Document

advertisement

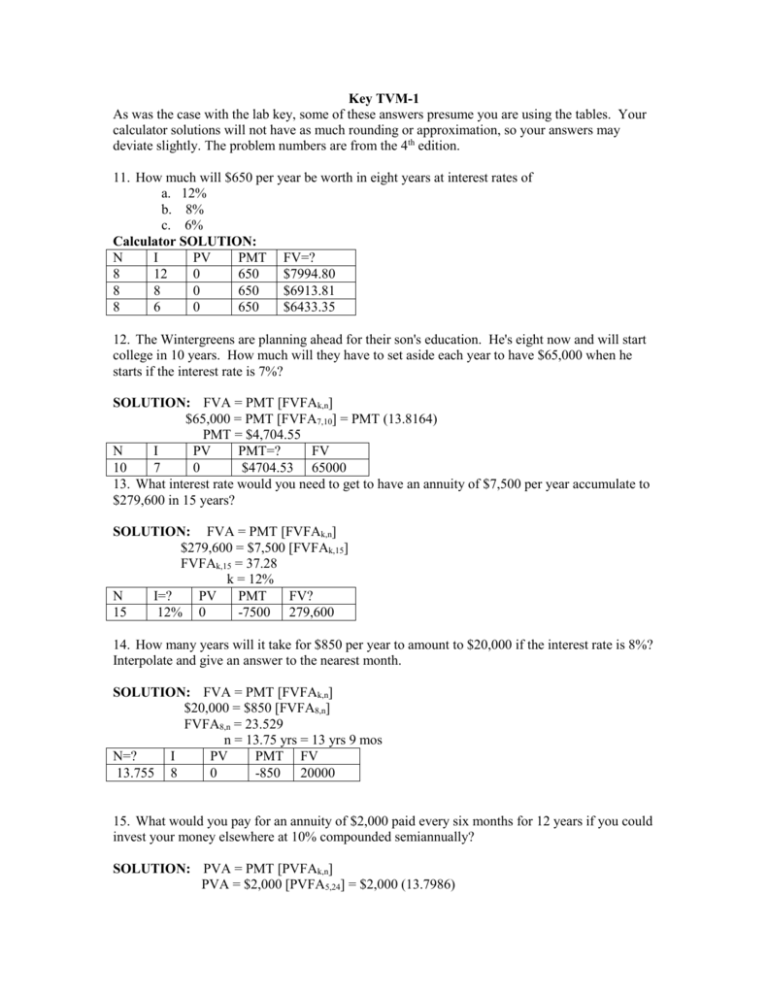

Key TVM-1 As was the case with the lab key, some of these answers presume you are using the tables. Your calculator solutions will not have as much rounding or approximation, so your answers may deviate slightly. The problem numbers are from the 4th edition. 11. How much will $650 per year be worth in eight years at interest rates of a. 12% b. 8% c. 6% Calculator SOLUTION: N I PV PMT FV=? 8 12 0 650 $7994.80 8 8 0 650 $6913.81 8 6 0 650 $6433.35 12. The Wintergreens are planning ahead for their son's education. He's eight now and will start college in 10 years. How much will they have to set aside each year to have $65,000 when he starts if the interest rate is 7%? SOLUTION: FVA = PMT [FVFAk,n] $65,000 = PMT [FVFA7,10] = PMT (13.8164) PMT = $4,704.55 N I PV PMT=? FV 10 7 0 $4704.53 65000 13. What interest rate would you need to get to have an annuity of $7,500 per year accumulate to $279,600 in 15 years? SOLUTION: FVA = PMT [FVFAk,n] $279,600 = $7,500 [FVFAk,15] FVFAk,15 = 37.28 k = 12% N I=? PV PMT FV? 15 12% 0 -7500 279,600 14. How many years will it take for $850 per year to amount to $20,000 if the interest rate is 8%? Interpolate and give an answer to the nearest month. SOLUTION: FVA = PMT [FVFAk,n] $20,000 = $850 [FVFA8,n] FVFA8,n = 23.529 n = 13.75 yrs = 13 yrs 9 mos N=? I PV PMT FV 13.755 8 0 -850 20000 15. What would you pay for an annuity of $2,000 paid every six months for 12 years if you could invest your money elsewhere at 10% compounded semiannually? SOLUTION: PVA = PMT [PVFAk,n] PVA = $2,000 [PVFA5,24] = $2,000 (13.7986) N 24 I 5 PVA = $27,597.20 PV=? PMT FV 2000 0 27597.28 16. Construct an amortization schedule for a four-year, $10,000 loan at 6% interest compounded annually. SOLUTION: PMT?= $2,885.91 N=4 I=6 PV=10000 Year Beg Bal PMT INT Prin Red 1 $10,000.00 $2,885.91 $600.00 $2,285.91 2 7,714.09 2,885.91 462.85 2,423.06 3 5,291.03 2,885.91 317.46 2,568.45 4 2,722.58 2,885.91 163.35 2,722.56 would have the customer pay three cents extra on the last payment. 24. a. b. c. d. End Bal $7,714.09 5,291.03 2,722.58 +0.03 The bank Adam Wilson just purchased a home and took out a $250,000 mortgage for 30 years at 8%, compounded monthly. How much is Adam’s monthly mortgage payment? How much sooner would Adam pay off his mortgage if he made an additional $100 payment each month? Assume Adam makes his normal mortgage payments and at the end of five years, he refinances the balance of his loan at 6%. If he continues to make the same mortgage payments, how soon after the first five years will he pay off his