1 - NUS Business School

advertisement

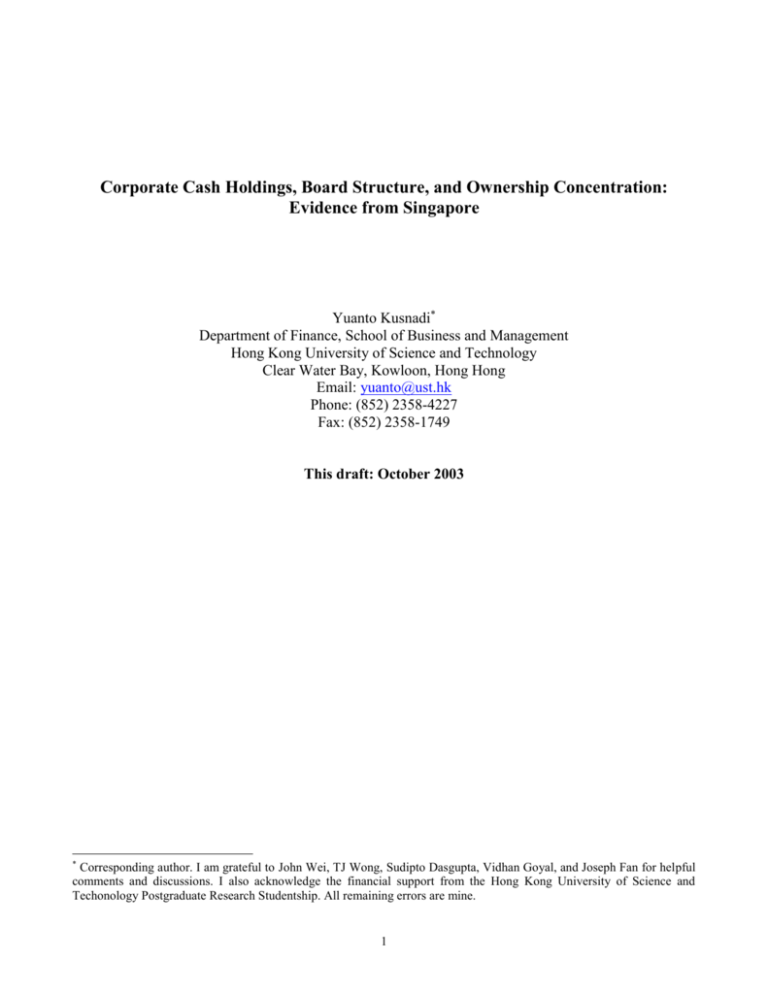

Corporate Cash Holdings, Board Structure, and Ownership Concentration: Evidence from Singapore Yuanto Kusnadi* Department of Finance, School of Business and Management Hong Kong University of Science and Technology Clear Water Bay, Kowloon, Hong Hong Email: yuanto@ust.hk Phone: (852) 2358-4227 Fax: (852) 2358-1749 This draft: October 2003 * Corresponding author. I am grateful to John Wei, TJ Wong, Sudipto Dasgupta, Vidhan Goyal, and Joseph Fan for helpful comments and discussions. I also acknowledge the financial support from the Hong Kong University of Science and Techonology Postgraduate Research Studentship. All remaining errors are mine. 1 Corporate Cash Holdings, Board Structure and Ownership Concentration: Evidence from Singapore Abstract Corporations hold cash balances for a variety of reasons. We document that board size and nonmanagement blockholder ownership are significantly related to the ratio of cash to net assets for a sample of publicly listed firms in Singapore. While the relationship between board size and cash holdings is positive and significant, non-management blockholder ownership is inversely related to cash holdings. Our findings are consistent with the agency cost hypothesis. Since firms with large boards and low non-management blockholder ownership are normally poorly governed, shareholders of such firms do not have much power in forcing the managers to distribute the excess cash to them. As a result, those firms hold higher cash balances than firms who have better control mechanisms (ie: small board and large non-management blockholder ownership). 2 1. Introduction One of the main benefits often cited by companies is that having large cash helps to fund capital investments, especially when internal funds are cheaper than external funds. However, there is a growing concern that managers of cash-rich firms are subject to more severe agency problems. According to Jensen (1986), when managers have more free cash flow at their disposal, they are likely to overinvest in negative NPV projects, at the expense of the shareholders or consume more discretionary perquisites which increase their private benefits.1 Very few studies have actually looked at what determines the level of corporate cash holdings (particularly in Asia). Opler, Pinkowitz, Stulz, and Williamson (1999) examine the determinants and consequences of corporate cash holdings for publicly listed firms in the U.S. Their findings suggest that there is an optimal level of cash balance. Growth opportunities (as measured by market-to-book) and volatility of cash flows are both positively related to cash holdings. Moreover, large firms tend to hold more cash. In general, they provide evidences which support the static trade-off model of cash holdings. A recent paper by Dittmar, Mahrt-Smith, and Servaes (2003) explores the relationship between corporate governance and corporate cash holdings. They find that one important determinant of corporate cash holdings is the shareholders rights variable (which proxies for corporate governance). Firms in countries with poor shareholder protection (poor corporate governance) tend to hold larger cash balances. They find that firms hold more cash even when their capital market is developed, which is consistent the agency-cost explanation of cash holdings. Hence, shareholders in countries with poor shareholder protection do not have strong power in preventing the managers from disgorging the excess cash. 1 See Lang, Stulz, and Walkling (1991), Blanchard, Lopez-de-Silanes, and Shleifer (1994), Harford (1999) for empirical evidences on the value destroying activities that that cash rich firms undertake. 3 In this paper, we attempt to extend the cross-sectional studies on the relationship between corporate governance and corporate cash holdings by using firm-specific data from Singapore.2 Since past studies have not looked at the impact of corporate governance mechanisms on the level of corporate cash holding, the availability of data on the corporate governance mechanisms allow us to examine some interesting issues in more detail. Specifically, we want to test if firm-specific variables such as board size, the proportion of independent directors, managerial ownership (direct and indirect), non-management blockholder ownership, government ownership, and other firm-specific variables (age, disclosure of corporate governance practice, presence in mainboard, CTI (Corporate Transparency Index) score, and auditor), could determine the level of cash balances that the firm holds. We find that market-to-book (which proxies for investment opportunities) and capital expenditures are positively related to cash holdings, which are similar to that found by previous studies. Board size (non-management blockholder ownership) is positively (inversely) related to cash holdings. Our findings confirm the importance of corporate governance in the determination of corporate cash holdings and provide evidence that is consistent with the agency cost explanation as documented by Dittmar et al. (2003). Small boards tend to be more efficient and are associated with higher valuation (Yermack, 1996). Non-management blockholders also help to alleviate the conflict of interest between managers and shareholders by acting as monitors (Lins, 2003). In general, large boards and low non-management blockholder ownerships are associated with more severe agency problem, which implies poor corporate governance. Managers of such firms have no incentive to distribute the excess cash back to the shareholders because of the lack of monitoring. As a consequence, these firms hold more cash than firms with more effective corporate governance. See “ST Engineering says no change to dividend policy”, 8 th July 2003, AFX News Limited for an example of the dividend policy of a publicly listed company in Singapore with large cash balance. 2 4 Our results are robust to alternative definition of cash holdings as well as to specifications involving additional control variables. Our paper is organized as follows: Section 2 discusses the related studies on corporate governance and corporate cash holdings. Section 3 describes our sample, which is followed by the empirical tests and discussion of the results in Section 4. Section 5 concludes the paper. 2. Related literatures on corporate governance and corporate cash holdings A recent survey by Dennis and McConnell (2003) divide the current literature on international corporate governance into two broad categories. The first generation of research replicates issues which have been found to be pertinent in the U.S. into an international setting. The second generation of research takes into account the legal environments and compares the effectiveness of corporate governance mechanisms across different systems. 