The Art of Tax by P. James Wallace, Senior Tax Advisor, LRTP

advertisement

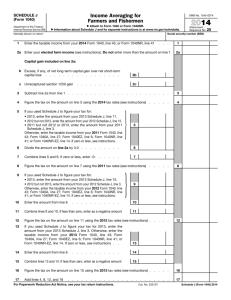

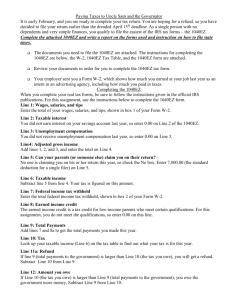

The Art of Tax by P. James Wallace, Senior Tax Advisor, LRTP “Lines and Forms, 2006” Occasionally, I have the opportunity to help someone who has prepared a Form 1040A or a Form 1040EZ wrongly because they did not see a line on the form to enter some particular item. Sometimes, an item of income is simply omitted (big mistake). Sometimes it is just misclassified (sometimes significant, sometimes you get away with it). For instance, I’ve seen Form W-2G gambling winnings misreported as wages. That time, there was no consequence, but that’s not always true. What if that taxpayer had also claimed an earned income credit and incorrectly counted the gambling winnings as earned income? The IRS might be real interested in that mistake. Many people don’t realize that Forms 1040A and 1040EZ are amputated versions of the full Form 1040. They are just Forms 1040 with a lot of the less frequently used lines omitted. If there is an item that doesn’t have a line on your Form 1040A or 1040EZ, you had better fill out the Form 1040. It is never a mistake to upgrade to a longer form. Still, some people feel most comfortable with the same form they have filed every year even when their situation changes. So what does the IRS do? The IRS keeps adding new lines to the 1040A and the 1040EZ to give people the chance to see those items that they would have seen if they had just moved to the next form up. This year, Form 1040EZ will have 14 numeric entries on its page 1, plus for some taxpayers a page 2. EZ isn’t so easy, is he. So why am I harping on forms and lines as my February theme? First, it’s a new tax season and there the traditional annual changes to the forms. In fact there is a brand new alternative to the 1040, 1040A, and 1040EZ, called the 1040EZ-T, with which we will conclude this column. But my second reason is that Congress, in their infinite wisdom, screwed the IRS by changing the tax law after the IRS had already sent this year’s forms to press! Hence, you, the taxpayer, have new opportunities to misunderstand the forms this year. Let me start my explanation with something that is actually clearer on the Form 1040 this year. In the Adjustments to Income section (lines 23-37 of the Form 1040), line 24 is new this year and states “Certain business expenses of reservists, performing artists, and feebasis government officials, Attach Form 2106 or 2106-EZ”. An army reservist, for instance, can put his un-reimbursed army reserve expenses listed on his Form 2106 here instead of on his schedule A where they might be limited. It looks like this is new tax law, but no, it has been in effect for a number of years. Previously, this same item would have been reported with a marginal note on the total adjustments line of this section of the Form 1040. Same thing with this year’s new line 34, “Jury duty pay you gave to your employer” – also previously available with a marginal entry. Now back to Congress. There were a number of tax breaks set to expire in 2006, such as the adjustment to income for educator expenses, which many people expected Congress to extend. Well Congress didn’t act to extend those provisions, the IRS took them off the tax forms, and then went to press. Then Congress enacted the extensions. Thanks a lot. So what do you do if you have qualifying educator expenses? You put it on Form 1040, line 23, “Archer MSA deduction” along with any Archer MSA deduction and a marginal note. Another expired then extended adjustment to income is the tuition and fees deduction. Its line was also eliminated. It is to be included on Form 1040, line 35, “Domestic production activities deduction” along with any domestic production activities deduction and a marginal note. Of course it could be more profitable to claim an education credit instead. Hmmm, better calculate it both ways, including state consequences. The sneakiest expired/dropped from the form/then extended provision is the sales tax deduction in lieu of the income tax deduction on the Schedule A. So even though line 5 of the Schedule A only says “income tax”, state and local sales tax can be deducted on this same line instead. A marginal entry of “ST” with line 5 is required when the sales tax is taken. Colorado is one of the trickiest states with respect to this provision. I recommend that every Colorado taxpayer who itemizes compare the two alternatives. I will have more to say about this in the March column. I will wrap this column up with the telephone excise tax refund. Telephone companies have collected a Federal excise tax for over a century. Now you can get a refund of these excise taxes that you paid from March, 2003 through July, 2006. But you have to file a tax return to get that refund. If you file a Form 1040, you will report the amount of the refund on line 71; Form 1040A on line 42; Form 1040EZ on line 9. These lines are in the refundable credits section and are counted as part of the total payments you have made against your tax liability. If you otherwise owe the government, it will reduce your liability. If you are getting a refund, it will increase your refund. What if your income is low enough that you aren’t required to file a tax return? Then the Form 1040EZ-T was introduced this year just for you! It has just one numerical entry: the amount of the excise tax to be refunded to you. So how much excise tax do you get? You have two ways to figure it. First, you can dig out your telephone bills for the last three years, put the info on the new Form 8913 to calculate it, and file that Form 8913 with your Form 1040, 1040A, 1040EZ, or 1040EZT. Or you can skip the record keeping and the Form 8913 and use the IRS’s official estimate (the “safe harbor” method, see your Form 1040, ect. instructions) and get zero, $30, $40, $50, or $60. Hurray! If you had a business, including a Schedule C business, at any time in 2003 through 2006, be prepared for the headache of the special calculations that apply to businesses. Sorry. <Need habitual, tag line here. Examples: “Now keep those pencils and wits sharp, y’hear?” Or “Remember, pigs get fat, but hogs get slaughtered.” Or “Keep it legal, now.” Or > The Art of Tax is a column by P. James Wallace who is solely responsible for its content and is not approved by the IRS, his employers, or any other person or organization. The purpose of The Art of Tax is to educate, raise awareness, and maybe even entertain. It is not to be construed as legal, tax, or financial advice as the particulars of anyone’s situation may differ and information disseminated in a public forum is never to be relied upon without appropriate investigation of a person’s particulars and possible exceptions. Furthermore, license issues prevent Mr. Wallace from issuing any but tax advice, and that only under certain strictly limited circumstances not met in this publication.