Business Organizations Outline

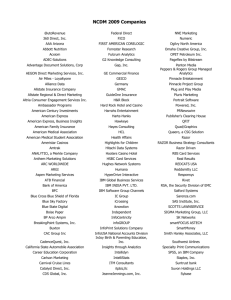

advertisement