The subject of Management Accounting builds on the knowledge

advertisement

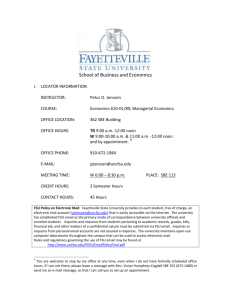

BUDAPEST BUSINESS SCHOOL COLLEGE OF FINANCE AND ACCOUNTANCY- FINANCE DEPARTMENT 1149 BUDAPEST, BUZOGÁNY ST. 10-12. / FAX: +36-1-4696697 SYLLABUS Management Accounting Spring Term Course title: Management Accounting Course code: Status: Contact hours: 3 Credits: 3 Prerequisites: Passed exam on Financial Accounting II. Course unit leader: Madarasiné Szirmai Andrea Office number: A 107 e-mail address: szirmai.andrea@pszfb.bgf.hu --- Tutor(s): Aims and learning outcomes: The subject of Management Accounting builds on the knowledge obtained in the Financial Accounting and gives a summary on information which need to the management to make different decisions. The aim is to teach the student what kind of information and data are necessary to the management, in what level these shall be provided and which division in the business activity. The students learn the basis of the budgetary procedures, correspondences, analysis of budgets and costs. After learning the methods of calculations, the students will learn the book-keeping of the whole production activity, using nature of costs, cost centres and cost objects. It will give them a wider and deeper understanding of cost recognition and analysis. 1 Course schedule Consultations (semester weeks) Topic 1st – 2nd - 3rd –4th 5th-6th 7th-8th 9th -10th 11th -12th The aim and the roles of management accounting (MA) Definitions of MA Where in the organization? Distinguish of MA and FA Repeat the structure of income statements Cost calculation: reasons, how, what to measure Cost, expense, expenditure Cost/Asset management Classification of costs Preparing budgets using separation of variable and fix costs Breakeven point Managerial costing Planning of costs Assignments Analytical – ledger accounting Calculation of costs Control and analysis of costs Methods of cost management Standard costing and norms Production costs, production process Cost budgets Methods of calculation of production cost Rules on production cost in the HAR Content of the regulation of production cost Calculation schema Detailed content of production cost Recognition of costs in 5th, 6th (cost centres)and 7th (cost objects) class of accounts - Reconciliation of costs - Recognition of costs in 5th, 6th (cost centres)and 7th (cost objects) class of accounts - Reconciliation of costs Course policies Students are invited for compulsory attendance on the lectures. Assignments 1. Oral assignments in the class: different topics and examples will be set to the student in the classes to answer and solve them. 2. Written exams: 2 written exams during the semester on Management Accounting 2 Assessment and grading The final mark will be composed of: (i) the 2 written exams on Management Accounting (ii) the students’ class contribution, participation in the discussions to be held connecting to the lectures, home assignments (in a maximum 10 % of total maximum points of the written exams) The students will get one final mark for the written and oral exam as the mark of the Management Accounting. Grading of written exam: the points (percentages) corresponding to marks from 1-5. 0-60% Fail (1) 61-69% Pass (2) 70-79% Satisfactory (3) 80-89% Good (4) 90-100% Excellent (5) Compulsory readings - Robert Hodge: Accounting (ISBN139781844808052, Publisher Cengage Learning, London, March 2008) - Larry M. Walter: Intorduction to managerial accounting (E-book) - Larry M. Walter: Managerial and Cost Accounting (E-book) - 2000. C: Act on Hungarian Accounting (English version) - Class materials + readings Recommended readings - Pauline Weetman: Managerial Accounting, Pearson - Leticia Gaxle Rayburn: Principles of Cost Accounting, Irwin - Calvin Engler: Managerial Accounting, IRWIN - http://www.cimaglobal.com/ - http://www.imanet.org/ 3