Key Dates for This Year's Annual Enrollment

advertisement

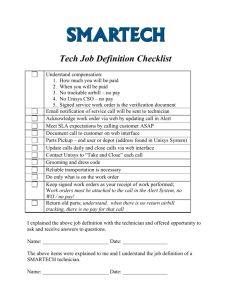

2005 Annual Enrollment Newsletter October 11, 2004 Table of Contents What’s Changing for 2005 Page 2 What Else You Need to Know Page 9 Your Health. It Matters. Page 14 Reminders Page 15 Taking Action Page 17 Information Resources Page 19 Your Rights Page 21 1 What’s Changing for 2005 Welcome to Unisys 2005 Benefits Annual Enrollment! This 2005 Annual Enrollment Newsletter highlights everything you need to know about Annual Enrollment. This section provides you with an overview of changes you need to be aware of for 2005. Medical Plan Changes Aetna PPO Options Renamed the Aetna Choice POS II Options In-Network Areas Expanded for the Aetna Choice POS II Options (currently known as the PPO options) Discontinued Medical Plans UnitedHealthcare EPO Plan Additional Flexibility with HealthPartners® Your Medical Election at Retirement Long-Term Disability (LTD) Improvements LTD Contributions Reduced LTD Tax Status Based on When Your Disability Starts Health Care Flexible Spending Account (FSA) Limit Increased Vision Plan Changes Retail Frame Allowance Increase New Partner for Laser Vision Correction Contribution Changes The LTD contribution change, beneficiary designation, and the YBR Web site sections of this Newsletter are the only sections that apply to employees in Puerto Rico. The information in this Newsletter, together with the Health and Welfare summary plan description (SPD), the plan change summaries for 1998 to 2000, and the Annual Enrollment Newsletters for 2001 to 2004, serve as the plan document and summary plan description for the Health and Welfare benefits available to eligible U.S. employees. The terms of the plans remain in full force and effect, except for the changes described in this Newsletter. All of these documents are available on the Unisys U.S. Benefits Web site (User ID: Unisys; Password: usbenefits). 2 Medical Plan Changes Aetna PPO Options Renamed the Aetna Choice POS II Options The current Aetna Preferred Provider Organization (PPO) Option One and Option Two will be renamed Aetna Choice Point of Service (POS) II – Option One and Option Two as noted below: Option Name in 2004 Aetna PPO Option One Aetna PPO Option Two Option Name in 2005 Deductible and InNetwork Coinsurance Remain Unchanged Aetna Choice POS II Option One $1,000 individual $2,000 family deductible Aetna Choice POS II Option Two 70%/30% coinsurance $250 individual $500 family deductible 80%/20% coinsurance The name change is necessary in order for you and the Plan to take advantage of deeper discounts from network providers. All participants in the Aetna Choice POS II options for 2005 will receive new medical ID cards in late December. While the option names are changing, for the most part, the benefits and the way the Plan works will remain unchanged. The minor exceptions are the following improvements when you use network providers: Outpatient allergy testing and shots provided by office staff will be subject to the office visit copay, if any (versus deductible and coinsurance, as it is today) In-office surgery will be subject to the office visit copay (versus deductible and coinsurance, as it is today) The Aetna Choice POS II options continue to retain the same features and benefit levels as previously enjoyed under the Aetna PPO options: No Primary Care Physician (PCP) designation is required. This is an open access plan -- this means that you do not need a referral to obtain covered services from any network provider. You still may use a provider that is outside of the network, and benefits will still be payable but at a lower level than would be paid if you used a network provider. If you participate in the Aetna PPO Option One or the Aetna PPO Option Two in 2004 and do not take any action before your Annual Enrollment deadline for 2005, your coverage will default into the equivalent Aetna Choice POS II option with the same eligible family members that you are currently covering effective January 1, 2005. You will not be allowed to change your medical option until 2006, unless you experience a qualified life event that allows for a mid-year change. 3 In-Network Areas Expanded for the POS Plans The new Aetna Choice POS II options (currently known as the PPO options) have significantly expanded service areas for 2005 in Georgia, Illinois, Indiana, Michigan, Minnesota, Montana, North Carolina, Oregon, South Dakota, and Texas. There are also some relatively minor expanded service areas in a number of other states. Check your Annual Enrollment options on YBR to see if your home ZIP code is in the network or not for 2005. The plan name will include a notation to indicate if your home ZIP code IS IN network or NOT IN network. The benefits you receive will be 20% lower if you fail to use network providers and you either live in or receive your care in a network ZIP code area. Discontinued Medical Plans As a result of the ongoing review of medical plans offered by Unisys, and as announced last year, PacifiCare of Colorado and PacifiCare of Oregon will be eliminated in 2005 due to high cost and relatively low enrollment. Capital District Physician’s Health Plan is also being eliminated as of January 1, 2005 because the plan would not renew with Unisys. If you are currently in one of the plans no longer being offered as of January 1, 2005, other medical options are available and should be