Fundamental of Accounting

advertisement

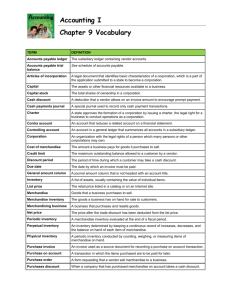

University of South Asia Lahore Layyah Campus Fundamental Accounting B.com Course Outline First Semester BEFORE MID Basic Terminology of Accounting Accounting concept Debit credit rules Book –keeping Journal ,ledger, Trail balance Theory and practical work of (journal,ledger,Trail balance) Accounting Equation Theory and practical work of ( accounting equation) BASIC TERMINOLOGY Definition of Business Activity or action under taken by a trader with objective to earn profit, is called business. Example: Banking business etc. Trader A person who performs or dealing in trading is known as trader. Types of Business There are three types of business Trading Manufacturing Service Trading It is a type of business in which the trader purchase, merchandise/goods and sells then in same position. Manufacturing It is another type of a business in which trader, trade purchase goods and sells them after some changing Example: Sugarcane, sugar Service It is another type of a business in which any person rending services for earning income is formation as services business Example: Teacher, Doctor etc Transaction Any dealing between two or more persons in the business for goods or services which effects financial position of a business is called transaction. Manufacturer A person, who manufactured goods for business, is called manufacturer. Proprietor A person who invests the money or things in the business is called proprietor, owner. Capital Proprietor money or things which he invests in the business is called capital. In other words, a proprietor interest in the business is called capital Drawings The cash or goods taken away from business by the owner for this personal or private user are called drawing. Basic Transaction Merchandise Purchase Purchase Return/Return out word Purchase Allowance Purchase Discount Sales / Turnover Sales Return / In word / Return by Customer Sales Allowance Sales Discount Reason of Return Sales Profit / Loss Invoice / Bill Voucher Trade Discount, Cash Discount, Discount Allowed, Discount Receipt Case Memo, Debtor, Creditor Revenue/Income, Expenses Material, Direct Material Indirect Material Account, Types of Account, according to British Approach, American Approach Salary and Wages Commission Business Transaction A business transaction is occurrence of a condition that must be recorded as an exchange of merchandise / services in case of it purchase and sales at particular price and date. Cash Transaction When cash is paid or received recorded as a result of an exchange of merchandise or services on cash bases is called cash transaction. Credit Transaction When the payment or receipt of cash for future date. Merchandise The things purchased for resale purpose. Purchases Merchandise purchased for being sold purposes. It may be cash purchase and credit purchase. Purchase Return If purchased merchandise are return by supplier / creditor, due to any reason is called purchase return. Reasons o Found defective goods. o Damaged o Not according to sample o Excess of quantity ordered Purchase Allowance If purchaser inform supplier that some merchandise are damage, reduction in price by supplier. Purchase Discount The concession allowed by the supplier on the purchase of merchandise. Sales / Turnover Merchandise sold are called sale. When merchandise are sold by any person at particular price. It may be cash sale / credit sale. Sales Return / inword When any purchase goods are returned by customer to business due to any reason some purchases Reasons o Found defective goods. o Damaged o Not according to sample o Excess of quantity ordered Sales Allowance It the seller is informed by the purchaser, that some goods are effective due to some reason, and agree to sale on reduction price. Sales Discount The concession allowed by the seller on the sales of goods to purchaser. Profit Excess income over expense. Loss Excess expense over income. Invoice / Bill A document list given by seller to buyer for credit or cash sales, purchase of goods. Voucher Written evidence which prepare in support of business transaction is called voucher. Trade Discount It is a deduction allowed by trader/seller, to buyer on list price of product at time of its selling When merchandise are sold in bulk. When custom is old customer. When merchandise are sold to trader. No accounting transaction passed and record, but it verbal. Cash Discount A discount which is allowed or received at the time of cash receipt or payment on credit sales or purchases. Discount Allowed A discount which is allowed by seller to buyer at the time of early receipt against credit sales. Discount Received A discount which is received by the buyer from seller at the time of early payment against credit purchase. Cash Memo It is a voucher that is used for exchange of goods or services for cash. Debtor The person who sold goods is business on credit/cash base. Creditor The Person who purchase goods for business on credit/cash base. Revenue/Income