CONDOMINIUM HOTELS By Ray Iwamoto This article provides an

advertisement

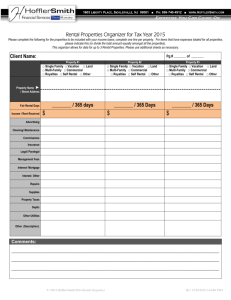

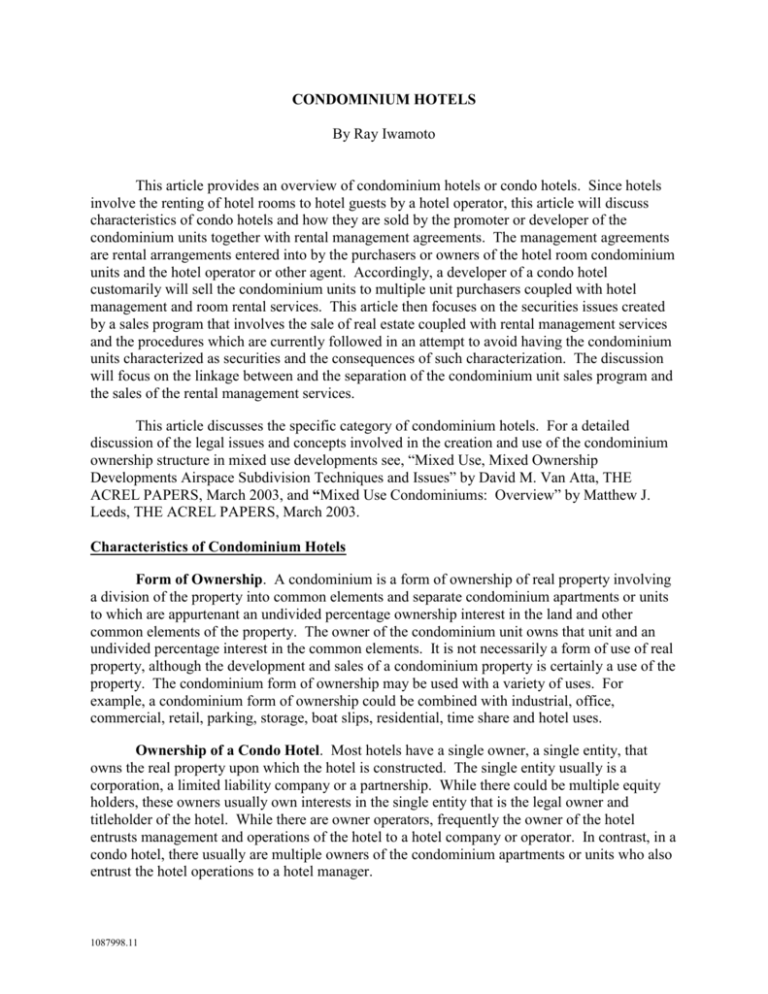

CONDOMINIUM HOTELS By Ray Iwamoto This article provides an overview of condominium hotels or condo hotels. Since hotels involve the renting of hotel rooms to hotel guests by a hotel operator, this article will discuss characteristics of condo hotels and how they are sold by the promoter or developer of the condominium units together with rental management agreements. The management agreements are rental arrangements entered into by the purchasers or owners of the hotel room condominium units and the hotel operator or other agent. Accordingly, a developer of a condo hotel customarily will sell the condominium units to multiple unit purchasers coupled with hotel management and room rental services. This article then focuses on the securities issues created by a sales program that involves the sale of real estate coupled with rental management services and the procedures which are currently followed in an attempt to avoid having the condominium units characterized as securities and the consequences of such characterization. The discussion will focus on the linkage between and the separation of the condominium unit sales program and the sales of the rental management services. This article discusses the specific category of condominium hotels. For a detailed discussion of the legal issues and concepts involved in the creation and use of the condominium ownership structure in mixed use developments see, “Mixed Use, Mixed Ownership Developments Airspace Subdivision Techniques and Issues” by David M. Van Atta, THE ACREL PAPERS, March 2003, and “Mixed Use Condominiums: Overview” by Matthew J. Leeds, THE ACREL PAPERS, March 2003. Characteristics of Condominium Hotels Form of Ownership. A condominium is a form of ownership of real property involving a division of the property into common elements and separate condominium apartments or units to which are appurtenant an undivided percentage ownership interest in the land and other common elements of the property. The owner of the condominium unit owns that unit and an undivided percentage interest in the common elements. It is not necessarily a form of use of real property, although the development and sales of a condominium property is certainly a use of the property. The condominium form of ownership may be used with a variety of uses. For example, a condominium form of ownership could be combined with industrial, office, commercial, retail, parking, storage, boat slips, residential, time share and hotel uses. Ownership of a Condo Hotel. Most hotels have a single owner, a single entity, that owns the real property upon which the hotel is constructed. The single entity usually is a corporation, a limited liability company or a partnership. While there could be multiple equity holders, these owners usually own interests in the single entity that is the legal owner and titleholder of the hotel. While there are owner operators, frequently the owner of the hotel entrusts management and operations of the hotel to a hotel company or operator. In contrast, in a condo hotel, there usually are multiple owners of the condominium apartments or units who also entrust the hotel operations to a hotel manager. 1087998.11 Increased Capital. The condominium form of ownership facilitates having multiple owners. The condominium units may be separately bought, sold and mortgaged. The condominium form of ownership facilitates multiple sources of capital because of the multiplicity of owners and because the units may be separately financed and used as mortgage collateral. This enhances the promoter’s or developer’s ability to raise capital and provides a source of funding with which to pay off or pay down construction financing, thereby avoiding the necessity of the developer’s take out financing. Long-term financing is provided by each unit purchaser and his or her lender. Use of Real Property. The concept of a hotel is a specific use of real property as well as a physical structure. Zoning regulations classify real property into permitted and prohibited uses and include specific categories of use such as residential, industrial, business and resort or hotel. Enlightened zoning officials, recognizing that condominiums are a form of ownership and not a form of land use, will not zone for or prohibit condominiums as part of their land use and zoning classifications. Zoning and land use restrictions play a large role in condo hotels. There are many large scale condo hotels in which a few unique individuals take up long-term residence. Others will buy their units with no intention of having hotel guests use their units in their absence. These owners will buy their units with no intention of entering into any rental management agreement with the hotel operator. Most buyers are not in such circumstances, however. They intend instead to rent their units, usually through the hotel operator. Zoning requirements could also impact whether the property or a part of the property could be used for long-term residency. As discussed below, zoning requirements will dictate restrictions on use to be included in the condominium documents. As with any place of public accommodation, as that term is defined in the Americans With Disabilities Act and its regulations, as amended, 42 U.S.C. §§ 12101 et seq., (“ADA”), there are a certain number of hotel rooms that must be accessible in accordance with the standards of the ADA, so the purchasers of these units will be prohibited by provisions in the Declaration from modifying these rooms. Form of Ownership Combined with Use. When you combine a hotel with a condominium, you combine a form of ownership with a specific use. Therefore, condo hotels can be viewed as hybrids. As with hybrid cars that combine gasoline engines with battery powered engines, the condo hotel combines the condominium form of ownership with a hotel use. However a hotel use is very much a mixed-use type condominium with long-term residential, short-term rentals and a mixture of various commercial uses. In any mixed-use condominium project, separate metering or sub-metering of utilities is essential in order to avoid or minimize disputes. The condominium documents will need to include provisions that attempt to balance the interests of basically three groups: the owners of the commercial apartments, the owners of the hotel room apartments who desire to reside therein and the owners of the hotel room apartments who place their units in the hotel pool. The condominium documents might include provisions that restrict the use of the condominium units in any manner which is inconsistent or incompatible with or not in keeping with the hotel operations of the building. On the other side of the coin, there should be provisions precluding the commercial apartments from operating in such a manner that may be inconsistent not only with a hotel operation but also with the interests of the condominium association of apartment owners. These would include restrictions as to hours of operations. The association would also want to maintain control over the physical appearance of the building. 