CfA Title - Skills CFA

advertisement

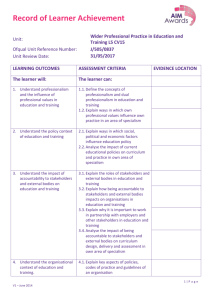

Level 5 Sales (Wales) Level 5 Higher Apprenticeship in Sales ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 1 Level 5 Diploma in Sales Qualification Title Level 5 Diploma in Sales (QCF) Credit Value 68 Level 5 Structure reference Minimum GLH Maximum GLH To achieve a Level 5 Diploma in Sales you must complete a minimum of 68 credits: Qualification Structure 1. 18 credits must be completed from GROUP A MANDATORY UNITS 2. A minimum of 36 credits from GROUP B OPTIONAL UNITS 3. A maximum of 14 credits from GROUP C OPTIONAL UNITS A minimum of 44 credits must be achieved through the completion of units at Level 4 or above. Mandatory Group A Ofqual Ref. D/502/9735 Y/503/0608 Title Managing responsible selling Understanding and developing customer accounts Sales forecasts and target setting Credit 4 8 6 Level 4 5 5 GLH 35 40 30 Credit 8 6 6 6 Level 5 5 5 5 GLH 40 30 30 30 6 5 30 6 6 5 5 5 7 4 TBD 7 7 7 7 6 5 5 4 4 4 4 4 5 6 6 6 6 5 30 30 45 45 45 60 30 TBD 30 30 30 30 30 Optional Group B Ofqual Ref. L/503/0606 R/503/0610 Y/503/0611 D/503/0612 H/503/0613 A/503/0617 T/503/0616 M/502/9738 K/502/9740 T/502/9739 M/502/9741 T/502/9742 J/503/0880 L/503/0878 J/503/0877 R/503/0879 M/503/0615 ©2014 Skills CFA Title Understand the integrated functions of sales and marketing Motivation and compensation for sales teams Coaching and mentoring Designing, planning and managing sales territories Analysing the financial potential and performance of customer accounts Bid and tender management for account managers Developing a product portfolio Operational sales planning Analysing the marketing environment Sales negotiations Finance for sales managers Writing and delivering a sales proposal Customer Relationship Management Developing strategic relationships with major customers Salesforce organisation Planning and implementing sales and marketing strategy Sales forecasting and budgeting Relationship management for account managers Level 4 NVQ Diploma in Business Administration (QCF) • Page 2 D/503/0609 Leading a team 6 5 30 Credit 4 6 3 3 4 6 4 Level 4 4 4 4 4 4 4 GLH 23 49 15 16 26 33 20 Optional Group C Ofqual Ref. H/506/1957 M/506/1959 J/506/1949 M/506/1962 A/506/1995 R/506/2909 F/506/1982 ©2014 Skills CFA Title Prepare specifications for contracts Manage events Develop and maintain professional networks Encourage learning and development Manage a budget Recruitment, selection and induction practice Develop working relationships with stakeholders Level 4 NVQ Diploma in Business Administration (QCF) • Page 3 Title Managing responsible selling Level 4 Credit Value 4 GLH 35 Unit Reference No. D/502/9735 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Explain sales- related legal and regulatory requirements and Codes of Practice 1.2 Understand the principles of contract law and the penalties for misrepresentation 1.3 Analyse the potential impact of social and ethical concerns relating to the sales function 1.4 Explain how processes and policies in the organisation meet ethical and social requirements and comply with legal and regulatory requirements 1. Know legal, regulatory, ethical and social requirements pertaining to the sales function ©2014 Skills CFA 2. Understand how to manage the sales function in a way that complies with legislation 2.1 Describe how to ensure that sales employees have a clear understanding of the organisation’s legal, regulatory, ethical and social policies and procedures and the importance of putting them into practice 2.2 Explain how to monitor the way that legal, regulatory, ethical and social policies and procedures are put into practice 2.3 Describe how to provide support to the sales team in putting legal, regulatory, ethical and social policies and procedures into practice 3. 3.1 Explain how to identify and correct any failures to meet the legal and regulatory requirements 3.2 Explain how and when to provide full reports about any failures to meet requirements to senior management 3.3 Explain how to monitor and manage complaints regarding legal, regulatory, ethical and social requirements Know how to deal with noncompliance Level 4 NVQ Diploma in Business Administration (QCF) • Page 4 Title Understanding and developing customer accounts Level 5 Credit Value 8 GLH 40 Unit Reference No. Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Evaluate the organisational and personal influences of the Decision Making Unit on buying practices 1.2 Evaluate choice criteria of customers and how such criteria affects sales 1.3 Review the concept of ‘preferred supplier’ status 1.4 Identify buying practices used by organisations 1.5 Evaluate measures of quality relating to buying and accredited quality programmes 1.6 Identify capability and capacity assessments customers undertake on potential suppliers 1. Understand buying practices of customers 2. Understand customer support issues 2.1 Evaluate how organisations develop product or service specifications for buying purposes 2.2 Evaluate how the technical and resource support provided by own organisation adds value for the customer 2.3 Evaluate competitive practices relating to the decision making process 3. Understand own organisation's unique business value 3.1 Evaluate own organisation’s activity plans in relation to customers 3.2 Evaluate own organisation’s ability to respond to customer buying requirements 4. Understand how to prepare for customer procurement 4.1 Explain how to maintain and update own knowledge of customers’ industry sectors 4.2 Evaluate how an organisation can influence the criteria customers use to select suppliers 4.3 Examine how certain organisation may be more attractive and compatible to ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 5 4.4 4.5 4.6 4.7 5. Understand how to use information gathered to plan to develop customer accounts ©2014 Skills CFA particular organisations Analyse the strengths and weaknesses of different suppliers within a sector Identify strategies for achieving preferred supplier status Evaluate the features of different types of contracts between organisations and their customers Evaluate contractual practices relating to determining supply terms and conditions 5.1 Identify tactics which could be utilised to achieve the strategies in developing and winning new accounts 5.2 Evaluate the importance of ongoing evaluation and monitoring of current customer accounts 5.3 Evaluate an organisations customer information to plan how to develop current and new accounts Level 4 NVQ Diploma in Business Administration (QCF) • Page 6 Title Sales forecasts and target setting Level 5 Credit Value 6 GLH 30 Unit Reference No. Y/503/0608 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Explain how to forecast future trends 1.2 Evaluate information needed for sales forecasting and how it is analysed 1.3 Analyse common causes of variances between forecast and actual sales 1.4 Evaluate the effects of failing to forecast 1.5 Explain how to set challenging and realistic sales objectives and targets 1. Understand forecasting in relation to sales targets 2. Understand forecasting in own organisation 2.1 Evaluate own organisation’s available sales information 2.2 Evaluate other information available in own organisation that could contribute to sales forecasting activities 2.3 Evaluate how plans for product and service development may impact on sales forecasts 2.4 Compare past variances between forecast sales and sales achieved and reasons for those variances 2.5 Evaluate the benefits of using IT and software systems for sales forecasting 2.6 Explain measurement and control mechanisms applied by own organisation for the reporting of variances 2.7 Identify problems and issues outside of own control which may impact upon sales forecasting activities and achieving of sales targets 3. 