Audited Accounts 2015

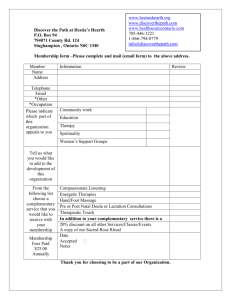

advertisement