2 Basic Features. A condominium consists of apartments or units and common elements, including the land. Condo hotels are mixed-use projects with mixed-use types of condominium units. The hotel rooms are designated as separate condominium units that make up the bulk of the number of units in the condo hotel and are sold to the general public. Profit centers are tied to the creation of special use condominium units that can be owned by a single or multiple commercial unit purchasers. They can also be leased to commercial operators. Typically, what is not designated as an apartment or unit is a common element. These include lobbies, corridors, stairwells, elevators, escalators, swimming pools, etc. Often the condominium documents will include requirements for scheduled maintenance and capital expenditures with respect to the common elements to assure the upkeep of the hotel. Parking stalls could be designated as common elements or as parking units or as limited common elements for the exclusive use of a designated condominium unit or group of units. Recreational facilities, such as swimming pools, are usually designated as common elements, with the costs of maintenance thereof to be paid by the unit owners in accordance with their percentage interests in the common elements. The expenses of maintenance of the common elements are pooled and paid by all the unit owners in accordance with their respective percentage ownership interests that are appurtenant to their units. The expenses of the units themselves are not pooled but are payable by the respective unit owner. Commercial Condominium Units. Conference and meeting facilities, spas, restaurants, bars, lounges, banquet facilities, sundry shops and other retail stores are usually designated in the declaration or other such condominium creation document as commercial condominium units. These units can be kept by the promoter, purchased by the hotel operator and either operated by the hotel operator or leased to a retail merchant, or purchased by a third-party purchaser. Hotel Operator Facilities. As in all hotels, there is a front desk. The front desk and other back-of-the-house facilities are also usually designated as commercial condominium units. These are either kept by the developer if the developer is also the hotel operator or sold to the hotel operator. Frequently the condominium declaration will describe this unit as a unit that will at all times include a clerk’s desk or counter that will be manned and operated 24 hours a day in order to provide clerk service and facilities for registration of guests and other hotel-type services. Certain areas of the building that would normally be common elements in non-hotel condominium projects are often designated as part of the front desk unit or as a limited common element appurtenant to the front desk unit. These would include loading docks, trash rooms, rest rooms, porte cochere areas, etc., and would be maintained by the owner of the front desk unit. In some projects the association of apartment owners would contract for the use of these amenities subject to the payment of a fee intended to reimburse the owner for the maintenance costs. Common Interests. The condominium documents will assign various percentage ownership interests that will be appurtenant to each condominium unit. In some jurisdictions these are called “common interests”. This percentage interest represents the apartment unit’s allocated undivided ownership in the land and the common elements of the project and the apartment unit’s share of common profits and expenses of the project. The percentage assigned to the various classes of units is usually left to the developer, subject to the requirements of the condominium law of the jurisdiction, such as a requirement to allocate in a fair and equitable manner. Since the primary use of the condominium will be as a hotel, often the percentage 3 allocation is assigned in such a manner as to favor or give precedence to the hotel room units and is then further allocated among the hotel room units in accordance with floor area. Other Provisions. The condominium documents will frequently provide that the owners and their guests will have a non-exclusive license for access to the hotel desk unit, the restaurant, spa and other commercial units for their intended purposes and to have access to banquet, meeting and conference facilities and spa units and other hotel amenities that are commercial units and not common elements, subject to rules and regulations set by the owners of such units and the payment of fees as established by such owners. As will be discussed below, it is critical that the purchasers of the hotel room units have the ability to rent their rooms on their own or through a rental management agency that is not the owner of the front desk apartment. The license for access to the hotel desk unit is necessary to assure all unit owners that their guests will always have access to the front desk. The condominium documents should provide that the front desk operator will provide room access keys to the association of apartment owners without charge. A hotel condominium is still a condominium and as in non-hotel condominium projects, the association of apartment owners should have the right of access to the units for emergency repairs, especially when not all of the units will be managed by a manager under a management agreement. The condominium documents should also provide that the front desk operator will provide room access keys to hotel guests. It would be reasonable to also