SAA Answers

advertisement

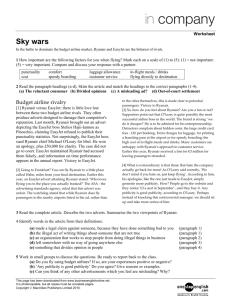

MA in Management – Strategic Analysis Module Evaluating Strategies Blank Page G. SAA Answers SAA 1 – Evaluating the Suitability of EasyJet’s strategy EasyJet’s existing strategy can be characterised as low price/low value added (route 1 on the strategy clock) concentrating on Luton and Liverpool hubs (not the main UK airports) and targeting routes with little direct competition from other airlines (which builds up elements of access and variety based positioning). EasyJet exploited the major environmental change that resulted from the initial liberalisation of the EU airline market. The attractiveness of this “low cost” strategic group within the market has brought in new competitors (like BA’s GO) so the industry structure is changing. EasyJet’s decision to buy new aircraft and open new routes can be seen as an attempt to pre-emptively protect and build on their current position. The deals with Geneva airport and TEA also allow them to exploit an EU “open skies” agreement with Switzerland if finalised using the same strategic approach. The strategy is largely expanding upon existing capabilities in operating a low cost airline. Expanding the fleet of aircraft potentially offers cost efficiency advantages in terms of economies of scale and scope across a bigger number of routes. Standardising on new Boeing 737-300s and 737-700s should also help minimise operational costs as well as the purchase economies from the deal (discounts). Other parts of the value chain are also consistent with this low cost approach – headquarters at Luton rather than a more expensive location (although not mentioned in the illustration the HQ is pared down to a minimum to reduce overheads. Aircraft maintenance is also contracted out). As EasyJet is privately owned then the massive increase in gearing implied by the financing of new aircraft is perhaps less unattractive to investors than would be the case if the company was public. Ideally, it would be helpful to have more information on EasyJet’s current value chain and its capabilities to deliver the “low cost” approach. The big strategic issue to be resolved is the extent to which their current positioning is defensible if they start to expand – with risks from competitor reaction, perhaps from airlines previously unaffected by their strategy and the capabilities of EasyJet to deliver the same strategic approach on five-times the scale. SAA 2 – Evaluating the Acceptability of Easyjet’s strategy The risks of the new strategy are related to the extent of expansion – both strategically in terms of their ability to deliver on a bigger scale (a five-fold expansion of operations) and financially in terms of the impact of long-term gearing (loans from the banks). Their existing capabilities in this type of business (they were one of the first in Europe) and the potential use of equipment trust certificates to re-finance the purchase at a later date might help. There are few details about the potential returns in the illustration, but this seems to be an expanding sector in which EasyJet already has an established position. It seems to make strategic sense in terms of both protecting their existing position and creating the potential to exploit new opportunities (Switzerland) but more information on projected passenger d:\533575112.doc volumes and revenues would help in assessing both returns and risks (e.g. ROCE, NPV, payback and break-even). As a privately owned airline then the number of key stakeholders is at least reduced by not having shareholders, Stelios Haji-Ioannou is the owner and chief executive. However, the banks are going to be particularly interested in the company given their exposure in terms of gearing – though they should be supportive providing the revenue flows increase as planned! Given the leanness of the organisation then the employees are likely to have a strong input. Governments are likely to be supportive of EasyJet’s approach as it encourages competition – though some may have closer ties to “national flag carriers” who are potential competitors. SAA 3 – Evaluating the Feasibility of EasyJet’s strategy EasyJet has built up experience as a successful “low cost” airline and the proposed strategy is an extension of existing capabilities. The cultural web of the organisation is also not likely to see major changes and create problems of managing implementation. The question is whether the system can be stretched into a five-fold expansion. The expansion into Switzerland, with the deals with Geneva airport and TEA, including the switch to Boeing 737s, would seem to be strategically sensible given the potential “open skies” agreement. The alliance, with an option to acquire TEA, should also offer synergies whilst reducing the risks of further stretching the existing EasyJet system. Financing is a major issue for this strategy – the cash flow for the aircraft deposit and longterm bank loans may indicate adequate financial resources, but conclusions depend upon an examination of this part of the deal in terms of impact on the company’s capital structure (gearing) and cash flow projections. Given the banks have leant the money then some judgements can be implied but, in practice, this would be a critical part of the overall strategy evaluation. d:\533575112.doc