reviewed as you consider your elections for 2005. PLANS NO LONGER OFFERED AS OF JANUARY 1, 2005 Capital District Physician’s Health Plan (NY) POSSIBLE ALTERNATIVES FOR 2005 Harvard Pilgrim MVP Aetna HMO Kaiser Colorado PacifiCare (CO) PacifiCare (OR) UnitedHealthcare EPO (for retirees, pre-Medicare only) Kaiser Northwest Aetna Choice POS II Option One Aetna Choice POS II Option Two If you do not make a new medical election before your Annual Enrollment deadline, you will default into the Aetna Choice POS II Option Two with the same eligible family members that you are currently covering, effective January 1, 2005. You will not be allowed to change your medical option until 2006, unless you experience a qualified life event that allows for a mid-year change. UnitedHealthcare EPO Plan The UnitedHealthcare EPO plan will be offered in many locations in Nebraska for the 4 first time, effective January 1, 2005. To find out plan details and/or if you are eligible to enroll, log on to the YBR Web site. If you participate in any of the United Healthcare EPO options for 2005, you will receive two sets of new ID cards. Additional Flexibility with HealthPartners® HealthPartners recently announced that their primary clinics will be easier to use by reducing the need for referrals for most specialty care, effective October 1, 2004. If eligible, you can go to any specialist in the plan’s network - not just those designated by your care network - without a referral. Materials explaining the changes and who is eligible are available through your primary clinic. Your Medical Election at Retirement To allow for a broader range of choices for post-employment medical coverages, Unisys approached the HMOs offered through the company to request more liberal enrollment guidelines. We are pleased to announce that beginning January 1, 2005, many HMOs have agreed to allow retirees to join their plan at retirement, even though they may not have participated in the plan while active employees. If you are considering retiring in 2005, you are urged to plan ahead to be sure that the medical plan you want will be available to you as a post-retirement alternative. Please access YBR and review which plans may be available to you by referencing the table on the Retiree Medical Overview page. Be sure to look at the rules that apply to enrollment in the plan, since some HMOs continue to require that you be a member while you are still an active employee in order to participate as a retiree (or eligible former employee), some accept only members not eligible for Medicare, and some do not accept retirees at all. To find out more, go to the YBR Web site, to view which plans are available to you if you retire in 2005. You can use the online modeling tools to compare your choices. Long-Term Disability (LTD) Improvements LTD Contributions Reduced* The LTD Plan will be more affordable in 2005. The 2005 contribution rate for the LTD Plan for all employees will be reduced by $.06 per $100 of pay. This benefits you if you are already participating in the LTD Plan or if you elect to begin participating as of January 1, 2005. *Also applies to employees in Puerto Rico. LTD Tax Status Based on When Your Disability Starts You have a choice of having your LTD contribution deducted on a pre- or post-tax basis. As of January 1, 2005, the tax status of your LTD benefit payment will be based on the 5 tax status in force at the time your disability starts. If you choose to pay for LTD coverage on a pre-tax basis in 2005 and you become disabled in 2005, your LTD benefit will be taxable, even if your first LTD payment begins in 2006. If you choose to pay for LTD coverage on a post-tax basis in 2005 and you become disabled in 2005, your LTD benefit will not be taxable (for federal income tax purposes), even if your first LTD payment begins in 2006. This new ruling applies to all future disability claims regardless of how your contributions were paid in the past. Log on to the YBR Web site for more information about LTD and your contribution options for 2005. Health Care Flexible Spending Account Limit Increased To expand your opportunities for reimbursement of eligible healthcare expenses on a pre-tax basis, the maximum amount that you can contribute to the Health Care Flexible Spending Account (FSA) is increasing. Health Care Flexible Spending Account 2004 Maximum $3,000 2005 Maximum $5,000 Please remember the following in regard to your participation in the FSA: If you fail to make an election before the Annual Enrollment deadline, your 2004 election amount will be assumed for 2005. You will not be allowed to change that amount until 2006, unless you experience a qualified life event that allows for midyear changes. Any 2005 contributions not used by December 31, 2005 will be forfeited, so be sure to plan carefully. There is no change in the Dependent Care FSA maximum. It remains at $5,000 per year for any day-care expenses as defined under IRS guidelines. Log on to the YBR Web site for more information about the Health Care FSA offered through Unisys for 2005. Tools to help you project your healthcare and dependent care expenses are available in the Decision Tool Kit on the Annual Enrollment page. 6 Vision Plan Changes The Vision Plan provider – Spectera – has announced two changes to the Plan. Retail Frame Allowance Increase The retail frame allowance will be increased from $120 to $130, effective January 1, 2005. The wholesale