It is means received amount from sold of merchandise in the business. Expenses Cost doing business is called expenses. Material Buying things which are made different things. Direct Material Direct material are those material which are used directly in manufacturing a products e.g. cotton, cloth. Indirect Material The materials which necessarily used in manufacturing a product, but the cost of those material cannot be directly measures of that product, Account A summarized record of transactions relating to a particular person or things is called account. Types of Account, according to British Approach Personal Account. Real Account. Nominal Account. Personal Account Accounts which is relating to persons, firms, companies, are called personal account. Real Account Accounts, which keep records of properties or things owned by business, are called real account. or The account which contains Assets, Liability, owner, equity of a business, is called real account. Nominal Accounts All these accounts which keep record of expenses, gain, losses. Types of Account, according to American Approach I) Assets. II) Liabilities. III) Capital. IV) Revenue. V) Expense. Commission Remuneration for services performed by one person to another normally o the percentage basis is called commission Salary A fixed remuneration for services performed by one person to another for fixed period and fixed price is called salary. Book Keeping Book-Keeping is an art of recording the business transaction is prescribed manner in set of book, is called Book Keeping. A book keeper is responsible for recording of business data. His job is clerical nature. It is field of recording accounting system. For preparing of book-keeping, not require any special skill or knowledge. It is base of Accounting. Definition of Book-Keeping Book-Keeping is the recording branch of accounting. Book-Keeping System There are two system of Book-Keeping Single Entry Book System. Double Entry Book System Objectives of Book-Keeping To keep written record of business. To provide periodic results. For Owner For Management. For Suppliers. For Owner The primary objective of book-keeping with reference to the owner is to the supply of following: The amount of profit earned or loss sustain during trading period. Increase of decrease in owner, equity and total value of Assets, Liabilities. For Management The books-keeping must provide financial information, to management, such information help then in _ future, for planning, and taking decision. For Suppliers Book-keeping provide information to suppliers, and other financial institution who have no access in determining financial position of a business What is Accounting Accounting is the art of recording, analyzing, classifying, summarizing, reporting, interpreting and projecting and communicating the results of economic activity or business activities In another words we can say accounting is language of business. Recording In this part we record the books of original entry. Classifying After analyzing business transaction divided into Real, Personal, Nominal Accounts. Prepare journal, ledger transaction. Analyzing Analyzing, according Personal, Nominal and Real Account, of different business transactions. For analyzing apply Debit, Credit rules. Identify Capital, Revenue and Expenses. Summarizing In summarizing prepare from ledger or profit and loss trading and balance sheet. Reporting Prepare business summarizing along with signature of Authentic Officer and prepared formal documents. Interpreting After reporting, gives its explanation in easy words to interested person in business provide them accurate information to investor, owner, customer, Govt. or any person who engaged in business activities. Projecting In this field of Accounting, take information _____, reporting, interpreting for business future. Example: o Future product quantity. o Future product quality, material, purchase, area etc. The purpose of Accounting The basic purpose of accounting is to provide decision makers with information useful in making economic decision. Such as Money, land, labor, wages. To provide information about the accounting period results. To provide information about financial position of business. To provide information to management for future planning. To provide information for income tax collection. To provide information for general purpose. Financial Position The financial resources and obligations of an organization as described in a balance sheet. Limitations of Accounting It deals only with past transactions. Accounting statements do not ____ the effect of inflation. Accounting Cycle Accounting Cycle start from journal ______ and end with balance sheet. DIFFERNIATE BETWEEN BOOK-KEEPING AND ACCOUNTING Difference Points Book-keeping 1: Recording it is recording phase of it is summarizing phase of accounting system 2. Skill 3. Base accounting system it does not require any it requires special skill and special skill or knowledge knowledge It is the basis of accounting It