 26 of the said Rules, for

the contraventions discussed in foregoing paras.

Defence:.

In this matter the noticee has filed defence reply dated 11-01-2011,

as follows:

It was stated that:

1. They are running a small scale unit engaged in the manufacturing of

submersible pumps and turbine pumps without motor being attached to

it since 2005-06 and are also engaged in repairing of the submersible

pumps and open well pumps since beginning. It was also stated that he

is not having any ISI certificate for manufacturing of power driven

pumps and hence he is only manufacturing pumps and selling as pump

kits only. This pump kit cannot run on itself and has to be attached with

the driving force i.e. motor to make it as power driven pump set. The

noticee stated that they do not have the capacity to manufacture the

motor of pump set. A power driven pump consists of a pump and a

motor which is a force for running the pump. The noticee stated that he

only clears the pumps without motors by showing as pump kits in our

sale bills. Similarly the noticee stated that they manufacture the turbine

pumps and is selling it without the electromotive force i.e. motor or

diesel engine. Hence, the sale bills show the sale of only turbine

pumps without any motor/engine attached with it.

2. It was stated that the main work of the noticee is to undertake

the repairing of the submersible pumps and open well pumps. The

noticee stated that their unit consists of only two rooms, where only

two workers are employed and that too not regularly but casually.

3. The noticee stated that they are a tiny industry where the proprietor

of the unit also personally does the production work unit with a small

turnover. They stated that the allegation made in the Show Cause

Notice that the noticee have evaded the Central Excise duty of Rs.

9415547- and have manufactured submersible pump sets, turbine pump

sets and open well pumps without BIS certification is far from truth and

are baseless allegation.

4. The noticee further says and submits that the pumps manufactured by

him i.e. submersible pumps, open well pumps and turbine pumps

were without motor i.e. it does not have any attachments of power or

electromotive force. The noticee is statedly selling the same as pump

kits, hence the buyer/customer has to attach the motor with pump kit

to make it a power driven pump set. Without the power being attached,

it cannot be termed as power driven pumps. Hence no ISI certification is

required if the goods manufactured by the noticee are not the power

driven pumps. Hence, the department's allegation are baseless and the

demand is not justified on pump kits manufactured and sold by

noticee as the same does not require the BIS certification. The noticee

is eligible for small scale exemption under notification no. 8/2003 for a

turnover up to Rs. 1.5 crore on pump kits manufactured and sold.

Sales of the unit of noticee is well below Rs. 1.5 crore, hence, there is

no case for the department to demand the Central Excise duty on the

pump kits.

5.

It was stated that the sale of turbine pump was without the

attachment of diesel engine and till the diesel engine is attached, it

cannot be termed as power driven pump which require BIS

certification. Hence, no duty can be demanded on the turbine pumps

without attaching diesel engine. Similarly the noticee has statedly only

sold mini open well kits which do not have any rewinding motor so as to

connect with electric power.

6. The noticee says and submits that he is engaged mainly in repairing of

the open well and submersible pumps and is having a good reputation in

the field of repairing. He undertakes the repairing work with

guarantee and hence they issue the guarantee card to their customers in

this regard.

7. The noticee submits that in the impugned SCN, the demand of Central

Excise duty has been made on the basis of lorry receipts of transporters

alleging that the same are V-4 type submersible pump sets cleared by the

noticee. In this regard, he urged the department as to how the LR have

been linked with the noticee as it does not contain any description of

pump or pump sets or its type. The noticees have never manufactured V4 type submersible pump sets as stated earlier. Even though lorry

receipt does not mention name of noticee as consigner and contains

some strange name, which have been alleged as if the noticee have

cleared the goods under the said LRs. The department has not proved

that the said LRs belongs to noticee nor any statement of the

transporters have been recorded or put forth as an evidence in SCN.

Without such necessary evidence, it is the onus on the department to

prove that the goods as alleged in lorry receipt of some unknown

transporters/parties are the pump sets manufactured and cleared by

noticee. Looking to manpower employed and the electricity bill, we

are not able to understand how the department says that 513 pumps

have been manufactured by noticee. Annual production capacity of the

unit is about 600 pump kits. We failed to understand the department's

stand of demanding duty on such huge quantity of pump sets which were

never manufactured by the noticee. For manufacturing such a huge

quantity of pump sets the unit would have required the necessary raw

material such as Casting, Stamping, Copper winding wire, shaft etc.