frame allowance of $50 (approximate retail value of $120 to $150) will continue for private providers who use Crown Optical Laboratory. New Partner for Laser Vision Correction The Laser Vision Correction (LASIK) partner has been changed to Laser Vision Network of America (LVNA), effective July 1, 2004. LVNA is one of the largest LASIK networks in the United States. You can still receive the same discounts on LASIK through LVNA that were previously available through Spectera. The plan allows for 15% off usual and customary prices for LASIK, or 5% off a promotional price. And, the discount is applied to costs that are already below the national average. Note that Spectera’s prior LASIK partner, TLCVision, has agreed to continue to service existing members through June 30, 2005. If you already have started treatments through TLCVision, you should continue to receive discounted services through mid2005. Log on to the YBR Web site for more information about the vision plan offered through Unisys. Contribution Changes Unisys continues to look for ways to minimize the cost of healthcare benefits for employees while managing increasing healthcare costs. Although plan costs have increased, Unisys is absorbing a portion of the increase to keep your contribution increase minimal. Read on for additional details about how different benefits are affected. Slight Increase in Contributions for the Dental Plan, the Vision Plan and Select HMOs Due to plan cost increases, there will be slight increases in the contribution rates for the Dental Plan, Vision Plan and select HMOs offered through Unisys in 2005. There will be no increase in contributions from the 2004 Aetna PPO – Option One and Option Two contribution rates to the 2005 Aetna Choice POS II – Option One and Option Two plans. In addition, some HMO contribution rates are not increasing for 2005. You can model your contribution rates for your 2005 health/insurance benefits plans by logging on to the YBR Web site. Select Compare Your Medical Options, Compare Your Dental Options or Compare Your Vision Options. 7 Long-Term Disability Contribution Reduced The good news is that there will be a reduction in the contribution rate for Long-Term Disability. Your HMO May Cost You More Than Another HMO Available to You You may be able to save money on your medical benefits in 2005. Some HMO plans already cost employees more than other medical plans being offered by Unisys. Each fully-insured HMO plan dictates the rate they charge Unisys each year and some of the HMOs we offer lead the market with the highest costs. These relatively high-cost plans are assigned the highest contributions. With this said, the highest HMO contributions are not increasing for 2005, when compared to 2004. The HMOs with the highest contributions for 2005 are: Cimarron Harvard Pilgrim Keystone East MVP – NY MVP – VT Optima Optimum Choice Physicians’ Health Plan - MI It is possible that another medical plan offered through Unisys in your area will cost you less while still providing the benefits and features you need. The Health Plan Comparison feature available on the YBR Web site during Annual Enrollment can help you see how your current plan measures up against other options available to you. Participants in Coventry (IA) HMO will see a reduction in contributions for 2005 because the HMO no longer ranks among the highest cost HMOs. Log on to the YBR Web site for more information about the medical plans offered through Unisys for 2005 and to view 2005 contributions. 8 What Else You Need to Know There are several important facts and features you should be aware of before you make your Annual Enrollment elections. Annual Enrollment Using the Your Benefits ResourcesTM (YBR) Web Site Preview Window Available on YBR Before Annual Enrollment Begins. Beneficiary Designations Online Beneficiary Designation Capabilities Alternative Care UnitedHealth AlliesSM Health Values Program From UnitedHealthcare Alternative Health Care Programs From Aetna Aetna NavigatorTM Guest Access Be a Guest on the Aetna Navigator Web Site Short-Term Disability Short-Term Disability (STD) Clarification The LTD contribution change, beneficiary designation, and the YBR Web site sections of this Newsletter are the only sections that apply to employees in Puerto Rico. 9 Annual Enrollment Using the Your Benefits ResourcesTM (YBR) Web Site The Your Benefits ResourcesTM (YBR) Web site has everything you need to make changes, view covered dependents, compare plans, and view contribution rates. You can find the following tools on the YBR Web site Annual Enrollment home page: Online Reference Guide - See information about different types of plans offered to you by Unisys. Coverage as of Today for You and Your Dependents - View current coverage for you and your dependents. Find a Provider - See detailed information about physicians associated with the plans available to you. Compare Hospital Quality and Doctor Profiles - Compare the ratings of hospitals and doctors in your area. Compare Your Medical Options - Determine which plan is right for you by comparing the plans available to you. This tool will allow you to review expanded summaries of each plan, including copays, and major plan design features, as well as contributions. You can also compare your 2004 plan with your 2005 options. Estimate Your Flexible Spending Accounts (FSAs) - This may help you determine if participating in the Health Care FSA