ASSET PURCHASE AGREEMENT BETWEEN Alliant International

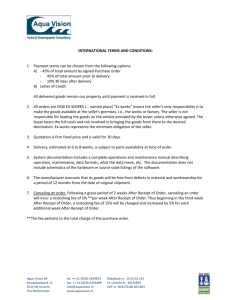

advertisement