The department has not shown any single piece of evidence on record to

justify that the noticee have purchased the unaccounted raw material

from any supplier of raw materials. No pain has been taken to put forth

such evidence of raw material supplier in the impugned SCN. Without

procuring the raw material, how one can manufacture such big quantity

of pump sets as demanded in SCN.In this regard we rely on the

judgments which are mentioned in the defence reply submitted by us.

8. The noticee states that no evidence has been put forth in SCN to whom

such big quantity of pumps has been sold by the noticee. The

department has not recorded any evidence from any of the buyers to

prove that they had purchased the pump sets from the noticee

without bill On the contrary, the undertaking/affidavits of some

customers stating that they had purchased only pump kits without

motor from the noticee and that too only under cover of proper bill as

Exhibit-2 of our defence reply dated 11-1-211.

9.

The noticee submits that, the duty has been demanded on the basis of a

computer printout taken from pen drive, however the department fails

to prove that it is pen drive of the noticee. In fact, the pen drive

belongs to accountant of the noticee Shri Shaileshbhai Savalia. Shri

Shaileshbhai Savalia in his statement dated 18-1-210 has also

confirmed the same. He is the accountant of various other firms; hence

his pen drive also contains the details of other firms. We fail to

understand how the entire details of the same pendrive are considered

as transactions of the noticee's firm. The noticee further submits in this

regard that they do not have any computer system installed at their

unit. Further, the department has not proved where in the pen drive

was installed and worked upon. This printout does not contain name of

noticee's firm as supplier of goods. Some unknown names are

appearing in these printouts which have been alleged to be noticee's

clearance/sales. How the department have presumed that this

transaction is noticee's is not understandable. The allegations of

clandestine removal of the finished goods have been based on the

strength of computer generated printout allegedly taken from pen

drive vide panchnama dated 18-1-210.

The noticee has disputed the authenticity of the said papers as

"document in evidence" in terms of provision of Section 36B of the

Central Excise Act, 1944. Admissibility of the computer generated

Printout material under the said section has been made subject to the

fulfilment of certain conditions, detailed herein.

It is well settled proposition of law that evidentiary value of computer

generated printouts cannot be used to prove clandestine removal, if

they do not satisfy the very condition of their admissibility as

"documents in evidence" under section 36B(2) of the Central Excise

Act, 1944 relating to their production by the computer during the

period involved. It will be useful to go through the text of Section 36B

of the Central Excise Act, 1944 as under:

SECTION 36B.

Admissibility of micro films,

facsimile copies of documents

and computer print outs as documents and as evidence

(1) Notwithstanding anything contained in any other law for the

time being

in force, —

(a) a micro film of a document or the reproduction of the image or

images embodied in such microfilm (whether enlarged or not); or

(b) a facsimile copy of a document; or

(c) a statement contained in a document and included in

a Printed material produced by a computer (hereinafter referred to as

a” Computer prints out"), if the conditions mentioned in sub-section

(2)and the other provisions contained in this section are satisfied

inrelation to the statement and the computer in question all be deemed

to be also a document for the purposes of this Act and the rules made

there under and shall be admissible in any proceedings there under,

without further proof or production of the original, as evidence of any

contents of the original or of any fact stated therein of which direct

evidence would be admissible.

(2) The conditions referred to in sub-section (I) in respect of a

computer print out shall be the following, namely:—

(a) the computer print out containing the statement was produced by the

computer during the period over which the computer was used regularly

to store or process information for the purposes of any activities

regularly carried on over that period by the person having lawful

control over the use of the computer;

(b) during the said period, there was regularly supplied to the

computer in the ordinary course of the said activities, information

of the kind contained in the statement or of the kind from which the

information so contained is derived;

(c)throughout the material part of the said period, the computer was

operating properly or, if not, then any respect in which it was

not operating properly or was out of operation during that

partofthatperiod was not such as to affect the production of the

document or the accuracy of the contents; and

(d)the information contained in the statement reproduced or is

derived from information supplied to the computer in the ordinary

course of the said activities.

(3) Where over any period, the function of storing or p rocessing

information for the purposes of any activities regularly carried on over

that period as mentioned in clause (a) of sub-section (2) was regularly

performed by computers, whether —

(a) By a combination of computers operating over that period;

or

(b) by different computers operating in succession over that period;

or

(c) by different combinations of computers operating in succession

over that period; or

(d) in any other manner involving the successive operation over that

period, in whatever order, of one or more computers and

one

or more combinations of computers, all the computers

used for that purpose during that period shall be treated for the

purposes of this section as constituting a single computer; and

references in this section to a computer shall be construed

accordingly.