and/or Dependent Care FSA is right for you and how much you may want to elect for 2005. Preview Window Available on YBR Before Annual Enrollment Begins* Preview your options on the YBR Web site before Annual Enrollment begins. The preview window will be available from October 11 through October 17, 2004. By going to the YBR Web site during the preview window, you can check annual contributions and model your options for 2005. Please note that you will not be able to submit changes during this preview window. To preview your 2005 benefits options, log on to the YBR Web site. *Applies to employees in Puerto Rico. Beneficiary Designations Online Beneficiary Designation Capabilities If you have not yet taken advantage of the new and easy ways to update your beneficiary information for the Unisys plans in which you participate, you are encouraged to do so now. If you previously signed paper beneficiary designations, they are on file, archived at Unisys, and are still valid unless superseded by an on-line update. Not sure if you did file a paper designation? Or, not sure who is on the paper designation? The best thing to do is to forget the paper and go online now to indicate who you want your beneficiaries to be. The new online designations allow you to more readily review your designations and update them as your personal circumstances change. You won’t need to wonder about who you named or search for your beneficiary paper again! 10 On the YBR Web site you may designate a beneficiary for the following programs. You may also call the Unisys Benefits Service Center (UBSC) at 1-877-864-7972 to update your Beneficiary Designation. Company-Provided Life Insurance Business Travel Accident and Seat Belt Insurance* Unisys Pension Plan (UPP) - including: Retirement Accumulation Account* UPP Death Benefit (the death benefit applies if over age 55 and more than 10 years of service)* On the Fidelity NetBenefits® Web site you may designate a beneficiary for the Unisys 401(k) Savings Plan. These designations are maintained separately at Fidelity Investments. You may also call the Unisys Savings Plan at 1-800-600-4015 to update your Beneficiary Designation.* For the Group Universal Life plan (GULP), if you participate and have not designated a beneficiary, or want to change beneficiaries, you still need to fill out a paper form. Go to the Marsh@WorkSolutions Web site at http://www.personal-plans.com/unisys to download the form, or call Marsh@WorkSolutions at 1-800-222-1617. Completed forms must be signed and returned to Marsh@WorkSolutions at the address on the form. Marsh@WorkSolutions retains the beneficiary designations for GULP.* If you have not named a beneficiary for one or more of the plans, Unisys assumes a Standard Beneficiary Designation as defined under the plan provisions. The Standard Beneficiary Designation is based on a hierarchy of spouse, surviving children, surviving parents, surviving siblings, or estate. When designating a beneficiary, specific information can help to reduce claim processing time in the future. Please provide the name, date of birth, Social Security Number, relationship to you and address of your beneficiary. If you designate a trust as your beneficiary, you will be required to provide the name and complete address of the trustee and the date of the trust agreement. *The Business Travel Accident and Seat Belt Insurance, GULP, UPP, and 401(k) Savings Plan beneficiary designations are the only designations that apply to employees in Puerto Rico. Alternative Care UnitedHealth AlliesSM Health Value Program From UnitedHealthcare If you participate in the UnitedHealthcare medical plan, UnitedHealthcare has added UnitedHealth AlliesSM Health Value Program to help you save from 10 to 50 percent on average on your alternative non-covered healthcare purchases from a nationwide network of physicians, healthcare professionals, and medical facilities in a wide range of specialties. The program can help you save on services like Laser Vision Correction, teeth whitening, massage therapy, acupuncture and much more. 11 You will receive a set of ID cards that can be used for access to discounted services from network providers that offer alternative health services. You will also receive a second set of swipe ID cards for your primary health plan that can be used by in-network providers to expedite verification of eligibility and submission of claims. If you are a UnitedHealthcare member, visit the UnitedHealthcare Web site at www.myuhc.com and click on Other Benefits in the My Coverage and Costs section, for more information about the UnitedHealth Allies Health Value Program. Alternative Health Care Programs From Aetna If you participate in an Aetna medical plan, the Alternative Health Care Programs from Aetna are offered to you as a service to help you take advantage of today's interest in alternative medicine. They can help save you money on nontraditional services and products that you may already be using or may wish to explore. The program includes: Natural Alternatives - reduced rates on alternative therapies including acupuncture, chiropractic, massage therapy, and nutritional counseling Vitamin Advantage™ - reduced rates on vitamins and nutritional supplements Natural Products - reduced rates on health-related products, such as aromatherapy, foot care, and natural body care products If you are an Aetna member,, visit the Aetna Web site at http://www.aetna.com/index.htm