provide that the operator may charge the owner of the unit a fee for check in and check out services. Hotel Unit Condominiums. The purchasers (and users) of the condominium hotel units have the value of access to hotel type and level of amenities and to hotel type and level of services such as room service, concierge, bellmen and valet services. Frequently this means that condo hotels command higher prices than non-hotel residential condominium projects. The condominium unit owner also has the benefit of professional management, which often rises to the level of five-star management if there is branded management by a hotel operator such as Marriott, Ritz Carlton, Hyatt, Four Seasons or Westin. Rental Management Agreement. Most buyers intend to include their units in the hotel pool (not to be confused with a rental pool and the pooling of income and expenses) and will enter into a management agreement with the hotel operator. There is then a sharing of room revenues for a specific unit between the manager and the owner of the unit. Generally the room revenues, after deducting travel agent commissions and credit card commissions, are divided evenly between the owner and the operator. At times, the operator takes a percentage fee (5 to 10%) before splitting the revenues. Frequently these agreements continue on an annual basis subject to termination by either party on thirty days notice. The manager determines the room rate. The manager pays the costs of maid services, laundry, linens, housekeeping, advertising and other such hotel costs and expenses. The owner agrees to reimburse the manager for maintenance and repair to the unit, other than normal housekeeping services, and sometimes minor maintenance costs are not passed on to the owner. The owner has to pay the maintenance fees charged by the association of apartment owners, real estate taxes, utility bills, insurance and other such ownership costs. The owner also agrees to furnish the unit in accordance with the manager’s standards. Sometimes the owner pays for extra cleaning at least twice a year. This would include rug shampooing, painting, furniture and fixture repairs, etc. The owner’s rights to use of the unit will also be specified in this agreement. 4 Economics of Investment. An investor who is interested in an investment in a hotel room through the purchase of a condominium hotel unit will find that financing the purchase and carrying the expenses of ownership may be more difficult than other forms of real estate ownership. The owner’s costs are payable from the owner’s share of the net revenues as stated above. Typically, there could be negative cash flow. For example, lenders will often require the purchaser to fund 20% or more as the buyer’s equity investment. In addition, sometimes there are requirements to prepay real property taxes for the first year on an estimated basis until the individual unit taxes are determined. Often there will be a requirement to also prepay six months of maintenance fees. On a $250,000.00 condominium hotel unit, the down payment would be $50,000.00, closing costs could be around $2,000.00 in addition to these prepay items. For a $200,000.00 loan, the monthly debt service could be around $1,300.00. After adding homeowner dues and monthly installments of property tax, the total monthly carry could be around $2,000.00 for an annual amount of $24,000.00. If the owner projects 60% occupancy at an average rate of $185 per night, minus a 10% fee and a 50-50 split with the hotel manager, that leaves the owner with approximately $18,000 a year of cash flow for a deficit of about $6,000.00 per year. At an average rate of $150 per night, the deficit would be around $9,000.00 annually. Of course, there are also tax attributes to consider. Whether these matters may be discussed with potential purchasers leads to a discussion of the securities issues. Rental Arrangements and the SEC Section 5(a) of the Securities Act of 1933 prohibits the use of the mails or any instrument in interstate commerce to sell or to transmit for the purpose of sale or delivery after the sale, of any “security” for which a registration in not in effect. The definition of “security” in Section 2(1) of the Securities Act of 1933 includes an “investment contract”. In the leading case of SEC v. W.J. Howey, 328 U.S. 293, 90 L.ED. 1244 (1946), the United States Supreme Court (with Justice Frankfurter dissenting) defined the term “investment contract” as “a contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of a promoter or a third party.” The Court said that the definition “embodies a flexible rather than a static principle, one that is capable of adaptation to meet the complex and variable schemes devised by those who seek the use of the money of others on the promise of profits.” Howey involved the sale of citrus orchard groves coupled with a contract for cultivating the groves, marketing the fruit and remitting the net proceeds to the investor. The principles of Howey have been extended to the sale of condominium units. What are the consequences of violating the securities laws in the sale of hotel condominiums by the developer and its sales agents? If the sale of the hotel condominiums are deemed to be investment contracts and, therefore, securities for which there is no securities registration, then the SEC could bring injunctive proceedings and/or an action to seek money penalties for securities violations. In addition, the SEC may transmit evidence to the Attorney General who may, in turn, institute criminal proceedings. In the 1960’s, the SEC enjoined the developers of the Maui Hilton (now called Kaanapali Villas) from any further sales of the project. In the MauiHilton project, the hotel rooms were sold to individual condominium purchasers by the developers with an agreement by the Hilton Hotel Corporation that it would manage the units as a hotel provided a certain number of units participated. Participation was not mandatory. About half of the units had been sold. 5 The developers were required to offer rescission to the purchasers. Since these were securities, the rescission offer had to be registered. It took about a year to clear the registration through the SEC. Approximately 18 of the 114 apartment owners accepted the rescission offer. Then the developers were required to register a new securities offering, i.e., an offering of the 18 rescinded units