(4)

In any proceedings under this Act and the rules made there under

where it is desired to give a statement in evidence by virtue of this

section, a certificate doing any of tile following things, that is to say,

—

(a) Identifying the document containing the statement and describing

the manner in which it was produced;

(b)giving such particulars of any device involved in the production of

that document as may be appropriate for the purpose of showing

that the document was produced by a computer;

(c) dealing with any of the matters to which the conditions mentioned in

subsection (2) relate,

and purporting to be signed by a person occupying a responsible

official position in relation to the operation of the relevant device

or the management of the relevant activities (whichever is

appropriate) shall be evidence of any matter stated in the

certificate; and for the purposes of this sub-section it shall be

sufficient for a matter to be stated to the best of the knowledge and

belief of the person stating it.

(5)

For the purposes of this .section, —

(a)

Information shall be taken to be supplied to a computer if it

is supplied thereto in any appropriate form and whether it is so

supplied directly or (with or without human intervention) by means

of any appropriate equipment;

whether in the course of activities carried on by any official,

information is supplied with a view to its being stored or processed

for the purposes of those activities by a computer operated otherwise

than in the course of those activities, that information, if duly

supplied to that, computer, shall be taken to be supplied to it in

the course of those activities;

(b)

Document shall be taken to have

been produced by

a computer whether it was produced

by it directly or (with or

without human intervention) by means of any appropriate equipment.

Explanation. — For the purposes of this section, —

(a) ''computer' 1 means any device that receives, stores and processes

data, applying stipulated processes to the information and supplying

results of these processes; and

(b) any reference to information being derived from other information

shall be a reference to its being derived there from by calculation,

comparison or any other process.

The condition in respect of the computer printout laid down in that

section, as is evident from the reading of its sub section(2), is that,

the computer printout containing the statement was produced by the

computer during the period over which the computer was used

regularly to store or possess the information.

In the instant case document used as base is computer generated

printout as specified under clause (c) of sub section (1) of section

36B ibid. If the conditions mentioned in sub-section (2) and the

other provisions contained in this section are satisfied in relation to

the statement and the computer in question, the said computer

printout shall be deemed to be a document for the purpose of this act

and the rules made there under and shall be admissible in any

proceedings there under. Not a single condition contained under subsection (2) of section 36B ibid is satisfied in the instant case as regard

with said computer printout, as under:

•

•

•

•

The computer printout containing the details was not produced from

any computer of the noticee but the same was taken from the pen drive

of Shri Shaileshbhai Savalia;

The said computer printout was not produced by the computer during

the period over which the computer was used regularly to store or

process information for the purpose of any activities regularly carried

on over that period by the person having lawful control over the use of

the computer;

There is nothing on record which even suggest that during the said

period, there was regularly supplied to the computer in the ordinary’

course of the said activities, information of the kind contained in the

statement or of the kind from which the information so contained is

derived;infact there was no computer installed at our premises:

There is nothing on record which even suggest the information

contained in the computer generated printout reproduced or is derived

from information supplied to the computer in the ordinary course of the

said activities;

In the instant case provision of sub section (3) of section 36B ibid is also

not applicable, in as much as nothing on record or proved that the function

of storing or processing information for the purposes of any activities

regularly carried on over that period was regularly performed by computer

by any means either by a combination of computers operating over that

period or by different computers operating in succession over that period

or in any other manner involving the successive operation over that

period, in whatever order, of one or more computers and one or more

combinations of computer.

Most important in case of presumption of computer printout as

evidence in any proceedings under the Central Excise Act, 1944 and the

rules made there under, there is a requirement of a statement in

evidence by virtue of this section, and a certificate identifying the

document containing the statement and describing the manner in which it

was produced and giving such particulars of any device involved in the

production of that document as may be appropriate for the purpose of

showing that the documents was produced by a computer and/or dealing

with any of the matter to which the conditions mentioned in sub section(2)

relate, and purporting to be signed by a person occupying a responsible

official position in relation to the operati on of the relevant computer shall

be evidence of any matter stated in the certificate. Further, it is also

requires to be stated to the best of the knowledge and belief of the person

stating it.

