albertsons inc /de - Vanderbilt Business School

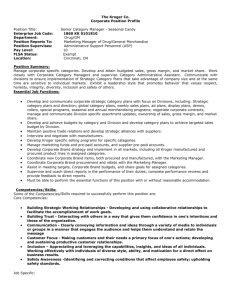

advertisement

Print Name __________________________ Owen Graduate School of Management Vanderbilt University Final Examination Management 413 Final must be completed on or before 9:00 a.m. October 13, 2004 You are allowed to take three hours to complete this exam; you must use the three hours in one block. You may use any materials we covered in the course, and you may use any notes you took in the class. Total points on this exam: 126 This exam has two parts: Questions you answer, and supplemental materials you need for some of the questions. Please sign the following statement after you have completed the exam. I have followed all requirements of the Owen School honor code in completing this exam, and I used no more than three hours to complete the exam. Name _______________________________________ Please return the exam to the box outside the door to Germain Böer’s office. Question I (48 Points) Use the budget schedules from K&R to answer these questions. Consider each question separately unless one question specifically refers to another. ______________ 1. Ignore the constraint report for this question. What is the minimum number of Benches that K&R must plan to sell in order to cover all the budgeted direct (traceable) costs of Benches for the six-month period? Show computations to support your answer. ______________ 2. What would be the impact on expected November segment contribution for Jane Green if the expected cost of blue paint increased by ten percent? ______________ 3. How much will budgeted company profit decline for the month of July if the Majestic Table is dropped from the product line? 4. You have the following actual data on sales for Jane Green for the month of October. Jane Green Foot Stool Royal Bench Budget 1,300 320 Actual 1,100 400 200 1,820 500 2,000 Total dollar sales $ 58,800 $ 95,000 Variable marketing costs Transportation--2% Commissions--5% $ 1,156 2,940 $ 1,880 4,750 35,440 39,536 54,000 60,630 $ 325 920 500 920 Majestic Table Standard production costs times units Total variable costs Fixed marketing costs Traceable to product Promotion Administration Actual units sold times budgeted unit prices $ 91,100 Answer the following questions using the K&R budget schedules and the above data: ___________________ How much did profit change because actual units sold differed from budgeted units? ___________________ The proportions of units actually sold differs from that budgeted; write the word “increase”, decrease, or no change in the blank at the left to indicate the profit impact of the difference in units sold from budgeted. ___________________ How much did actual prices in total differ from the target prices for the products. 2 ______________ 5. Compute the dollar break-even sales for the West Territory for the month of July. ______________ 6. Compute the dollar sales required for the West Territory for July if the territory manager wants to generate a territory contribution of $40,000. ______________ 7. Compute the total dollar breakeven point for the six month period for the total company. _______________ 8. How much will the East Territory contribution for the total six months change if the sales price of the Table rises to $120? Indicate whether the change is an increase or decrease in territory contribution. 3 9. Why do the fixed costs on the budget schedules for the East Territory not equal the sum of the fixed costs for Joe Brown and Jane Green, the salespeople who work in this territory? _______________ 10. Suppose the company decides to spend another $5,000 in July on advertising, how much will the July sales have to increase to cover this added expense? 4 Question II (48 Points) Use the information in the supplemental materials for Question II (Albertsons Inc. and Kroger Co.) to answer the following questions. Use the most recent year for all your calculations. Consider each question separately unless one question specifically refers to another one. ______________ 1. Compute the break-even point for Albertsons Inc. for the most recent year using revenues and expenses related to operations only. ______________ 2. Compute the break-even point for Kroger Co. for the most recent year using revenues and expenses related to operations only. Note that you must compute the gross profit for Kroger since the income statement does not include this amount. 