PCard Manual - Shawnee State University

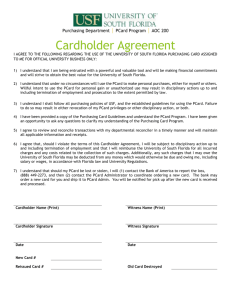

advertisement