2.1 Board structure and ownership concentration The separation of ownership and control is a central theme in the corporate governance literature. Berle and Means' (1932) influential study changed the perspective of the modern corporation and initiated the debate on the agency problem. Given the separation of ownership and control, and diversified ownership, shareholders no longer have the incentive to monitor the performance of a specific firm, since this firm only represents a fraction of their total investment. Given the lack of incentive for shareholders to monitor, managers can collude among themselves and expropriate the shareholders by consuming more discretionary perquisites (e.g.: first class airplane tickets, plush company cars, paying themselves high salaries and bonuses, etc) or pursuing projects that may only give a small return on investment to the shareholder. Hence, the conflict of interest between 5 shareholders and managers implies there is no guarantee that shareholders interests will be the sole important factor managers consider in the running of a corporation. Subsequently, Jensen and Meckling (1976) introduce a new definition of "the firm". According to them, the agents are bounded by contracts and although each agent pursues his/her own self-interest, they must function as a team in order to attain success. Fama (1980) and Fama and Jensen (1983) extend this contractual viewpoint of the firm and suggest that despite the problems mentioned previously, firms characterized by the separation of ownership and control can still survive. As long as there are appropriate internal and external mechanisms, such as managerial ownership, boards of directors, labor market for managers, and corporate control market, to discipline the agents (especially managers), the firm can still function efficiently and effectively. Numerous studies have analyzed the costs and benefits of the dispersed ownership structure that is common in the U.S. In particular, Shleifer and Vishny (1986) assess whether large minority shareholders can minimize the free-rider problem (Grossman and Hart, 1980) that is associated with a dispersed ownership structure. When their shareholdings increase, investors can take a more proactive role in monitoring the managers, to the extent that they can even replace the managers by mounting a takeover bid. However, there are also worries that high ownership concentration by minority shareholders can work to the other shareholders' disadvantage. Demsetz and Lehn (1985) find that ownership structure is related to firm size, firm specific uncertainty and systematic regulation. While smaller firms and those that do not belong to regulated industries are characterized with dispersed ownership, firms operating in riskier environments tend to have more concentrated ownership. They also test the Berle and Means prediction that concentrated ownership structure will have a positive effect on firm performance. Their results show that there is no 6 apparent evidence of a significant relationship between ownership structure and corporate performance (measured by accounting profit rate). This is consistent with the findings in Demsetz (1983). On the other hand, Morck, Schleifer, and Vishny (1988), Stulz (1988), and McConnell and Servaes (1990))document that firm value is related to ownership structure in the U.S.. There seems to be a non-linear relationship between firm value and insider equity ownership. The benefits of having a large inside shareholder peak at a certain point, beyond which the benefits will be significantly outweighed by the costs, such that it will no longer make economic sense to have a concentrated ownership structure.3 The effectiveness of the board of directors as a monitoring mechanism has also been widely studied (John and Senbet, 1998). These studies have focused on two board attributes: board size and and board composition. A large board tends to be less effective (Jensen, 1993), as decision-making becomes slower due to the involvement of more people. Yermack (1996) finds an inverse relationship between Tobin's Q and board size, supporting the hypothesis that a small board improves firm value. Boards of directors are often passive because they have the tendency to be friendly to management. As a result, they do not perform as expected in terms of their responsibilities in disciplining and monitoring the managers. This motivates the need to employ outsiders into the board.4 Outside directors are those who do not have a family or business relationship with the managers of the firm. Similar to the issue of blockholder ownership, the studies on the effect of outside directors on the agency problem yield mixed findings. While some studies find that outside directors align the interests 3 McConnell and Servaes (1990) find that the relationship between insider equity ownership and Tobin's Q is an inverted U shape, with Tobin's Q reaching its maximum value when insiders own approximately 40 percent of the shares. Morck et al. (1988) uncover a slightly different relationship. Initially, Tobin's Q rises as insider ownership rises to 5 percent. Subsequently, it falls as ownership increases to 25 percent and only rises slightly beyond that point. 4 Baysinger and Butler (1985) document an increasing trend towards board independence in the 1970s. Those firms with greater board independence at the beginning of the decade have better performance at the end of the decade. It seems to suggest that board independence induce a positive impact on firm performance. 7 of managers and shareholders5, there are also studies that advise against having more outside directors.6 2.2 Corporate governance in emerging markets Research on corporate governance systems in countries outside the U.S. and U.K. is growing at a rapid pace. Recent papers have looked at the corporate governance mechanisms (board composition and ownership structure) in Asia, Europe, and other emerging markets. La Porta, Lopez-De-Silanes, and Shleifer (1999) trace the ultimate ownership of the 20 largest corporations in 27 wealthiest economies and find that with the exception of those economies which enjoy good shareholder protection (eg: Australia, Canada, U.K., and U.S.), only a number of the economies are characterized by dispersed ownership structure (as suggested by Berle and Means (1932)). More interestingly, they find that family and state control are relatively common in many emerging markets (eg: Argentina, Hong Kong, Singapore, Belgium, and others). In addition, the controlling shareholders typically have control rights which exceed their cash-flow rights, resulting in the expropriation of minority shareholders by the controlling shareholders. They suggest that one potential solution is to introduce legal reforms, especially in emerging markets. Claessens, Djankov, and Lang (2000) examine the separation of ownership and control in a sample of 2,980 companies in 9 East-Asian countries. They document that Asian companies are characterized by concentrated ownership structures, with more than two-thirds of the firms controlled by a single shareholder. The controlling family exercises their control rights (which exceed their cash flow rights) through the use of cross-shareholdings and pyramid structures. The fact that the top 5 Fama (1980) and Fama and Jensen (1983) claim that outside directors are disciplined by the managerial labor market, while Brickley, Coles, and Terry (1994) find that as more outside directors are employed, the stock market reacts positively to the adoption of a poison pill. 8 managements are often linked to the controlling families further exacerbates the agency problems minority shareholders face, which supports the findings by La Porta et al. (1999). Another interesting finding they uncover is that the largest ten families in Indonesia, Philippines, and Thailand have control over the majority of the companies in their sample, which suggests the dominant role family shareholdings play in Asia (except for Japan, where most of the firms are widely held). State control is also found to be prevalent in Indonesia, Malaysia, Singapore, Korea, and Thailand. A follow up study by Claessens, Djankov, Fan, and Lang (2002) document the benefits as well as costs of large shareholdings using a sample 1,301 publicly listed firms in eight East-Asian countries (with Japan being excluded from the original sample). They find that