Ch7GNBPM - Business304

advertisement

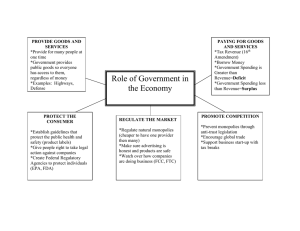

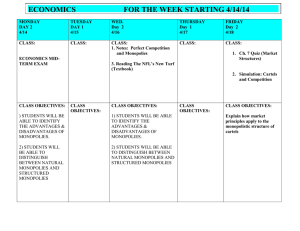

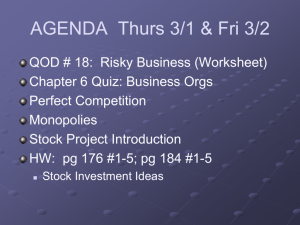

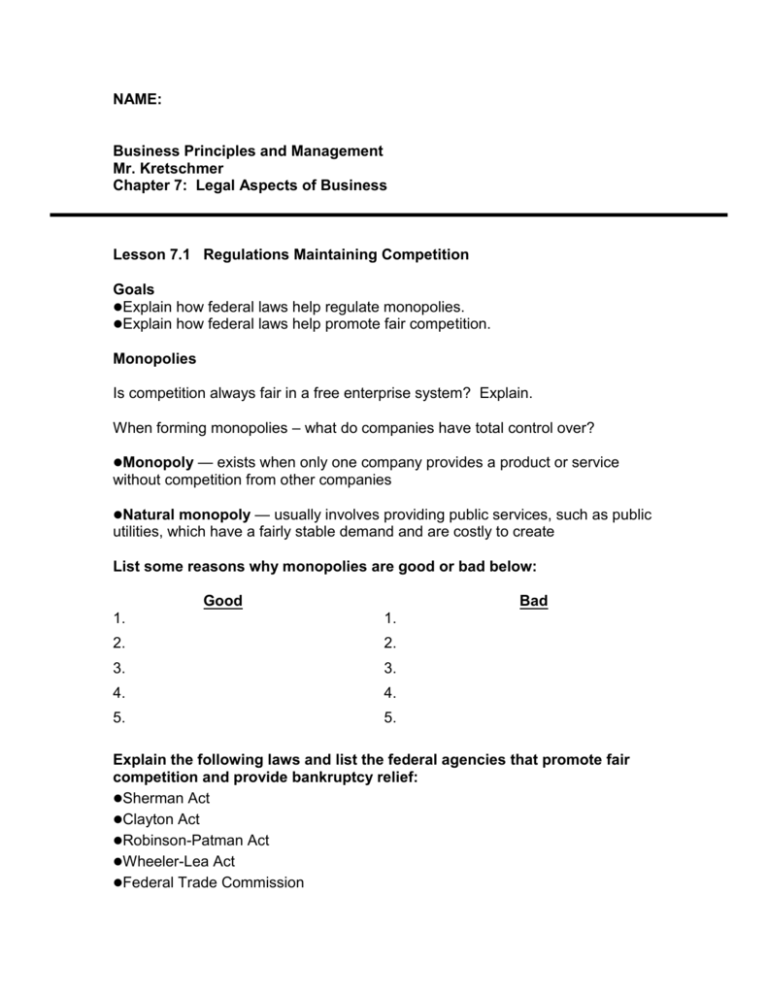

NAME: Business Principles and Management Mr. Kretschmer Chapter 7: Legal Aspects of Business Lesson 7.1 Regulations Maintaining Competition Goals Explain how federal laws help regulate monopolies. Explain how federal laws help promote fair competition. Monopolies Is competition always fair in a free enterprise system? Explain. When forming monopolies – what do companies have total control over? Monopoly — exists when only one company provides a product or service without competition from other companies Natural monopoly — usually involves providing public services, such as public utilities, which have a fairly stable demand and are costly to create List some reasons why monopolies are good or bad below: Good Bad 1. 1. 2. 2. 3. 3. 4. 4. 5. 5. Explain the following laws and list the federal agencies that promote fair competition and provide bankruptcy relief: Sherman Act Clayton Act Robinson-Patman Act Wheeler-Lea Act Federal Trade Commission Other federal agencies Bankruptcy relief Give some examples of monopolies that exist that the government has strict control over: What can powerful businesses do to drive out competition? Give an example. Why was the (FTC) Federal Trade Commission created? Look at the types of practices prohibited by the Federal Trade Commission in Figure 7-1 on page 165 in your textbook. Lesson 7.2 Regulations Protecting Business and the Public Goals Explain how patent, copyright, and trademark protection benefits business. Describe the ways in which government regulations protect consumers. Describe three methods used by state and local governments to regulate business. Intellectual Property Intellectual rights are very important for government to protect for inventors, authors, and creators of distinct symbols and names for goods and services. Explain what each of the agreements are that are listed below: Patent - Copyright - Trademark - Intellectual Property - Regulations Protecting the Public Explain in details what each of the items do for the public below: Food and drugs — Food and Drug Administration (FDA) – Explain what the FDA does: How does the Food and Drug Administration benefit consumers? Nonfood products — Federal Trade Commission (FTC), Consumer Product Safety Act Information — Electronic Communications Privacy Act Why does the government require labels be placed on non-food items such as tobacco products that warn the consumer? How important is information liability? Can you give an example of where someone would use your information in a way that they are not authorized to use it? Explain. What is the difference between interstate commerce and intrastate commerce? Is there any regulation on what type of sign or what the sign will say for business owners in our town? Why is this a sensitive topic in a historic district like Honesdale? State and Local Regulations Licensing — a way to limit and control those who plan to enter certain types of businesses Public franchise — contract that permits a person or organization to use public property for private profit Building codes (control the physical features of structures) and zoning (specifies which land areas may be used for homes and for different types of businesses) Who is the building code enforcer in our town? Why does the government hold such high standards on building codes? List five professions that require a license before you can operate that business or work in a specific field: 1. 2. 3. 4. 5. Lesson 7.3 Business Taxes Goals Discuss the nature of taxes and the fairness of progressive, proportional, and regressive taxes. Identify and explain the most common types of taxes that affect business. Fairness of Taxation - Explain what each tax policy is below: Proportional tax (also called flat tax) Progressive tax Regressive tax Types of Taxes – Explain each type of tax listed below: Income Sales tax tax Excise tax Property tax Give an example of where someone would use a public facility for a private business. Taxes paid to the government amount to ______ percent of all taxes collected, while various state and local taxes account for the remaining _____ percent. . List five reasons how the United States government uses your good paying tax dollars. 1. 2. 3. 4. 5. Are taxes fair? What about occupational taxes? Do you have occupational taxes in the township that you live in? Comparative Tax Rates