3.1 Use a forecasting method(s) to prepare an analysis to predict future sales trends 3.2 Consult colleagues about sales forecasts and identify the implications for the organisation ©2014 Skills CFA Be able to forecast sales Level 4 NVQ Diploma in Business Administration (QCF) • Page 7 4. Be able to set sales targets and objectives and devise measurement activities to monitor them ©2014 Skills CFA 4.1 Set challenging and realistic sales objectives and targets based on sales forecasts 4.2 Devise measurement activities to monitor actual performance against forecast sales Level 4 NVQ Diploma in Business Administration (QCF) • Page 8 Title Understand the integrated functions of sales and marketing Level 5 Credit Value 8 GLH 40 Unit Reference No. L/503/0606 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Analyse how a marketing strategy supports an organisation 1.2 Evaluate the relationships between marketing, sales and other functions 1.3 Analyse how a marketing strategy supports the sales function 1. Understand how a marketing strategy supports the sales function 2. Understand marketing research 2.1 Evaluate the use of up to date and relevant market information to support sales-related decisions 2.2 Differentiate between primary and secondary data 2.3 Identify and interpret trends in salesrelated data 2.4 Differentiate between sources of market information and evaluate the validity of data 2.5 Evaluate a range of analytical tools to analyse sales-related information and why each one might be chosen in a given situation 2.6 Analyse the suitability, relevance, validity and reliability of market information 3. 3.1 Review how to obtain feedback from colleagues about the usefulness of sales-related information 3.2 Evaluate budget allocations for obtaining market information 3.3 Evaluate the importance of the sales function contributing realistic market information to the marketing function 3.4 Evaluate how an organisation’s policy on the storage of information can meet data protection requirements 3.5 Appraise how the use of sales-related information can result in changes to ©2014 Skills CFA Understand the use of marketing research in sales Level 4 NVQ Diploma in Business Administration (QCF) • Page 9 the marketing mix and the marketing and sales strategy 4. Be able to use market analyses in sales 4.1 Employ market analyses to inform the development of a sales strategy that takes account of market trends and competitor activity 4.2 Review market analysis to identify a clear positioning message that aims to satisfy target 4.3 Review the competitive edge of the organisation’s products / services 4.4 Calculate the financial return to the organisation resulting from the targeting of customers 5. Be able to progress sales through alignment with marketing strategies 5.1 Identify how the organisation can benefit from addressing the requirements of target markets 5.2 Review how new products / services allow the organisation to satisfy customers’ changing needs and how this generates return upon investment 5.3 Appraise how marketing strategies and plans help to develop and maintain positive relationships with the organisation’s sales team(s) and customers, and the resultant benefits in terms of customer loyalty and competitive advantage 5.4 Evaluate the value of marketing in progressing sales ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 10 Title Motivation and compensation for sales teams Level 5 Credit Value 6 GLH 30 Unit Reference No. R/503/0610 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Evaluate the interrelationship between motivation, compensation, and sales success 1.2 Explain motivation theories and team building techniques that support motivation 1.3 Identify the importance of providing recognition for the sales team 1.4 Review methods to recognise sales performance 1.5 Evaluate the range of financial and non-financial incentives and motivational tools available to motivate members of the sales team 1.6 Explain how to carry out appraisals and performance assessments in order to judge the levels of personal motivation in the sales team 1.7 Evaluate how personal development plans can be used to encourage motivation and achievement 1.8 Explain performance measures that can be used to measure and evaluate sales teams 1. Understand motivation and compensation for sales teams individuals 2. Be able to review motivation and compensation for own sales team ©2014 Skills CFA 2.1 Review formal and informal methods by which the motivation of own sales team is monitored and measured 2.2 Evaluate recognition and the compensation package(s) for own sales team 2.3 Evaluate scope for change in recognition and compensation package(s) in order to maintain or improve motivation 2.4 Review performance measures that are used to measure and evaluate own sales team Level 4 NVQ Diploma in Business Administration (QCF) • Page 11 Title Coaching and mentoring Level 5 Credit Value 6 GLH 30 Unit Reference No. Y/503/0611 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Describe the principles of coaching and mentoring 1.2 Explain how linking mentoring with objectives and activities is effective in developing individuals, teams and organisations 1.3 Explain how coaching and mentoring can benefit individuals, teams and organisations 1.4 Explain the processes of coaching and mentoring 1.5 Explain the boundaries of coaching and mentoring 1.6 Evaluate the importance of communication skills in coaching and mentoring 1.7 Explain how to conclude the coaching or mentoring process, reviewing success against agreed criteria 1. Understand the principles of coaching and mentoring 2. Be able to plan a coaching or mentoring programme 2.1 Plan a coaching or mentoring programme based on identified performance needs 2.2 Agree success criteria for a coaching or mentoring programme 3. Be able to deliver a coaching or mentoring programme 3.1 Organise coaching or mentoring sessions 3.2 Deliver coaching or mentoring sessions and maintain records 3.3 Review coachees’ or mentees’ progress toward their agreed goals 4. Be able to evaluate own coaching or mentoring practice 4.1 Gather feedback and evaluate own coaching or mentoring practice 4.2 Evaluate the impact of coaching or mentoring on the individual, the team and the organisation ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 12 Title Designing, planning and managing sales territories Level 5 Credit Value 6 GLH 30 Unit Reference No. D/503/0612 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Identify the reason why own organisation has chosen its sales territories 1.2 Review own organisation’s market and customer segmentation