- Mark E. Moore

advertisement

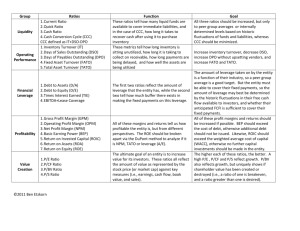

Chapter 6, 7 AND 8 Ratio Classes to Consider (what do they measure, how computed, provide types?) A. Turnover ratios B. Leverage ratios C. Return on investment ratios D. Profitability ratios 1. What ratio and activity is measured by each of the following? A. The product of net margin and asset turnover B. The relationship of net income to sales C. The relationship of total liabilities and book value of equity D. The product of return on assets and financial leverage 2. A company pays a dividend on common stock, thereby reducing its cash balances. What effect does payment of the dividend have on its leverage ratio and net profit margin? Leverage Net Profit Margin (Debt/Equity) (Net Income/Sales) Increase (?) Decrease(?) No Effect (?) 3. What will $1,000 (compounding at 8 percent per year) grow to in 5 years? 4. The subject company has the following revenue trend. Calculate the compound annual rate for 2009-2013? Period Ending Total Revenue 2008 2009 2010 2011 2012 12,348,000 12,562,000 12,843,000 13,893,000 14,190,000 2013 15,259,000 Betty Lou’s Balance Sheets for December 31, 2011 and 2012 Current assets Fixed assets Total assets 2011 $170 280 450 2012 $200 300 500 Current liabilities Long-term debt Equity 2011 $90 170 190 Betty Lou’s Income Statement for the year ended December 31, 2012 Revenue $350 Cost of goods sold 50 Gross margin ?? Operating expenses 80 Depreciation 30 Interest expenses 30 Taxes 64 5. Compute Betty Lou’s interest coverage ratio (time interest earned) for 2012? 6. Compute Betty Lou’s after tax return on average equity for 2012? 7. Compute Betty Lou’s after tax return on “ending” invested capital in 2011? 2012 $100 180 220 8. Following are selected financial ratios for the subject company and its RMA peers as of the valuation date: Subject Company RMA Peers Sales/inventory 11.2 11.6 Sales/net working capital 46.5 9.0 Cost of sales/payables 6.4 14.6 Comment on the following (on a relative basis): A. To what extent is subject company is suffering financial stress and is leaning on suppliers? B. To what extent has the subject company reduced its accounts payable at the valuation date? C. Is there evidence the subject company’s net working capital had ballooned due to temporary factors. D. Is there evidence the subject company is more efficient in its management of inventory. 9. Which of the following are reasons for adjusting reported financial data (why?)? A. To eliminate discretionary expenses of the business B. To make historical statements more representative of expected future performance C. To compare the subject to companies of different size D. To separate out non-operating assets and their related income or expense 10. A subject company uses a shorter depreciation period for its equipment than is common in the industry, but there is no indication that it actually achieves a lower useful life for the equipment. Relative to the industry, the subject company’s: A. Earnings are overstated, and the net book value of equipment is stated comparably. B. Earnings are overstated, and the net book value of equipment is understated. C. Earnings are overstated, and the net book value of equipment is overstated. D. Earnings are understated, and the net book value of equipment is stated comparably. 11. The subject company reported the following results for years 20X1 to 20X4 ($000): 2011 2012 2013 2014 Revenue $600 $610 $655 $675 Cost of goods sold 300 306 333 345 Operating expense 100 102 150 115 Pretax income 200 204 183 230 You have analyzed the company’s financial operations and discovered the following facts: 1. Expenses related to non-operating assets were $80,000 per year. 2. Income related to non-operating assets was $20,000 in each of 2013 and 2014. 3. Throughout the review period, the firm bought its raw materials from a firm owned by related parties. On the open market, raw materials could have been purchased for $60,000 less per year. 4. In 2013 the firm recorded $35,000 of expense related to an unprecedented labor strike. You are estimating the pretax income of the business in order to determine the fair market value of 100 percent of the company. After appropriate adjustments are made, COMPUTE firm A’s four-year average pretax income: 12. Be able to compute and distinguish/differentiate the following financial ratios: a) Quick asset ratio b) Inventory turnover based on ending inventory for the year c) Inventory turnover based on average inventory for the year d) Inventory turnover based on beginning inventory for the year e) Be able to assess relative liquidity (draw conclusions relative to peers) f) Be able to assess relative turnover ratios and draw conclusions relative to peers g) Be able to link changes in ratios to changes in business activities (e.g. more franchises) h) Be able to link coverage and leverage ratios(relative to peers) 13. Be able to understand different elements of risk: (which are specific and general) a) Business risk b) Investment risk c) Country risk d) International risk e) Exchange rate risk f) Political risk 14. Fully understand how the 5-forces model works and be able to analyze scenarios. 15. understand differences in the cost leadership and product differentiation strategies 16. Know what a Focus Strategy is and how it works 17. Understand the benefits of SWOT analysis for an appraiser. 18. Be able to analyze financial ratios in terms of meaning and implications (DuPont Ratio elements; interpreting changes in ratios like change in ROI) 19. What are the appropriate sources of information for economic research on a business given the size, nature and location of the firm? New Material for March 3, 2015 Chapter 5 Chapter 5-4 20. Which of the following aspects of the economic and political environment would likely be the LEAST important for a local manufacturer of Cotton Clothing: A. Local labor pool B. Global demand for Cotton C. Foreign competitors entering the U.S. market D. Consumer spending Chapter 5-3/4 21. What is the purpose of Analyzing Industry Conditions and in what way does the Appraiser Use the results of this Analysis. A. To determine the effect of industry trends on the risk of the subject company B. To determine and justify the extent to which industry financial ratios should be adjusted C. To determine the appropriate adjustments to the reported profitability of the subject company D. To determine the appropriate pricing multiples used for guideline companies Chapter 6 Chapter 6-1 22. All of the following are examples of Porter’s five competitive forces EXCEPT: A. B. C. D. E. Threat of new entrants Bargaining power of customer Level of regulatory control Rivalry amongst existing firms Threat of Substitute Products Chapter 6-2 23. In the five factor analysis, factors which increase competitive rivalry in an industry include: A. B. C. D. E. F. G. H. High switching costs for customers Rapid market growth Large number of competitors High levels of product differentiation Low levels of product differentiation Steep Learning Curves High Fixed-to-Variable cost ratios Low Barriers to Entry in an Industry Chapter 6-6 24. Market conditions affecting the impact of substitutes include which of the following? A. B. C. D. E. F. G. Number of customers relative to sellers Relative price of substitutes Relative quality of substitutes Switching costs to customers Relative Performance of substitutes Concentration in the Industry Bargaining Power of Suppliers Chapter 6-4 25. In the following list, identify which party is the supplier and which party would likely have greater bargaining power (and why). A. B. C. D. E. F. G. Timber producers and paper companies Drug industry and hospitals Tire industry and automobile manufacturers Travel agents and airlines Crude oil producers and Crude Oil Refiners Cotton Mills and Textile Producers Casual Dining Restaurants and People Going out for Dinner Chapter 6-6 26. Overall, suppose that cost leadership is a valid. Identify which of the following activities create value (Value Drivers or Key Success Factors). A. B. C. D. E. F. G. Aggressive construction of facilities on an efficient scale Tight control of costs and overhead Elimination of marginal customer accounts Developing a design or brand image Extensive Research and Development Streamlining Distribution Channels Reducing labor costs through outsourcing or moving offshore.