3. Which company will add the most to profit from a $10 million increase in sales? Circle the name of the company that will get the biggest profit increase and explain why that company will get the biggest profit increase. Albertsons Inc. Kroger Co. 5 4. Complete the following table and then compute the cash gap for each company. Place your cash gap answer in the blank below the table. Albertsons Inc. Kroger Co. Average number of days in receivables Average number of days in payables 25.59 Average number of days in inventory 38.39 Compute the cash gap for each company ______________ Albertsons Inc. cash gap ______________ Kroger Co. cash gap (be sure to use FIFO inventory minus the LIFO credit to get the net inventory for this calculation) ______________ 5. How much would the before tax operating income be for Albertsons if the company had the same gross profit percentage that Kroger Co. has? 6 6. Kroger Co. plans to increase advertising by $10 million, and its marketing managers think this will increase sales by $15 million. How much will before tax profits change if Kroger Co. decides to make the added expenditure on advertising? ___________________ Profit change (Indicate whether it is positive or negative.) Should the company increase its advertising by $10 million? Why? Can you legitimately compare the gross profit calculations for Albertsons and Kroger? Yes or no, and explain. 7 8. A Kroger store has limited shelf space on which to display product for sale. Assume Kroger has 100 linear feet of shelf space that it can assign to only one of the following products. Product A Product B Estimated Monthly Sales $300,000 $350,000 Margin Percentage 35% 40% The store will spend $40,000 per month promoting Product B, but will spend nothing on promoting Product A. Which product should get the shelf space? Justify your answer with appropriate numerical analyses. 8 9. Assume Kroger introduces a new line of products that target the consumer interested in low prices. The product line is a big hit and within months of introduction the product makes up one-half of all sales for the company. Assume that the sales of this product amount to $26,895.5 for the latest year and that cost of goods sold for these sales amounts to $16,137.3 and that everything else on the income statement remains the same. Use these data plus the data on the Kroger financial statements and Yahoo information to answer the following questions. _____________ Write UP or DOWN in the blank at the left to indicate whether the break-even point for Kroger will go up or down because of this new product line. ______________ Compute the new gross profit for the company in dollars. ______________ Compute the new before tax amount for Kroger. ______________ Compute the new after tax net income for Kroger 9 ______________ What is the current market capitalization for Kroger ______________ What is the new market capitalization for Kroger after introducing the new line of products? Question III (15 Points) How does XBRL help companies to improve their profits? 10 Question IV (15 Points) Why is Joerg losing money? Provide computations to support your answer. 11 Supplemental Materials Management 413 Management Accounting Final Exam October 12, 2004 ALBERTSONS INC /DE/ CONSOLIDATED BALANCE SHEETS January 29, January 30, (In millions, except par value data) 2004 2003 ---------------------------------------- ------------------- -----------------<S> <C> <C> ASSETS Current Assets: Cash and cash equivalents $ 289 $ 162 Accounts and notes receivable, net 683 647 Inventories 3,035 2,973 Assets held for sale 69 120 Prepaid and other 343 366 ---------------------------------------- ------------------- -----------------Total Current Assets 4,419 4,268 Land, buildings and equipment, net 9,145 9,029 Goodwill1, 400 1,399 Intangibles, net 130 214 Other assets 300 301 ----------------------------------------- ------------------- -----------------Total Assets $ 15,394 $ 15,211 ========================================= =================== ================== LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable $ 1,774 $ 1,993 Salaries and related liabilities 659 615 Self-insurance 262 244 Current maturities of long-term