Test 1, Review Questions

advertisement

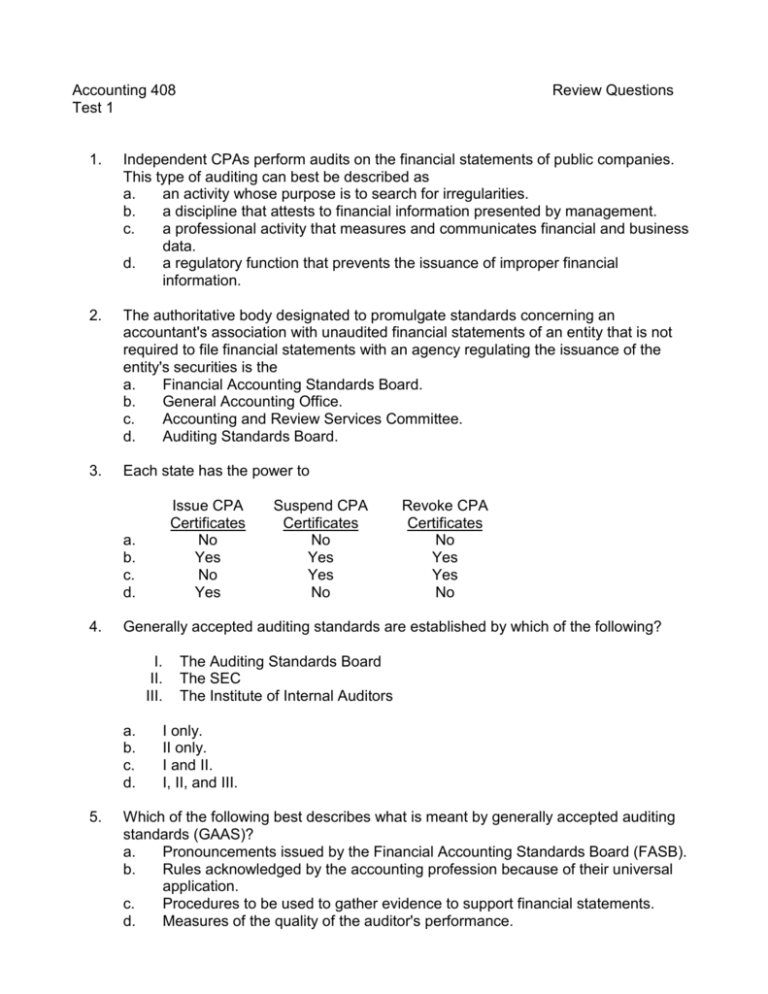

Accounting 408 Test 1 Review Questions 1. Independent CPAs perform audits on the financial statements of public companies. This type of auditing can best be described as a. an activity whose purpose is to search for irregularities. b. a discipline that attests to financial information presented by management. c. a professional activity that measures and communicates financial and business data. d. a regulatory function that prevents the issuance of improper financial information. 2. The authoritative body designated to promulgate standards concerning an accountant's association with unaudited financial statements of an entity that is not required to file financial statements with an agency regulating the issuance of the entity's securities is the a. Financial Accounting Standards Board. b. General Accounting Office. c. Accounting and Review Services Committee. d. Auditing Standards Board. 3. Each state has the power to Issue CPA Certificates No Yes No Yes a. b. c. d. 4. Revoke CPA Certificates No Yes Yes No Generally accepted auditing standards are established by which of the following? I. II. III. a. b. c. d. 5. Suspend CPA Certificates No Yes Yes No The Auditing Standards Board The SEC The Institute of Internal Auditors I only. II only. I and II. I, II, and III. Which of the following best describes what is meant by generally accepted auditing standards (GAAS)? a. Pronouncements issued by the Financial Accounting Standards Board (FASB). b. Rules acknowledged by the accounting profession because of their universal application. c. Procedures to be used to gather evidence to support financial statements. d. Measures of the quality of the auditor's performance. 6. In deciding to undertake an audit engagement, the CPA would most likely consider which generally accepted auditing standard(s)? a. The four reporting standards. b. The three field work standards. c. The second field work standard requiring consideration of the internal control structure. d. The three general standards. 7. Which statement is not one of the generally accepted auditing standards of reporting? a. The report shall state whether the financial statements are presented in accordance with GAAP. b. The report shall state whether the audit was conducted in accordance with GAAS. c. Informative disclosures in the financial statements are to be regarded as reasonably adequate unless otherwise stated in the report. d. The report shall contain either an expression of opinion regarding the financial statements taken as a whole or an assertion to the effect that an opinion cannot be expressed. 8. GAAS consist of general standards, standards of field work, and standards of reporting. The standards of field work include which one of the following? a. The audit is to be performed by a person or persons having adequate technical training and proficiency. b. In all matters relating to the assignment, an independence in mental attitude is essential. c. The work is to be adequately planned and assistants, if any, are to be properly supervised. d. Due professional care is to be exercised in the performance of the audit and preparation of the audit report. 