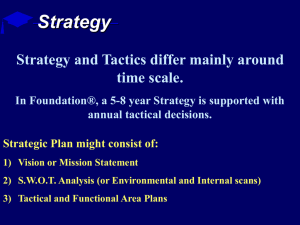

Strategy Overview & Support Discussion

advertisement

Accounting 2220 Zeigler - Board of Director’s Memorandum Assignment Group Task #2 - Support for Strategy, Vision & Mission Determination As your company prepares its long-term “Strategy Memorandum” to the Board of Directors, consider the six basic strategies discussed at the end of your Capsim Team Member Guide. Your company may use one of these strategies or reference them as a starting point for your own custom strategy. Characteristics of each strategy are outlined below. 1) Do you want to be a “BROAD COST LEADER”? A Broad Cost Leader strategy maintains a presence in both segments. The company gains a competitive advantage by keeping R&D costs, production costs and material costs to a minimum, enabling the company to compete on the basis of price. Prices will be below average. Automation levels will be increased to improve margins and to offset second-shift labor and overtime costs. SAMPLE MISSION STATEMENT: Low-priced products for the industry: Our brands offer solid value. Our primary stakeholders are bondholders, customers, stockholders and management. Typical Firm Profile: More likely to re-position products than introduce new ones to the market. Capacity improvements are less-likely to be undertaken (may run overtime instead). Automation may be pursued to increase margins. Investments will be financed with debt and/or stock issues. Tends to spend less on promotion and sales; Focus on Market Share, Profits, and Stock Price. 2) How about being a “BROAD DIFFERENTIATOR”? A Broad Differentiation strategy maintains a presence in both segments. The company will gain a competitive advantage by distinguishing products with an excellent design, high awareness and easy accessibility. R&D competency is developed that keeps designs fresh and exciting. Products keep pace with the market, offering improved size and performance. Prices will be above average. Capacity is expanded as higher demand is generated. SAMPLE MISSION STATEMENT: Premium products for the industry: Our brands withstand the tests of time. Our primary stakeholders are customers, stockholders, management and employees. Typical Firm Profile: Higher R&D spending to keep products fresh. Maintaining a presence in both market segments. Spending heavily on advertising and sales to create maximum awareness and accessibility. Prices tend to be higher; Focus on Market Share, Profits, and Stock Price. 3) How about consideration for a “NICHE COST LEADER”? (LOW-TECH SEGMENT) A Niche Cost Leader Strategy concentrates on the Low-Tech segment. The company gains a competitive advantage by keeping R&D costs, production costs and material costs to a minimum, enabling the company to compete on the basis of price. Prices will be below average. Automation levels will be increased to improve margins and to offset second shift/overtime costs. SAMPLE MISSION STATEMENT: Reliable products for low tech customers: Our brands offer value. Our primary stakeholders are bondholders, stockholders, customers and management. Typical Firm Profile: Multiple product lines in the low-tech segment; Invest heavily in automation. Spend heavily on Promotion Budget (less on Sales Budget). Investments financed with debt and/or stock issues. Focus on ROS, ROE, and Profits. 4) Might you want to be a “NICHE DIFFERENTIATOR”? (HIGH-TECH SEGMENT) A Niche Differentiation strategy focuses on the High-Tech segment. The company gains a competitive advantage by distinguishing its products with excellent design, high awareness, easy accessibility and new products. The company will develop an R&D competency that keeps designs fresh and exciting. Products will keep pace with the market, offering improved size and performance. The company will price above average. The company will expand capacity as it generates higher demand. SAMPLE MISSION STATEMENT: Premium products for technology oriented customers: Our brands define the cutting edge. Our primary stakeholders are customers, stockholders, mgmt and employees. Typical Firm Profile: Multiple product lines in high-tech segment ; Minimum focus in low-tech segment. High promotion and sales investments to create maximum awareness and accessibility. High R&D expenditures to introduce new product lines often and keep existing products fresh. Unlikely to invest in increased automation or production capacity. Focus on ROA, Asset Turnover, and ROE. 5) How about being a “COST LEADER WITH PRODUCT LIFECYCLE FOCUS”? A Cost Leader with a Product Lifecycle Focus gains a competitive advantage by keeping R&D costs, production costs and material costs to a minimum, enabling the company to compete on the basis of price. A product lifecycle focus will allow the company to reap sales for many years on each new product – introduced into the High-Tech segment. Products will then mature into Low-Tech products. SAMPLE MISSION STATEMENT: Reliable products for mainstream customers: Our brands offer value. Our primary stakeholders are bondholders, stockholders, customers and management. Typical Firm Profile: Low R&D spending (very little re-positioning, introduce new product every 2-3 years). Invest in automation early in the product’s life-cycle. High spending on promotion and sales. Focus on ROE, ROS, and Profits. 6) Might you consider being a “DIFFERENTIATOR WITH PRODUCT LIFECYCLE FOCUS”? A Differentiation with a Product Lifecycle Focus strategy distinguishes its products with excellent design, high awareness and easy accessibility. The company must develop an R&D competency that keeps designs fresh and exciting as they change in appeal from High Tech to Low Tech. Products keep pace with the market, offering improved size and performance. The company will price above average. The company will expand capacity as it generates higher demand. SAMPLE MISSION STATEMENT: Premium products for mainstream customers: Our brands stand the tests of time. Our primary stakeholders are customers, stockholders, management and employees. Typical Firm Profile: Multiple product lines in both segments. High promotion and sales investments to create maximum awareness and accessibility. High R&D expenditures to re-position product lines often as they migrate from high to low-tech. Unlikely to invest heavily in increased automation or production capacity. Focus on ROA, Stock Price, and Asset Turnover. Summary Again, there is no "magic bullet," for a guaranteed winning strategy. Each simulation is dynamic/fluid. Poor tactics can undermine a good strategy while good tactics can overcome a poor strategy. Successful firms will focus on planning, strategic alignment, teamwork, competitor analysis, and tactical adjustments. For further information on strategy, log on to Capsim, click on Help then Online Guide. Once the guide opens, click on Six Basic Strategies and read through the information.