and select Members + Consumers / Products + Programs / Health + Wellness / Alternative Heath Care, for more information about the Alternative Healthcare Programs from Aetna. Aetna Navigator Guest Access Be a Guest on the Aetna NavigatorTM Web Site The Aetna Navigator Web site home page provides selected functions and information and is available to all Unisys employees. During Annual Enrollment, Aetna provides a guest ID that allows you to access the entire Web site so you can view most of the features and tools available to Aetna members. To view the complete Web site, log on to www.myaetna.com. To view medical screens, use User Name: choicepos2; Password: choicepos2. In addition, you can view the Health Care and Dependent Care FSA screens, use User Name: fsahealthdep1; Password: fsahealthdep1. You may call an Aetna representative at 1-800-223-3580 for more information about this Web site. 12 Short-Term Disability Short-Term Disability (STD) Clarification Under the terms of the Unisys STD Plan, you will be considered “disabled” if you miss work (full or partial days) for more than two consecutive weeks, and you meet both of the following conditions: You are under treatment by a licensed physician who certifies your disability and Broadspire (the third party administrator for the Plan) can verify that you are unable, due to your disability, to perform the essential functions of your regular occupation at any job site within Unisys. Essential functions include the ability to work your normal work schedule In order to satisfy the second condition above, you or your doctor must provide Broadspire with objective medical information that supports your inability to perform the essential functions of your job. For more information about STD, log on to the Unisys U.S Benefits Web site (User ID: Unisys; Password: usbenefits). 13 Your Health. It Matters The Unisys approach to health, disease and disability management gives you the tools, information and resources to help you take charge of your health. Here are some highlights of the programs available year round. Health Risk Assessment (HRA) This easy to use, online tool can give you a better understanding of your health risks and show you ways to lead a healthier lifestyle. LivingWise Web Site Go year-round to the LivingWise Web site for a great one-stop resource to research health information, drug information and medical news. Nurseline* Nurseline offers access to medical professionals who can answer your questions and help you make informed, appropriate health and medical decisions for you and your family. Disease Management* If you or someone in your family has a chronic condition such as asthma, heart disease, diabetes or cancer, our Disease Management Program, administered through SHPS, can help you: learn more about the condition, avoid behaviors that may aggravate it, save time and money by avoiding inappropriate medical care or tests, develop a plan to help prevent further complications, and follow your treatment plan more closely, so that you get better results from your healthcare. Your Health Is Your Business Participation in these programs is completely voluntary and confidential. The programs are run by an independent, nationally recognized disease management company. You should be assured that any information made available to the Disease Manager is kept strictly confidential. In no event is your personal health information disclosed to Unisys. Read more about the tools available to help manage your health on the Unisys U.S. Benefits Web site (User ID: Unisys; Password: usbenefits). *The Nurseline and Disease Management Program offered through Unisys are available to employees enrolled in Aetna HMO, Aetna Choice POS II , Medica Choice, PPOM or UnitedHealthcare EPO medical plans. If you are not enrolled in one of these plans, contact your plan directly to learn about resources available through your plan. 14 Reminders Making the Choice You Believe Best Meets Your Needs Choosing benefits for yourself and your dependents is an important decision. Make sure you evaluate all of your choices carefully. Before you make any elections, consider the value of your current coverage and how each available option might meet your needs. Try not to make contributions the only determining factor in your decision. Use the Unisys U.S. Benefits Web site and use the YBR Web site to help you investigate your options. There is plenty of information available to you through these resources. Picking a Primary Care Physician Many HMOs require that your care be coordinated through a Primary Care Provider (PCP) or Primary Care Clinic (PCC) in order to receive plan benefits. Even HMOs that do not require PCP/PCC referrals to access network care strongly recommend that you designate a PCP/PCC for yourself (and each covered family member, if applicable). If you are enrolling in a new plan for 2005 and that plan requires a PCP or PCC, you must choose one during Annual Enrollment. The YBR Web site will prompt you to select a PCP or PCC. If you do not choose a PCP/PCC and one is required, your plan may or may not assign one to you automatically. You will not be able to access care in 2005 if you do not have a PCP or PCC designation and your plan requires one. Confirming Your Election If you make changes to your benefit elections online, make sure you print your online “Completed Successfully” page. This is your Confirmation Statement. Keep