there is an incentive effect, ie: when the cash-flow rights of the largest shareholder increases, firm value increases. However, as the wedge between control rights of the largest shareholder and the cash flow rights increases, firm value tends to fall, which is consistent with an entrenchment effect. Their findings support the empirical prediction by Shleifer and Vishny (1997) who argue that controlling shareholders play a positive role (incentive effect) only up to a certain point, beyond which their control rights enables them to derive private benefits which are detrimental to firm value (entrenchment effect). Faccio and Lang (2002) use the same methodology to examine the ultimate ownership of more than 5,000 corporations in 13 Western European countries. Two common types of controlling shareholders characterize the firms in Western Europe: dispersed control and family control. While firms in the U.K. and Ireland are generally widely-held, other countries (especially in the continental Europe) exhibit more prominent family control, which are similar to most Asian companies. Besides pyramids and cross-holdings, Western European companies employ the use of dual class shares (which are not common in Asia) to gain significant control over the corporations. 6 Mace (1986) and Jensen (1993) support the view that the managers control the outside directors, since the CEOs are likely to be the ones who select the outside directors. 9 Lins (2003) further explores the relationship between management equity ownership and firm valuation in the emerging markets. He finds a significant negative relationship between firm value and management ownership (when there is separation in control and cash flow rights). The relationship becomes stronger in countries with poor shareholder protection. Large non-management blockholders play a positive governance role and help to reduce the value discounts associated with the mis-aligned incentives between managers and shareholders. By restricting their sample to only eight East-Asian firms, Lemmons and Lins (2003) document that firms earn lower returns during the crisis period when there is a separation between management control and cash flow ownership through the use of pyramidal ownership structures. Pyramidal ownership structures (which have been found to be prevalent in Asian companies) have the potential of encouraging managers to expropriate the minority shareholders. These findings are consistent with Johnson, Boone, Breach, and Friedman (2000) and Mitton (2002), who also find that legal environment (such as the degree of shareholder protection) and firm-specific corporate governance mechanisms have significant effects on the performance of Asian countries (and firms) during the Asian financial crisis which occurred in 1997-1998. A series of recent papers by Mak and Li (2001), Wiwattanakanthang (2001), Fishman (2001), Chen, Fan, and Wong (2002), Yeh (2002), Joh (2003), and Johnson and Mitton (2003) examine the different aspect of corporate governance mechanisms in individual Asian countries such as Singapore, Thailand, Indonesia, Taiwan, Korea, and Malaysia. Mak and Li (2001) find that government ownership is prevalent in Singapore companies (through the involvement of Temasek Holding). A related study by Mak and Kusnadi (2003) documents that there exists an inverse relationship between board size and firm value in Malaysia and Singapore. Wiwattanakanthang (2001) finds that companies with controlling shareholders tend to perform better than those with no controlling shareholder in Thailand. Her findings suggest that unlike 10 in other Asian countries, controlling shareholders in Thailand do not seem to expropriate the minority shareholders. One possible explanation is probably because of the less common use of pyramid and cross-holdings in separating the control rights and cash-flow rights. Chen, Fan, and Wong (2002) look at the board structure of companies that went public in China and documents that about one-third of the directors have some affiliations with the government. The political connection implies that only a handful of directors truly possess the professional qualifications that are normally required. The boards in China are composed of male-dominated, lowly educated senior directors. This evidence supports the agency view of government decentralization. The value of political connections is also found to be important in Indonesia and Malaysia. As documented by Fishman (2001) and Johnson and Mitton (2003). Yeh (2002) reports that family controlled firms in Taiwan tend to employ more family members to the boards as the divergence between control rights and cash-flow rights becomes more pronounced. Besides, when controlling families increase their cash-flow rights, they will employ less family directors. He also documents that there exists a significant inverse relationship between family’s involvement in the board and firm value. His findings are consistent with the negative entrenchment and positive incentive effects as documented by Claessens et al. (2002). Joh (2003) explores the relationship between corporate governance and firm performance in Korea, before the financial crisis occurred in 1997. He finds that firm performance (measured by profitability) is low when family control is also low. Similar to the previous findings on Asian companies, firms with high divergence between control rights and cash-flow rights tend to have lower profitability due to the expropriation by controlling shareholders. Moreover, chaebol firms are also found to have lower performance, suggesting that the degree of expropriation are more severe for firms affiliated with business groups. 11 2.3 Determinants and implications of cash holdings Opler et al. (1999) test for two competing theories of cash holdings, which are similar in spirit to those which have been discussed in the capital structure literature: the trade-off theory and the financing hierarchy theory. The trade-off model hypothesizes that there is an optimal level of cash holdings, which is determined by trading off the costs and benefits of holding cash. There are two costs associated with holding cash: cost of carry (because cash earns lower return than comparable investments) and agency costs (because managers have the incentive to invest the excess cash in negative NPV projects). Lang et al. (1991) find that firms with high cash flows and low q ratios tend to engage in value destroying acquisitions, which are detrimental to firm value. The transaction costs motive of holding cash looks into the opportunity costs of cash shortfalls and predicts that firms hold more cash when they have better investment opportunities and more volatile cash flows. It also expects a positive relationship between capital expenditures and cash holdings. Meanwhile, dividend is expected to be inversely related to cash holdings. The precautionary motive of holding cash considers the impact of asymmetric information on firm’s ability to raise funds. Firms may choose not to go to the markets to raise capital even when they have the capacity to do so because of undervaluation problem. Similar to the pecking order theory of capital structure, the financing hierarchy model argues that there is no optimal level of cash holdings. Cash holdings are determined by firms’ financing and investment activities. Essentially, in the financing hierarchy model, we are indifferent between debt and cash. One important variable that can potentially determine which of the two theories hold is investment. The trade-off model predicts a positive relationship between investment and cash holdings while the financing hierarchy view predicts that investment is negatively related to cash holdings. 