Down

advertisement

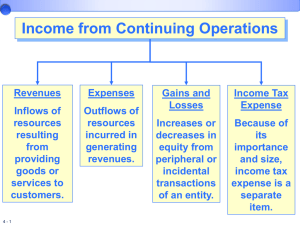

CHAPTER 4 THE INCOME STATEMENT, COMPREHENSIVE INCOME, AND THE STATEMENT OF CASH FLOWS Overview The purpose of the income statement is to summarize the profit-generating activities that occurred during a particular reporting period. Comprehensive income includes net income as well as a few gains and losses that are not part of net income and are considered other comprehensive income items instead. The purpose of the statement of cash flows is to provide information about the cash receipts and cash disbursements of an enterprise that occurred during the period. This chapter has a twofold purpose: (1) to consider important issues dealing with the content, presentation, and disclosure of net income and other components of comprehensive income and (2) to provide an overview of the statement of cash flows, which is covered in depth in Chapter 21. Learning Objectives LO4-1 Discuss the importance of income from continuing operations and describe its components. LO4-2 Describe earnings quality and how it is impacted by management practices to manipulate earnings. LO4-3 Discuss the components of operating and nonoperating income and their relationship to earnings quality. LO4-4 Define what constitutes discontinued operations and describe the appropriate income statement presentation for these transactions. LO4-5 Define extraordinary items and describe the appropriate income statement presentation for these transactions. LO4-6 Define earnings per share (EPS) and explain required disclosures of EPS for certain income statement components. LO4-7 Explain the difference between net income and comprehensive income and how we report components of the difference. LO4-8 Describe the purpose of the statement of cash flows. LO4-9 Identify and describe the various classifications of cash flows presented in a statement of cash flows. LO4-10 Discuss the primary differences between U.S. GAAP and IFRS with respect to the income statement and statement of cash flows. Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-1 Lecture Outline Part A: The Income Statement and Comprehensive Income I. Income from Continuing Operations A. Income from continuing operations includes the revenues, expenses, gains, and losses that will probably continue in future periods. 1. Income tax expense always is shown as a separate expense. 2. A distinction often is made between operating and nonoperating income. (T4-1) 3. A single-step income statement format groups all revenues and gains together and all expenses and losses together. (T4-2) 4. A multiple-step income statement format includes a number of intermediate subtotals before arriving at income from continuing operations. (T4-3) 5. There are more similarities than differences between income statements prepared according to U.S. GAAP and those prepared applying IFRS. (T4-4) II. Earnings Quality A. Earnings quality refers to the ability of reported earnings (income) to predict a company’s future earnings. 1. To enhance predictive value, analysts try to separate a company’s transitory earnings effects from its permanent earnings. 2. Many believe that corporate earnings management practices reduce the quality of earnings. Two major methods used by managers to manipulate income are (1) income shifting and (2) income statement classification. B. Not all items included in operating income should be considered indicative of a company’s permanent earnings. (T4-5) 1. Restructuring costs include costs associated with shutdown or relocation of facilities or downsizing of operations. GAAP requires these costs to be expensed in the period(s) incurred. 2. Asset impairment losses and inventory write-down charges are other operating expenses that call into question the issue of earnings quality. 3. Earnings quality is affected by revenue issues as well. C. Some nonoperating items have generated considerable discussion with respect to earnings quality, notably gains and losses generated from the sale of investments. (T4-6) III. Separately Reported Items (T4-7) A. Intraperiod tax allocation associates tax expense or tax benefit with continuing operations and any item reported below continuing operations. (T4-8) B. Discontinued operations involve the disposal or planned disposal of a component of an entity. (T4-9) 1. The FASB and IASB are working together to develop a common definition of what constitutes a component of an entity. At the time this text was published, a final Accounting Standards Update had not been issued, © The McGraw-Hill Companies, Inc. 2013 4-2 Intermediate Accounting, 7/e 2. When the component has been sold, the income effects of a discontinued operation includes (1) the operating income or loss of the component from the beginning of the reporting period to the disposal date, and (2) the gain or loss on disposal. (T4-10) 3. When the component is considered held for sale, the income effects of a discontinued operation includes (1) operating income or loss of the component from the beginning of the reporting period to the end of the reporting period, and (2) an impairment loss if the carrying value (book value) of the assets of the component is more than fair value minus cost to sell. (T4-11) 4. The assets and liabilities of a component considered held for sale are reported separately in the balance sheet at the lower of their carrying amount (book value) or fair value minus cost to sell. C. Extraordinary items are material gains and losses that are both unusual in nature and infrequent in occurrence. (T4-12) 1. Extraordinary gains and losses are presented, net-of-tax, in the income statement below discontinued operations. 2. A material gain or loss that is either unusual or infrequent should be reported as a separate component of continuing operations. 