it for your records. No supplemental statement will be mailed to your home, unless you make your changes via telephone through the Unisys Benefits Service Center (UBSC). Confirmation Statement Mailed to You: Yes Make changes on the YBR Web site No √ Make changes by calling the UBSC √ √ No changes 15 Key Dates for This Year's Annual Enrollment October 11, 2004 Preview 2005 health/insurance benefits options and contributions, check your covered dependents’ status, and use planning tools. October 18, 2004 Annual Enrollment begins at 9:00 a.m. Eastern time. November 3, 2004 Annual Enrollment ends at midnight Eastern time on the YBR Web site, and at 5:00 p.m. Eastern time at the Unisys Benefits Service Center. January 1, 2005 2005 benefits coverage and contributions begin* *Coverage requiring satisfactory evidence of insurability - the addition of Long-Term Disability Insurance or increases in Company-Provided Life Insurance exceeding $100,000 - will become effective on the first day of the month after the Unisys Benefits Service Center is notified that the insurance company has approved coverage, but not earlier than January 1, 2005, provided the required completed evidence of insurability forms are received by the insurance company no later than December 31, 2004. New Plan, New ID Card If you are enrolling in a new medical plan for 2005, you can expect to receive your new identification card no later than the last week of December. If you do not receive a new ID card but you should, contact the plan directly. You can find contact information for all medical plans offered through Unisys on the YBR Web site. Note: No new ID cards will be issued for the prescription drug program. If you participate in UnitedHealthcare EPO, or Aetna Choice POS II Option One or Option Two, you will receive a new medical ID card for 2005. 16 Taking Action What You Need to Do The chart below details what, if anything, you need to do during Annual Enrollment. Take action () if you're… changing any of your benefits for 2005 (including Flexible Spending Account participation). See Fast and Easy Enrollment below. adding, deleting or changing any dependent information. currently enrolled in a medical plan that is not available for 2005. (If you do nothing, you will default in the Aetna Choice POS II – Option Two.) Do nothing (X) if you're… X keeping the same benefits you had in 2004. X Including the same dependents in your coverage through Unisys in 2004. electing the same annual contribution amounts for the Flexible Spending Accounts. X Fast and Easy Enrollment Follow these steps to register your 2005 elections, October 18 through November 3, 2004: First, review this entire Annual Enrollment Newsletter to learn about important benefit changes for 2005. Then, go to the Your Benefits ResourcesTM (YBR) Web site directly or link from the Unisys U.S. Benefits Web site (User ID: Unisys; Password: usbenefits). On YBR, enter your User ID and Password. If you have not yet registered on YBR, follow the prompts. Go to the Annual Enrollment home page. Select the Enroll (View Coverage/Make Changes) button to register your elections. Carefully review your personal information and your dependent’s information to be sure they are accurate. Call the Unisys Benefits Service Center at 1-877-8647972 if you need to make any changes to this information that cannot be made online. Make any other necessary elections or changes (e.g., medical plan, vision coverage, FSAs, etc.). Submit your elections. Print your Completed Successfully page and keep it for your records. You will not receive a Confirmation Statement in the mail. 17 When You Can Enroll Annual Enrollment runs from October 18 through November 3, 2004. You can make as many changes as you want on the YBR Web site 24 hours a day, Monday through Saturday, and after 1:00 p.m. Eastern time on Sundays – from any computer with Internet access. If you need personal assistance with something not available on the YBR Web site, you can speak to a benefits representative from the Unisys Benefits Service Center (UBSC) by calling 1-877-864-7972. The UBSC is available from 9:00 a.m. to 5:00 p.m. Eastern time, Monday through Friday. Annual Enrollment closes on November 3, and Annual Enrollment elections cannot be accepted as of midnight Eastern time on YBR, and as of 5:00 p.m. Eastern time through the UBSC. No Internet Access? There are plenty of ways to get information or enroll online, even if you don't have Internet access at home. All you need is any computer with Internet access. Go to your local library or check your local phone directory for places that provide Internet access to the public. Dependent Information Changes Go to YBR and carefully review your personal information and your dependent’s information for accuracy. Call the Unisys Benefits Service Center at 1-877-864-7972, if you need to make any changes to this information that cannot be made online. 