12 Their findings support the static trade-off model of cash holdings. While growth opportunities (as measured by market-to-book), investment, R&D expenditures, and volatility of cash flows are positively related to cash holdings; size and networking capital are negatively related to cash holdings. They argue that their results are consistent with both the transaction costs and precautionary motives of cash holdings. Dittmar et al. (2003) find a significant relationship between investor protection and corporate cash holdings in a sample of over 10,000 firms from various emerging market. Firms in countries with poor shareholder protection (poor corporate governance) hold more cash than those in countries with good shareholder protection. Their findings are robust even after controlling for capital market development and support the agency-cost explanation of cash holdings. The agency cost theory suggests that there is a conflict of interests between managers and shareholders. As a result, managers tend to engage in activities which do not maximize firm value, such as investing the accumulated cash balance in negative NPV projects or in expensive acquisitions. On the other hand, putting the excess cash in the bank also does not maximize firm value because of the low rate of return cash earns. Hence, large cash balance might eventually results in lower firm performance. In fact, Opler et al. (1999) find that operating losses have the effect of reducing the cash holdings of firms. However, a recent paper by Mikkelson and Partch (2003) argue that large cash holdings do not necessarily imply negative performance. The operating performance of firms with large persistent cash reserves is comparable to or even better than the performance of firms from matched samples. Since ownership structures (which proxy for managerial incentive) do not affect cash holdings, their results are inconsistent with the agency cost explanation. Dittmar et al. (2003) attributes the lack of support for the agency cost theory to the fact that shareholders in the U.S. enjoy good shareholder protection. 13 3. Sample data Our sample consists of 230 firms that are listed in the Singapore Stock Exchange (SGX). We collect financial variables, board structure, ownership concentration, and other relevant variables for each company for the financial year ending in 1999. The sources for these data are the annual reports of individual companies and Datastream. Following previous studies, we have excluded firms operating in the financial industry (banks, insurance companies, securities companies, etc) from our sample. We have also removed firms with negative book equity values. We use the logarithm of the ratio of Cash and Equivalents to Net Assets (assets less cash and cash equivalents) as our proxy for cash holdings. Other financial variables include: Assets (the book value of total assets) as a proxy for firm size; Market-to-book (ratio of market value of equity plus book value of liabilities to total asset) as a proxy for investment opportunities; Leverage (ratio of total liabilities to total asset); Tangibility (ratio of fixed asset to total asset); ratio of Capital Expenditures (change in fixed asset plus depreciation) to Net Assets as a proxy for capital spending; and a Dividend dummy (representing firms that pay dividends). The board variables are: Board Size; Audit Committee Size; % Executive Directors and NonExecutive Directors in the Board and Audit Committee; Dummy variables (Nomination and Remuneration) denoting the presence of nomination and remuneration committee in the board. The ownership variables are: Insider Ownership (percentage of equity ownership7 by the insiders, ie: executive directors) and Non-Management Blockholder Ownership (percentage of equity ownership by blockholders who are not insiders, ie: those with more than 5 percent stake). 7 The insider ownership includes both direct and indirect holdings by the executive directors. 14 We have included four other dummy variables: Government (representing the presence of government ownership), Mainboard (whether the firm is listed on main board), Governance Disclosure (whether the company disclose a separate report of corporate governance in its annual report), and Auditor (whether the auditor is a Big 5 accounting firm). Lastly, but not least, we further incorporate two other firm-specific variables: Age (the number of years since the company is incorporated); and CTI Score (Corporate Transparency Index score for the firm). Appendix 1 gives the detailed description of each variable. [Insert Appendix 1 here] Table 1 reports the breakdown for the sample companies that are used in the study. Our sample covers firms in 8 industry sectors in Singapore. The industry sector with the largest number of firms in our sample is Manufacturing (97 firms) and the majority of the companies are listed on the Mainboard (almost 80 percent). [Insert Table 1 here] The descriptive statistics for the financial, board structure, ownership concentration and other variables are given in Table 2. We observe that the mean (median) book value of total assets for our sample is S$730 millions ($169 million). On average, Singapore firm holds about 22 percent of its net assets as cash, with leverage of 45 percent, fixed asset ratio of 36 percent, market-to-book of 2.03, and spends about 7 percent of its net assets as capital expenditures. In addition, 82 percent of the firms in our sample pay out dividends to the shareholders. For board characteristics, the mean (median) board size and audit committee size for Singapore firms are 7.3 (7) and 3.2 (3) respectively. The minimum (maximum) number of directors is 4 (14). 15 Executive directors make up about 41 percent of the board and 22 percent of the audit committee. The average proportion of non-executive directors in both the board and audit committees is about 70 percent and 78 percent respectively. The insiders (executive directors) in our sample, on average, own 30 percent of the common stock, with a maximum holding of 93 percent. The non-management blockholders own an average of 32 percent of the common stock. The maximum non-management blockholder ownership is 89 percent. We observe that the insider ownership in our sample is higher than in the U.S.8 The last few statistics reveal that 11 percent of the firms in the Singapore sample are government linked. The firms in our samples are mostly established firms, with a mean age of about 23 years old. The average CTI score of 37 (out of 100) and the fact that only 68 percent of our sample firms report their corporate governance practices signal that the level of transparency and disclosure of Singapore companies is still relatively low. [Insert Table 2 here] 4. Empirical tests and discussion of results In this section, we will focus on the empirical tests and discussion of results on the relationship between corporate cash holdings, board structure and ownership concentration. We will also present some robustness checks and investigate the effects of adding more control variables or changing our proxy of cash holdings and our firm specific variables. The dependent variable that we mostly use in our regression models is our proxy of cash holdings, which is the ratio of Cash and Equivalents to Net Assets. 8 Agrawal and Knoeber (1996) find that the median insider ownership for a set of Forbes 800 firms in 1987 is 1.7 percent and 9.6 percent respectively. 