3. There are no extraordinary gains and losses under IFRS. (T4-13) IV. Accounting Changes A. Accounting changes fall into one of three categories: (1) a change in an accounting principle, (2) a change in estimate, or (3) a change in reporting entity. B. Most voluntary changes in accounting principles are accounted for retrospectively by revising prior years’ financial statements. (T4-14) 1. The comparative financial statements are revised. 2. The appropriate accounts are adjusted. 3. A disclosure note provides clear justification that the change is appropriate. The note also indicates the effects of the change on items not reported on the face of the primary statements, as well as any per share amounts affected for the current period and all prior periods presented. C. A change in depreciation, amortization, or depletion method is considered to be a change in accounting estimate that is achieved by a change in accounting principle. These changes are accounted for prospectively, exactly as we would account for any other change in estimate. D. A change in accounting estimate is reflected in the financial statements of the current period and future periods. (T4-15) V. Correction of Accounting Errors A. Errors discovered in the same year they are made are simply corrected by journal entry. B. Treatment of errors discovered in a year subsequent to the year the error is made depends on whether the error is material. 1. If the error is not material, it is simply corrected in the year discovered. 2. If the error is material, the correction is considered a prior period adjustment which requires an addition to or reduction in beginning retained earnings and a restatement of previous years' financial statements. Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-3 VI. Earnings per Share Disclosures A. Earnings per share (EPS) is the amount of income achieved during a period for each share of common stock outstanding. B. All corporations whose common stock is publicly traded must disclose EPS. C. The EPS for (a) income before any separately reported items, (b) each separately reported item, and (3) net income, must be disclosed. (T4-16) VII. Comprehensive Income A. The purpose of the income statement is to summarize the profit-generating activities that occurred during a particular reporting period. B. Comprehensive income is the total change in equity for a reporting period other than from transactions with owners. C. The information in the income statement and other comprehensive income items can be presented either (1) in a single, continuous statement of comprehensive income or (2) in two separate, but consecutive statements, an income statement and a statement of comprehensive income. (T4-17) D. Both U.S. GAAP and IFRS allow companies to report comprehensive income in either a single statement of comprehensive income or in two separate statements. (T4-18) Part B: The Statement of Cash Flows I. Usefulness of the Statement of Cash Flows A. The purpose of the statement of cash flows (SCF) is to provide information about cash receipts and cash disbursements that occurred during a period. B. A SCF is presented for each period in which results of operations are provided. II. Classifying Cash Flows A. The SCF classifies all transactions affecting cash into one of three categories: (T4-19) 1. Operating activities are inflows and outflows of cash related to the transactions entering into the determination of net operating income. (T4-20) a. The Direct Method b. The Indirect Method 2. Investing activities involve the acquisition and sale of (1) long-term assets used in the business and (2) nonoperating investment assets. 3. Financing activities involve cash inflows and outflows from transactions with creditors (excluding trade creditors) and owners. B. Significant investing and financing transactions not involving cash also are reported. C. The classification of certain cash flows differs between U.S. GAAP and international accounting standards. (T4-21) © The McGraw-Hill Companies, Inc. 2013 4-4 Intermediate Accounting, 7/e PowerPoint Slides A PowerPoint presentation of the chapter is available at the textbook website. Teaching Transparency Masters The following can be reproduced on transparency film as they appear here, or you can use the disk version of this manual and first modify them to suit your particular needs or preferences. Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-5 INCOME STATEMENTS — DELL INC. . Consolidated Statements of Income (In millions, except per share amounts) January 28, 2011 Net revenue: Products Services, including software related Total net revenue Cost of net revenue: Products Services, including software related Total cost of net revenue Gross margin Operating expenses: Selling, general, and administrative Research, development, and engineering Total operating expenses Operating income Interest and other, net Income before income taxes Income tax provision Net income Earnings per common share: Basic Diluted Fiscal Year Ended January 29, 2010 January 30, 2009 $50,002 11,492 61,494 $43,697 9,205 52,902 $52,337 8,764 61,101 42,068 8,030 50,098 11,396 37,534 6,107 43,641 9,261 44,670 5,474 50,144 10,957 7,302 661 7,963 3,433 (83) 3,350 715 $ 2,635 6,645 624 7,089 2,172 (148) 2,024 591 $ 1,433 7,102 665 7,767 3,190 134 3,324 846 $ 2,478 $ 1.36 $ 1.35 $ .73 $ .73 $ 1.25 $ 1.25 Illustration 4-2 T4-1 © The McGraw-Hill Companies, Inc. 2013 4-6 Intermediate Accounting, 7/e SINGLE-STEP INCOME STATEMENT An advantage of the single-step format is its simplicity. MAXWELL GEAR CORPORATION Income Statement For the Year Ended December 31, 2013 Revenues and gains: Sales ............................................................................ Interest and dividends ................................................. Gain on sale of investments ........................................ Total revenues and gains ....................................... Expenses and losses: Cost of goods sold ...................................................... Office salaries ............................................................. Depreciation ................................................................ Miscellaneous ............................................................. Interest ........................................................................ Total expenses and losses ...................................... Income before income taxes .......................................... Income tax expense ....................................................... Net income ..................................................................... $573,522 26,400 5,500 605,422 $302,371 47,341 24,888 16,300 14,522 405,422 200,000 80,000 $120,000 Illustration 4-3 T4-2 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-7 MULTIPLE-STEP INCOME STATEMENT An advantage of the multiple-step format is that it separately reports operating and nonoperating activities. MAXWELL GEAR CORPORATION Income Statement For the Year Ended December 31, 2013 Sales revenue ................................................................ Cost of goods sold ........................................................ Gross profit ................................................................... Operating expenses: Office salaries .............................................................. $47,341 Depreciation ................................................................. 24,888 Miscellaneous .............................................................. 16,300 Total operating expenses ...................................... Operating income .......................................................... Other income (expense): Interest and dividend revenue ..................................... 26,400 Gain on sale of investments .......................................... 5,500 Interest expense ........................................................... (14,522) Total other income, net ......................................... Income before income taxes ......................................... Income tax expense ....................................................... Net income .................................................................... $573,522 302,371 271,151 88,529 182,622 17,378 200,000 80,000 $120,000 Illustration 4-4 T4-3 © The McGraw-Hill Companies, Inc. 2013 4-8 Intermediate Accounting, 7/e INTERNATIONAL FINANCIAL REPORTING STANDARDS Income Statement Presentation. There are more similarities than differences between income statements prepared according to U.S. GAAP and those prepared applying international standards. Some of the differences are: International standards require certain minimum information to be reported on the face of the income statement. U.S. GAAP has no minimum requirements. International standards allow expenses to be classified either by function (e.g., cost of goods sold, general and administrative, etc), or by natural description (e.g., salaries, rent, etc.). SEC regulations require that expenses be classified by function. In the U.S., the “bottom line” of the income statement usually is called either net income or net loss. The descriptive term for the bottom line of the income statement prepared according to international standards is either profit or loss. As we discuss later, we report “extraordinary items” separately in an income statement prepared according to U.S. GAAP. International standards prohibit reporting “extraordinary items.” T4-4 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-9 OPERATING INCOME AND EARNINGS QUALITY Operating income could include some unusual items that may or may not continue in the future. Income Statements – JDS Uniphase Corporation Income Statements (in part) ($ in millions) Net revenue Cost of sales Gross profit Operating expenses: Research and development Selling, general, and administrative Amortization of intangibles Impairment of goodwill Impairment of long-lived assets Restructuring costs Total operating expenses Operating loss Years Ended July 3, ,,, June 27, 2010 2009 $1,363.9 $1,283.3 816.8 796.7 547.1 486.6 174.9 167.1 380.9 27.8 --17.7 601.3 (54.2) 399.0 27.0 741.7 13.2 38.5 1,386.5 (899.9) Illustration 4-5 T4-5 © The McGraw-Hill Companies, Inc. 2013 4-10 Intermediate Accounting, 7/e NONOPERATING INCOME AND EARNINGS QUALITY Some nonoperating items have generated considerable discussion with respect to earnings quality, notably gains and losses from the sale of investments. Income Statements – Intel Corporation Income Statements (in part) Years Ended December 30 (in millions) Operating income Gains on investments, net Interest and other, net Income before taxes 2000 10,395 3,759 987 15,141 1999 9,767 883 578 11,228 Illustration 4-7 T4-6 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-11 SEPARATELY REPORTED ITEMS ► Discontinued operations, and ► Extraordinary items Income from continuing operations before income taxes and extraordinary item Income tax expense Income from continuing operations before extraordinary item Discontinued operations, net of $xx in taxes Extraordinary items, net of $xx in taxes Net income $XXX XX XXX XX XX $XXX Their income tax effect is included in the separate presentation rather than as part of the amount reported as income tax expense. T4-7 © The McGraw-Hill Companies, Inc. 2013 4-12 Intermediate Accounting, 7/e INTRAPERIOD TAX ALLOCATION ► Intraperiod tax allocation associates tax expense or tax benefit with continuing operations and