strategies in relation to market 1.3 Explain how to undertake an investigation and evaluation of sales territories 1.4 Evaluate sales territories taking into account the size and economic support systems that may influence choice of territory boundaries 1.5 Evaluate the potential turnover, profit and growth potential of a territory 1.6 Review resource requirements for a territory in terms of sales activities 1.7 Explain why territory administration and information about potential territories are important to territory planning 1.8 Explain how to design sales territories in terms of size, location, number of customers, prospective accounts and number of contacts 1.9 Identify how to monitor, evaluate and measure territory and individual sales performance 1. Understand sales territory design, planning and management 2. Understand factors that affect territory management ©2014 Skills CFA 2.1 Evaluate competitor activities relating to territory structures 2.2 Identify the spread of own organisation’s potential and existing customers 2.3 Review own organisation’s sales forecasts and sales targets and criteria for successful territories 2.4 Evaluate sales budgets and own organisation’s performance management systems Level 4 NVQ Diploma in Business Administration (QCF) • Page 13 2.5 Identify the key drivers for selecting or retaining a territory management approach for structuring sales team activities 2.6 Evaluate suitable territories through investigation of the financial, economic and external marketing environments 3. Be able to review and revise territory plans 3.1 Carry out a market assessment on a territory based on own organisation’s criteria, including external market information and sales forecasts 3.2 Review the time and human resources needed to cover a territory and meet sales and profit targets 3.3 Evaluate the risks and benefits of defining new sales territories 3.4 Plan sales resource requirements based on information about number, size and location of customers 3.5 Set financial and sales activity targets for the sales team 4. Be able to resource sales territories 4.1 Set boundary lines for each sales territory 4.2 Assign sales team members territories by matching knowledge, abilities and skills ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 14 Title Analysing the financial potential and performance of customer accounts Level 5 Credit Value 6 GLH 30 Unit Reference No. H/503/0613 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Estimate the lifetime value cash flow that will be generated if the customer maintains an average loyalty level 1.2 Calculate the sales volume required to achieve target profitability 1.3 Measure the potential variable costs that could impact upon the profitability of accounts 1. Be able to use financial tools to assess and prioritise new accounts and measure potential value 2. Be able to follow the organisation's management accounting procedures 2.1 Evaluate costs of fixed overheads and administrative support and apply them in line with the organisation’s management accounting procedures 2.2 Use a customer account profit statement for ongoing measurement of customer performance 3. 3.1 Evaluate the business and financial risks associated with each account and draw up a risk profile of the accounts 3.2 Estimate the value of each account using available financial and qualitative evidence 3.3 Review the financial performance and other features of each account to identify key trends and variances 3.4 Make business decisions about the future direction of an account based on its financial performance 3.5 Prepare contingency plans for when problems arise in financial performance of an account 3.6 Consult and communicate with stakeholders to ensure that they have access to appropriate financial performance data ©2014 Skills CFA Be able to evaluate financial risks Level 4 NVQ Diploma in Business Administration (QCF) • Page 15 Title Bid and tender management for account managers Level 5 Credit Value 6 GLH 30 Unit Reference No. A/503/0617 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Describe the principles of bid and tender management 1.2 Describe the bid cycle 1. Understand the principles of bid and tender management 2. Be able to prepare for a bid 2.1 Analyse the role of management and own organisation’s procedures for bidding 2.2 Identify the customer’s perspective and needs 2.3 Qualify the opportunity 2.4 Determine the bid strategy 2.5 Analyse competitors who may also bid 2.6 Establish a bid plan 3. 3.1 Write a bid to meet the needs of customer and own organisation Be able to write a bid 4. Be able to tender a bid to the customer 4.1 Tender a bid to the customer 5. Understand how to follow up the tendering of the bid 5.1 Explain how to carry out post-tender activities ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 16 Title Developing a product portfolio Level 5 Credit Value 6 GLH 30 Unit Reference No. T/503/0616 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Explain the importance of long and medium-term planning to the success of a portfolio of products / services 1.2 Evaluate the sales and organisation benefits obtained from being involved in the portfolio development process 1.3 Outline the factors to be considered when reviewing the profitability of products / services 1.4 Evaluate tools and techniques used in analysing product and service portfolios from a sales perspective 1.5 Review how to develop contingency plans to address risks and changing circumstances 1.6 Evaluate the inter-relationships that occur between products / services within a portfolio and their impact on buying decisions 1.7 Evaluate the need to consult with colleagues and other stakeholders during the review of a portfolio 1. Understand product portfolio development 2. Understand how to contribute to the development of a product portfolio 2.1 Evaluate the importance of contributing to the development and marketing of products / services that offer the best return on investment, in line with the organisation’s objectives, and how to do so 2.2 Evaluate the importance of monitoring how your products / services are priced, promoted and distributed, in response to feedback from customers 3. 