16 4.1 Board structure and cash holdings Table 3 outlines 4 models that we use to explore the relationship between board structure and cash holdings. Since past studies have shown that a large board tends to be more inefficient, firms with large boards are implied to have poor corporate governance. Dittmar et al. (2003) document that firms in countries with poor shareholder protection (which also implies poor governance) hold larger cash balances. Hence, we hypothesize that there is a positive relationship between board size and cash holdings. One of the main objectives of establishing audit committees is to strengthen the ability of the board in monitoring the performance of managers. Audit committees often require its members to be non-executive. As a result, we hypothesize that cash holdings and the percentage of non-executive directors in the audit committee are inversely related. The function of the nominations committee is primarily to nominate candidates for board appointments. Other responsibilities may include recommending membership and chairs of board committees, evaluating board and director performance, and determining the independence of nonexecutive directors. The functions of the remuneration committee generally include recommending a remuneration framework for the board and recommending remuneration packages for individual directors and senior executives in the company. Like the audit committee, these two committees are primarily designed to improve the accountability of the board to shareholders and the monitoring of management by the board. We hypothesize that the presence of these committees in a firm improves its corporate governance, which in turn implies a decrease in cash holdings. In Model (1), we regress our dependent variable (cash holdings) only on the logarithm of board size, the percentage of non-executive directors in the board, and industry dummies to control for 17 industry effects. Although the sign of the coefficient on the logarithm of board size is positive as we hypothesize, it is not statistically significant. We add the audit committee variables and the two dummy variables for nomination and remuneration committee in Model (2). Again, all the three coefficients on the logarithm of board size (0.35), the logarithm of audit committee size (-0.37) and the percentage of non-executive directors in the audit committee (-0.47) are not significant in model without the industry dummies. Similarly, none of the dummies representing the presence of nomination and remuneration committees is significant. Next, we examine the impact of adding financial and other firm-specific variables in Model (3) and (4) to control for firm-specific effects. Prior studies have found that firm size, leverage, tangibility, market to book, capital expenditures, and dividends are important determinants of corporate cash holdings. Large cash holdings are associated with small, dividend-paying firms; firms with high market to book and ratio of capital expenditures to total assets; and low tangible asset ratios. In Model (3), although the coefficient on the logarithm of board size increases from 0.26 to it is only marginally significant (with a p-value of 0.07). Similarly, the coefficient on the percentage of non-executive directors continues to be insignificant. There is no size effect as documented by Dittmar et al. (2003) since the coefficient on the logarithm of Assets (which is our proxy for firm size) is not significant. The signs of the other financial variables are consistent with our predictions and they are highly significant at least at the 1 percent level. In particular, the coefficient on the market-to-book (0.33) and capital expenditure (1.70) are both positive. Firms with higher market-to-book (ie: when there is improved investment opportunities) and capital spending tend to increase their cash holdings, which are consistent with the transactions and precautionary motives of cash holdings. This finding is similar to that found by Opler et al. (1999) and Dittmar et al. (2003) and provides evidence that is supportive of the trade-off model of cash holdings. 18 The two other firm-specific variables (logarithm of Age and Mainboard dummy) do not affect cash holdings. In Model (4), the coefficient on the logarithm of board size increases in magnitude from 0.40 (in Model (3)) to 0.47. Its significance also improves and it becomes highly significant at the 5 percent level. As firms increase their board size, they tend to hold more cash. One possible explanation for this is that as the board size increases, it becomes less effective as monitoring mechanisms, which implies poor corporate governance. This in turn prevents the shareholders from forcing managers to distribute excess cash as dividends, and as a result, the cash balances increase. The coefficient on the percentage of non-executive directors in the audit committee is still insignificant. We also note that the coefficient of determination has increased from 0.04 in Model (1) to 0.33 in Model (4), indicating that the firm-specific variables have the effect of better explaining the relationship between board structure and cash holdings. [Insert Table 3 here] 4.2 Ownership concentration and cash holdings After establishing the relationship between the board variables and cash holdings, we will now turn our attention to the ownership variables and present the results in Table 4. Studies by Morck et al. (1988), and McConnell and Servaes (1990) uncover a curvilinear relationship between firm value and insider ownership. We include the insider ownership and its squared term in our regression models to account for the possibility of a non-linear relationship between cash holdings and insider ownership, which is what previous studies have documented between firm value and insider ownership. Lins (2003) argues that non-management blockholders play a positive governance role by helping to reduce the value discounts when there is a separation in the control and cash flow rights held 19 by a firm’s management group. We define non-management blockholders as those owning 5% or more of the equity of a firm who are not the managers (insiders) of the firm. We hypothesize that increased non-management blockholder ownership leads to better corporate governance and hence lower cash holdings. Similar to Table (3), we include only the industry dummies in Model (1) and (2) and incorporate the firm-specific variables as additional control variables in Model (3) and (4). None of the coefficients on insider ownership (and its squared term) is significant at conventional level in Model (1) and (2), which is consistent with the findings by Mikkelson and Partch (2003). Meanwhile, the coefficient on the non-management blockholder ownership (-0.82) is negative as predicted and it is highly significant (with a p-value of 0.03).9 Adding the firm-specific variables does not alter the significance of the coefficients on insider ownership in Model (3) and (4). The coefficient on the non-management blockholder ownership (0.82) remains negatively significant, and its significance has improved (with a p-value of 0.01). Hence, there exists an inverse relationship between non-management blockholder ownership and cash holdings, which suggests that non-management blockholders act as external monitors and prevent managers from disgorging excessive cash balance. The magnitudes of the coefficients on the financial variables are relatively similar to that in Table 3 and they are still highly significant. We also document that the relationship between firm size and cash holdings is positive, which is contrary to the negative size effect found by Dittmar et al. (2003). Similar to Table 3, the R-square has again increased from 0.03 in Model (1) to 0.33 in Model (4). 