any separately reported item. ► The Maxwell Gear Corporation had income from continuing operations of $200,000 before income tax expense and an extraordinary gain of $60,000 in 2013. The income tax rate is 40% on all items of income or loss. Therefore, the company’s total income tax expense is $104,000 (40% x $260,000). Illustration 4-8 Income Statement Presented Incorrectly — No Intraperiod Tax Allocation (Extraordinary Gain) Incorrect Presentation Income from continuing operations before income taxes Income tax expense Income before extraordinary gain Extraordinary gain (gross) Net income $200,000 (104,000) 96,000 60,000 $156,000 Illustration 4-8a Income Statement — Intraperiod Tax Allocation (Extraordinary Gain) Correct Presentation Income from continuing operations before income taxes Income tax expense Income before extraordinary gain Extraordinary gain, net of $24,000 tax expense Net income $200,000 (80,000) 120,000 36,000 $156,000 Illustration 4-8b, T4-8 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-13 DISCONTINUED OPERATION ► If a component of an entity has either been disposed of or classified as held for sale, we report the results of its operations separately in discontinued operations. T4-9 © The McGraw-Hill Companies, Inc. 2013 4-14 Intermediate Accounting, 7/e DISCONTINUED OPERATIONS — When the component has been sold When the component has been sold, the income effects of a discontinued operation includes: 1. Operating income or loss (revenues, expenses, gains and losses) of the component from the beginning of the reporting period to the disposal date. 2. Gain or loss on disposal. The Duluth Holding Company has several operating divisions. In October 2013, management decided to sell one of its divisions that qualifies as a separate component according to generally accepted accounting principles. The division was sold on December 18, 2013 for a net selling price of $14,000,000. On that date, the assets of the division had a book value of $12,000,000. For the period January 1 through disposal, the division reported a pre-tax loss from operations of $4,200,000. The company’s income tax rate is 40% on all items of income or loss. Duluth generated after-tax profits of $22,350,000 from its continuing operations. Duluth’s income statement for the year 2013, beginning with income from continuing operations, would be reported as follows: Income from continuing operations $22,350,000 Discontinued operations: Loss from operations of discontinued component (including gain on disposal of $2,000,000*) $(2,200,000) † Income tax benefit 880,000 ‡ Loss on discontinued operations (1,320,000) Net income $21,030,000 * Net selling price of $14 million less book value of $12 million † Loss from operations of $4.2 million less gain on disposal of $2 million ‡ $2,200,000 x 40% Illustration 4-9 T4-10 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-15 DISCONTINUED OPERATIONS — When the component is considered held for sale When the component is considered held for sale, the income effects of a discontinued operation includes: 1. Operating income or loss (revenues, expenses, gains and losses) of the component from the beginning of the reporting period to the end of the reporting period. 2. An “impairment loss” if the carrying value (book value) of the assets of the component is more than fair value minus cost to sell. The Duluth Holding Company has several operating divisions. In October of 2013, management decided to sell one of its divisions that qualifies as a separate component according to generally accepted accounting principles. On December 31, 2013, the end of the company’s fiscal year, the division had not yet been sold. On that date, the assets of the division had a book value of $12,000,000 and a fair value, minus anticipated costs to sell, of $9,000,000. For the year, the division reported a pre-tax loss from operations of $4,200,000. The company’s income tax rate is 40% on all items of income or loss. Duluth generated after-tax profits of $22,350,000 from its continuing operations. Duluth’s income statement for 2013, beginning with income from continuing operations, would be reported as follows: Income from continuing operations $22,350,000 Discontinued operations: Loss from operations of discontinued component (including impairment loss of $3,000,000*) $(7,200,000) † Income tax benefit 2,880,000 ‡ Loss on discontinued operations (4,320,000) Net income $18,030,000 * Book value of $12 million less fair value net of cost to sell of $9 million † Operating loss of $4.2 million plus impairment loss of $3 million ‡ $7,200,000 x 40% Illustration 4-10 T4-11 © The McGraw-Hill Companies, Inc. 2013 4-16 Intermediate Accounting, 7/e EXTRAORDINARY ITEMS ► Extraordinary items are material gains and losses resulting from transactions or events that are both: Unusual in nature. Infrequent in occurrence, considering the environment in which the entity operates. ► Extraordinary gains and losses are presented in the income statement, net-of-tax, below discontinued operations. ► If an event is material and either unusual or infrequent, but not both, it should be reported as a separate component of continuing operations. A common example of an unusual or infrequent item is restructuring costs. T4-12 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-17 INTERNATIONAL FINANCIAL REPORTING STANDARDS Extraordinary items. U.S. GAAP provides for the separate reporting, as an extraordinary item, of a material gain or loss that is unusual in nature and infrequent in occurrence. In 2003, the IASB revised IAS No. 1. The revision states that neither the income statement nor any notes may contain any items called “extraordinary.” T4-13 © The McGraw-Hill Companies, Inc. 2013 4-18 Intermediate Accounting, 7/e CHANGE IN ACCOUNTING PRINCIPLE ► Most voluntary changes in accounting principles are accounted for retrospectively by revising prior years’ financial statements. ► The steps used to account for changes are as follows: ► 1. The comparative financial statements are revised. 