Table of contents

advertisement

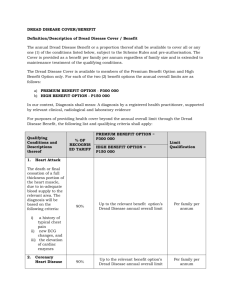

LEARNER’S STUDY GUIDE Investigate dread disease products and their place in wealth management (113913) NAME: ORGANISATION: COURSE NO.: OR RPL: Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Contents Instructions to the learner 2 UNIT 1 Dread disease products as an insurance product (SO1) 7 UNIT 2 Dread disease products offered by different financial services institutions (SO2) 14 UNIT 3 The legal framework for dread disease (SO3) 19 UNIT 4 Dread disease as part of holistic wealth management (SO4) 28 Answers to Self-tests 35 Addendum 1 38 Addendum 2 46 Version 1 2016/03/06 1 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Instructions to the learner Introduction Welcome Welcome to the learning intervention that deals with the investigation of dread disease products and their place in wealth management. This learning intervention forms part of a Level 4 skills programme (Investigate dread disease products and their place in wealth management), which enables you to meet the minimum requirements to be “fit and proper” in terms of the FAIS legislation. Purpose of this This learning intervention will provide you with the knowledge learning and skills to provide insurance solutions by investigating dread intervention disease products and their place in wealth management. Overall outcome By the end of this learning intervention, you will be able to do the following:: Explain dread disease as an insurance product. Investigate dread disease products offered by different financial services institutions. Explain the legal framework for dread disease. Describe dread disease as part of holistic wealth management. Target audience This learning intervention is intended for learners in a financial services environment. It will add value to financial planners, intermediaries, financial advisers, healthcare intermediaries, product developers, co-ordinators of medical schemes, financial call centre agents, and trustees of medical schemes and retirement funds. It views dread disease insurance as an integral part of holistic financial planning that is not necessarily part of life cover. Delivery medium This training will take place in the form of self-study. In other words, you are required to work through this self-study guide and complete the activities included. The activities are comprehensive, practical, and experiential in nature. They are based on “real work” where learners work with real workplace scenarios and case studies. Prerequisites Learning assumed to be in place: Version 1 2016/03/06 Learners should be competent in Communication, Mathematical Literacy, and Financial Literacy at NQF Level 3. 2 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Learners’ roles and responsibilities You are required to do the following: Work through this self-study guide. Complete activities. Ask for guidance and support when required. Complete the assessment. Introduction to Investigation of dread disease products and their place in wealth this self-study management is the central theme of this training and is guide discussed in detail in this self-study guide. This guide makes use of icons to guide you in your learning process. Below is a description of these icons: Icon Meaning Icon Meaning Self-tests and activities Assignments and assessments Study Outcomes Read Action verbs Version 1 2016/03/06 This guide uses action verbs in its learning outcomes. Action verbs tell you what you must DO. Action verb Explanation Compare Examine in order to note the similarities and/or differences Explain Make known in detail, clarify Identify Ascertain the origin, nature, or definitive characteristics Indicate Show by using examples Name List, define, tell, show, label, collect, tabulate, who, when, where Research Conduct an investigation to compare, contrast, distinguish, analyse, categorise, examine, identify, explain, separate 3 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management The diagram below illustrates the broad process to follow when applying technical knowledge and skill in investigating dread disease products and their place in wealth management and will also illustrate how the self-study guide is structured. Investigate dread disease products and their place in wealth management (113913) UNIT STUDY READ SELF-TEST/ ACTIVITY ASSESSMENT Start here UNIT 1 Dread disease products as an insurance product UNIT 2 Dread disease products offered by different financial services institutions UNIT 3 The legal framework for dread disease The outcomes for this unit The content of sub-units 1.1-1.4 Complete Self-test 1 The outcomes for this unit Read Addendum 1 The content of sub-units 2.1-2.2 Complete Self-test 2 The outcomes for this unit The content of sub-units 3.1-3.3 Complete Self-test 3 The outcomes for this unit UNIT 4 Dread disease as part of holistic wealth management The content of sub-units 4.1-4.3 Complete Self-test 4 Start preparing for your final assessment Page 1 Version 1 2016/03/06 4 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Unit standards The overall outcomes and specific outcomes of this learning intervention are aligned with registered Unit Standard 113913. This means that if you are able to demonstrate competence in the learning outcomes, which are aligned to the specific outcomes of the unit standard, you will qualify for credits, which will contribute towards the 120 credits required for a national certificate at Level 4. If you are unable to demonstrate competence, you will not obtain any credits for the unit standard. This learning intervention is aligned to the following unit standard as illustrated in the table below: Unit standard title Investigate dread disease products and their place in wealth management Unit standard number NQF level Number of credits 113913 4 2 This means a total of two credits towards a national certificate. How is this course made up? This course has four units. Each unit corresponds to a specific outcome (SO) as indicated in the SAQA documentation (Addendum 2). Each unit has a number of sub-units. These subunits correspond to the assessment criteria (AC) as indicated in the SAQA documentation. Note: SO1AC1 refers to Specific Outcome 1, Assessment Criterion 1. Assessment In order to obtain the two credits for Unit Standard 113913 as discussed previously, you must provide evidence of your competence after working through this self-study guide. Providing evidence of your competence will occur during the assessment process. The laid-down policies, procedures, and related issues regarding assessments will be explained to you before the assessment takes place. You will also be given an overview of, or instructions on how, the assessment will take place, what evidence you must produce, how you must prepare yourself, etc. A qualified assessor or your line manager will guide and support you throughout this process. Resources Version 1 2016/03/06 The following resources will assist you in preparing for your assessment: 5 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Reference Availability Internet DiscoveryWorld. N.d. [Online] Available: www.discoveryhealth.co.za. Liberty Life. N.d. [Online] Available: www.liberty.co.za. Momentum. N.d. [Online] Available: www.momentum.co.za. Old Mutual – Investment and Insurance Products for South African Individuals and Institutions. N.d. [Online] Available: www.oldmutual.co.za. Sanlam – Your Financial Services Group. N.d. [Online] Available: www.sanlam.co.za. Company product guides: member booklets Marketing and catalogues as available from the company department with which the learner has dealings. Our wish to you Version 1 2016/03/06 Everything of the best in your studies. Enjoy every moment that you spend studying. It is time well spent in making sure of your future. 