is business language Debit Amount recorded on left side of account. Credit Amount recorded on right side on account. Rules of Debit and Credit Accounting Debit Credit Increase in Assets. Decrease in Assets. Increase in Expense/loss. Decrease in Expense. Decrease in Liabilities. Increase in Liabilities. Decrease in Capital/Ownership. Increase in Revenue. Decrease in Revenue Increase in Capital/Ownership JOURNAL A book of original entry to record different business transactions chronologically (according to date) is called journal CHARACTERISTIC OF JOURNAL A transaction is recorded originally in the journal A transaction is recorded on the same day when it takes place Narration is given for each entry It provides all necessary information about a transaction It helps to locate and remove errors NARRATION “A short explanation of each transaction which is written below each entry is called narration” DOUBLE ENTRY SYSTEM “A system in which equal debit and credit entries are made for every transaction.in which every business transaction effects two or more accounts is double entry system” COMPOUND ENTRY “The entry in which more than one accounts are debited or more than one accounts are credited is called Compound entry” For example: Wage Debit Rent = To Cash Credit PRACTICS MATERIAL FOR GENERAL JOURNAL Q.1. Mr. Ali started the business in 2007 and journalizes the following transactions May 01. Started the business with cash Rs. 400,000 02. Deposited cash into bank 300,000 03. Purchased building and payment made by cheques 150,000 04. Goods purchased by cheques 15,000 05. Goods sold for cash and amount deposited into bank 10,000 06. Insurance premium paid by cheques 5,000 Q.2. Enter the following transactions into general journal with the month of March March 01. Merchandise distributed as free sample Rs 15,00 02. Merchandise given as charity 37 03. Merchandise taken away by the proprietor 36 04. Merchandise destroyed by fire 190 05. Merchandise stolen by dishonest worker 950 06. On Eid day merchandise given as charity 640 07. Merchandise used in the home of proprietor 390 Q.03.Mr. Ali started the business in 2004. The following transactions occurred during the month of July July 01. Mr Ali opened a bank account in the name of the business with a deposit of cash Rs 45,000 02. Mr Ali purchased land to be used as the parking plot for a total price of Rs.140,000, Ali cash down payment of Rs.28,000 was made and a note payable was issued for the balance of the purchase price 03. Mr Ali purchased a small portable building for Rs.4,000 cash .the purchase price included installation of the building on the parking plot. 04. Mr Ali purchased office equipment on credit from Suzuki and company for Rs.3,000 05. Mr Ali paid Rs.2,000 of the amount owed to Suzuki and company INTRUCTIONS a) Prepare journal entries for the month of July b) Post to ledger accounts of the three-column running balance form c) Prepare a trail balance at July. LEDGER “The book in which all business transactions are finally recorded in the concerned accounts in a summarized and classified form is called ledger” POSTING “The process of transferring the business transactions from journal to ledger is known as posting” FOLIOING “The process of entering the ledger page number in “ledger column” of the journal and journal page number in Journal column of the ledger is called “Folioing” GENRAL LEDGER The ledger in which all the accounts are posted except debtors or creditors when ledger or creditors is prepared is called general ledger. TRAIL BALANCE A statement which is prepared by taking out the debit and credit balances of all accounts appearing in ledgers in order to check the arithmetical accuracy of the ledger is called Trail balance. ADVANTAGES OF TRAIL BALANCE 01. It provides proof of arithmetical accuracy of accounting entries 02. It facilitate the preparation of final accounts by providing in summarized form. ADVANTAGES OF LEDGER Following are the main advantages of Ledger 01. It provides guarantee of successful application of double entry system 02. It provides summarized record of every account separately 03. It helps in preparation of final accounts CHARACTERISTICS OF LEDGER Ledger has two identical sides 01. Left hand side (debit side) 02. Right hand side ( credit side) DIFFERENCE BETWEEN JOURNAL AND LEDGER Journal Ledger It is a book of first entry It is book of second entry Recording in journal is called journalizing Recording in ledger is called posting Unit of data is called transactions Unit of data in ledger is called account ACCOUNTING EQUATION “A method by which the financial position of a business can be checked at glance is called accounting equation.” “A statement which shows the equality of business assets and liabilities is called accounting equation” Assets=Liabilities +owners equity OWNER EQUITY “Capital invested by the proprietors is called owner equity” PRACTICS MATERIAL OF ACCOUNTING EQUATION Q.1. Show the effect of following transactions on the accounting equation. a) Mr Ali started