2. The appropriate accounts are adjusted. 3. A disclosure note provides clear justification for the change along with the effects of the change on items not reported on the face of the primary statements, as well as any per share amounts affected for the current period and all prior periods presented. A change in depreciation, amortization, or depletion method is considered to be a change in accounting estimate that is achieved by a change in accounting principle. We account for these changes prospectively, exactly as we would any other change in estimate. T4-14 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-19 CHANGE IN ACCOUNTING ESTIMATE ► A change in accounting estimate is reflected in the financial statements of the current period and future periods. T4-15 © The McGraw-Hill Companies, Inc. 2013 4-20 Intermediate Accounting, 7/e EARNINGS PER SHARE Earnings per share (EPS) is the amount of income earned expressed on a per share basis. In its simplest form, EPS is computed by dividing net income by the weighted average number of common shares outstanding. All corporations whose common stock is publicly traded must disclose EPS. The EPS for (a) income before any separately reported items, (b) each separately reported item, and (3) net income, must be disclosed. T4-16 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-21 EARNINGS PER SHARE (continued) Charming Shoppes, Inc. Consolidated Statements of Operations (in part) ($ in thousands, except per share data) Loss from continuing operations before extraordinary item Loss from discontinued operations, net of tax Extraordinary item, net of tax Net loss Basic earnings (loss) per share Loss from continuing operations before extraordinary item Loss from discontinued operations Extraordinary item Net loss Diluted earnings (loss) per share: Loss from continuing operations before extraordinary item Loss from discontinued operations Extraordinary gain Net loss Year Ended January 30, January 31, February 2, 2010 2009 2008 $ (77,962) _ -$ (77,962) $ (.67) --$ (.67) $ (.67) --$ (.67) $ (180,351) (74,922) -$ (255,273) $ (4,163) (85,039) 912 $ (88,290) $ (1.57) (.65) -$ (2.22) $ (.03) (.70) .01 $ (.72) $ (1.57) (.65) -$ (2.22) $ (.03) (.70) .01 $ (.72) Illustration 4-13 T4-16 (continued) © The McGraw-Hill Companies, Inc. 2013 4-22 Intermediate Accounting, 7/e COMPREHENSIVE INCOME ► Comprehensive income is the total nonowner change in equity for a period. ($ in millions) Net income Other comprehensive income: Net unrealized holding gains (losses) from investments (net of tax)* Gains (losses) from and amendments to postretirement benefits plans (net of tax)† Deferred gains (losses) from derivatives (net of tax) ‡ Gains (losses) from foreign currency translation (net of tax) § Comprehensive income * † ‡ § $xxx $xx (x) (x) x xx $xxx Changes in the market value of certain investments (described in Chapter 12). Gains and losses due to revising assumptions or market returns differing from expectations and prior service cost from amending the plan (described in Chapter 17). When a derivative designated as a cash flow hedge is adjusted to fair value, the gain or loss is deferred as a component of comprehensive income and included in earnings later, at the same time as earnings are affected by the hedged transaction (described in the Derivatives Appendix to the text). Gains or losses from changes in foreign currency exchange rates. The amount could be an addition to or reduction in shareholders’ equity. (This item is discussed elsewhere in your accounting curriculum.) Illustration 4-15 The information in the income statement and other comprehensive income items can be presented either (1) in a single, continuous statement of comprehensive income or (2) in two separate, but consecutive statements, an income statement and a statement of comprehensive income. T4-17 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-23 INTERNATIONAL FINANCIAL REPORTING STANDARDS Comprehensive Income. Both U.S. GAAP and IFRS allow companies to report comprehensive income in either a single statement of comprehensive income or in two separate statements. Other comprehensive income items are similar under the two sets of standards. However, an additional OCI item, changes in revaluation surplus, is possible under IFRS. In Chapter 10 you will learn that IAS No. 1647 permits companies to value property, plant, and equipment at (1) cost less accumulated depreciation or (2) fair value (revaluation). IAS No. 38 provides a similar option for the valuation of intangible assets. U.S. GAAP prohibits revaluation. If the revaluation option is chosen and fair value is higher than book value, the difference, changes in revaluation surplus, is reported as other comprehensive income and then accumulates in a revaluation surplus account in equity. T4-18 © The McGraw-Hill Companies, Inc. 2013 4-24 Intermediate Accounting, 7/e STATEMENT OF CASH FLOWS ► ► ► OPERATING ACTIVITIES Inflows and outflows of cash that result from activities reported in the income statement. Includes most of the elements of net income, but reported on a cash basis rather than an accrual basis. INVESTING ACTIVITIES Inflows and outflows of cash related to the acquisition and disposition of long-term assets (such as property, plant and equipment, and intangible assets) and investment assets (except those classified as cash equivalents and trading securities). The purchase and sale of inventories are not considered investing activities. FINANCING