18 Information Resources The Your Benefits ResourcesTM Web site, the Unisys U.S. Benefits Web site, and provider Web sites are convenient, online resources where you can find the information you need to make informed choices for you and your family. These Web sites contain a wealth of information. And, you can log on to any of these sites from any computer with Internet access for convenient, on-demand access to resources and enrollment information. If you don't have access to a computer at home or the office, check your local public library or telephone directory to find places that offer public Internet access. For example, look under "coffee houses" or "Internet". And, should you need additional help, the Unisys Benefits Service Center is only a telephone call away at 1-877-864-7972. If you're looking for information about: Go to: Making elections or changes for 2005 Major features of the: Medical Plans Dental Plan Vision Plan Prescription Drug Program Company-Provided Life Insurance Flexible Spending Accounts Coverage as of today for you and your dependents Finding a provider Comparing hospital quality and doctor profiles Estimating and comparing medical expenses by options Estimating your Flexible Spending Accounts Changing dependent information and verifying full-time student dependent status Selecting beneficiaries for Life Insurance, Business Travel Accident & Seat Belt Insurance, and the Unisys Pension Plan Carrier Web sites Plan provider contact information Enrolling in the Flexible Spending Accounts 19 Your Benefits ResourcesTM (YBR) http:www.resources.hewitt.com/unisys Have your YBR User ID and Password ready. If you do not have a User ID or Password, follow the prompts to establish them. 2005 information will be available for preview as of October 11, 2004. However, Annual Enrollment changes cannot be made until October 18, 2004. The YBR Web site is available 24 hours a day, Monday through Saturday, and after 1:00 p.m. Eastern time on Sundays - from any computer with Internet access. Please note, if you have not made beneficiary designations on YBR, your designation remains on paper forms (or you are defaulted to the standard beneficiary) and will not show on the Web site until you designate your beneficiaries online. Not sure who you previously named? The best thing to do is to make a new designation online to ensure you name the beneficiaries you want. Our healthcare strategy Short- and Long-Term Disability General benefit information for the Medical Plan, Dental Plan, Vision Plan, Prescription Drug Program, LongTerm Care Insurance, Life Insurance, Group Universal Life Plan (GULP), and Flexible Spending Accounts Disease Management, Nurseline and the Health Risk Assessment Unisys U.S. Benefits Web site http://www.app3.unisys.com/usbenefits If you need additional help Unisys Benefits Service Center (UBSC) Call 1-877-864-7972 User ID: Unisys Password: usbenefits The Web site is available 24 hours a day, seven days a week - from any computer with Internet access. If you need personal assistance with something related to Annual Enrollment that is not available on the YBR Web site, you can speak to a benefits representative from the UBSC. The UBSC is available from 9:00 a.m. to 5:00 p.m. Eastern time, Monday through Friday. For international calls use a countryspecific AT&T® Direct access number and call 1-877-864-7972. To get a countryspecific access number, call an AT&T operator or log on to www.att.com/traveler. Fidelity NetBenefits http://netbenefits.fidelity.com 401(k) Savings Plan beneficiary information and new designations Unisys Savings Plan telephone number: 1-800-600-4015. Representatives are available from 8:30 a.m. to midnight Eastern time, Monday through Friday (excluding New Your Stock Exchange holidays). Please note, if you have not made a beneficiary designation for the Unisys 401(k) Savings Plan on Fidelity Netbenefits®, your designation remains on paper forms and will not show on the Web site until you make your election online. 20 Your Rights Know Your Rights Federal law requires healthcare plans to comply with minimum coverage provisions if certain medical procedures are covered under the plans. The Aetna Choice POS II options, Unisys Post-Retirement and Extended Disability Medical Plan (PRM), and HMO options comply with the mandated requirements and did so in advance of the legislation. If you participate in a healthcare plan offered as an alternate to the Unisys plans, you should also receive information from your alternate plan. Health Insurance Portability and Accountability Act of 1996 Unisys makes every effort to protect the privacy of health information for participants. Unisys has always maintained privacy practices that ensure your personal health information is protected. Read more about Unisys Privacy Practices (Privacy of health information) on the Unisys U.S. Benefits Web site (User ID: Unisys; Password: usbenefits). In April 2003, you were sent a “Notice of Privacy Practices” document that explains certain rights with regard to your personal health information. Please note that there has been a change in the address and phone number that you should use if you want to (a) exercise any of your HIPAA rights (as described on pages 4-5 of the Notice), (b) file a complaint relating to the Plans' or a Business Associate's failure to comply with HIPAA (as described on pages 5-6 of the Notice) or (c) file a request for an additional paper copy of the Notice (as described on page 6 of the Notice). The new address, email address and phone number are: Unisys Corporation Health Plans HIPAA Compliance Office Unisys Corporation M.S. E8-106 Unisys Way Blue Bell, PA 19424 Email at: HIPAAComplianceOfficer@Unisys.com Phone Number: 1-215-986-5404 Your health information is typically used and retained by the health plan in which you are enrolled. You should contact your health plan administrator directly to obtain copies of your health information and exercise