debt and capital lease obligations 520 119 Other current liabilities ` 470 477 ---------------------------------------- ------------------- -----------------Total Current Liabilities 3,685 3,448 Long-term debt 4,452 4,950 Capital lease obligations 352 307 Self-insurance 469 367 Other long-term liabilities and deferred cr. 1,055 942 Commitments and contingencies Stockholders' Equity: Preferred stock - $1.00 par value; authorized - 10 shares; designated 3 shares of Series A Junior Participating; issued - none - - Common stock $1.00 par value; authorized - 1,200 shares; issued 368 shares and 372 shares, respectively 368 372 Capital in excess of par 155 128 Accumulated other comprehensive loss (109) (96) Retained earnings 4,967 4,793 ------------------------------------------ ------------------- -----------------Total Stockholders' Equity 5,381 5,197 ------------------------------------------ ------------------- -----------------Total Liabilities and Stockholders' Equity $ 15,394 $ 15,211 1 ALBERTSONS INC /DE/ CONSOLIDATED EARNINGS For the 52 weeks ended January 29, (In millions, except per share data) 2004 --------------------------------------------- ----------------Sales $ 35,436 Cost of sales 25,306 --------------------------------------------- ----------------Gross profit 10,130 Selling, general and administrative expenses 8,822 Restructuring (credits) charges (10) Gain on sale of New England Osco drugstores Merger-related credits --------------------------------------------- ----------------Operating profit 1,318 Other expenses: Interest, net (409) Other, net (3) --------------------------------------------- ----------------Earnings from continuing operations before taxes 906 Income tax expense 350 --------------------------------------------- ----------------Earnings from continuing operations 556 Discontinued operations: Operating (loss) income Loss on disposal Income tax (benefit) expense --------------------------------------------- ----------------(Loss) earnings from discontinued operations --------------------------------------------- ----------------Earnings before cum effect of change in accounting 556 principle Cumulative effect of change in accounting principle (net of tax of $60) --------------------------------------------- ----------------Net Earnings $ 556 ============================================= ================= 2 January 30, January 31, 2003 2002 --------------- -----------------$ 35,626 $ 36,605 25,248 26,179 --------------- -----------------10,378 10,426 8,598 8,731 (37) 468 (54) (15) --------------- -----------------1,817 1,296 (396) (425) (16) (8) --------------- -----------------1,405 863 540 367 --------------- -----------------865 496 (50) 10 (379) (143) 5 --------------- -----------------(286) 5 --------------- -----------------579 501 (94) --------------- -----------------$ 485 $ 501 =============== ================== ALBERTSONS INC /DE/ Consolidated Cash Flows For the 52 weeks ended January 29, January 30, January 31, (In millions) 2004 2003 2002 -------------------------------------------- ------------------ -----------------Cash Flows From Operating Activities: Net earnings $ 556 $ 485 $ 501 Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation and amortization 969 943 913 Net deferred income taxes 172 100 (129) Other noncash charges 48 21 42 Stock-based compensation 25 19 19 Goodwill amortization 56 Gain on curtailment of postretirement benefits (36) (36) Net gain on asset sales (24) (9) (54) Restructuring (credits) charges (8) (16) 424 Discontinued operations noncash charges 365 54 Cumulative effect of change in acctg principle 94 Changes in operating assets and liabilities: Receivables and prepaid expenses (38) 21 (110) Inventories (62) 112 40 Accounts payable (242) (100) (68) Other current liabilities 29 (88) 287 Self-insurance 120 106 71 Unearned income 25 32 3 Other long-term liabilities (11) (25) (4) ---------------------------------------------- ----------------- ------------------ -----------------Net cash provided by operating activities 1,545 2,060 2,009 ---------------------------------------------- ----------------- ------------------ -----------------Cash Flows From Investing Activities: Capital expenditures (1,094) Proceeds from disposal of land, buildings and equipment 72 Proceeds from disposal of assets held