ACTIVITIES Cash inflows and outflows from transactions with creditors (excluding trade creditors) and owners. T4-19 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-25 CASH FLOWS FROM OPERATIONS ACTIVITIES Under the direct method, the cash effect of each operating activity is reported directly in the statement. By the indirect method, we arrive at net cash flow from operating activities indirectly by starting with reported net income and working backwards to convert that amount to a cash basis. T 4-20 © The McGraw-Hill Companies, Inc. 2013 4-26 Intermediate Accounting, 7/e CASH FLOWS FROM OPERATIONS ACTIVITIES (continued) Arlington Lawn Care (ALC) began operations at the beginning of 2013. ALC’s 2013 income statement and its year-end balance sheet are shown below ($ in thousands). ARLINGTON LAWN CARE Income Statement For the Year Ended December 31, 2013 Service revenue Operating expenses: General and administrative Depreciation Total operating expenses Income before income taxes Income tax expense Net income $90 $32* 8 40 50 15 $35 * Includes $6 in insurance expense. ARLINGTON LAWN CARE Balance Sheet At December 31, 2013 Assets Current assets: Cash $54 Accounts receivable 12 Prepaid insurance 4 Total current assets 70 Equipment 40 Less: Accumulated depreciation (8) Total assets $102 Liabilities and shareholders’ equity Current liabilities: Accounts payable** $7 Income taxes payable 15 Total current liabilities 22 Shareholders’ equity: Common stock 50 Retained earnings 30*** Total liabilities and shareholders’ equity $102 ** For general and administrative expenses *** Net income of $35 less $5 in cash dividends paid Illustration 4-17 T4-20 (continued) Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-27 CASH FLOWS FROM OPERATIONS ACTIVITIES (continued) ARLINGTON LAWN CARE Statement of Cash Flows For the Year Ended December 31, 2013 ($ in thousands) Cash Flows from Operating Activities Cash received from customers* $78 Cash paid for general and administrative expenses** (29) Net cash flows from operating activities $49 * Service revenue of $90 thousand, less increase of $12 thousand in accounts receivable. **General and administrative expenses of $32 thousand, less increase of $7 thousand in accounts payable, plus increase of $4 thousand in prepaid insurance. Illustration 4-17A ARLINGTON LAWN CARE Statement of Cash Flows For the Year Ended December 31, 2013 ($ in thousands) Cash Flows from Operating Activities Net income Adjustments for noncash effects: Depreciation expense $ 8 Changes in operating assets and liabilities: Increase in prepaid insurance (4) Increase in accounts receivable (12) Increase in accounts payable 7 Increase in income taxes payable 15 Net cash flows from operating activities $35 14 $49 Illustration 4-17B, T4-20 (continued) © The McGraw-Hill Companies, Inc. 2013 4-28 Intermediate Accounting, 7/e INTERNATIONAL FINANCIAL REPORTING STANDARDS Classification of Cash Flows. Like U.S. GAAP, international standards also require a statement of cash flows. Consistent with U.S. GAAP, cash flows are classified as operating, investing, or financing. However, the U.S. standard designates cash outflows for interest payments and cash inflows from interest and dividends received as operating cash flows. Dividends paid to shareholders are classified as financing cash flows. IAS No. 7, on the other hand, allows more flexibility. Companies can report interest and dividends paid as either operating or financing cash flows and interest and dividends received as either operating or investing cash flows. Interest and dividend payments usually are reported as financing activities. Interest and dividends received normally are classified as investing activities. Typical Classification of Cash Flows from Interest and Dividends U.S. GAAP Operating Activities Dividends received Interest received Interest paid IFRS Operating Activities Investing Activities Investing Activities Dividends received Interest received Financing Activities Dividends paid Financing Activities Dividends paid Interest paid Siemens AG, a German company, prepares its financial statements according to IFRS. In the statement of cash flows for quarter ended March 31, 2011, the company reported interest and dividends received as operating cash flows, as would a U.S. company. However, Siemens classified interest paid as a financing cash flow. Siemens AG Statement of Cash Flows (partial) For the Nine Months Ended March 31, 2011 (€ in millions) Cash flows from financing activities: Proceeds from re-issuance of treasury stock Repayment of long-term debt Change in short-term debt and other Interest paid Dividends paid Dividends paid to minority shareholders Financing discontinued operations Net cash used in financing activities-continuing operations 109 (13) 85 (72) (2,356) (81) (401) (2,729) T 4-21 Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-29 Suggestions for Class Activities 1. Real World Scenario In March of 2005, Daimler-Chrysler AG announced that it would recall some 1.3 million MercedezBenz cars worldwide to fix problems with their alternators and batteries. The recall covered E-class, CLS-class, E, and SL models. In 2010, Toyota recalled several of its brand models to fix problems involving accelerator pedals. These recalls cost Daimler-Chrysler and Toyota tens of millions of dollars. In 2005, Hurricane Katrina destroyed much of the city of New Orleans. That hurricane was the costliest hurricane, as well as one of the five deadliest, in the United States. Suggestions: Have the class consider the income statement presentation of the income effects of these events. Will the effects be included in continuing operations? Will they be presented gross, or net-of-tax? How do the events underlying the income