9 We have also regressed cash holdings only on blockholder ownership as an alternative specification to Model (2). The coefficient on the blockholder ownership (-0.81) is negatively significant and it is not different from that obtained in Model (2). The alternative specification to Model (4) yields similar results. 20 [Insert Table 4 here] 4.3 Robustness tests In this section, we will combine the results from the previous sections and perform a series of robustness checks by adding in more control variables or changing our proxy of cash holdings. Table 5 presents the results of our robustness checks. For the sake of brevity, we only report the coefficients on the board and ownership variables in Table 5.10 The main findings from the previous sections are that board size and non-management blockholder ownership play important roles in the determination of cash holdings in Singapore firms. We combine all the board and ownership variables in Model (1) and examine whether the sign and significance of the two above mentioned variables still remains the same. The coefficient on the logarithm of board size increases from 0.47 (Table 3, Model (4)) to 0.58, and it remains highly significant (with a p-value of 0.05). The coefficient on the logarithm of audit committee size (-0.96) now becomes weakly significant, indicating that as more directors are added into the audit committee, its monitoring function becomes more effective (probably due to the addition of more non-executive directors into the audit committee). For the coefficient on the non-management blockholder ownership (-1.46), it is still negative and significant at the 1 percent level. The magnitude and significance of the other control variables are stable. Overall, our first robustness test has shown that board structure and ownership concentration remain influential in determining the level of corporate cash holdings. In Model (2), we introduce two dummy variables: Large (equals 1 when the board size is larger than the median value, 0 otherwise) and Large Blockholder (equals 1 when the non-management blockholder ownership is larger than the median value). We replace the coefficients on the logarithm 10 The complete results are available upon request from the author. 21 of board size and non-management blockholder ownership with the two dummies. The coefficient on the first dummy (0.38) is positive and significant (with a p-value of 0.02). The economic significance of the result is substantial. Moving from a small to large board has the effect by increasing the cash holdings by 37 percent. The coefficient on the logarithm of audit committee size now becomes negative and significant at the 5 percent level, further confirming the important role of audit committee in establishing better corporate governance for a firm. Although the coefficient on the second dummy (-0.26) is negative, it is only significant at the 10 percent level. We have also regressed our dependent variable only on the two dummies, the industry dummies and the firm-specific control variables, and obtain similar results (not reported). Since previous study on Singapore corporate governance has reported that the Singapore government (through its corporate arm, Temasek Holdings) owns substantial ownership in many large Singapore companies, we add the Government dummy variable in Model (3). To help promote corporate transparency and provide investors and other stakeholders with relevant (and reliable) information in a timely and understandable fashion, The Business Times has launched a Corporate Transparency Index (CTI) that assesses the level of disclosure in financial results released by listed companies. The index is a score from 0 to 100, with a passing mark of 50 considered to be an adequate level of transparency. We further incorporate the CTI score as a control variable in Model (3). In a way, we can treat a company with a high score on the CTI Index to be better-governed than a company with a low score. As a result, we predict that a higher CTI score decreases the level of cash holdings. Fan and Wong (2003) have shown that auditors also play important governance role in Asian companies. Hence, we also add the Auditor dummy variable in Model (3). Our board and ownership 22 variables continue to be significant as before (albeit weaker in significance), but none of the three control variables we introduce are significant. The results in Model (3) suggest that government ownership, CTI Score and auditors do not affect the level of corporate cash holdings in Singapore. Recent studies on Asian corporate governance have documented the prevalence of family as the ultimate controlling owners of Asian corporation, which ultimately leads to the expropriation of minority shareholders. We examine the effect of family control on the cash holdings by introducing a family control dummy variable (which equals one if insider ownership is greater than 50 percent) in Model (4). We hypothesize that firms with family control tend to hold more cash, hence, we expect a positive relationship between family control and cash holdings. The results show that although the coefficient on the family control dummy is positive (0.09), it is not significant, while the coefficients on the logarithm of board size (0.61) and the coefficient on non-management blockholder ownership (1.39) remain highly significance. Hence, our evidence suggests that family control has little effect on the cash holdings, which is consistent with the findings by Dittmar et al. (2003). Model (5) is equivalent to Model (1), except that we replace our dependent variable by Cash and Equivalents / Sales. Dittmar et al. (2003) argue that using sales instead of assets as a deflator is better because sales tend to be less affected by conservatism. Some of the coefficients (Insider ownership, its squared term, nomination committee), which do not affect cash holdings previously are now significant. Governance mechanisms seem to have increasing importance on cash holdings when we deflate the cash holdings by sales. Hence, the relationship between board structure, ownership concentration and corporate cash holdings is robust. [Insert Table 5 here] 23 5. Conclusion Following Opler et al. (1999) and Dittmar et al. (2003) who have documented the potential determinants of cash holdings in the U.S. as well as in other emerging markets, it is natural to dig deeper into the issue and question whether or not firm-specific corporate governance mechanisms play some roles in the cash balances held by corporations. Using a sample of 230 firms in Singapore, our findings suggest that board size and nonmanagement blockholder ownership are important determinants of corporate cash holdings. Most of the firm-specific variables that are used in previous studies also continue to be significant in the expected manner. In particular, the coefficients on market-to-book and capital spending are positively significant. We provide additional evidence of the importance of corporate governance in the determination corporate cash holdings and the relevance of the agency cost theory, as documented by Dittmar et al. (2003). Firms with poor corporate governance (large board and small non-management blockholder ownership) face more severe agency problems and hold higher cash balances. Although our results are robust to series of additional tests, one of the limitations of this study is that our sample period is only 1 year. One possible avenue for future research is to test the relationship using time-series data over a number of years. In April 2001, the Singapore Exchange (SGX) has started to adopt the Code of Corporate Governance. It consists of four sections on board matters, remuneration matters, audit and accountability, and communication with shareholders. Companies are required to describe their corporate governance practices in accordance with the guidelines that have been set out in the Code. It will be interesting to examine whether the rulings will improve the quality of corporate disclosure and subsequently mitigate the agency problem shareholders currently encounter. 