for sale 119 Other (23) ---------------------------------------------- ----------------Net cash used in investing activities (926) ---------------------------------------------- ----------------Cash Flows From Financing Activities: Cash dividends paid (279) Payments on long-term borrowings (120) Stock purchases and retirements (108) Proceeds from long-term borrowings 9 ---------------------------------------------- ----------------Proceeds from stock options exercised 6 Net commercial paper activity and bank borrowings ---------------------------------------------- ----------------Net cash used in financing activities (492) ---------------------------------------------- ----------------Net Increase in Cash and Cash Equivalents 127 Cash and Cash Equivalents at Beginning of Year 162 ---------------------------------------------- ----------------Cash and Cash Equivalents at End of Year $ 289 ============================================== ================= 3 (1,359) (1,455) 101 288 578 118 18 (31) ------------------ -----------------(662) (1,080) ------------------ -----------------(306) (143) (862) -----------------14 -----------------(1,297) -----------------101 61 -----------------$ 162 ================== (309) (89) 623 -----------------23 (1,153) -----------------(905) -----------------24 37 -----------------$ 61 ================== 4 5 KROGER CO CONSOLIDATED BALANCE SHEETS (In millions) -------ASSETS Current assets Cash and temporary cash investments Receivables Receivables - Taxes FIFO Inventory LIFO Credit Prefunded employee benefits Prepaid and other current assets January 31, 2004 -------- February 1, 2003 -------- $ $ $ - 159 674 66 4,493 (324 300 251 -----5,619 11,178 3,134 6 247 -----20,184 ------ $ 248 Total current assets Property, plant and equipment, net Goodwill, net Fair value interest rate hedges (Note 10) Other assets Total Assets LIABILITIES Current liabilities Current portion of long-term debt including obligations under capital leases Accounts payable Accrued salaries and wages Deferred income taxes Other current liabilities Total current liabilities Long-term debt including obligations under capital leases Face value long-term debt including obligations under capital leases Adjustment to reflect fair value interest rate hedges (Note 10) Long-term debt including obligations under capital leases Deferred income taxes Other long-term liabilities Total Liabilities Commitments and Contingencies (Note 14) SHAREOWNERS EQUITY Preferred stock, $100 par, 5 shares authorized and unissued Common stock, $1 par, 1,000 shares authorized: 913 shares issued in 2003 and 908 shares issued in 2002 Additional paid-in capital Accumulated other comprehensive loss Accumulated earnings Common stock in treasury, at cost, 170 shares in 2003 and 150 shares in 2002 Total Shareowners Equity Total Liabilities and Shareowners Equity 6 - - - $ - 171 677 4,465 (290 300 243 -----5,566 10,548 3,575 110 303 -----20,102 ------ $ 352 ) - ) - - 3,058 547 138 1,595 - ------ 5,586 3,269 571 39 1,377 - ------ 5,608 8,012 8,112 104 110 - ------ 8,116 - ------ 8,222 990 1,481 - ------ 16,173 - ------ - 709 1,713 - ------ 16,252 - ------ - - - 913 908 2,382 (124 ) 3,667 (2,827 ) 2,317 (206 ) 3,352 (2,521 ) - ------ 4,011 - ------ $ 20,184 - ------ 3,850 - ------ $ 20,102 THE KROGER CO. CONSOLIDATED STATEMENTS OF EARNINGS Years Ended January 31, 2004, February 1, 2003 and February 2, 2002 (In millions, except per share amounts) -------------------------Sales Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below Operating, general and administrative Rent Depreciation and amortization Goodwill amortization Goodwill impairment charge Asset impairment charges Restructuring charges Merger-related costs Operating Profit Interest expense Earnings before income tax expense and cumulative effect of accounting change Income tax expense Earnings before cumulative effect of accounting change Cumulative effect of an accounting change, net of income tax benefit of $10 in 2002 Net earnings Earnings per basic common share: Earnings before cumulative effect of accounting change Cumulative effect of an accounting change, net of income tax benefit Net earnings 2003 (52 weeks) -------$ 53,791 39,637 2002 (52 weeks) -------$ 51,760 37,810 2001 (52 weeks) -------$ 50,098 36,398 10,354 653 1,209 444 120 - -----1,374 604 - -----770 9,618 656 1,087 15 1 - ------ 2,573 619 - ------ 1,954 9,483 650 973 103 91 37 4 - -----2,359 648 - -----1,711 455 - -----315 733 - ------ 1,221 668 - -----1,043 - (16) - - -----$ 315 - ------ - ------ $ 1,205 - ------ - - -----$ 1,043 - ------ $ $ $ 0.42 - - -----$ 0.42 - ------ 7 1.57 (0.02) - ------ $ 1.55 - ------ - 1.30 - - -----$ 1.30 - ------ KROGER CO CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended January 31, 2004, February 1, 2003 and February 2, 2002 (52 weeks) (In millions) 2003 2002 2001 ---------------------------Cash Flows From Operating Activities: Net earnings $ 315 $ 1,205 $ 1,043 Adjustments to reconcile net earnings to net cash provided by operating activities: Cumulative effect of an accounting 16 change, net of income tax benefit of $10 in 2002 Depreciation and amortization 1,209 1,087 973 Goodwill amortization 103 LIFO charge (credit) 34 (50) 23 Merger-related costs 1 4 Goodwill impairment charge 444 Asset impairment charges 120 91 Item-cost conversion 91 EITF 02-16 adoption 28 Deferred income taxes 331 468 258 Other 22 38 18 Changes in operating assets and liabilities net of effects from acquisitions of businesses: Inventories (20) (62) (121) Receivables 3 2 22 Prepaid expenses 5 (34) (77) Accounts payable (318) 359 (34) Accrued expenses 224 (4) 10 Income taxes receivable (payable) (62) (11) 2 Contribution to company sponsored pension plan(100) Other 8 49 32 - ------ - ------ - ------ Net cash provided by operating 2,215 3,183 2,347 activities - ------ - ------ - ------ Cash Flows From Investing Activities: Capital expenditures, excluding (2,000) (1,891) (1,913) acquisitions Proceeds from sale of assets 68 90 70 Payments for acquisitions, net of cash (87) (126) (103) acquired Other (7) 20 32 - ------ - ------ - ------ Net cash used by investing activities (2,026) (1,907) (1,914) - ------ - ------ - ------ Cash Flows From Financing Activities: Proceeds from issuance of long-term 347 1,353 1,368 debt Reductions in long-term debt (487) (1,757) (1,137) Debt prepayment costs (17) (14) Financing charges incurred (3) (16) (18) Proceeds from issuance of capital 39 41 72 stock Treasury stock purchases (301) (785) (732) Cash received from interest rate swap 114 terminations Increase (decrease in book overdrafts 107 (88) 14 - ------ - ------ - ------ Net cash used by financing activities (201) (1,266) (433) Net increase (decrease)in cash and temp inv. (12) 10 Cash and temporary cash investments: Beginning of year 171 161 161 - ------ - ------ - ------ End of year $ 159 $ 171 $ 161 - ------ - ------ - ------ - 8 9 10 Use this material to answer the question that starts on page 11. Ich verstehe nicht weswegen mein Gewinn nicht höher ist. Meine Verkaeufer arbeiten hart und mein Umsatz steigt Monat fuer Monat.1 Jörg Buchmller made these comments after reviewing the income statement for his company operations for the past six months. This is his first income statement since he started the business six months ago to manufacture and sell three products: Kaiser, Kinder, and Jungen. Sales Variable costs* Contribution margin 4.550.000 DM 3.750.000 800.000 Labor cost Administrative cost Marketing cost Total costs Net profit 400.000 DM 500.000 200.000 1.100.000 (300.000) DM *Materials purchased for these products during the six months: Kaiser 1.250.000 DM Kinder 3.100.000 Jungen 600.000 After reviewing this statement, Jörg asked his accountant for information on the sales of the three products. The accountant supplied these numbers: Product sales for the six months in Deutsch Marks: Kaiser Kinder Jungen 950.000 DM 2.600.000 1.000.000 1 I just do not understand why my profits are not higher. My salesmen are working very hard, and my sales are growing month by month. 11 Jörg's accountant also provided this balance sheet. Assets Cash 25.000 DM Accounts receivable 300.000 Raw materials inventories for:* Kaiser 700.000 Kinder 200.000 Jungen 300.000 Plant assets (net) 1.000.000 Total assets 2.525.000 DM Liabilities and Equity Payables 1.400.000 DM Equity 1.125.000 Total Liabilities and Equity 2.525.000 DM *The company has no work-in-process or finished goods inventory on hand. Remember this company has been in business only six months, so use 180 days instead of 365 for any computations requiring the number of days in one-half year. 12