effects differ in terms of the likelihood that they will occur again in the foreseeable future? Points to note: The product recall event can be compared to the recall of Tylenol capsules in 1982. In the Tylenol case, the circumstances surrounding the event led Johnson & Johnson to classify the loss as an extraordinary item. This product recall event resulted in a new package design for the product (in fact for the entire industry) reducing the likelihood that similar losses would occur in the future. The capsules were recalled because someone put poison in some of the capsules. In the auto industry, however, product recalls are not uncommon. You might have your students access the most recent financial statements of Ford Motor. In the financial statements for the year ended December 31, 2010, in Note 31 under Commitments and Contingencies they will find that product recalls are included in accrued liabilities in the balance sheet. In the balance sheet for the year ended December 31, 2010, the current and noncurrent liability “Dealer and customer allowances and claims,” exceeded $10 billion (note 17). The Hurricane Katrina losses present another good opportunity to discuss extraordinary gains and losses. Are losses in the Gulf of Mexico from hurricanes unusual and infrequent? Is this type of loss likely to occur again in the foreseeable future? Note that the FASB’s EITF specifically ruled that the Hurricane Katrina losses do not qualify for extraordinary reporting. © The McGraw-Hill Companies, Inc. 2013 4-30 Intermediate Accounting, 7/e 2. Research Activity Aramark Corporation, a leading provider of a broad range of managed services to business, educational, healthcare and governmental institutions and sports, entertainment and recreational facilities, reported discontinued operations in its income statements for its 2011, 2010, and 2009 fiscal years. Suggestions: Have the class access the company’s financial statements for the fiscal year ended September 30, 2011, using EDGAR, which can be located at: www.sec.gov. Ask them to answer the following questions: 1. What segments of the company were discontinued? 2. What was the net-of-tax income (loss) from discontinued operations for the 2011 and 2010 years? 3. What was the net proceeds (net selling price) of the component that was discontinued? Points to note: Aramark sold its wholly-owned subsidiary, Galls, LLC and reported net-of-tax losses from this discontinued operation of $11,732 thousand and $1,635 thousand for fiscal years 2011 and 2010, respectively. The net proceeds from the sale of Galls, LLC was $75 million. 3. Dell Analysis Have students, individually or in groups, go to the most recent Dell annual report using EDGAR which can be located at: ww.sec.gov. Ask them to: 1. Compare revenues, operating expenses, net income, and net income as a percentage of revenue dollars with those in the 2011 annual report in Appendix B of the text. Are there any discernible trends? How might they be interpreted? 2. Has the company made any changes in its revenue recognition method? 3. Does the income statement contain any separately reported items? 4. Compare cash flows from operating, investing, and financing activities with those in the 2011 report. Are there any discernible trends? How might they be interpreted? 5. Use EDGAR to locate the most recent annual report information for Apple, Dell’s competitor. Using the most recent annual report information for both companies, compare growth (from the prior year) in revenue and net income, net income as a percentage of revenue dollars, and operating expenses as a percentage of revenue. Instructors Resource Manual © The McGraw-Hill Companies, Inc. 2013 4-31 4. Professional Skills Development Activities The following are suggested assignments from the end-of-chapter material that will help your students develop their communication, research, analysis and judgment skills. Communication Skills. In addition to Communication Case 4-6, Integrating Case 4-15 can be adapted to ask students to answer the requirement in the form of a formal report. Communication Case 4-5 and Integrating Case 4-15 do well as group assignments. Judgment Case 4-1 and Ethics Case 4-7 create good class discussions. Real World Cases 4-4 and 4-17, and Research Case 4-14 are suitable for student presentation(s). Research Skills. In their careers, our graduates will be required to locate and extract relevant information from available resource material to determine the correct accounting practice, perhaps identifying the appropriate authoritative literature to support a decision. Research Case 4-8 and Exercises 4-20 and 4-21 provide excellent opportunities to help students develop this skill. In addition, Real World Case 4-4 can be adapted to require students to research the authoritative literature on the presentation of pro forma earnings. Analysis Skills. The “Broaden Your Perspective” section includes Analysis Cases that direct students to gather, assemble, organize, process, or interpret data to provide options for making business and investment decisions. In addition to Analysis Case 4-16, Judgment Cases 4-9 and 4-10 also provide opportunities to develop and sharpen analytical skills. Judgment Skills. The “Broaden Your Perspective” section includes Judgment Cases that require students to critically analyze issues to apply concepts learned to business situations in order to evaluate options for decision-making and provide an appropriate conclusion. In addition to Judgment Cases 4-1, 4-2, 4-3, 4-9, 4-10, and 4-12, Communication Cases 4-5 and 4-6 also require students to exercise judgment. CPA Simulation. Students can test their knowledge of the concepts discussed in this chapter and at the same time practice critical professional