your other HIPAA rights described in the Notice. New Claims and Appeals Procedures The procedures under which you file claims and appeals for health/insurance benefits has been modified. Read more on the Unisys U.S. Benefits Web site (User ID: Unisys; Password: usbenefits) for a description of the new procedures (Claims and Appeals Procedures). Rights Under the Newborns’ and Mothers’ Health Protection Act Plans offering group health insurance coverage generally may not restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal delivery, or less than 96 hours following a delivery by a cesarean section. However, a shorter stay may be permitted if the 21 attending provider (for example, the attending physician, nurse, midwife, or physician assistant), after consultation with the mother, discharges the mother or newborn earlier. Also, plans and issuers may not set the level of benefits or out-of-pocket costs so that any later portion of the 48-hour (or 96-hour) stay is treated less favorably to the mother or newborn than any earlier portion of the stay. A plan also may not require a physician or other healthcare provider to obtain authorization for prescribing a stay of up to 48 hours (or 96 hours). However, you may be required to pre-certify in order to use certain providers or facilities, or to reduce your out-of-pocket costs. For information on pre-certification, contact your plan’s customer service department. Rights Under the Women’s Health and Cancer Rights Act of 1998 The Women’s Health and Cancer Rights Act requires group health plans that provide coverage for mastectomies to also cover reconstructive surgery and prostheses following mastectomies. The law mandates that a member receiving benefits for a medically necessary mastectomy who elects breast reconstruction after the mastectomy will also receive coverage for: Reconstruction of the breast on which the mastectomy has been performed; Surgery and reconstruction of the other breast to produce a symmetrical appearance; Prostheses; and Treatment of physical complications of all stages of mastectomy, including lymph edemas. This coverage will be provided in consultation with the attending physician and the patient, and will be subject to the same annual deductibles and coinsurance provisions that apply for the mastectomy. If you have any questions about your coverage for mastectomies and reconstructive surgery, you are encouraged to contact your plan’s customer service department. Note for New Jersey Residents The Health Care Quality Act, a New Jersey statute, requires that companies with healthcare plans such as the Aetna Choice POS II Options and Aetna HMO, notify you that these self-funded health plans are not subject to New Jersey state consumer protection regulations. The law also requires that you be informed which state-mandated benefits are not covered under these plans. If you are enrolled in, or elect to enroll in, the Aetna Choice POS II options, or the Aetna HMO, you will be enrolled in a self-insured health plan which is administered by Aetna on behalf of Unisys. These plans are known as ERISA plans, which are authorized under the federal Employee Retirement Income Security Act (ERISA). This act provides rules and regulations regarding the conduct of the plans. These plans are exempt from complying with New Jersey State law governing health insurance, including but not limited to: •State laws mandating coverage for specific health insurance benefits; and •State laws granting individuals the right to appeal to an independent entity any final decision by a managed-care organization to reduce or deny treatment for a covered healthcare service. Even though Aetna may appear on your health insurance card or in correspondence 22 about your coverage, you may not have the same legal rights as those covered by stateregulated health plans. This chart lists the services included in the state-mandated health insurance benefits and the coverage under the Unisys plans. NJ State Mandated Benefits Aetna HMO, Aetna Choice POS II Options One and Two For certain treatments for Wilm’s tumor Covers treatments for this condition which are not deemed to be investigational or experimental For certain treatments for cancer Covers treatments for cancer which are not deemed to be investigational or experimental For mammograms Voluntarily covers these tests at least as frequently as mandated by the New Jersey Legislature For off-label uses of certain drugs Does not cover drugs for treatments for which the drug has not been approved by the Federal Food and Drug Administration For pharmacies Voluntarily complies with the mandated requirements For inpatient benefits following birth Voluntarily complies with the mandated length of stay For lead-poisoned children and Voluntarily complies with the mandated childhood immunizations services For health wellness promotion programs Voluntarily complies with the mandated services For treatment of diabetes Voluntarily complies with the mandated services For PAP smears Voluntarily complies with the mandated services For prostate cancer screening Voluntarily complies with the mandated services For reconstructive breast surgery Voluntarily complies with the mandated following a mastectomy services For inpatient benefits following a Voluntarily complies with the mandated mastectomy services For therapeutic treatment of inherited Voluntarily complies with the mandated metabolic diseases services 23