3.1 Analyse the range of products / services within the portfolio 3.2 Assess how to monitor demand for your products / services 3.3 Write a business case for amendments ©2014 Skills CFA Be able to analyse the product portfolio Level 4 NVQ Diploma in Business Administration (QCF) • Page 17 or additions to your organisation’s portfolio, including the investment required and the forecast return on investment 3.4 Analyse the profitability and lifecycle of the products / services within the portfolio 3.5 Analyse the markets at which the products / services are targeted and determine factors impacting upon their growth ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 18 Title Operational sales planning Level 4 Credit Value 5 GLH 45 Unit Reference No. M/502/9738 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Describe how own organisation’s business and marketing strategies inform operational sales planning 1. Understand how own organisation's business and marketing strategies inform operational sales planning 2. Understand sales forecasting techniques 2.1 Describe how historical sales data informs sales forecasts 2.2 Explain a range of sales forecasting techniques 2.3 Describe how sales forecasts are used to set sales objectives and targets 3. Be able to set objectives and targets in a sales plan 3.1 Develop a time plan for the establishment of objectives and targets for sales plans 3.2 Use sales forecasts to set objectives and targets for a sales plan 4. Be able to write an operational sales plan 4.1 Write an operational sales plan to meet objectives and targets 4.2 Specify and allocate sales territories 4.3 Write a business case to obtain the resources to achieve the operational sales plan’s objectives and targets 5. Understand how to manage the implementation of the operational sales plan through the sales team 5.1 Explain how to communicate the operational sales plan to all stakeholders and define individual roles and targets in the sales activity plan 5.2 Explain how to monitor and control the operational sales plan using agreed key performance indicators 6. Understand how to deal with variances to the operational sales plan 6.1 Describe variances that may occur in the implementation of the operational sales plan 6.2 Identify contingency plans to address variances 6.3 Explain the organisation’s procedure ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 19 for dealing with unforeseen variances Title Analysing the marketing environment Level 4 Credit Value 5 GLH 45 Unit Reference No. K/502/9740 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Conduct an audit of the internal environment using an analysis tool 1.2 Conduct an audit of the micro environment using an analysis tool 1.3 Conduct an audit of the macro environment using an analysis tool 1. Be able to conduct an audit of an organisation's internal, micro and macro environment 2. Understand the impact of internal, micro and macro factors on own and customer's organisation 2.1 Explain the impact of internal capabilities on own organisation’s positioning in the market 2.2 Explain the impact of industry dynamics on own and customer’s organisation 2.3 Explain the impact of macro factors on own and customer’s organisation 3. 3.1 Derive information and intelligence by conducting a relative SWOT analysis on own organisation’s marketing environment using findings from the audits 3.2 Analyse the impact of own organisation’s SWOT on the sales function 3.3 Recommend actions to address the impact of own organisation’s SWOT on the sales function ©2014 Skills CFA Be able to recommend actions for the sales function by conducting a SWOT analysis on own organisation's marketing environment Level 4 NVQ Diploma in Business Administration (QCF) • Page 20 Title Sales negotiations Level 4 Credit Value 5 GLH 45 Unit Reference No. T/502/9739 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Describe how to assess own organisation’s negotiating power and stance 1.2 Describe how to research and assess the customer’s negotiating power and likely stance 1.3 Explain the types of customer objections that might arise and how to handle these 1.4 Explain the concept of ‘win-win’ in Sales situations and how this is achieved and managed during sales negotiations 1.5 Explain what happens when a ‘win-win’ is not achieved 1.6 Explain why it is important to record and confirm details of a sales negotiation and the method to do this in own organisation 1. Understand what is involved in a sales negotiation 2. Be able to prepare for a sales negotiation ©2014 Skills CFA 2.1 Identify the customer’s main requirements from a negotiation 2.2 Research and assess the bargaining power of the customer to identify their overall negotiating stance 2.3 Identify personal and organisational weaknesses that could be exploited by the customer in a negotiation and prepare strategies for responding 2.4 Research main competitor strengths and weaknesses 2.5 Define objectives for the negotiation and identify own organisation’s desired outcomes 2.6 Assess the resource requirements for the sales negotiation 2.7 Identify key variables and set parameters for them including Level 4 NVQ Diploma in Business Administration (QCF) • Page 21 potential concessions and trade-offs 2.8 Cost the variables, including potential concessions and trade-offs, in order to identify the best price and terms for your organisation as well as the minimum price and terms acceptable to own organisation 2.9 Identify potential problems that could arise during the negotiation and how you will formulate solutions to overcome them 3. ©2014 Skills CFA Be able to carry out a sales negotiation with a customer 3.1 Create a ‘win-win’ situation during the negotiation by balancing the needs of own organisation with those of the customer 3.2 Agree on the terms and conditions for the supply of the product or service 3.3 Record, store and confirm outcomes of the negotiation both internally and with the customer 3.4 Evaluate the outcomes of the negotiation using a Win/Loss analysis Level 4 NVQ Diploma in Business Administration (QCF) • Page 22 Title Finance for sales managers Level 4 Credit Value 7 GLH 60 Unit Reference No. M/502/9741 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Calculate gross profit margin 1.2 Calculate net profit ratio 1.3 Explain the difference between margin and mark-up and when each of these are used in practice 1.4 Calculate return on capital employed 1. Be able to calculate profitability ratios for sales-related decisions 2. Know how to set a sales budget 2.1 Identify different methods used for setting budgets 2.2 Explain how to establish information needs and identify information sources for setting a sales budget 2.3 Describe the different approaches to effective consultation and negotiation when setting a sales budget 2.4 Explain how to develop budget frameworks 2.5 Explain how to set a contingency plan for variances to a budget 3. Understand how to manage a sales budget 3.1 Explain how to use the budget to monitor and control performance against budget parameters 3.2 Explain how to identify the causes of variances between budget and actual expenditure 3.3 Explain how to implement the actions needed to deal with the causes of variances between budget and actual expenditure. 