plus approximately 150 unsold units. In addition, if sale of the condominium hotel units is deemed to be the sale of a security for which there is no registration, the purchasers are entitled to civil remedies, which are essentially rescission plus interest (less any income received), or damages if the hotel condominium unit has been sold. Then there are all of the anti-fraud and misrepresentation remedies under the Securities law and in particular 10(b)(5) liability, which is beyond the scope of this article. Since the condominium units are intended to be owned by multiple owners and yet used as hotel rooms and rented to hotel guests on a short-term basis by a centralized hotel operator or manager, there is a risk that the sales of the condo units coupled with rental management services will be an investment contract, i.e., a security, subject to the Securities and Exchange Act of 1933. Therefore, the challenge to the promoter/developer is the avoidance of converting what is intended as a real estate project into a securities offering subject to oversight and regulation by the Securities and Exchange Commission. The Securities and Exchange Commission has taken the position that the offer or sale of condominium units may be classified as the offer or sale of “securities” within the meaning of the Securities Act of 1933 if the unit is offered or sold with a rental pool arrangement, a mandatory rental agreement or is otherwise based on representations of economic benefit to the purchaser to be derived from managerial efforts of a third party in connection with the rental of the units. To avoid the sales of the condominium units being re-characterized as sales of investment contracts and therefore securities under the Securities Exchange Act of 1933, rigid procedures must be followed. The great majority of purchasers of a hotel condominium unit or any other resort condominium property plan to use the unit only part of the time and most of them intend to rent their unit out when they are not personally using it. In addition, zoning requirements could constrain the use of certain condo hotel properties as long-term residential properties. A Honolulu hotel was purchased and then converted to a condominium hotel. The land upon which this hotel is located is not zoned for hotel use and the use as a hotel is a legal non-conforming use. In addition, the improvements are a non-conforming structure because there are insufficient parking stalls to satisfy current zoning requirements. Therefore, it is essential that the hotel not lose its non-conforming use status and non-conforming structure status. As a result, the condominium documents include use restrictions requiring that a certain percentage of the hotel room units be used strictly for short-term hotel type rentals and prohibiting the owners of the hotel room units from installing microwave ovens, sinks and other kitchen type equipment. If a purchaser purchases a unit that is required to be used for short-term hotel-type rentals, how then does a sale of that unit escape characterization as an investment contract? The saving feature is probably the fact that the purchaser has the discretion, flexibility and right to rent the unit on his or her own and thus possibly avoid the third prong of the Howey test, i.e., the 6 expectation of profits solely from the efforts of the promoter or a third party.1 Therefore, it is essential even under the Intrawest structure (to be discussed below) to emphasize to the purchasers that there is no requirement that they enter into any management agreement with the promoter or any third-party managing agent. As described above, the condominium documents in describing the front desk apartment will include provisions whereby the operator of the front desk will provide check in and check out services and issue keys to all hotel guests and this is not limited to the guests of owners who enter into rental management agreements with the hotel operator. If the hotel operator is permitted to charge a fee for such services, it would be prudent to include a statement that the fee will not be greater than the equivalent fee charged to owners who enter into rental management agreements with the hotel operator. The same concept would apply to any provisions of hotel operator assisted telephone service, internet cable type services and pay per view movies and other hotel type services. Until 2002, and the issuance by the SEC of its No Action, Interpretive and/or Exemptive Letter: Intrawest Corporation, November 8, 2002 (the “Intrawest No Action Letter”), developers would implement procedures to insure that their sales personnel were trained not to mention the possibility of rental management services. Prior to the Intrawest No Action Letter, developers would issue guidelines to their brokers and their sales personnel emphasizing that there is to be no mention of, no discussion of and no answering of questions concerning economic or tax benefits or even rental arrangements. Attached is a typical form (“Attachment 1”) used by developers to provide guidance to brokers and their sales force. The guidelines are derived from various SEC releases and no action letters. In SEC Release No. 33-5347, the SEC stated that in order to avoid having the condominium units characterized as securities, the developer could only disclose the availability of rental services in response to an inquiry from a purchaser. In other words, a “don’t ask, don’t tell” policy. The developer would even send “shills” who would pretend they were buyers interested in buying a unit with rental management services in an effort to police the activities of sales personnel, and the report of the shills would be placed in a burden of proof file. Under the Intrawest No Action Letter, no one is permitted to mention or discuss or answer questions about economic or tax benefits. However, and this is a significant change resulting from the Intrawest No Action Letter, it may be possible to include a simple statement in sales or other promotional brochures and sales personnel may state that “Ownership may include the opportunity to place your unit in a rental arrangement.” In its letter to the SEC describing Intrawest’s proposed sales of condominium units with the offering of rental management services, the attorneys from Ballard Spahr who represented the developer, stated that Intrawest intended to inform the buyers of the availability of a rental arrangement and that the SEC’s “don’t ask, don’t tell” policy concerning renting takes its position to an illogical extreme whereby the purchaser is prevented from including in due diligence what he or she can do with the unit when not occupying it. The staff saw merit in this argument and in this No Action Letter the SEC informed Intrawest that, if Intrawest informed 1 The Supreme Court in SEC v. W.J. Howey Co., 328 U.S. 293, rehearing denied, 329 U.S. 819 (1946) created the “economic realities” analysis whereby an interest will be classified as a security only if three elements are concurrently present: (i) an investment of money; (ii) in a common enterprise; and (iii) the expectation of profits solely from the efforts of the promoter or a third party. 