The Portfolio Balance or Asset Market Approach

advertisement

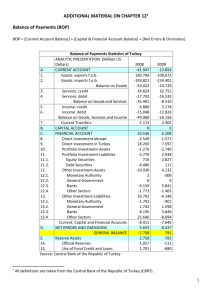

Chapter 5 The Monetary and Portfolio Approaches to External Balance Both approaches emphasizes the role of money and asset trade (not trade in goods and services) as the primary determinant of equilibrium: Balance of Payments (BOP) under a fixed exchange rate Exchange rate in a flexible rate system Equilibrium (BOP) here means the sum of categories I, II, and III transactions is zero, i.e, there is no official reserves flow. Monetary Approach: emphasizes the relationship between money demand and supply. Portfolio Approach: include other assets in addition to money. The Monetary Approach to BOP Imbalance in BOP is the result of dis-equilibrium in the money market A BOP deficit (surplus) is the result of excess supply (demand) for money A closer look at the money market A simplified Central bank balance sheet (Table 1) Money Supply: Ms = a(BR + C) a = monetary multiplier BR = bank reserves C = currency in circulation 1 (BR + C) = monetary base Money supply is changed by Open Market Operation (OMO) and short-term official reserves transactions OMO = buying or selling of domestic reserves (government bonds) Short-term official reserves transactions = category IV in BOP accounts Increase in central bank’s assets increases the money supply. The Linkage Between Disequilibrium in BOP and Changes In the Money Supply A BOP deficit requires a credit in Category IV transaction. Domestic central bank must decrease its holding of international reserves. This decreases domestic money supply. Conversely, a BOP surplus increases domestic money supply. Note that under the fixed exchange rate monetary policy cannot be independent. Money Demand . L f (Y , P, i ,W , E ( p), O) Money Market equilibrium (see diagram) Ms = L The Monetary Approach to Exchange Rate Determination Under a flexible exchange rate, BOP is always in equilibrium. Dis-equilibrium in the money market will cause fluctuations of the exchange rate. Suppose there is an increase in the money supply, this will lead to a situation called incipient BOP deficit. The adjustment process. 2 Two-Country Model Money demand in country A and B: La k a PaYa ; Lb kb PbYb Money Supply in country A and B: M sa ; M sb ; Equilibrium in both money markets M sa k a PaYa ; M sb kb PbYb Suppose we have PPP: ea / b Pa Pb From the money market equilibrium 3 Pa M sa k bYb b ea / b Pb M s k aYa , We finally arrive at ea / b a s b b b s a a M kY M kY . The Portfolio Balance or Asset Market Approach Assumptions: Integrated capital markets. Individuals hold both foreign and domestic assets. Imperfect substitution of foreign and domestic assets. Foreign assets are more risky. Individuals maximize their expected return from their portfolios. Portfolio rearrangements cause movements in BOP or exchange rate. Expectations are important in determining asset movements. Interest rate parity: 4 id i f xa RP Definition of wealth: Wd Ms Bd eBf , W where d should be defined as real domestic wealth, but will be inconsistent in the definition of wealth which is all in nominal terms. This is not a problem if we are dealing in the short-run where prices do not change. Demand for assets: Each individual holds three types of assets in their portfolio: (a) domestic money, (b) domestic bonds, and (c) foreign bonds: Ld f [id , i f , xa , RP, Yd , Pd , Wd ] , Bd f [id , i f , xa , RP, Yd , Pd , Wd ] , 5 B f f [id , i f , xa , RP, Yd , Pd , Wd ] . Supply of these assets are assumed to be exogenous. Thus, we have equilibrium in all three asset markets. Portfolio Adjustments The key point to remember here is that regardless of the type of disturbance, the country that experiences a capital outflow will also have a BOP deficit or a currency depreciation. Thus the main analytical tool you need to use is the interest parity condition. 1. A open market sale of government security by the home country’s central bank. The end result is an appreciation of the home currency. 2. An increase of inflation expectations by domestic residents. The end result will be a depreciation of the home currency. 3. An increase in real income in the home country. The end result will be an appreciation of the home currency. 4. + 5. An increase in real wealth of the domestic residents. Indeterminate result on home currency. 6. An increase in supply of foreign bonds. The end result will be an appreciation of the home currency. 6