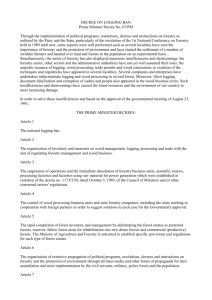

Forestry

advertisement