7 prospective purchasers that ownership may include an opportunity to place the unit in a rental arrangement and told the purchaser to speak with rental management personnel of its choice or from an affiliate of Intrawest that was located nearby, and the other procedures described in the letter to the SEC were followed, the staff of the SEC would not recommend enforcement action to the Commission. So Intrawest is permitted to offer rental management services so long as there is no pooling of income under the rental management arrangement and there continues to be no discussion of economic or tax benefits in the sales of the units. In order to highlight the changes resulting from the Intrawest No Action Letter, in the attached specimen guidelines for guidance to brokers and their sales personnel, permitted and still prohibited actions under the Intrawest No Action Letter are set out in italics. Sales personnel have to be trained on how to steer buyers to the rental agent personnel and both have to be well versed as to what they are permitted to say and prohibited from saying to prospective purchasers of the units. As stated in the Intrawest No Action Letter, it only represents the staff’s position on enforcement and does not purport to express any legal conclusion on the questions presented. Commentators have written that, since the SEC began publishing their No Action Letters, the SEC intends for parties to review and compare them with their own situation and factual patterns and that these letters are somewhat in the nature of “safe harbors”. However the facts and circumstances must be almost identical or there would be risks involved. Technically, no one but Intrawest may rely on the Intrawest No Action Letter. Unless a developer follows the Intrawest model exactly as presented to the SEC, there would be serious risks involved and the developer should instead seek its own no action letter. (See discussion below concerning the use of refundable versus non refundable deposits in the sales contracts for the condominium units.) While condo hotels merge the condominium form of ownership with hotel management operations, in the marketing of the condominium units and the arrangements for the rental management of the units, the sales program must be separated from the rental program and the sales force must be divorced from and separated from the rental management personnel. This separation is essential in every aspect and is vital to avoiding characterization as a security. The sales office and the rental management offices and location of their respective personnel and the personnel of these respective programs should be separate and distinct and perhaps even on different floors. There should be different telephone numbers and email addresses. Sales personnel should be instructed that they can only make the simple statement that was approved in the Intrawest No Action Letter, i.e., “Ownership may include the opportunity to place your unit in a rental arrangement” and can say no more on the subject other than suggesting that the buyer speak to a rental manager of their choice or to the rental management personnel located on the property. If the buyer insists on asking the sales personnel about rental, the sales personnel should say that rental management is up to the buyer, that there is no requirement to have such arrangements before buying the unit. A list of prospective rental management agents including the affiliated manager may be provided. The sales personnel can and should emphatically state that there is to be no pooling of income and expenses and that there is no pooling program whatsoever. Beyond that, the sales personnel should be instructed to say that they are prohibited from discussing rental any further. Sales brochures and other marketing materials, including websites should not mention rental management services or any 8 rental program with the sole exception of the statement, “Ownership may include the opportunity to place your unit in a rental arrangement.” Rental management personnel should be instructed that their program is to be kept separate and apart from the sales program, that no one may sign any rental management agreement before signing a contract to buy a unit and the rental management agreement will only be effective and will be contingent on the actual closing of the purchase of the unit, that there can be no incentives offered for buyers to enter into rental management agreements and emphasis should be placed on the fact that the buyers are truly free to enter into rental management arrangements with agents of their choice or to attempt to rent the units on their own without an agent and that there are no penalties for doing so and also no incentives for signing with the rental management company. The actual rental management agreement form should not be given to any prospective purchaser who has not yet signed a sales contract for the purchase of a unit. It would also be the safer policy for the rental management personnel to not provide details of the rental management program until the purchaser has signed a sales contract for the unit. For example, until a sales contract is signed, it would be preferable not to provide the budget of estimated expenses for the unit. This of course does not preclude any budgets for estimate common maintenance expenses for the common areas, if any, that are incident to the ownership of the unit (separate and apart from rental expenses). Note that the Intrawest No Action Letter states that “Under no circumstances will Intrawest enter into a rental management agreement