In the instant case, only reliance is placed on a computer generated

printout taken from pen drive to charge the clandestine removal. To

sustain the admissibility of the computer print outs for proving the

charge of clandestine removal by noticee, admissibility of the printed

material under the said section 36B ibid, is required to be made

considering fulfilment of certain conditions detailed there in. In the instant

case, the print outs were not produced by the computer but it was taken

from pen drive of other person Shaileshbhai Savalia.

In view of the above, the computer print out used as evidence is not

admissible document in terms of section 36B of the Central Excise Act,

1944. Therefore, these computer generated printouts cannot be used to

prove clandestine removal as "document in evidence" in as much as the

same do not satisfy the very condition of their admissibility as

document in evidence under section 36B(2)(a) of the Central Excise act

1944.

It is alleged that the accountant of the noticee admitted the correctness of

the entries in the computer generated printout.

The recorded admission of the accountant of noticee is far from truth, in

as much as documentary evidence in this regard shows contrary to the

deposition. In this regard it is a well settled position, that when the

documentary evidence, the authenticity of which is not under dispute,

shows otherwise, the same has to be given more credibility than the oral

version. In the instant case the documentary evidence are showing

contrary to the deposition made by the accountant of noticee.

Without admitting and without prejudice to above submission, kind

attention of your honour is invited towards the fact that prejudice of the

department was still continued up to issue of show cause notice. The

department not only failed to establish factum of manufacture of pumps

but also failed to extend the benefit of cum-duty price.

The goods seized by the department and released provisionally were the

pump kits and not pump sets and hence not liable for confiscation as the

same are liable for SSI exemption.

No Central Excise duty can be demanded on pumpkits manufactured and

sold by the noticee as same is eligible for SSI exemption under Notification

No. 8/2003. No duty can be demanded on the repairing of the pumps.

Having said that the pump kits are eligible for SSI exemption, no duty can

be demanded; hence the question of levy of interest and imposition of

penalty does not arise.

In these circumstances, show cause notice demanding duty on the basis of

belief that goods were manufactured by noticee's firm is liable to be

quashed abintoto. And requested to drop the proceeding proposed under

the show cause notice.

Personal Hearing :

Personal hearing in the matter was held on 17.08.2011 during which

Shri Jagdish V. Busa, Consultant appeared on behalf of M/s. Rainbow

Engg. Co, Shri D. B. Ranparia, partner of P.I.Manufacturing Co.; Prop. M/s

Kasama Pump; Prop. M/s. Sai Srinivas Traders; Prop. M/s. Geeta

Enterprises and Prop. M/s. Gupta Machinery and reiterated the

contentions made by them in written submissions.

The Consultant also stated that the unit is an SSI unit and is also

engaged in repairs and selling of kits of pumps. He also made following

pleas;

i.

ii.

iii.

iv.

v.

vi.

vii.

viii.

They have cleared only Kits and not entire pump;

The figures worked from pen-drive are hit by the proviso contained

in section 36B and the same are not satisfied; hence the demand

based on pen-drive is not supported by evidence and therefore the

same cannot be confirmed.

The turbine pumps are sold without attachment of diesel engine i.e.

electromotive force to run the same, hence it is not ‘power driven

pump’

The clearances of kit are eligible for the SSI exemption Notification.

The Lorry Receipts relied by the department do not carry any

indication which shows that the pumps were sold by the noticee.

No statement of buyers has been recorded.

Cum-duty price benefit may be allowed, if not satisfied with the

above arguments; and

Affidavits of customers evidencing purchase of only pump kits

without motor, may be taken into consideration.

Nobody appeared for the Proprietor of M/s. Dildar Machinery, Aurangagad.

DISCUSSION AND FINDINGS:

I have carefully gone through the entire case records, Show Cause Notice, and the

contentions raised in written defense replies filed by the noticees as well as

arguments put forth during the course of personal hearing.

1) The issue to be decided in the present proceedings is whether Power Driven

Pumps manufactured and cleared by the noticee No. 1 are eligible for the value

based SSI exemption under Notification No.08/2003-CE dated 1.03.2003, as

amended, or not and whether the details derived from the seized pen drives are

hit by the proviso contained in Section 36B or otherwise.

