Revising Production and Costs

advertisement

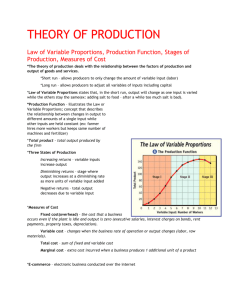

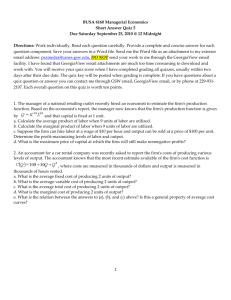

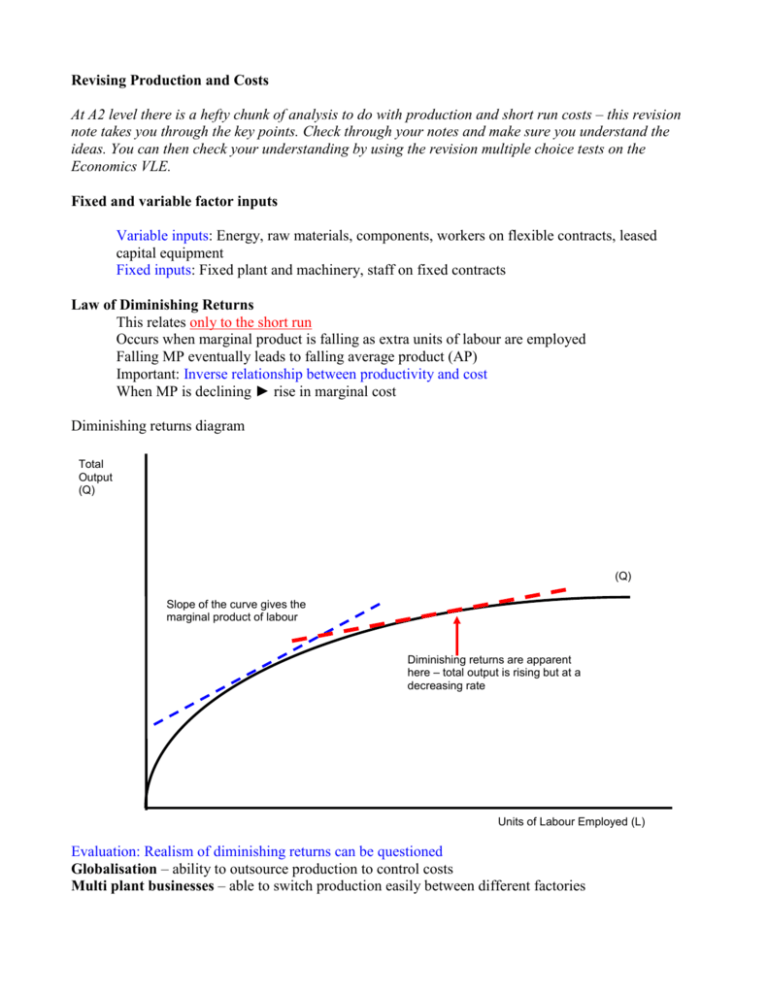

Revising Production and Costs At A2 level there is a hefty chunk of analysis to do with production and short run costs – this revision note takes you through the key points. Check through your notes and make sure you understand the ideas. You can then check your understanding by using the revision multiple choice tests on the Economics VLE. Fixed and variable factor inputs Variable inputs: Energy, raw materials, components, workers on flexible contracts, leased capital equipment Fixed inputs: Fixed plant and machinery, staff on fixed contracts Law of Diminishing Returns This relates only to the short run Occurs when marginal product is falling as extra units of labour are employed Falling MP eventually leads to falling average product (AP) Important: Inverse relationship between productivity and cost When MP is declining ► rise in marginal cost Diminishing returns diagram Total Output (Q) (Q) Slope of the curve gives the marginal product of labour Diminishing returns are apparent here – total output is rising but at a decreasing rate Units of Labour Employed (L) Evaluation: Realism of diminishing returns can be questioned Globalisation – ability to outsource production to control costs Multi plant businesses – able to switch production easily between different factories Long run production The scale of production can change because all factor inputs are variable Leads us on to looking at economies and diseconomies of scale 1. Increasing returns to scale when the % change in output > % change in inputs ► falling LRAC 2. Decreasing returns to scale when the % change in output < % change in inputs ► rising LRAC 3. Constant returns to scale when the % change in output = % change in inputs ► constant LRAC Take a revision multiple choice test here Fixed and Variable Costs Fixed costs do not vary directly output – also known as the overhead costs of a business Examples: Rental costs of buildings Costs of purchasing plant and machinery Costs of full-time contracted salaried staff Interest payments on loans Depreciation of fixed capital (due solely to age) Total fixed costs remain constant as output changes Average fixed costs must fall as output increases (in the short run) A change in fixed costs has no effect on marginal cost Variable costs Variable costs vary directly with output. Examples: Costs of intermediate raw materials and components Wages of part-time staff or employees paid by the hour Costs of electricity and gas Depreciation of capital inputs due to wear and tear. Sunk costs: Costs that cannot be recovered if a business opts to leave a market or industry Cost measures 1. Total cost = total fixed cost + total variable cost 2. Average cost = total cost / output 3. Marginal cost = change in total cost from producing an extra unit of output 4. Average fixed cost = total fixed cost / output 5. Average variable cost = total variable cost / output The next diagram shows the conventional shape of short run cost curves – note in particular the relationship between marginal and average cost – practice drawing these cost curves so that you can always do them accurately in an exam. Costs Marginal Cost (MC) Average Total Cost (ATC) Average Variable Cost (AVC) Average Fixed Cost (AFC) Output (Q) Q1 Important: A change in variable costs (e.g. higher oil prices, rising foodstuff prices or an increase in the national minimum wage) causes an upward shift in both average and marginal cost A change in fixed costs (e.g. a rise in interest rates or perhaps a fall in the rate of capital depreciation) has no effect on the variable costs of production. This means that only the average total cost curve shifts. There is no change in the marginal cost curve Costs Costs A rise in variable costs A fall in fixed costs AC2 AC1 AC1 MC2 AC2 MC1 MC1 Output (Q) Output (Q) In the next revision note we will look at revenues and profits and how changes in short run costs and demand affects the price and output decisions of businesses. Take a revision multiple choice test on short run costs here