3.4 Explain how to provide information on performance against the sales budget to others in the organisation 3.5 Explain how to monitor the sales budget to identify unethical practice or potential fraud 4. Understand bonus systems for sales team members 4.1 Explain how to evaluate the need for a bonus system ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 23 4.2 Explain how to choose bonus options for sales team members 4.3 Explain methods of setting bonuses 4.4 Explain how to calculate the cost of bonuses 4.5 Explain how to negotiate bonuses with sales team members 4.6 Describe how to evaluate the effectiveness of a bonus system 5. Understand how to assess creditworthiness of customers in order to set a credit limit for the customer ©2014 Skills CFA 5.1 Explain organisation policy for credit agreements with customers 5.2 Explain the process for approving the granting of credit 5.3 Explain how to check creditworthiness of a customer 5.4 Explain how to complete a formal agreement with the customer and the financial basis for future trading Level 4 NVQ Diploma in Business Administration (QCF) • Page 24 Title Writing and delivering a sales proposal Level 4 Credit Value 4 GLH 30 Unit Reference No. T/502/9742 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Ensure that the customer’s requirements are understood 1.2 Ensure that all identified issues requiring clarification are resolved before the proposal is finalised 1.3 Identify the conditions and constraints which need to be included within the proposal in order to protect the organisation’s interests 1.4 Develop the content of the proposal in house style and within legal and ethical constraints 1.5 Provide the required level of detail as briefed by the customer and supply the proposal within the agreed time-scales 1. Be able to develop a sales proposal 2. Be able to deliver a sales proposal to a customer 2.1 Deliver the proposal to the customer within an agreed timescale 2.2 Ensure the customer is happy with the proposal, addressing any issues and amending it as required 2.3 Ensure that information is stored and managed according to Data Protection legislation 3. 3.1 Evaluate the outcome of the proposal and recommend improvements for the future ©2014 Skills CFA Be able to evaluate the proposal Level 4 NVQ Diploma in Business Administration (QCF) • Page 25 Title Customer Relationship Management Level 5 Credit Value GLH Unit Reference No. Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Analyse the role of CRM in the retention of customers 1.2 Analyse the role of CRM in developing new customers 1.3 Evaluate different approaches to CRM 1.4 Explain key information requirements for CRM systems 1. Understand the importance of a Customer Relationship Management system (CRM) for a Sales function 2. Be able to use a CRM system to develop sales 2.1 Develop a plan for the use of customer information that aligns with the sales strategy 2.2 Use a CRM system to develop a picture of your customers’ requirements and buying patterns 2.3 Use a CRM system to segment your customer base 2.4 Identify the most profitable customers from an analysis of customer information 2.5 Use data to drive sales from an existing customer base 2.6 Adhere to organisational policies and procedures, legal and ethical requirements when using a CRM system 3. Be able to make improvements to the use of an organisations CRM system 3.1 Analyse the use of customer information within an area of responsibility 3.2 Evaluate different ways to measure the effectiveness of CRM systems 3.3 Plan improvements to the use of CRM within own area of responsibility 3.4 Implement plans to improve CRM within own area of responsibility 3.5 Evaluate the effectiveness of improvements to the use of CRM ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 26 Title Developing strategic relationships with major customers Level 6 Credit Value 7 GLH 30 Unit Reference No. J/503/0880 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Explain the principles of developing mutually beneficial relationships with major customers 1.2 Evaluate distinctions between transactional selling and major customer management 1.3 Evaluate advantages and dangers of major customer management to own organisation and customer organisations 1.4 Develop criteria to use to select major customers based on strategic long term value of customers 1.5 Analyse methods to obtain buy-in from senior management and colleagues for major customer management 1.6 Explain the stages of major customer relationship development 1.7 Evaluate behaviours which build up a relationship of trust with a major customer 1. Understand the principles of developing strategic relationships with major customers 2. Be able to identify major customers and develop major customer plans that are mutually beneficial ©2014 Skills CFA 2.1 Identify the customer(s) which fulfil the organisation’s criteria to be classed as a major customer 2.2 Analyse the major customer’s business and their corporate business and marketing strategy 2.3 Analyse the current and future strategic and operational business challenges faced by the major customer 2.4 Identify and agree prioritised common business objectives between own organisation and the major customer, which are consistent with both organisations’ financial objectives and business strategies 2.5 Assess with the major customer Level 4 NVQ Diploma in Business Administration (QCF) • Page 27 strategic options towards achieving the common business objectives which involve mutual working 2.6 Work in partnership with the major customer to develop a plan and actions towards addressing the identified challenges and common objectives 3. Be able to develop strategic relationships with major customers to meet mutual objectives 3.1 Analyse expertise required in own team to work with the major customer 3.2 Co-ordinate business functions across own organisation to develop strategic relationships with the major customer 3.3 Evaluate opportunities for creating long term value for the major customer 3.4 Evaluate methods for reducing risk to the major customer regarding own organisation’s products and services 4. Be able to evaluate the success of strategic relationship activities and plan for future activities 4.1 Monitor and critically evaluate the outcomes of activities in developing the strategic relationship with the major customer, including the return on the investment being made 4.2 Develop a plan to address any issues regarding the outcome of strategic relationship activities 4.3 Develop a succession plan for maintaining a successful relationship with the major customer, with contingencies should particular individuals no longer be able to work with the major customer 4.4 Evaluate systems for storing and planning major customer information ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 28 Title Salesforce organisation Level 6 Credit Value 7 GLH 30 Unit Reference No. L/503/0878 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Evaluate issues relating to health and safety, equality and diversity when planning for salesforce structures, procedures and activities 1.2 Analyse different ways in which human, financial and capital resources can be deployed in the salesforce 1.3 Evaluate ways of making use of specialist expertise in relation to recruiting, selecting and keeping members of the salesforce 1.4 Evaluate different working practices and methods including central base and remote working in the salesforce 1.5 Evaluate quality assurance processes for the management and use of resources 1.6 Analyse technology used by the salesforce and how it can be used for remote working 1. Understand how to organise the salesforce 2. Understand internal and external factors affecting the organisation of the salesforce 2.1 Analyse organisation strategies which may impact on future salesforce planning 2.2 Analyse legislative and regulatory requirements and codes of practice relating to employment in the salesforce 2.3 Analyse trends and developments in the sector which might impact upon future salesforce planning 3. Be able to use sales planning and sales trends in order to inform salesforce resourcing 3.1 Use sales planning and forecasting information to assess the scope of resource requirements for