The exemption contained in Notification no. 08/2003-CE to power driven pumps

is subject to the condition that the same are manufactured according to BIS

specifications as envisaged in the Annexure to “list of goods eligible for SSI

exemption” to the aforesaid Notification under Chapter 84 which reads as

under;

“All goods other that power driven pumps, primarily designed for handling

water which do not conform to standards specification by BIS [Bureau of

Indian Standards] for such pumps”

From the above, it is evident that the power driven pumps viz. submersible

pumps, open well pumps and turbine pumps, etc falling under CETH 8413, (if

manufactured) which do not conform to standards specified by BIS, would not be

eligible for the benefit of SSI exemption under the above notification.

From the case records and the show cause notice, it is evident that the power

driven pumps, manufactured by the noticee No. 1 were not conforming to BIS

standards and hence they were not eligible for exemption under aforementioned

notification. This is also not disputed by the noticee No. 1 or his consultant

representing them.

2)

The point of dispute raised by the noticee consultant and in their written

submissions is as under:

[1] They have cleared only kits of the pumps in certain cases

[2] The figures taken from their pen drives for arriving at the demands are

hit by the provisions of Section 36B of the Central Excise Act and hence no

evidence can be relied on the same.

[3] Turbine pumps were cleared without the electromotive force i.e. without

attachment of diesel engine and hence it cannot be taken as power driven

pumps.

I find that the specific contention of the noticee no. 1, that they have cleared

pump kit without attaching any electromotive force and therefore eligible for the

benefit of Notification No. 08/2003-CE supra, merits consideration. Pump kit were

cleared without any motor attached with it, and therefore it cannot be called ‘power

driven’ and as per the above definition in the Annexure attached to the said

Notification, only “power driven pumps” are put under exclusion in the Annexure. If

no electromotive force is attached therein, then it cannot be termed as power

driven pump. The noticee in his statement also has stated that “the kits

manufactured by them were the pumps without windings and their values would be

Rs. 1500/- less than the normal pumps and the noticee no. 1 has shown the

descriptions of the pumps which were cleared on bills “as kits “. It is further

submitted by them that the buyer has to attach the motor with pump kit to make it

power driven pump set, hence, no BIS certification is required, if the goods

manufactured by them are not the power driven pump. They have also produced

the affidavits of customers/buyers; evidencing the purchase of only pump kits

without motors. Hence, I am of the considered opinion that the pumps cleared

without motor i.e. the electromotive force to run the said pump, do not require BIS

specifications and hence the same do not fall under the exclusion category and

therefore Kits cleared by the noticee no. 1 are eligible for SSI exemption under the

aforesaid notification. Hence, I am giving the benefit of Exemption under Noti.

8/2003-CE on the kits cleared to the extent of value of Rs. 7,39,589/-, which do

not merit demand of duty.

2. With reference to their second contention that the demand has been arrived at

by taking the figures retrieved from the two pen drives seized from the factory

premises of the noticee no. 1, I find that the same are not hit by the provisions of

Section 36B of the Central Excise Act, 1944, inasmuch as the same were recovered

during the course of search of the factory premises of the noticee no. 1. The details

of the said two pen drives were retrieved under the proceedings of panchnama in

presence of the proprietor and accountant of the noticee no. 1. The accountant Shri

Shaileshbhai Manjibhai Savalia, in his statement dated 18.1.210 has stated that his

work was to take the chits/records from the noticee No.1 to his office and after

entering the same on his computer, he used to return the chits and printouts to

Shri Sureshbhai, Proprietor of noticee No.1 and he was not having any data saved

anywhere else, other than the two pen drives or any records in his possession. The

printouts obtained from these pen drives reflected the sale of different pump sets

cleared by noticee No.1 to their different customers, during the period from

December 2008 to March 2009 and the chits and lists, from which this data was

prepared, were given by proprietor.

Similarly, the contents of the said pen drives have been confirmed by the

proprietor of the noticee no. 1 in his statement dated 18.1.210 stating that after

getting the details entered in pen drives, he had destroyed the chits and had not

preserved the hardcopies of printouts; that he had not got the details of earlier

periods entered in soft form, and for the subsequent period, the chits/challans had

already been seized by the department; that apart from the seized records, he had

not preserved any other records; that he had not shown the full details and sale

prices of the pumps in the summary lists/chits recovered from noticee No.1;

Further it is also confirmed during the course of investigation that the

accountant used to enter the transactions of the noticee no 1’s sale and other

entries in the said two seized pen drives on the instructions of the proprietors and

after entering them in the pen drive, the chits/challans were destroyed by them. It

is also evident from the record seized during the search on 07.12.2009 like various

chits/challans/LR’s, Warranty cards etc; that the practice of entering the same into

the soft version i.e. in pen drive for the past period must have been carried as

narrated by the proprietor of the noticee no 1. The seized documents were for the

subsequent periods, which were yet to be entered in the pen drive and the prior

data was found in the said two pen drives seized. Hence, I am of the view that the

pen drives recovered during the course of search and duly confirmed by their

accountant and proprietor contains the record of illicit removal of power driven

pumps by the noticee no 1 to their various customers.