business with cash Rs. 200,000 b) He purchased building for Rs. 10,000 c) He purchased goods worth for cash Rs. 50,000 d) He sold goods to Aslam for Rs.20, 000 costing Rs.17, 000 on credit basis e) He withdraws cash Rs.3, 000 for his personal use. Q.2.Compute the missing amounts in each of following three cases. Assets= Liabilities + Owner equity a) 3, 72000 = 2, 28000 + ? b) ? = 150,000 + 100,000 c) 820,000 =? + 380,000 AFTER MID Bank reconciliation statement Theory and practical work of ( BRS) Cash book and its types Theory and practical work of cash book Depreciation Method of depreciation Theory and practical work of ( depreciation ) Inventory Approaches use for recording inventory Method of recording inventory Theory and practical work of ( inventory) BANK RECONCILIATION STATEMENT “A statement which contains a complete and satisfactory detail of the difference in balance as per the cash book, and pass book is called Bank reconciliations statement” METHOD OF PREPARING BRS Starting with cash book, or Pass book balance Through adjusted cask book Correct method NOTE: CORRECT BANK BALANCE (In case of cash book) If cash book balance is overdraft then the items added should be deducted and the items deducted should be added to bring correct bank balance CORRECT BANK BALANCE (In case of bank statement) if bank statement balance is overdraft then the items added are deducted and vice versa in order to bring correct bank balance. PRACTICS MATERIAL Q.NO. 1… From the following particulars, prepare a bank reconciliation statement as on 31st march 1990, and arrive at the balance as per pass book 01. On 31st march 2005, the bank balance as per the cash book was, Rs. 15000. 02. Cheques deposited into the bank on 28th march but were not collected by the bank by 31st march, Rs. 1000. 03. Cheques issued but were not presented for the payment by 31st march , Rs.1550. 04. The bank credited a dividend of Rs. 2000, on 31st march but the intimation was received by the trader on 5th april 2005. 05. A cheque of Rs. 500 was received from a customer and was entered in the bank column of cash book on 25 march but was paid into the bank on 1st april. Q.NO.2: Prepare a bank reconciliation statement of Mr.ali as on 31st march 2004, from the particulars given below. a) Balance as per the pass book Rs. 30200 b) Insurance premium of Rs 1000 was directly paid by the bank for which there is no record in the cash book c) Interest of Rs.700 is credited by the bank in the pass book which is not recorded in the cash book . d). Cheques for a total amount of Rs, 20000, were deposited into the bank in march but a cheque for Rs.2500 out of them was credit in April e) A cheque for Rs 6500 was deposited into the bank on march but in April the cheque was returned by the bank …. CASH BOOK A book of original entry in which all cash receipts and payments are recorded chronologically is called cash book. CHARACTERISTICS OF CASH BOOK A cash book having following characteristics Only cash transactions are recorded It serves for both journal and the ledger simultaneously KINDS OF CASH BOOK The cash book having following kinds Single column cash book Double column cash book Three column cash book SINGLE COLUMN CASH BOOK A cash book in which only cash receipts and payments are recorded is called single column cash book. DOUBLE COLUMN CASH BOOK A cash book in which cash as well as discount transactions are recorded is called double column cash book. THREE COLUMN CASH BOOK A cash book in which cash, bank and discount transactions are recorded on each side in three columns, separately is called three column cash book. PETTY CASH BOOK The book in which petty items of expenses are recorded is called petty cash book CONTRA ENTRY A transactions in which cash and bank accounts are involved, and which are recorded on both the sides of cash book is called contra entry CHEQUE BOOK A book which is issued by bank to its customer containing number of blank cheques for withdrawing of money is called cheque book. BANK STATEMENT A copy of customer account which is issued by a bank to its customer normally informing about his balance after regular interval is bank statement PASS BOOK A copy of the customer account in the bank ledger is called pass book. ADVANTAGES OF CAHS BOOK A cash book having following advantages It shows the actual bank balance position It prevents misrepresentation in recording the banking transactions It helps customer in detecting any mistake in bank transaction Daily cash receipts and payments may be easily ascertained Any defalcation of money can be detected through verification of cash book DIFFERNCE BETWEEN CASH BOOK AND CASH ACCOUNT CASH BOOK CASH A/C It is a separate book in which cash transactions are directly recorded It is an account in a ledger in which posting is made from journal Narration is given in the cash book Narration is not given in cash account DIFFERENCE BETWEEN CASH BOOK AND PASS BOOK CASH BOOK PASS BOOK It is maintained by customer It is maintained by banker Its debit balance shows cash at bank and credit balance shows bank overdraft It debit balance shows bank overdraft and credit balance shows cast at bank DIFFERENT CASUSES OF DISAGREEMENT BETWEEN CASH BOOK, AND PASS BOOK They are following different point of different causes of disagreement Timing difference Transaction without informing about them to other party Errors PRACTICS MATERIAL TITLE: cash book Q.NO. 1… Write the following transactions in the Single Column cash book of Mr.Ali . The data which are given below.. 