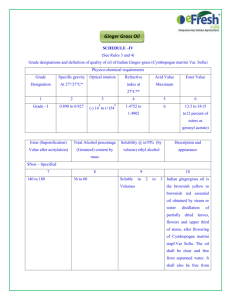

A Report on - High Value Agriculture Project

advertisement