with a prospective purchaser before such purchaser enters into a purchase and sale agreement for one or more units. Upon entering into a purchase and sale agreement with Intrawest, a purchaser is required to pay a non-refundable deposit equal to 10% to 20% of the purchase price.” Depending on the project and the jurisdiction, developers will use various forms, such as reservation agreements and other purchase and sale agreements wherein the deposits may be refundable. This could represent a significant difference to the SEC staff. The Intrawest No Action Letter also states that “The Staff has indicated that entering into a rental agreement after the purchase and sale agreement have been executed but before closing is unacceptable. See FC Beach Joint Venture (available May 29, 1998).” The Intrawest No Action Letter emphasized that the effectiveness of their rental management agreement will be conditioned upon the consummation of the sale. Whether this feature overcomes the fact that the purchase and sale agreement used by other developers may not be as binding as the one used by Intrawest is unclear. As mentioned above, the prudent course would be for each developer to seek its own no action letter tailored to its own situation. There is still a “don’t ask, don’t tell” policy that remains in place even with the rental management personnel. They can only provide historic market rental information if asked and only to the extent such information is available through public sources, and such information can only be given in its raw data form. No projections of rental rates, income, expense or occupancy or any other financial information can be given. If the project has been operating, usually the operating data is publicly available and so the buyer may be told what the rack rates have been for the project as well as publicly available occupancy information. If the project has not yet opened then only publicly available information concerning other projects in the area may be disclosed in its raw data form. 9 Summary. Condo hotels, as a legal structure, begin with a “marriage” of condominium hotel ownership with hotel operations. In order to avoid the registration and other requirements applicable to the sales of securities, it becomes imperative to avoid having the sales of the condominium units characterized as the sale of securities. This requires a “divorce” or “separation” of the marketing of the condominium units from the hotel rental management services and of the personnel selling the condominium units from the personnel involved in selling the hotel rental management services. This separation involves a separation in geographic location, a separation of personnel and differences in what the respective personnel are permitted to say and to show the prospective purchaser. The gasoline does not mix with the battery. 10 LIST OF ATTACHMENTS Attachment 1 Broker’s Responsibilities in Sale of Units in the XYZ Project to Avoid Classification of Condominium Sales as Securities (“Guidelines”) 11 ATTACHMENT 1 BROKER’S RESPONSIBILITIES IN SALE OF UNITS IN THE XYZ PROJECT TO AVOID CLASSIFICATION OF CONDOMINIUM SALES AS SECURITIES Dated: Honolulu, Hawaii ____________, 20___ 1. The broker should undertake a training program for all sales personnel involved in the sale of units in XYZ condominium project (the “Project”), to alert them to possible securities violations and to fully familiarize them with the terms of the Securities and Exchange Commission Release No. 5347 dated January 4, 1973, as well as the Guidelines for Salespersons attached as Exhibit B hereto. 2. All salespersons should be required to attend a training program for the Project prior to being allowed to sell the Project and the broker should obtain and keep on file a Receipt, in the form attached hereto as Exhibit A, signed by each salesperson acknowledging receipt of the Guidelines as set forth in Exhibit B attached hereto. 3. The broker should cause each buyer of a condominium unit to sign a Securities Disclaimer statement, in the form attached hereto as Exhibit C, acknowledging that no representations have been made with respect to the rental of apartments and investment aspects. Intrawest The broker should cause each buyer of a condominium unit to sign a Securities Disclaimer statement, in the form attached hereto as Exhibit C, acknowledging that no representations have been made with respect to investment aspects 4. The broker should make frequent and unannounced spot checks of all salespersons to determine if such salespersons are fully complying with the Guidelines as set forth. 5. The broker should keep a timely and complete record of his findings and should immediately terminate from the Project any salespersons making statements which could subject XYZ Developer or its affiliated companies to securities or other sanctions. 6. The broker should instruct all salespersons to not give any legal interpretation to a purchaser or prospective purchaser of the documentation for the Project, including without limitation the Public Reports issued by the Real Estate Commission, the Declaration of Condominium Property Regime and By-Laws, Sales Contract, or Apartment Deed. Receipt for Guidelines The undersigned hereby acknowledges receipt of the “Guidelines for the Sale of Units in XYZ Project” dated __________ 20___ and hereby covenants and agrees with XYZ Developer to comply with all of the provisions thereof, and to indemnify and hold XYZ Developer harmless from any loss, liability or damage resulting from the undersigned’s failure to comply. Date: Salesperson Exhibit A GUIDELINES FOR THE SALE OF UNITS IN XYZ PROJECT Dated: Honolulu, Hawaii __________, 20___ The Securities and Exchange Commission has taken the position that the offer or sale of condominium units may be classified as the offer or sale of “securities” within the meaning of the Securities Act of 1933 if the unit is offered or sold with a rental pool arrangement, a mandatory rental agreement or is otherwise based on representations of economic benefit to the purchaser to be derived from managerial efforts of a third party. To avoid any implication of a sale of a security, it is imperative that all sales efforts for XYZ condominium project (the “Project”) conform to the following guidelines and sales practices: 1. Guidelines for Salespersons Each salesperson involved with the Project, including