9. Jordan is the executive partner of Cain & Jordan, CPAs. One of its clients is a large nonprofit charitable organization. The organization has asked Jordan to be on its board of directors, which consists of a large number of the community's leaders. For Cain & Jordan to be considered independent, which of the following requirements must be met? a. b. c. d. Board Participation Purely Honorary Yes No No Yes Audit Participation by Jordan Prohibited Yes Yes No No 10. Which of the following best describes why an independent auditor is asked to express an opinion on the fair presentation of financial statements? a. It is difficult to prepare financial statements that fairly present a company's financial position, results of operations, and cash flows without the expertise of an independent auditor. b. It is management's responsibility to seek available independent aid in the appraisal of the financial information shown in its financial statements. c. The opinion of an independent party is needed because a company may not be objective with respect to its own financial statements. d. It is a customary courtesy that all stockholders receive an independent report on management's stewardship in managing the affairs of the business. 11. Which paragraphs of an auditor's standard report on financial statements should refer to generally accepted auditing standards (GAAS) and generally accepted accounting principles (GAAP)? a. b. c. d. GAAS Opening Scope Scope Opening GAAP Scope Scope Opinion Opinion 12. An auditor includes a separate paragraph in an otherwise unmodified report to emphasize that the entity being reported on had significant transactions with related parties. The inclusion of this separate paragraph a. Is considered a qualification of the opinion. b. Violates generally accepted auditing standards if this information is already disclosed in footnotes to the financial statements. c. Necessitates a revision of the opinion paragraph to include the phrase "with the foregoing explanation." d. Is appropriate and would not negate the unqualified opinion. 13. When financial statements are presented that are not in conformity with generally accepted accounting principles, an auditor may express a a. b. c. d. Qualified Opinion Yes Yes No No Disclaimer of an Opinion No Yes Yes No 14. When a scope limitation has precluded the auditor from obtaining sufficient competent evidential matter to determine whether certain client acts are illegal, (s)he would most likely express a. an unqualified opinion with a separate explanatory paragraph. b. either a qualified opinion or an adverse opinion. c. either a disclaimer of opinion or a qualified opinion. d. either an adverse opinion or a disclaimer of opinion. 15. When compiling the financial statements of a nonpublic entity, an accountant should a. review agreements with financial institutions for restrictions on cash balances. b. understand the accounting principles and practices of the entity's industry. c. inquire of key personnel concerning related parties and subsequent events. d. perform ratio analyses of the financial data of comparable prior periods. 16. Which of the following procedures is an accountant least likely to perform during an engagement to review the financial statements of a nonpublic entity? a. Observing the safeguards over access to and use of assets and records. b. Comparing the financial statements with anticipated results in budgets and forecasts. c. Inquiring of management about actions taken at the board of directors' meetings. d. Studying the relationships of financial statement elements expected to conform to predictable patterns. Question Correct Number Version Answer ========================== 1 A B ------------------------2 A C ------------------------3 A B ------------------------4 A A ------------------------5 A D ------------------------6 A D ------------------------7 A B ------------------------8 A C ------------------------9 A D ------------------------10 A C ------------------------11 A C ------------------------12 A D ------------------------13 A A ------------------------14 A C ------------------------15 A B ------------------------16 A A -------------------------