the salesforce 3.2 Analyse salesforce resource requirements and identify potential gaps in resources that need to be filled ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 29 to achieve sales targets 4. Be able to review salesforce structure ©2014 Skills CFA 4.1 Evaluate current salesforce structure against future requirements 4.2 Recommend resources to support the development of the salesforce for future requirements Level 4 NVQ Diploma in Business Administration (QCF) • Page 30 Title Planning and implementing sales and marketing strategy Level 6 Credit Value 7 GLH 30 Unit Reference No. J/503/0877 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Evaluate the links between corporate strategy and sales and marketing strategy 1.2 Evaluate strategies for competitive advantage, growth, markets and different market positions 1.3 Evaluate methods for setting primary sales and marketing objectives 1.4 Explain how to select criteria for evaluating strategic options and how to use them to make decisions 1.5 Critically evaluate the impact of technological advances in strategic sales and marketing 1.6 Evaluate methods to apply sales and marketing strategies to operations 1.7 Evaluate sales and marketing theories for small and medium enterprises (SMEs) 1. Understand sales and marketing strategy 2. Understand strategic sales and marketing planning 2.1 Evaluate the concepts of strategic sales and marketing planning 2.2 Evaluate the need for and the scope of strategic sales and marketing planning 2.3 Evaluate audit and analysis in strategic sales and marketing planning 2.4 Evaluate the impact of future challenges and issues in strategic sales and marketing planning 3. Understand the implementation of a sales and marketing strategy 3.1 Evaluate methods for the implementation of a sales and marketing strategy 3.2 Evaluate methods for monitoring and evaluating the implementation of a sales and marketing strategy 4. Understand the implementation of sales and marketing plans 4.1 Evaluate methods for implementation of a strategic sales and marketing plan 4.2 Evaluate methods for monitoring and ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 31 evaluation the implementation of a strategic sales and marketing plan ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 32 Title Sales forecasting and budgeting Level 6 Credit Value 7 GLH 30 Unit Reference No. R/503/0879 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Evaluate the impact of sales forecasting on organisational planning 1.2 Evaluate the applicability and usefulness of short-, medium- and long-term sales forecasts on different parts of the organisation 1.3 Evaluate the impact of sales forecasting on sales managers and their sales objectives, targets, budgeting and remuneration systems 1. Understand the impact of sales forecasting on organisational planning 2. Understand factors that may affect sales trends 2.1 Evaluate internal factors that may affect sales trends 2.2 Evaluate external factors that may affect sales trends 3. 3.1 Evaluate qualitative techniques for forecasting sales 3.2 Evaluate quantitative techniques for forecasting sales 3.3 Evaluate the use of computer software for forecasting sales Understand qualitative and quantitative techniques for forecasting sales 4. Understand the importance of monitoring actual sales against forecast sales 4.1 Evaluate the importance of measuring and monitoring actual sales against forecast sales 4.2 Evaluate methods for measuring and monitoring actual sales against forecast sales and for revising sales forecasts 5. Understand budgeting methods 5.1 Evaluate budgeting methods and select a method likely to give an accurate budget to support sales forecasts 5.2 Evaluate methods for allocating the sales budget to sales teams 5.3 Evaluate methods to identify causes of variances between budget and actual expenditure and to analyse possible actions to address variances ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 33 Title Relationship management for account managers Level 5 Credit Value 6 GLH 30 Unit Reference No. M/503/0615 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Explain what information is needed about the account and competitors 1.2 Describe how to build trust with accounts 1.3 Explain how to provide expertise to improve the productivity of the account 1.4 Explain how to reduce the account’s financial burden 1.5 Explain how to improve the quality of service provision 1.6 Describe how to maintain account loyalty to own organisation 1. Understand how to build relationships with accounts 2. Understand how to use networking in sales 2.1 Evaluate methods for developing a personal network of contacts to meet current and future needs for information, resources and sales opportunities 2.2 Explain the importance of reciprocity and confidentiality in networking 2.3 Evaluate methods for maintaining communication with contacts in personal network 3. 3.1 Evaluate methods for researching prospective customer organisations suitable for consultative selling 3.2 Evaluate methods for establishing rapport and own credentials with customer organisation 3.3 Evaluate strategic questions to identify issues in the customer organisation which represent sales opportunities 3.4 Quantify in financial and strategic terms the effects of the most important issue or opportunity ©2014 Skills CFA Understand how to use consultative selling Level 4 NVQ Diploma in Business Administration (QCF) • Page 34 3.5 Evaluate solutions for the customer organisation issue 4. Know when and how to undertake stakeholder analysis 4.1 Describe the importance of and the need for stakeholder analysis 4.2 Describe how to identify and analyse the needs and concerns of different stakeholders 5. Understand how to monitor and control customer relationships 5.1 Evaluate the concept of monitoring and control in maintaining relationship management activities 5.2 Evaluate own organisation’s requirements relating to monitoring and control activities 5.3 Evaluate methods of formal and informal feedback for monitoring of key customer activities 5.4 Identify and evaluate techniques to be used to analyse information obtained during monitoring and control 5.5 Identify key strengths and weaknesses of the relationship and areas for improvement ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 35 Title Leading a team Level 5 Credit Value 6 GLH 30 Unit Reference No. D/503/0609 Learning Outcomes Assessment Criteria The learner will: The learner can: 1.1 Evaluate the relationship between leadership and management 1.2 Evaluate different styles of leadership and how to select and apply these to different situations and people 1. Understand principles of leadership 2. Know how to build trust between self and team 2.1 Explain how to make decisions considering the good of all stakeholders 2.2 Explain how to foster collaboration within own team and between own team and other teams in own organisation 2.3 Explain how to demonstrate fair, principled behaviour 3. 