Foreign Exchange Risk

advertisement

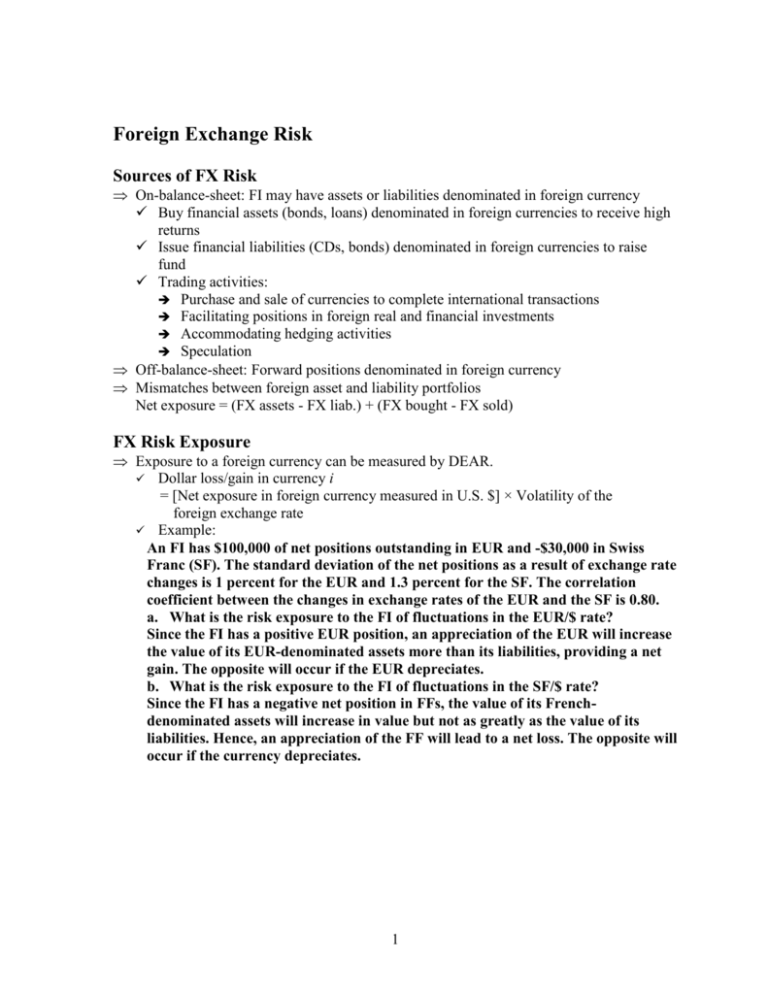

Foreign Exchange Risk Sources of FX Risk On-balance-sheet: FI may have assets or liabilities denominated in foreign currency Buy financial assets (bonds, loans) denominated in foreign currencies to receive high returns Issue financial liabilities (CDs, bonds) denominated in foreign currencies to raise fund Trading activities: Purchase and sale of currencies to complete international transactions Facilitating positions in foreign real and financial investments Accommodating hedging activities Speculation Off-balance-sheet: Forward positions denominated in foreign currency Mismatches between foreign asset and liability portfolios Net exposure = (FX assets - FX liab.) + (FX bought - FX sold) FX Risk Exposure Exposure to a foreign currency can be measured by DEAR. Dollar loss/gain in currency i = [Net exposure in foreign currency measured in U.S. $] × Volatility of the foreign exchange rate Example: An FI has $100,000 of net positions outstanding in EUR and -$30,000 in Swiss Franc (SF). The standard deviation of the net positions as a result of exchange rate changes is 1 percent for the EUR and 1.3 percent for the SF. The correlation coefficient between the changes in exchange rates of the EUR and the SF is 0.80. a. What is the risk exposure to the FI of fluctuations in the EUR/$ rate? Since the FI has a positive EUR position, an appreciation of the EUR will increase the value of its EUR-denominated assets more than its liabilities, providing a net gain. The opposite will occur if the EUR depreciates. b. What is the risk exposure to the FI of fluctuations in the SF/$ rate? Since the FI has a negative net position in FFs, the value of its Frenchdenominated assets will increase in value but not as greatly as the value of its liabilities. Hence, an appreciation of the FF will lead to a net loss. The opposite will occur if the currency depreciates. 1 Return of foreign investments Returns are affected by: Spread between costs and revenues Changes in FX rates: Changes in FX rates are not under the control of the FI Example: Sun Bank USA purchased a 10.5 million one-year euro loan that pays 10 percent interest annually. The spot rate for euro is EUR1.05/$. Sun Bank has funded this loan by accepting a British pound (BP)-denominated deposit for the equivalent amount and maturity at an annual rate of 6 percent. The current spot rate of the British pound is $1.50/£. a. What is the total income earned in dollars on this one-year transaction if the spot rates at the end of the year are EUR1.00/$ and $1.60/£?. b. What should be the BP to US $ spot rate in order for the bank to earn a return of 4 percent? Risk and Hedging Hedge can be constructed on balance sheet or off balance sheet On - balance-sheet hedge will also require duration matching to control exposure to foreign interest rate risk Off-balance-sheet hedge using forwards, futures, or options Example: North Bank has been borrowing in the U.S. markets and lending abroad, thus incurring foreign exchange risk. In a recent transaction, it issued a one-year $2 million CD at 2 percent and funded a loan in euro at 8 percent. The spot rate for the euro was EUR1.05/$ at the time of the transaction. a. Information received immediately after the transaction closing indicated that the euro will depreciate to EUR1.10/$ by year-end. If the information is correct, what will be the realized spread on the loan? What should have been the bank interest rate on the loan to maintain the 2 percent spread? Assume adjustments in principal value are included in the spread. b. The bank had an opportunity to sell one-year forward euro at EUR1.08. What would have been the spread on the loan if the bank had hedged forward its foreign exchange exposure? c. What would have been an appropriate change in loan rates to maintain the 2 percent spread if the bank intended to hedge its exposure using the forward rates? 2 Interest rate parity condition Equilibrium condition is that there should be no arbitrage opportunities available through lending and borrowing across currencies. This requires that F £/$= S£/$ [1+r (£ or foreign)] /[1+r($ or domestic)] Difference in interest rates will be offset by the expected change in exchange rates Example: Assume that annual interest rates are 6 percent in the United States and 2 percent in Japan. An FI can borrow (by issuing CDs) or lend (by purchasing CDs) at these rates. The spot rate is ¥100/ $. a. If the forward rate is ¥102/ $, how could the bank arbitrage using a sum of $1million? What is the expected spread? Borrow ¥100,000,000 in Japan by issuing CDs Interest and principal at year-end = ¥100,000,000 x 1.02 = ¥102,000,000 Make a loan in US Interest and principal = $1,000,000*1.06 = $1,060,000 Purchase ¥ at the forward rate of $1,060,000x¥102/ $ = ¥108,120,000 Spread =¥108,120,000 - ¥102,000,000 = ¥6,120,000 (6.12%) b. What forward rate will prevent an arbitrage opportunity? The forward rate that will prevent any arbitrage is given by solving the following equation: Ft = [(1 + 0.02) * 100]/(1.06) = ¥96.23/ $ Classroom problem: A money market mutual fund manager is looking for some profitable investment opportunities and observes the following one-year interest rates on government securities and exchange rates: rUS = 12%, rUK = 9%, S = $1.50/£, f = $1.6/£, where S is the spot exchange rate and f is the forward exchange rate. Which of the two types of government securities would constitute a better investment? 3