skills necessary for career success and preparation for the computer-based CPA Exam. The simulation for this chapter, Bart Company, tests students’ knowledge of the contents and presentation of the income statement. Access the simulations at the text website: www.mhhe.com/spiceland7e. © The McGraw-Hill Companies, Inc. 2013 4-32 Intermediate Accounting, 7/e Assignment Chart Questions 4-1 4-2 4-3 4-4 4-5 4-6 4-7 4-8 4-9 4-10 4-11 4-12 4-13 4-14 4-15 4-16 4-17 4-18 4-19 4-20 4-21 Instructors Resource Manual Learning Objective(s) 1 1 1 1 2 3 4,5,6 4 5 5 ---6 7 8 9 9 9 10 10 Est. time Topic (min.) Purpose of the income statement 5 Income from continuing operations 5 Operating and nonoperating income 5 Single-step and multiple-step income statements 5 Earnings quality 5 Restructuring costs 5 Intraperiod tax allocation 5 Discontinued operations 5 Extraordinary items 5 Extraordinary items 5 Change in accounting principle 5 Change in accounting estimate 5 Correction of errors 5 Earnings per share 5 Comprehensive income 5 Purpose of the statement of cash flows 5 Classification of cash flows 5 Noncash investing and financing activities 5 Direct method versus indirect method 5 IFRS; separately reported items 5 IFRS; statement of cash flows 5 © The McGraw-Hill Companies, Inc. 2013 4-33 Brief Exercises 4-1 4-2 4-3 4-4 4-5 4-6 4-7 4-8 4-9 4-10 4-11 4-12 Learning Objective(s) 1 1,3 1,3 1,3 5 3,5,6 4 4 4 7 9 9 4-13 4-14 © The McGraw-Hill Companies, Inc. 2013 4-34 9 9,10 Est. time Topic (min.) Single-step income statement 10 Multiple-step income statement 10 Multiple-step income statement 15 Multiple-step income statement 15 Extraordinary items 10 Separately reported items 15 Discontinued operations 10 Discontinued operations 10 Discontinued operations 10 Comprehensive income 10 Statement of cash flows; direct method 15 Statement of cash flows; investing and financing activities 15 Statement of cash flows; indirect method 10 IFRS; statement of cash flows 10 Intermediate Accounting, 7/e Exercises 4-1 4-2 4-3 4-4 4-5 4-6 4-7 4-8 4-9 4-10 4-11 4-12 4-13 4-14 4-15 4-16 4-17 4-18 4-19 4-20 4-21 4-22 Instructors Resource Manual Learning Est. time Objective(s) Topic (min.) 1,6 Income statement format; single-step and multiple-step 20 1,3,5,6 Income statement format; single-step and multiple-step 20 1,5,6,7 Multiple-step statement and comprehensive income 20 1,5,6 Income statement presentation; intraperiod tax allocation 20 4,6 Discontinued operations 15 1,3,4 Income statement presentation 20 4 Discontinued operations 15 4 Discontinued operations; disposal in subsequent year 10 6 Earnings per share 10 7 Comprehensive income 20 9 Statement of cash flows; classifications 10 11 Statement of cash flows preparation 15 9,10 IFRS; statement of cash flows 5 9 Indirect method; reconciliation of net income to cash flows 15 9 Statement of cash flows directly from transactions 20 9 Statement of cash flows; indirect method 15 9.10 IFRS; statement of cash flows 20 9 Statement of cash flows; indirect method 30 9 Statement of cash flows; direct method 25 6 FASB codification research 15 5,6,7,9 FASB codification research 20 1 through 9 Concepts; terminology 15 © The McGraw-Hill Companies, Inc. 2013 4-35 CPA/CMA Exam Questions CPA-1 CPA-2 CPA-3 CPA-4 CPA-5 CPA-6 CPA-7 CPA-8 CMA-1 CMA-2 CMA-3 Problems 4-1 4-2 4-3 4-4 4-5 4-6 4-7 4-8 4-9 4-10 4-11 Learning Objective(s) 4 3,4,5 4,5 4 9 9 10 10 1 3 5 Topic Discontinued operations Income from continuing operations Single-step income statement Discontinued operations Statement of cash flows; classifications Statement of cash flows; classifications IFRS IFRS Income from continuing operations Multiple-step income statement Extraordinary items Est. time (min.) 3 3 3 3 3 3 3 3 3 3 3 Learning Est. time Objective(s) Topic (min.) 1,3,4,5,6 Comparative income statements; multiple-step format 25 4 Discontinued operations 25 4,5 Income statement presentation 20 3,5 Income statement presentation; unusual items 10 1,3,5,6 Income statement presentation; unusual items 25 1,3,4,5,6 Income statement presentation 30 1,3,4,5,6,7 Income statement presentation; statement of comprehensive income; unusual items 30 1,3,5,7 Multiple-step statement of income and comprehensive income 20 9 Statement of cash flows 25 9 Integration of financial statements; Chapters 3 & 4 40 9 Statement of cash flows; indirect method 30 Star Problems © The McGraw-Hill Companies, Inc. 2013 4-36 Intermediate Accounting, 7/e Cases Judgment Case 4-1 Judgment Case 4-2 Judgment Case 4-3 Real World Case 4-4 Communication Case 4-5 Communication Case 4-6 Ethics Case 4-7 Research Case 4-8 Learning Objective(s) 2,3 3 2,3 3 5 5 3,5 2,3 Judgment Case 4-9 Judgment Case 4-10 IFRS Case 4-11 Judgment Case 4-12 3,4,5 3,4,5 9,10 3,4,5,7 Judgment Case 4-13 Research Case 4-14 Integrating Case 4-15 Analysis Case 4-16 Real World Case 4-17 2 3 3,5 1 1,3,4,5 Air France-KLM Case CPA Simulation 4-1 Instructors Resource Manual 10 Est. time (min.) Earnings quality 15 Restructuring costs 15 Earnings management 15 Pro forma earnings 15 Income statement presentation of gain 20 Income statement presentation 15 Income statement presentation of unusual loss 20 FASB codification; restructuring costs; exit or disposal cost obligations 40 Income statement presentation 20 Income statement presentation 20 Statement of cash flows; GlaxoSmithKline Plc. 15 Income statement presentation; unusual items; 20 comprehensive income Management incentives for change 15 Pro forma earnings 60 Balance sheet and income statement 35 Income statement information; Dell 10 Income statement information 45 Topic IFRS; income statement classifications; statement of cash flows; Air France-KLM 15 Contents and presentation of the income statement © The McGraw-Hill Companies, Inc. 2013 4-37