3.1 Explain how to communicate a vision to own team, which articulates underlying values and sets the context in which goals are selected and pursued 3.2 Explain how to have two-way communication with the team, enabling team members to ask questions, interpret the vision and see their role in achieving it Know how to share own vision with team 4. Know how to focus team members to complete tasks and achieve objectives ©2014 Skills CFA 4.1 Explain how to identify key tasks to achieve objectives 4.2 Explain how to allocate work to team members by communicating objectives and delegating tasks 4.3 Explain how to demonstrate encouragement and support of team members to complete tasks and achieve objectives 4.4 Explain how to steer a team through difficulties and challenges, including conflict Level 4 NVQ Diploma in Business Administration (QCF) • Page 36 4.5 Explain how to monitor progress and quality of work and provide constructive feedback 4.6 Explain how to provide recognition when objectives are achieved 5. Know how to create accountability in team members 5.1 Explain how to demonstrate accountability for achieving own tasks 5.2 Explain how to create accountability in team members 6. Know how to maintain alignment of own actions with team and organisation 6.1 Explain how to maintain alignment of organisation’s resources with its vision and goals 6.2 Explain how to demonstrate consistency in strategy, structure and resource allocation at operational level 6.3 Explain how to demonstrate own actions as being congruent with own words, at interpersonal level ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 37 Title Prepare specifications for contracts Level 4 Credit Value 4 GLH 23 Unit Reference No. H/506/1957 Learning Outcomes Assessment Criteria The learner will: The learner can: 1. Understand the principles supporting the preparation of specifications for contracts 1.1 Explain the scope of contract specifications 1.2 Explain the roles and interests of those who should be involved in a tender process 1.3 Analyse the legal implications of a range of types of contracts and agreements 1.4 Explain the requirements of confidentiality and data protection 1.5 Evaluate the risks associated with procurement and tendering processes 1.6 Explain the basis for the design of a tender evaluation process 2. Be able to prepare specifications for contracts 2.1 Confirm the requirements for the contract specification 2.2 Draft contract specifications that meet the requirements including postcontractual requirements 2.3 Specify the parameters of the contract in line with the requirements 2.4 Provide sufficient information to enable potential suppliers to develop proposals that are capable of meeting the specification 2.5 Define objective selection criteria to evaluate tender proposals 2.6 Establish a selection process that meets organisational requirements 2.7 Adhere to organisational policies and procedures, legal and ethical requirements when preparing specifications for contracts ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 38 Title Manage events Level 4 Credit Value 6 GLH 49 Unit Reference No. M/506/1959 Learning Outcomes Assessment Criteria The learner will: The learner can: 1. Understand the management of an event 1.1 Explain how organisational objectives will be met by an event 1.2 Explain the flexibilities and constraints of an event’s budget 1.3 Evaluate the use of project management techniques in event management 1.4 Analyse how models of contingency and crisis management can be applied to event management 1.5 Analyse the use of customer relationship management (CRM) systems to attract attendees 1.6 Evaluate the application of the principles of logistics to event management 1.7 Describe the insurance requirements of an event 2. Be able to manage the planning of an event 2.1 Identify the purpose of an event and the key messages to be communicated 2.2 Identify target attendees for an event 2.3 Assess the impact of an event on an organisation and its stakeholders 2.4 Establish requirements for resources, location, technical facilities, layout, health and safety 2.5 Identify how event-related risks and contingencies will be managed 2.6 Develop an event plan that specifies objectives, success and evaluation criteria 2.7 Make formal agreements for what will be provided, by whom and when 2.8 Determine methods of entry, security, access and pricing ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 39 3. Be able to manage an event 3.1 Manage the allocation of resources in accordance with the event management plan 3.2 Respond to changing circumstances in accordance with contingency plans 3.3 Deliver agreed outputs within the timescale 3.4 Manage interdependencies, risks and problems in accordance with the event management plan 3.5 Comply with the venue, insurance and technical requirements 3.6 Apply the principles and good practice of customer care when managing an event 3.7 Adhere to organisational policies and procedures, legal and ethical requirements when managing an event 4. Be able to follow up an event 4.1 Ensure that all post-event leads or actions are followed up 4.2 Optimise opportunities to take actions that are likely to further business objectives 4.3 Evaluate the effectiveness of an event against agreed criteria ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 40 Title Develop and maintain professional networks Level 4 Credit Value 3 GLH 15 Unit Reference No. J/506/1949 Learning Outcomes Assessment Criteria The learner will: The learner can: 1. Understand the principles of effective networking 1.1 Describe the interpersonal skills needed for effective networking 1.2 Explain the basis on which to choose networks to be developed 1.3 Evaluate the role of shared agendas and conflict management in relationshipbuilding 1.4 Evaluate the role of the internet in business networking 1.5 Assess the importance of following up leads and actions 1.6 Analyse ethical issues relating to networking activities 2. Be able to identify professional networks for development 2.1 Identify potential networks for professional development from an analysis of their benefits compared with individual needs and aspirations 2.2 Shortlist networks for development against defined criteria 2.3 Assess the benefits and limitations of joining and maintaining selected network(s) 3. Be able to maintain professional networks 3.1 Identify the potential for mutual benefit with network members 3.2 Promote their own skills, knowledge and competence to network members 3.3 Provide information, services or support to network members where the potential for mutual benefit has been identified 3.4 Establish the boundaries of confidentiality 3.5 Agree guidelines for the exchange of information and resources 3.6 Take action to ensure that participation ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 41 in networks reflects current and defined future aspirations and needs 3.7 Make introductions to people with common or complementary interest to and within networks ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 42 Title Encourage learning and development Level 4 Credit Value 3 GLH 16 Unit Reference No. M/506/1962 Learning Outcomes Assessment Criteria The learner will: The learner can: 1. Understand the principles of learning and development 1.1 Assess the role of continuous professional development (CPD) in identifying and meeting individuals’ learning and development for current and future business needs 1.2 Analyse the