cooperating brokers participating pursuant to written or oral agreements with a Project broker or otherwise subject to the control and counseling of a Project broker, must carefully observe each of the following guidelines. In the event that questions arise with respect to an individual situation or interpretation or application of guidelines not covered below, they should be referred to XYZ Developer, and to its counsel, for answer. (a) In order to avoid any implication of an economic inducement, salespersons are not to initiate any conversation with customers regarding rental investment aspects for the Project, tax consequence of ownership or the availability or feasibility of rentals. Salespersons are not to participate in any discussion or solicit any inquiry as to rental investment potentials or tax consequences of ownership. Intrawest Salespersons may mention a rental program but only as follows: “Ownership may include the opportunity to place your unit in a rental arrangement” If the prospective purchaser seeks more detailed information on unit rental, the salesperson may suggest that the person speak to a rental management company representative, either with any rental management company of the person’s choice or with a rental management company that is affiliated with the Developer. (b) In any sales presentation, no statement or representation of any kind is to be made as to any economic benefit or advantage which may be realized from owning a Exhibit B – Page 1 unit in the Project. Under no circumstances will there be any discussion of economic or tax benefits whatsoever. Even publicly available information such as rental history of comparable property in the area is not to be mentioned. Intrawest Representatives of the Rental Management Company that is affiliated with the Developer may not offer such information but may provide information concerning the rental history of comparable facilities in the area only in response to a specific inquiry from the buyer. Such information will only be in the form of raw data that has not been modified by sampling, statistical analysis or by any other means. Projections of future rental income or expected occupancy rates will not be provided by sales personnel or by representatives of the Rental Management Company. (c) A customer inquiring as to the general proposed uses for the units should be told that the units should be considered primarily as residences for personal occupancy, as set forth in the Sales Contract, Apartment Deed and other condominium documents. If the customer further inquires as to the investment aspects, he should be told that no representations regarding investment, income or tax benefits can be made. Intrawest The units need not be considered primarily as residences for personal occupancy. Sales personnel may state, “Ownership may include the opportunity to place your unit in a rental arrangement.” (d) A customer inquiring specifically as to whether he may rent his unit should be told that the unit should be purchased for owner-occupancy purposes, as set forth in the Sales Contract, Apartment Deed and other condominium documents. Intrawest The customer may be told that “Ownership may include the opportunity to place your unit in a rental arrangement.” (e) * A customer inquiring specifically as to the availability of a rental pool* should be advised in very clear terms that no rental pool is available. The term “rental pool” refers to the “pooling” or sharing of expenses and income among several owners. This should be distinguished from “rental arrangement” or “rental management services” under which the agent acts as the agent of the unit owner, returning all rental income to such owner arising directly from the use of the unit, less the agent’s expenses and fees. Exhibit B – Page 2 Intrawest Pooling of Rents will not be available under any circumstances. (f) A customer inquiring specifically about the availability of rental management* should be told that if, subject to restrictions set forth in the Sales Contract, Apartment Deed, and other condominium documents, an owner elects to rent his apartment, he must make his own arrangements. Intrawest The customer may be told that “Ownership may include the opportunity to place your unit in a rental arrangement.” The customer may be given a list of rental agents to speak to, including one affiliated with the developer. (g) 2. Salespersons should obtain a signed Securities Disclaimer statement from each person who signs a Sales Contract for a unit in the Project. Answers to Questions Commonly Asked by Prospective Purchasers The following is a list of typical questions asked by prospective purchasers. All salespersons should answer the questions as set forth below under each item. (a) What is the rental market like in this area? “I am sorry, under the securities laws I cannot make any projections or representations as to the potential for rentals or rental rates in this area.” Intrawest Sales Personnel may not provide this information. Representatives of the Management Company may provide publicly available historical rental information in raw data form, but only in response to an inquiry from the customer. (b) How much per day/per month would a unit like this rent for? “I am sorry, under the securities laws I cannot make any projections or representations as to the potential for rentals or rental rates in this area.” Intrawest Projections of future rental income or expected occupancy rates will not be provided. Neither the sales personnel nor the rental management personnel may provide any projections and the rental management personnel may only, in response to an inquiry provide only publicly available historical data and the data must be communicated in its raw Exhibit B – Page 3 form. Also, representatives of the rental management company may only provide information in response to specific inquiry. (c) Is there a possibility that the rental from my unit may cover my carrying costs? “I am sorry, under the securities laws I cannot make any projections or representations as to the potential for rentals or rental rates in this area.” Intrawest Neither the Sales Personnel nor the Rental Management Personnel may provide any information concerning projections of future results. (d) What kind of tax shelter will this unit create for me? What monthly expenses for this unit are deductible for tax purposes? “The