1998 Jan.01 .Cash in hand Rs. 15000 06. Purchased goods for cash Rs. 2000 16. Received from akbar Rs. 3000 18. Paid to babar Rs. 1000 20. Cash sales Rs.4000 25. Paid for stationery Rs. 60 30. Paid for salaries Rs. 1000 31. Purchased office furniture Rs. 2000 Q.NO.2: Write the following transactions in the Double Column cash book of Mr.Ali .The further data are given below. 1995 Jan. 01. Cash in hand Rs. 2000. 07. Received from Riaz and Co, Rs. 200, and discount allowed Rs. 10 12. Cash sales Rs. 1000. 15. Paid Zahoor and sons Rs. 500, and discount received Rs. 15. 20. Purchased goods for cash Rs. 300. 25. Received from Salman Rs. 500, and discount allowed Rs. 15. 27. Paid Hasan and sons Rs. 300. 28. Bought furniture for cash Rs. 100 31. Paid rent, Rs. 100. Q.3.From the following particulars write up a treble column cash of Mr. waseem may 2006 May. Rs. 1. cash in hand 20,000 2. cash at bank 15,000 3. goods sold for cash 45,00 4. goods bought for cash 9,000 5. received a cheque from Mr.Ali for Rs 9650 in full settlement of his dues Rs 98,00 and deposited into the bank 6. paid to zulfiqar cash Rs 5,000 and a cheque for Rs 47,00 in full settlement of his dues Rs 10,000 7. cash received from m. kaleem Rs.4,900 in full settlement of his dues Rs.5,000 8. paid cash to adnan Rs.1,950 in full clearance of his dues Rs.2,000 9. received a cheque from asim Rs. 3900 in full settlement of his dues Rs. 4,000 10. bank credited interest 500 11. bank debit charges 700 DEPRECIATION Definition of depreciation Objects of depreciation Necessary steps for chagrining depreciation Depreciation expense Defferance between straight line and diminishing balance method Causes of depreciation Scrap value Amortization Method of calculating depreciation Depreciations vs Fluctuation Types of depreciation DEFINITION OF DEPRECIATION “ The process of allocating the cost of a fixed assets over its estimated useful life in a rational and systematic manner” is called depreciation Physical value of assets decrease due to use in business OBJECTS OF DEPRECIATION The depreciation having following objects To find out net profit or loss for an accounting period To present a true and fair view of the state of affairs of the business To replace the asset NECESSARY STEPS FOR CHAGRINING DEPRECIATION The depreciation having following process for chagrining depreciation Determination of cost of an assets Estimated of the useful life of the assets Selection of method allocation DEPRECIATION EXPENSE The total allocated cost for one accounting period, which is matched against revenue is called depreciation expense CAUSES OF DEPRECIATION The following reason of Obsolescence Depletion Expiry of time Fall in the market price OBSOLESCENCE A process of becoming out of date or obsolete is called obsolescence “ in other words, reduction in the useful life of the assets arising from following factors Change in technology Improvement in production method Change in market demand STRAIGHT LINE METHOD The method under which cost of an assets is equally charged over the useful life of an assets is called straight line method. ADVANTAGES OF STRAIGHT LINE METHOD It having following advantages Easy calculation of depreciation amount Reducing the book value to zero DISADVANTAGES OF OF STRAIGHT LINE METHOD It having following disadvantages Higher depreciation is charged in last years of asset useful than its output If an additional assets are required the amount to be charged as depreciation to be recalculated DIMINISHING BALANCE METHOD The method in which asset is depreciated at fixed percentage over written down value of asset is called diminishing balance method ADVANTAGES It having following advantages It is also acceptable for income tax purpose No recalculation is necessary when additional assets are purchased DISADVANTAGES It having following disadvantage There is a lack of simplicity The asset is never fully depreciated DEPRECIATION VS FLUCTUATION DEPRECIATION FLUCTUATION It is permanent It is merely temporary It is continuing It is not continuing It is shrinkage in value It represent rise or fall in value It is concerned with book value It is conferenced with market value It refers to fixed assets It refers to floating assets It must be occur It may not occur It reduce value of assets gradually The value of assets may rise or fall on account of fluctuation It always loss or indicate always loss It may indicate either profit or loss, it depend on market value SCRAP VALUE The amount which will be realized at the end of the asset useful life is