advantages and limitations of different learning and development methods 1.3 Explain how to identify individuals’ learning and development needs 1.4 Evaluate the role of self-reflection in learning and development 2. Be able to support individuals’ learning and development 2.1 Promote the benefits of learning to people in own area of responsibility 2.2 Support individuals in identifying their current and likely future learning and development needs from a range of information sources 2.3 Agree with individuals the learning activities to be undertaken, ensuring they are within agreed budgets and consistent with business needs 2.4 Summarise agreed learning objectives, learning activities, review mechanisms and success criteria in a personal development plan 2.5 Create an environment that encourages and promotes learning and development 2.6 Provide opportunities for individuals to apply their developing competence in the workplace 3. Be able to evaluate individuals’ learning and development 3.1 Analyse information from a range of sources on individuals’ performance and development ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 43 3.2 Evaluate the effectiveness of different learning and development methods 3.3 Agree revisions to personal development plans in the light of feedback ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 44 Title Manage a budget Level 4 Credit Value 4 GLH 26 Unit Reference No. A/506/1995 Learning Outcomes Assessment Criteria The learner will: The learner can: 1. Understand how to identify financial requirements 1.1 Explain how to calculate the estimated costs of activities, resources and overheads needed to achieve objectives 1.2 Analyse the components of a business case to meet organisational requirements 1.3 Analyse the factors to be taken into account to secure the support of stakeholders 1.4 Describe the business planning and budget-setting cycle 2. Understand how to set budgets 2.1 Explain the purposes of budget-setting 2.2 Analyse the information needed to enable realistic budgets to be set 2.3 Explain how to address contingencies 2.4 Explain organisational policies and procedures on budget-setting 3. Be able to manage a budget 3.1 Use the budget to control performance and expenditure 3.2 Identify the cause of variations from budget 3.3 Explain the actions to be taken to address variations from budget 3.4 Propose realistic revisions to budget, supporting recommendations with evidence 3.5 Provide budget-related reports and information within agreed timescales 3.6 Explain the actions to be taken in the event of suspected instances of fraud or malpractice ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 45 Title Recruitment, selection and induction practice Level 4 Credit Value 6 GLH 33 Unit Reference No. R/506/2909 Learning Outcomes Assessment Criteria The learner will: The learner can: 1. Understand the principles and theories underpinning recruitment, selection and induction practice 2. Be able to recruit people into an organisation ©2014 Skills CFA 1.1 Explain workforce planning techniques 1.2 Describe the information needed to identify recruitment requirements 1.3 Assess the impact of an organisation’s structure and culture on its recruitment and selection policies and practices 1.4 Analyse the factors involved in establishing recruitment and selection criteria 1.5 Evaluate the suitability of different recruitment and selection methods for different roles 1.6 Analyse patterns of employment that affect the recruitment of staff 1.7 Explain the factors to be taken into account when developing job specifications, personal specifications and job advertisements 1.8 Explain the induction process 1.9 Explain the relationship between human resource processes and the induction processes 2.1 Determine current staffing needs 2.2 Identify current skills needs from identified staffing needs 2.3 Identify future workforce needs 2.4 Develop a resourcing plan that addresses identified needs within budgetary limitations 2.5 Evaluate the cost-effectiveness of different methods of recruitment for an identified role 2.6 Explain how recruitment policies and practices meet legal and ethical requirements Level 4 NVQ Diploma in Business Administration (QCF) • Page 46 2.7 Select the most appropriate method of recruitment for identified roles 3. Be able to select appropriate people for the role 3.1 Plan assessment processes that are valid and reliable 3.2 Provide those involved in the selection process with sufficient information to enable them to make informed decisions 3.3 Justify assessment decisions with evidence 3.4 Inform applicants of the outcome of the process in line with organisational procedures 3.5 Evaluate the effectiveness of the selection process 3.6 Adhere to organisational policies and procedures, legal and ethical requirements when carrying out selection assessments 4. Be able to induct people into an organisation 4.1 Develop induction materials that meet operational and new starters’ needs 4.2 Explain to new starters organisational policies, procedures and structures 4.3 Explain to new starters their role and responsibilities 4.4 Explain to new starters their entitlements and where to go for help 4.5 Assess new starters’ training needs 4.6 Confirm that training is available that meets operational and new starters’ needs 4.7 Provide support that meets new starters’ needs throughout the induction period ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 47 Title Develop working relationships with stakeholders Level 4 Credit Value 4 GLH 20 Unit Reference No. F/506/1982 Learning Outcomes Assessment Criteria The learner will: The learner can: 1. Understand working relationships with stakeholders 1.1 Analyse stakeholder mapping techniques 1.2 Explain how influencing skills and techniques can be used to enhance the relationship with stakeholders 1.3 Explain how expectation management and conflict resolution techniques are applied to stakeholder management 1.4 Analyse the advantages and limitations of different types of stakeholder consultation 1.5 Evaluate the risks and potential consequences of inadequate stakeholder consultation 2. Be able to determine the scope for collaboration with stakeholders 2.1 Identify the stakeholders with whom relationships should be developed 2.2 Explain the roles, responsibilities, interests and concerns of stakeholders 2.3 Evaluate business areas that would benefit from collaboration with stakeholders 2.4 Evaluate the scope for and limitations of collaborating with different types of stakeholder 3. Be able to develop productive working relationships with stakeholders 3.1 Create a climate of mutual trust and respect by behaving openly and honestly 3.2 Take account of the advice provided by stakeholders 3.3 Minimise the potential for friction and conflict amongst stakeholders 4. Be able to evaluate relationships with stakeholders 4.1 Monitor relationships and developments with stakeholders 4.2 Address changes that may have an effect on stakeholder relationships ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 48 4.3 Recommend improvements based on analyses of the effectiveness of stakeholder relationships ©2014 Skills CFA Level 4 NVQ Diploma in Business Administration (QCF) • Page 49