24 References Baysinger, B.D., Butler, H.R., 1985. Corporate governance and the board of directors: Performance effects of changes in board composition. Journal of Law, Economics and Organization 1, 101-124. Blanchard, O.J., Lopez-de-Silanes, F., Shleifer, A., 1994. What do firms do with cash windfalls, Journal of Financial Economics 36, 337-360. Berle, A., Means, G., 1932. The Modern Corporation and Private Property. MacMillan, New York. Brickley, J.A., Coles, J.L., Terry, R.L., 1994. Outside directors and the adoption of poison pills. Journal of Financial Economics 35, 371-390. Chen, D.H., Fan, J.P.H., Wong, T.J., 2002. Do politicians jeopardize professionalism? Decentralization and the structure of Chinese corporate boards. HKUST working paper. Claessens, S., Djankov, S., Lang, L.H.P., 2000. The separation of ownership and ontrol in East Asian Corporations. Journal of Financial Economics 58, 81-112. Claessens, S., Djankov, S., Fan, J.P.H., Lang, L.H.P., 2002. Disentangling the incentive and entrenchment effects of large shareholdings. Journal of Finance 57, 2741-2771. Demsetz, H., 1983. Corporate control, insider trading, and rates of return. American Economic Review, 313-316. Demsetz, H., Lehn, K., 1985. The structure of corporate ownership: causes and consequences. Journal of Political Economy 93, 1155-1177. Denis, D.K., McConnell, J.J., 2003. International corporate governance. Journal of Financial and Quantitative Analysis 38, 1-36. Dittmar, A., Mahrt-Smith, J., Servaes, H. , 2003. International corporate governance and corporate cash holdings. Journal of Financial and Quantitative Analysis 38, 111-134. Fama, E.F., 1980. Agency problems and theory of the firm. Journal of Political Economy 88, 288-307. Fama, E.F., Jensen, M.C., 1983. Separation of ownership and control. Journal of Law and Economics 26, 301-325. Faccio, M., and Lang, L.H.P, 2002. The ultimate ownership of Western European corporations. Journal of Financial Economics 65, 365-395. Fan, J.P.H, Wong, T.J., 2003. Do external auditors perform a corporate governance role in emerging markets: Evidence from East Asia, HKUST working paper. Fishman, R., 2001. Its not what you know … estimating the value of political connections. American Economic Review 91, 1095-1102. Grossman, S.J., Hart, O.D., 1980. Takeover bids, the free-rider problem and the theory of corporation. Bell Journal of Economics 11, 42-64. Harford, J., 1999. Corporate cash reserves and acquisitions. Journal of Finance 54, 1969-1997. Hermalin, B.E., Weisbach, M.S., 1988. The determinants of board composition. Rand Journal of Economics 19, 589-605. Jensen, M.C., Meckling, W.H., 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3, 305-360. 25 Jensen, M.C., 1986. Agency costs of free cash flow, corporate finance and takeovers. American Economic Review 76, 323-329. Jensen, M.C., 1993. The modern industrial revolution, exit and the failure of internal control systems. Journal of Finance 48, 831-880. Joh, S.W., 2003. Corporate governance and firm profitability: evidence from Korea before the economic crisis. Journal of Financial Economics 68, 287-322. John, K., Senbet, L.W., 1998. Corporate governance and board effectiveness. Journal of Banking & Finance 22, 371-403. Johnson, S., Boone, P., Breach, P., Friedman, E., 2000. Corporate governance in the Asian financial crisis. Journal of Financial Economics 58, 141-186. Johnson, S., Mitton, T., 2003. Cronyisms and capital controls: evidence from Malaysia. Journal of Financial Economics 67, 351-382. La Porta, R, Lopez-De-Silanes, F., Shleifer, A., 1999. Corporate Ownership Around the world. Journal of Finance 54, 471-517. Lang, L.H.P., Stulz, R.M., Walkling, R.A., 1991. A test of the free cash flow hypothesis: The case of bidder returns. Journal of Financial Economics 29, 315-335. Lemmon, M.L., and Lins, K.V., 2003. Ownership structure, corporate governance, and firm value: Evidence from the East Asian financial crisis. Journal of Finance 58, 1445-1468. Lins, K.V., 2003. Equity ownership and firm value. Journal of Financial and Quantitative Analysis 38, 159-184. Mace, M.L., 1986. Directors, Myth and Reality. Harvard Business School Press, Boston, MA. Mak, Y.T., Li., Y., 2001. Determinants of corporate ownership and board structure: Evidence from Singapore. Journal of Corporate Finance 7, 235-256. Mak, Y.T., Kusnadi., Y., 2003. Does board size really matters? Further evidence on the negative relationship between board size and firm value from Singapore and Malaysia. NUS Working paper. McConnell, J.J., Servaes, H., 1990. Additional evidence on equity ownership and corporate value. Journal of Financial Economics 27, 595-612. Mikkelson, W.H., amd Partch, M.M., 2003. Do persistent large cash reserves hinder performance? Journal of Financial and Quantitative Analysis 38, 275-294. Mitton, T., 2002. A cross-firm analysis of the impact of corporate governance on the East-Asian financial crisis. Journal of Financial Economics 64, 215-241. Morck, R., Schleifer, A., Vishny., R.W., 1988. Management ownership and market valuation: An empirical analysis. Journal of Financial Economics 20, 293-315. Opler, T., Pinkowitz, L., Stulz, R., Williamson, R., 1999. The determinants and implications of corporate cash holdings. Journal of Financial Economics 52, 3-46. Shleifer, A., Vishny, R.W., 1986. Large stakeholders and corporate control. Journal of Political Economy 94, 461-188. Stulz, R., 1988, Managerial control of voting rights. Journal of Financial Economics 20, 25-59. 26 Wiwattanakantang, Y., 2001, Controlling shareholders and corporate value: Evidence from Thailand. Pacific-Basin Finance Journal 9, 323-362. Yeh, Y.H., 2002. Board composition and the separation of ownership from control. Unpublished working paper. Yermack, D., 1996. Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40, 185-211. 27 Appendix 1 Definitions of Variables Name Financial variables Assets Cash & Equivalents / Net Assets Leverage Tangibility Market to Book Capital Expenditure / Net Assets Dividend Board Structure Board Size % Executive Directors % Non-Executive Directors Audit Committee Size % Executive Directors (Audit) % Non-Executive Directors (Audit) Nomination Committee Remuneration Committee Ownership Concentration Insider Ownership Insider Ownership2 Non-Management Blockholder Ownership Other variables Government Mainboard Age CTI Score Governance Disclosure Auditor Description Book value of total asset (in millions of dollars) Cash & equivalents divided by total asset Total liability divided by total asset Fixed asset divided by total asset Market value of equity plus book value of liability divided by total asset Change in fixed asset plus depreciation divided by total asset Dummy variable – 1 for firms that pay dividends during the financial year, 0 otherwise Total number of directors in the board Percentage of executive directors Percentage of non-executive directors Total number of directors in the audit committee Percentage of executive directors in the audit committee Percentage of non-executive directors in the audit committee Dummy variable -- 1 if there is a nomination committee, 0 otherwise Dummy variable -- 1 if there is a remuneration committee, 