income tax consequences of ownership will vary according to the individual circumstances of each owner and, therefore, we recommend that you consult your own tax adviser as to the possible deductions and other tax consequences applicable to you.” Intrawest Neither the Sales Personnel nor the Rental Management representatives are permitted to discuss tax aspects. (e) What about depreciation? What portion of the purchase price can I write off? “The income tax consequences of ownership will vary according to the individual circumstances of each owner and, therefore, we recommend that you consult your own tax adviser as to the possible deductions and other tax consequences applicable to you.” Intrawest Neither the Sales Personnel nor the Rental Management representatives are permitted to discuss tax aspects. (f) How much would a unit like this appreciate in value? “We cannot speculate as to the amount or whether it would appreciate at all.” Intrawest Neither the Sales Personnel nor the Rental Management representatives are permitted to discuss economic benefits. Exhibit B – Page 4 (g) What rental services do you provide? “We do not provide any rental services.” Intrawest The Sales personnel are to suggest that the buyer speak to a representative of a rental management company of their choice or to a representative of an affiliated rental management company. The office of this affiliated rental management company may be on site and in close proximity to the sales office. If the inquiry is from a potential purchaser who has not yet signed the sales contract to buy a unit, the Rental Management representatives should not provide a copy of the rental management agreement to the purchaser and should only provide general information about the services. (h) Who will manage my unit when I’m not using it? “The condominium documents provide for the appointment of a Managing Agent who has custodial responsibility over the entire Project and he will attend to the upkeep of the common property and the general operation of the condominium project. However, the Managing Agent will not ‘manage’ the interior of any individual unit.” Intrawest The Sales Personnel are permitted to inform the buyer that the unit may be placed in a management arrangement. (i) Will the Condominium Managing Agent handle the rental of my unit if I pay him extra? “The Managing Agent’s contract with the Association only provides for custodial and maintenance services.” (j) Do you have a rental pool which I could join? “No. No rental pools are available or being offered in connection with this Project.” Intrawest Pooling of Rents will not be available under any circumstance. Each unit will have separate income and expense accounts and each owner’s rental income will be directly tied to the number of days that its unit or units are rented. Exhibit B – Page 5 SECURITIES DISCLAIMER XYZ CONDOMINIUM PROJECT STATE OF HAWAII REAL ESTATE COMMISSION REGISTRATION NO. _______ The undersigned purchasers hereby acknowledge and certify that no representations or statements have been made to the undersigned by XYZ Developer, (the “Developer”) or any of its agents, representatives, real estate salespersons or brokers, with respect to the possibility or probability of rental or other income from the purchase or ownership of a condominium apartment in XYZ condominium project (the “Project”), or any other economic benefit or any tax benefit to be derived from the purchase or ownership of the apartment, including, but not limited to, any reference or representation to the effect that the Developer or the Managing Agent of the Project will provide, directly or indirectly, any services relating to the rental or sale of the apartment or any representation or reference to tax treatment (federal, state or otherwise) of any purchaser of an apartment. I have been informed and understand and agree that the rental or other disposition of the apartment and the provision of management services in connection with the apartment shall be my sole responsibility. I further acknowledge and agree that I have read and understand Article ____, Section ____ of the Sales Contract with respect to such representations. Date signed Purchaser Date signed Purchaser Date signed Purchaser APARTMENT NO. Intrawest The undersigned purchasers hereby acknowledge and certify that no representations or statements have been made to the undersigned by XYZ Developer, (the “Developer”) or any of its agents, representatives, real estate salespersons or brokers, with respect to the possibility or probability of rental or other income from the purchase or ownership of a condominium apartment in XYZ condominium project (the “Project”), or any other economic benefit or tax benefit to be derived from the purchase or ownership of the apartment, Exhibit B – Page 6 including, but not limited to, any rental information or any representation or reference to tax treatment (federal, state or otherwise) of any purchaser of an apartment, other than information that I may have an opportunity to place my unit in a rental arrangement. I have received only publicly available historic rental information from representatives of XYZ Management Company personnel and not from any condominium unit sales personnel. I have received no information concerning projected results. I have been informed and understand and agree that the rental or other disposition of the apartment and the provision of management services in connection with the apartment shall be my sole responsibility. I have been informed that XYZ Management Company’s rental program is completely voluntary on my part. I may choose to enter into an arrangement with another rental management company of my choice or to rent my unit on my own. I have not entered into any such rental management agreement prior to signing my Sales Contract for a unit. My rental management agreement with XYZ Management Company is separate from my Sales Contract for my unit and is contingent on my closing on the purchase of my unit. I am purchasing the unit for personal reasons and not based on any expectation of realizing an investment return through any rental program or services rendered by XYZ Management Company or any other third party agent. I further acknowledge and agree that I have read and understand Article ____, Section ____ of the Sales Contract with respect to such representations. Exhibit B – Page 7