File

Applied Economics Research Center

Karachi University

Macroeconomics 1

Assignment #1

Course Instructor: Tehseen Iqbal last date: February 20, 2013

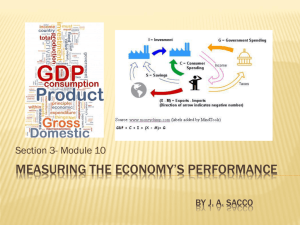

Q1.What are the three approaches to measuring economic activity? Why do they give the same answer?

Q2. Only goods and services that pass through organized markets count in GDP. Why?

Q3 Why are goods and services counted in GDP at market value? Are there any advantages or problems in using market values to measure production?

Q4 What is the difference between National Income and Personal income and how do we measures NI and PI?

Q5.For the purpose of assessing an economy’s growth performance, which is the more important statistics real GDP or nominal GDP? Why?

Q6. How good is GDP as a measure of national well being (welfare)? If it is not then why?

Q7 Why do we exclude intermediate goods from GDP?

Q8 Gross National Product, Net National Product and the national income are measures of the nation’s output. Yet, from conceptual standpoint, they differ; briefly explain what each attempt to measures.

Q9. A business firm produces a good this year that it doesn’t sell. As a result, the good is added to the firm's inventory. How does this inventory good find its way into GDP?

Q10. Which of the following are included in the calculation of this year’s GDP? (a)

Twelve-year-old Johnny mowing his family’s lawn; (b) Dave Malone buying a used car;

(c) Barbara Wilson buying a bond issued by General Motors; (d) Ed Ferguson’s receipt of a Social Security payment; (e) the illegal drug transaction

Q11. Indicate whether each of the following is included or excluded from GNP and the reasons for its inclusion or exclusion.

a) Government transfer payments. b) Rental income of owner-occupied homes. c) Change in inventories. d) Services of homemakers e) Indirect business taxes f) Export of goods and services g) Imports of goods and services. h) Business transfer Payments i) Financial transactions.

Q12 Indicate whether each of the following is included or excluded from national incomes and the rationale for its inclusion or exclusion. a) Undistributed corporate Profit. b) Proprietors’ income c) Capital gains. d) Indirect business taxes e) Net interest payment by government. f) Interest paid by consumers to business.

Q13. What is the difference in the two measures of inflation CPI and GDP deflator?

Q14 Consider an economy that produces only three types of fruit: apples, oranges and bananas. In the base year the production and price data were as follows.

Fruit

Apples

Quantity

3000 bags

Prices

$ 2 per bag

Bananas 6000 bunches $ 3 per bunch

Oranges 8 8000 bags $ 4 per bag

In the current year the production and price data are as follows.

Fruit

Apples

Quantity

4000 bags

Prices

$3 per bags

Bananas

Oranges

14000 bunches $ 2 per bunches

32000 bags $ 5 per bags a) Find nominal GDP in the current year and in the base year. What is the percentage increase since the base year? b) Find the percentage increase in the price level from the base year to the current year, using a fixed weight price index? c) Repeat part (b), using a variable weight price index. Are your answers similar?

Q15 You are given the following data on an economy

Gross domestic product =1000, Government purchase of Goods and services = 200,

Govt. deficit = 50, National Saving = 200, Investment = 150, Net factor Payment from abroad 25.

Find the following assuming that Government investment is zero a) Consumption b) Private saving c) Disposable income d) Gross domestic product e) Net export

Q16.Use the following hypothetical national income and product accounting data to answers parts a) –n)

National income = 2000, personal tax payments = 100, expenditure on services = 380,

Expenditure on non- durable goods = 370, personal saving = 150, receipt of factor income the rest of the world = 17, payment of factor income to the rest of the world = 20, gross private domestic investment = 410, Capital Consumption Allowance = 27, Imports

= 65, Net Export = -10. Government Purchase of Goods and Services = 490,

Undistributed Corporate Profit = 90, Corporate Profit Tax = 55, Dividents = 90, Indirect

Business Taxes = 57, Proprietors’ Income = 200, Government Transfer Payments = 300,

Government Interest Payment = 150, Net rental income = 100, Wages and Salaries1300,

Personal Interest Income = 0, Expenditure on New Plant and Equipment = 230,

Expenditure on New Residential Construction = 210

Find a) Exports, b) Corporate profit, c) Net National Product , d) Gross National Product, e) Net Factor income from the rest of the world, f) Gross Domestic Product, g) Net

Private Domestic Investment, h) Personal Consumption Expenditures, I) Expenditure on

Durable Goods, j) Disposable Income, k) Personal Income, l) Net Interest, m) Saving

Rate, n) Change in inventories

.