The seized records, details contained in pen drives, LRs seized and other

documents further confirm that the noticee no. 1 was engaged in illicit removal of

the power driven pumps of sized V-3, V-4, V-6 [submersible] open well and turbine

pumps without obtaining Central Excise registration and without payment of

Central Excise duty on the same. The said pumps were manufactured and cleared

by the noticee no. 1 without having BIS standards, hence they are not entitled to

the exemption on such clearance of the Power Driven Pumps and they are required

to discharge the appropriate Central Excise duty on the same. The said fact is also

admitted by the proprietor of the noticee no. 1 in his various statements recorded

during the course of investigation. The same is also evident from the statements of

their various suppliers who have confirmed that they have sold the raw material of

P.D. Pumps to the noticee no 1. So, I am not inclined to accept the said defense

and therefore I am inclined to confirm the C. Excise duty on the clearance of P.D.

Pumps without BIS specifications as derived from the data recovered from the said

two pen drives and the other seized records. The case laws cited by the noticee no.

1 are not squarely applicable to the facts and circumstance of the present case and

therefore, reliance placed on the said case laws is of no avail.

As regards, the noticee no. 1’s third argument pertaining to clearance of

Turbine pumps without attaching diesel engine i.e. electromotive force to run the

same, hence it is not power driven pump, I am of the view that the said turbine

pump can also run on electricity, apart from diesel engine, which is also confirmed

by the proprietor of the noticee no.1. Hence, there is no force in this defense put

forth by them and the duty of Central Excise is required to be discharged on the

clearance of the said turbine pumps manufactured without BIS specifications.

It has been further contended by the noticee no. 1 that 26 pumps seized

from their unit on 07.12.2009 were nothing but the Kits and not fully manufactured

power driven pumps. In this regard, I find that all these 26 pumps have been

provisionally released to the noticee no 1; hence the same are not available for my

examination/inspection. This argument appears to have been put forth as an afterthought and does not merit any consideration. Hence, there is no force in their

argument and hence these seized goods merits confiscation.

The noticee no. 1’s contention that they were also engaged in repairing of

pumps has to be accepted without any element of doubt and cannot be denied,

inasmuch as they had issued the bills for the repairing of the pumps and also some

chits recovered also reflect the same. But it does not, by any stretch of

imagination, be considered that the noticee no.1 was only doing the job of

repairing. The repairing work appears to have been done by the noticee no.1 on

their own returned and defective pumps. However, the value of repairs to the

extent of Rs. 1,14,740/- is not liable to Central Excise duty and the demand made

in the SCN is to be liable to be reduced to that extent.

It has been further argued by the noticee no.1 that the demand of Central

Excise duty has been made on the basis of lorry receipts of transporters alleging

that the same are V-4 type submersible pump sets, does not mention their name

as consigner and contains some strange names. Further, it is argued that the

department has not proved that the said LRs belonged to their firm nor any

statements of the transporter have been recorded to put forth as evidence in SCN.

Without such necessary evidence, the onus is on the department to prove that the

goods as alleged in lorry receipt of some unknown transporters/parties are the

pump sets manufactured and cleared by them. In this regard, I find that the said

Lorry Receipts were recovered during the course of search of the premises of the

noticee no. 1 and the proprietor of noticee no. 1 has himself admitted in his

statement that the same were the documents under which they have cleared the

pumps without preparing invoice and without payment of duty. Once a thing or

matter is admitted and is not challenged, it is not necessary to further collect the

evidence in this regard and hence, no statement of transporters has been recorded.

I find that the said lorry receipts are nothing but the incriminating documents

evidencing illicit removals. I further find that the demand raised on the basis of the

two pen drives seized and the other documents shows the illicit removal of power

driven pumps which do not bear BIS specifications.

It is further argued by the noticee no. 1 that for manufacturing such a huge