0 otherwise Percentage of equity ownership (both direct and indirect) by the insiders (executive directors) The square of Insider Ownership Percentage of equity ownership by non-management blockholders (those with more than 5 percent ownership) Dummy variable -- 1 for firms with government ownership, 0 otherwise Dummy variable -- 1 for firms listed on the main board, 0 otherwise The number of years since company is incorporated The Corporate Transparency Index was launched by Business Times in July 2000 to assess the level of disclosure in financial results released by Singapore-listed companies Dummy variable – 1 for firms that provide a separate report of corporate governance in the annual report, 0 otherwise Dummy variable – 1 for auditor which is a Big 5 accounting firm, 0 otherwise 28 Table 1 Sample Description The table presents the breakdown (in terms of mainboard and second board, as well as the different industries) for the sample of Singapore companies that is used in the study. It consists of 230 companies that are listed in the Singapore Stock Exchange (SGX). The data comes from the companies' annual reports for the financial year ending in 1999. Mainboard Second Board Industry Breakdown Commerce Construction Hotels/Restaurants Manufacturing Multi-Industry Properties Services Transportation/Storage/Communications TOTAL 29 No of companies 181 49 34 22 11 97 14 21 15 16 230 Table 2 Summary Statistics The table presents the summary statistics for the financials variables, board structure, ownership concentration variables, and other variables. Assets is the book value of total assets (in millions of dollars). Net Assets is calculated as total assets minus cash and equivalents. Leverage is calculated as total liabilities divided by total assets. Tangibility is calculated as fixed asset divided by total assets. Capital Expenditures is calculated as the change in fixed asset plus depreciation. Inside Ownership is the percentage of equity ownership (direct and indirect) held by the executive directors. NonManagement Blockholder Ownership is the percentage of shares held by blockholders (those with more than 5 percent ownership). For the dummy variables (Dividend, Nomination, Remuneration, Government, Mainboard, Governance Disclosure, Auditor), the mean represents the proportion of firm with a value of 1 for the variables. The sample size is 230. Mean Financial Variables Assets Cash & Equivalents / Net Assets Leverage Tangibility Capital Expenditure / Net Assets Market to Book Dividend Board Structure Board Size % Executive Directors % Non-Executive Directors Audit Committee Size % Executive Directors (Audit) % Non-Executive Directors (Audit) Nomination Remuneration Ownership Concentration Insider Ownership Non-Management Blockholder Ownership Other variables Government Mainboard Age CTI Score Governance Disclosure Auditor 30 Median Std Dev 730.48 169.45 22.28% 8.00% 45.47% 46.50% 35.56% 35.00% 6.63% 4.00% 2.03 1.78 0.82 - 2514.86 95.64% 17.92% 22.81% 12.76% 1.08 - 7.27 40.60% 69.40% 3.18 21.75% 78.25% 0.01 0.54 7 40.00% 60.00% 3 33.00% 67.00% - 2.00 19.92% 19.94% 0.48 15.10% 15.10% - 29.53% 23.50% 28.79% 32.13% 21.00% 30.28% 0.11 0.79 23.18 36.86 0.68 0.91 21 33 - 17.36 10.44 - Table 3 Board Structure and Cash Holdings The table presents the coefficients of OLS regression of cash holdings on board structure variables. The dependent variable is Cash and Equivalents / Net Assets. All regressions include industry dummy variables. R-square is the adjusted coefficients of determination. The p-value for each coefficient is reported in the parenthesis. The sample size is 230. *, **, *** denote statistical significance at the 10 percent, 5 percent, and 1 percent level respectively. Log (Board Size) % Non-Executive Directors (1) 0.26 (0.28) 0.39 (0.24) Log (Audit Committee Size) % Non-Executive Directors (Audit) Nomination Remuneration Log(Assets) Leverage Tangibility Capital Expenditure / Net Assets Market to Book Dividend Mainboard Log(Age) Constant R-square -0.57 (0.30) 0.04 Cash and Equivalents / Net Assets (2) (3) 0.35 0.40* (0.17) (0.07) 0.40 (0.17) -0.37 (0.44) -0.47 (0.30) 0.04 (0.96) 0.15 (0.27) 0.07 (0.20) -1.77*** (0.00) -0.85*** (0.01) 1.70*** (0.00) 0.33*** (0.00) -0.39*** (0.01) 0.16 (0.27) 0.03 (0.68) 0.18 -1.85* (0.81) (0.09) 0.03 0.33 (4) 0.47** (0.04) -0.51 (0.21) -0.35 (0.36) 0.14 (0.82) 0.14 (0.24) 0.09 (0.24) -1.81*** (0.00) -0.89*** (0.00) 1.78*** (0.00) 0.32*** (0.00) -0.40*** (0.01) 0.15 (0.30) 0.05 (0.46) -1.23 (0.31) 0.33 Table 4 Ownership Concentration and Cash Holdings The table presents the coefficients of OLS regression of cash holdings on ownership concentration variables. The dependent variable is Cash and Equivalents / Net Assets. All regressions include industry dummy variables. R-square is the adjusted coefficients of determination. The p-value for each coefficient is reported in the parenthesis. The sample size is 230. *, **, *** denote statistical significance at the 10 percent, 5 percent, and 1 percent level respectively. Insider Ownership Insider Ownership2 (1) -0.22 (0.78) -0.07 (0.95) Non-Management Blockholder Ownership Log (Assets) Leverage Tangibility Capital Expenditure / Net Assets Market to Book Dividend Mainboard Log (Age) Constant R-square 0.24 (0.33) 0.03 32 Cash and Equivalents / Net Assets (2) (3) -0.61 0.05 (0.45) (0.94) 0.57 -0.38 (0.61) (0.69) -0.82** (0.03) 0.11* (0.06) -1.77*** (0.00) -0.88*** (0.00) 1.76*** (0.00) 0.31*** (0.00) -0.39*** (0.01) 0.17 (0.27) 0.03 (0.65) 0.78** -1.44 (0.02) (0.22) 0.05 0.32 (4) -0.35 (0.62) 0.29 (0.76) -0.89*** (0.00) 0.13** (0.02) -1.84*** (0.00) -0.80*** (0.01) 1.67*** (0.00) 0.32*** (0.00) -0.36*** (0.01) 0.16 (0.29) 0.02 (0.78) -1.26 (0.27) 0.34 Table 5 Robustness Tests The table presents the coefficients of OLS regression of cash holdings on board structure and ownership concentration variables. All regressions include industry dummy variables and control variables that are used in the previous tables. Panel A report the results when the dependent variable is Cash & Equivalents / Net Assets; Panel B report the results when the dependent variable is Cash & Equivalents / Sales. Large is a dummy variable which equals 1 if the board size is larger than the median value and Large Blockholder is a dummy variable which equals 1 if the nonmanagement blockholder ownership is larger than the median value. R-square is the adjusted coefficients of determination. The p-value for each coefficient is reported in the parenthesis. The sample size is 230. *, **, *** denote statistical significance at the 10 percent, 5 percent, and 1 percent level respectively. Log (Board Size) Large Log (Audit Committee Size) % Non-Executive Directors (Audit) Nomination Remuneration Insider Ownership Insider Ownership2 Cash and Equivalents / Net Assets (1) (2) (3) (4) 0.58** 0.60* 0.61** (0.05) (0.06) (0.04) 0.38** (0.02) -0.96* -1.06** -0.93* -0.82 -2.63 (0.07) (0.05) (0.08) (0.11) (0.17) -0.60 (0.25) -0.77 (0.29) 0.10 (0.50) -1.14 (0.22) 1.60 (0.19) -0.80 (0.12) -0.17 (0.82) 0.13 (0.28) -1.17 (0.22) 1.50 (0.23) -0.62 (0.24) -0.80 (0.28) 0.10 (0.51) -1.06 (0.26) 1.53 (0.21) -0.46 (0.37) -0.69 (0.34) 0.11 (0.44) -2.66 (0.16) -5.51** (0.04) 0.10 (0.85) -5.52 (0.11) 7.30* (0.10) Family Control Non-Management Blockholder Ownership 0.09 (0.58) -1.46*** (0.00) Large Blockholder -1.44*** (0.00) -0.26* (0.09) Government Ownership Governance Disclosure Auditor CTI Score Constant R-square Cash and Equivalents /Sales (5) 1.99* (0.07) -1.35 (0.41) 0.42 -0.01 (0.99) 0.40 -7.53*** (0.00) -1.39*** (0.00) -0.02 (0.94) 0.16 (0.28) 0.00 (0.97) -0.00 (0.99) -1.43 (0.41) 0.41 33 -1.94 (0.22) 0.42 -5.54 (0.36) 0.45