called scrap value or scrap value means the price at which on assets will be sold at the end of its working life. TYPES OF DEPRECIATION TWO TYPES Amortization Depletion AMORTIZATION The process of allocating the cost of an intangible assets over its useful life in a rational and systemic manner Long term Good well Investment DEPLETION The process of measuring and recording the exhaustion of natural resources due to their use is called depletion Mine etc PRACTICS MATERIAL. Q.01.FIXED INSTALLMENT METHOD On 1st january 1981 Mr. Munir purchased machinery for Rs.21000. the estimated life of the machine is 10 years after which its break up value will be Rs.1000, only find out the amount of annual depreciation according fixed installment and prepare the machinery account for the first three years. Q.02. DIMISISHING BALANCE METHOD On 1st July 2002, Aslam purchased a second-hand machine for Rs.18000 and spent Rs.2000 on its repairs and installation on 30th June 2005 the machinery was disposed off for a sum of Rs13600. Assuming the books are closed on 31st December each year and taking the rate of depreciation at 10 % p.a. on diminishing balance and show the machinery account. INVENTORY (STOCK) INVENTORY MERCHANDISING COMPANIES OPERATING CYCLE OF MERCHANDISEING COMPANIES GENERAL LEDGER ACCOUNT SUBSIDIARY LEDGER CONTROLLING ACCOUNT APPROACHES USED IN ACCOUNTING FOR MERCHANDISING PERPETIUAL INVENTORY SYSTMEN PERIODIC INVENTORY SYSTEM DEFFERENCE BETWEEN PERPETUAL AND PERIODIC INVENTORY SYSTEM PRACTICS MATERIAL INVENTORY (STOCK) Goods or merchandise on hand that is goods remaining unsold is called, stock, stock in trade or inventory. Or The goods that a merchandising company sales to its customers are called inventory Example: stock of food, Automobiles etc. MERCHANDISING COMPANIES The merchandising companies are those that earn revenue in the business by selling their produce rather then services. OPERATING CYCLE OF MERCHANDISING COMPANIES The series of transactions through which a business generates its revenue and its cash receipts from customers is operating cycle It contain following basic transactions Purchase of merchandise Purchase ( inventory) Sales of the merchandise on account Collection of the accounts receivable from customer GENERAL LEDGER ACCOUNT The account in which we recording transactions only is called general ledger accounts, such types of accounts provide a useful overview of a company financial activities. They do not provide much of the detailed information needed by managers and other company employees in daily business operations is called general ledger account SUBSIDIARY LEDGER The ledger that provides detailed information about accounting records is called subsidiary ledgers. A subsidiary ledger shows separately the individual items which comprise the balance of a general ledger account CONTROLLING ACCOUNT A general ledger account which summarizes the content of a subsidiary ledger is called control account APPROACHES USED IN ACCOUNTING FOR MERCHANDISING TRANSACTIONS There are two approaches may be used in accounting for merchandising transactions Perpetual inventory Periodic inventory PERPETUAL INVENTORY In perpetual inventory system merchandising transactions are recorded as they occur, and the detailed of ledger account for inventory and cost of goods sold are kept perpetually upto-date. PERIODIC INVENTORY SYSTEM The system which are used to not keep upto date records, are not maintained either for inventory or for the cost goods solds DEFFERNCE BETWEEN PERPETUAL AND PERIODIC INVENTORY SYSTEM. PERPETUAL PERIODIC KEPT UPTO DATE RECORD NOT KEPT UPTO DATE RECORDS SHOWING SUBSIDIARY LEDGER ACCOUNT FOR EVERY PRODUCT COS IN THIS SYSTEM SUBSIDIARY LEDGER ACCOUNTS ARE NOT USED THEIS SYSTEM OF INVENTORY PROVIDE COMPLETE DETAIL ABOUT INVENTORY THIS SYSTEM OF INVENTORY PROVIDE UNCOMPLETE DETAILED OF INVENTORY l Perpetual inventory system › l Or Periodic inventory system › Determine cost of goods sold and inventory balance after each sale. Determine cost of goods sold and inventory balance only at end of each accounting period METHODS OF RECORDING INVENTORY There are following Lifo Fifo Average PRACTICS MATERIAL Q.1. on january 1st 1994, California, irrigation sold, 2000, rain master-30 oscillating sprinkler, heads to rancho landscaping, immediately, prior to this sale California perpetual inventory records for this sprinkler head included the following cost ledger PURCHASE DATE = QUANTITY = UNIT COST = TOTAL COST December 12, 1993 = 1200 = 18.5 = 22200 January = 1800 = 19.00 = 34200 9, 1994 a) Prepare a separate journal entry to record the cost of goods sold relating to the january 15 sale of 2000, rain master, 30, sprinklers heads assuming that California irrigation uses 1) Specific identification (1000 of the units sold were purchase are December 12, and the remaining 1000 were purchase on January 9 2) Average cost method. 3) Lifo and Fifo BEST OF LUCK, THIS IS NOT END OF THE WORLD. HEAD OF DEPARTMENT CAMPUS DIRECTOR SYED KHIZER ABBAS SHAH DR.RASHID IRSHAD CH