mortgage? How much interest will Adam pay in the tenth year of the loan i. if he does not refinance? ii. if he does refinance? SOLUTION: a. n = 360; I/Y = 8/12 = .666667; PV = 250,000; FV = 0 CPT PMT = $1,834.41 b. Add $100.00 to the PMT calculated above and recompute n: I/Y = .666667; PV = 250,000; PMT = (1,934.41); FV = 0 CPT n = 297.62 Adam would eliminate the last 62 months of payments by paying an additional $100/month c. First calculate the mortgage balance at the end of 5 years n = 60; I/Y = .666667; PV = 250,000; PMT = (1,834.41) CPT FV = $237,674.75 Then solve for n using the original PMT, the new I/Y, and the mortgage balance as the new PV I/Y = 6.0/12 = .50; PV = 237,674.64; PMT = (1,834.41); FV = 0 CPT n = 209.25 The mortgage would pay off about 90 months earlier. FV after the 108th payment (gives the remaining principal after 9 years) n = 108; I/Y = 8/12 = .666667; PV = 250,000 PMT = ($1834.41); CPT FV = $223,592.24 FV after the 120th payment = $219,312.02 (principal after 10 years) Principal payments = $223,592.24 - $219,312.02 = $4,280.22 Interest payment = 12 x $1834.41 - $4,280.22 = $22,012.92 - $4,280.22 = $17,732.70 d. i. ii. FV after the 60th payment (principal when the refinancing would occur) n = 60; I/Y = 8/12 = .666667; PV = $250,000; PMT = ($1834.41); CPT FV = $237,674.75; Then find the balance after 48 payments of the refinanced loan (end of the 9th year) n = 48; I/Y = 6/12 = .50; PV = $237,674.64; PMT = ($1834.41); CPT FV = $202,725.34. FV after the 60th payment = $192,600.63 (principal remaining at the end of the th 10 year) Principal payments = $202,725.34 - $192,600.63 = $10,124.71 Interest payment = 12 x $1834.41 - $10,124.71 = $22,012.92 - $10,124.71 = $11,888.21 26. Lee Childs is negotiating a contract to do some work for Haas Corp. over the next five years. Haas proposes to pay Lee $10,000 at the end of each of the third, fourth and fifth years. No payments will be received prior to that time. If Lee discounts these payments at 8%, what is the contract worth to him today? SOLUTION: Probably the easiest way to do this problem is to use the CFj part of your calculator instead of the way it is shown below. Either way is correct. This is an annuity problem, but the annuity doesn’t begin today. Since the payments occur at the end of the 3rd through 5th years, we can solve for the value of the annuity at the end of the second year using the following values: n = 3; I/Y = 8; PMT = 10,000; FV = 0 CPT PV = $25,770.97 This amount needs to be discounted back two periods to find the value today n = 2; I/Y = 8; PMT = 0; FV = 25,770.97 CPT PV = $22,094.45