6 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management UNIT 1 Dread disease products as an insurance product (SO1) After completing this unit, you should be able to do the following: Outcomes for this unit Explain the concept of dread disease, and give examples (AC1.1). Identify the different terminology used to describe dread disease for three different insurers (AC1.2). Name and explain the various medical conditions that are covered by dread disease products, and give an indication when the insurer would pay out for each condition (AC1.3). Identify dread disease events that would not be covered from a specific policy document, and give an indication why such events are excluded for the policy (AC1.4). Study the material for each sub-unit before moving on to the activities. 1.1 The concept of dread disease is explained with examples (AC1.1) Introduction The concept of dread disease is not easy to explain, as the product is offered in a variety of combinations, depending on the insurer. Historically, dread disease benefits were paid as a lump sum based on a multiple of salary or flat amount and limited to a few diseases; for example, a lump sum of R400 000 is paid on diagnosis of cancer as a once-off payment. Currently, dread disease cover is offered for a range of diseases and with more options of payment. Example Total dread disease cover amounts to R400 000, but first-stage cancer has been diagnosed. The benefit is, therefore, tiered accordingly. This means that the claim for first-stage cancer amounts to, for example, 20% of R400 000. Should the member’s condition worsen, further portions of the benefit will be paid until the total cover has been depleted. Version 1 2016/03/06 7 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management What is dread disease cover? Background Dread disease cover is a risk benefit offered by insurers to cover individuals in the event of serious illnesses. Most insurers offer a range of policies, although some insurers may cover more than others. The benefit is payable on diagnosis of any of, but not limited to, the following conditions (as offered by the insurer): Heart attack Open heart surgery Stroke Cancer Kidney failure Rheumatoid arthritis Muscular dystrophy Motor neuron disease Paralysis Major organ transplant Blindness Major burns Coma Multiple sclerosis Dementia Accidental brain damage Thirty years ago, the most severe ailments society suffered from were diseases such as tuberculosis and diseases associated with poverty. The Western lifestyle has evolved to such an extent that more illnesses related to our current lifestyle are prevalent. Some of these diseases are related to stress, refined nutrition, etc. Up until twenty years ago, risk benefits such as death cover and disability benefits were offered. The life insurers saw the need to fill the gap in the market. No longer do they provide the conservative products that cater for one condition or event. A variety of combinations of risk products can be used to supplement one another, providing for potential lifestyle changes and loss of income, depending on a client’s specific needs. Dread disease benefits became part of this spectrum. Version 1 2016/03/06 8 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Accelerated benefits This benefit is available when linking dread disease to life cover. Once a dread disease claim has been paid, the group life cover is reduced by the amount of the dread disease claim. Example Johan’s cover at Sanlam is as follows: Life cover: R600 000 Disability cover: R600 000 Dread disease: R400 000 Johan suffers a stroke, and Sanlam pays a dread disease benefit of R400 000. His life cover is reduced to R200 000 because the policy Johan has regards dread disease as an accelerated benefit. If Johan owned a non-accelerated policy, he would have retained his full life cover of R600 000, even though he received a dread disease benefit of R400 000. Reinstatement The benefit can be reinstated after the policyholder has returned to work and continued payment after a specified period of time as specified by the insurer. Example John suffers a heart attack on 1 May 2004. Old Mutual pays a benefit of R400 000. His policy covers the reinstatement of the benefit after 30 days. Should John suffer another heart attack two years later, the benefit will again be paid to him. 1.2 Different terminology used to describe dread disease is identified for three different insurers (AC1.2) Terminology in the industry Dread disease is identified as specific products offered by insurers. These products are defined by insurers as part of a unique range of benefits and, therefore, named differently. Dread disease is offered with life cover or as a standalone benefit. Most insurers have general names for all their risk benefits. These generic names include the following: Version 1 2016/03/06 Life cover Disability Dread disease Premium protection 9 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management The terminology for dread disease within one insurer can also be named differently when the features and target market of the product differ. The table below indicates the terminology used for the range of benefits available as dread disease benefits. Not all insurance organisations have been included. Risk Products OLD MUTUAL MOMENTUM DISCOVERY Name Dread disease benefits Severe Illness Core Severe Illness Comprehensive Severe Illness Core Critical Illness Comprehensive Critical Illness Classical Critical Illness Various: Severe Illness AcceleRater Female Severe Illness ModeRater Child Severe Illness Benefit Greenlight Myriad Integrator SANLAM Matrix Dread Disease LIBERTY Lifestyle Protector Living Lifestyle Living Lifestyle Optimum Living Lifestyle Optimum Plus FemAbility CareAbility 1.3 The various medical conditions covered by dread disease products are named and explained and an indication is given of when the insurer would pay out for each condition (AC1.3) Introduction Each medical condition subscribes to the terms and conditions within the policy document. Exclusions, limits, and terms of agreement will determine whether the benefit is paid. Two main factors are considered when a claim is lodged: The status of the policyholder in terms of the policy document and whether the policyholder is entitled to the benefit Version 1 2016/03/06 10 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Diagnosis of the condition must be made by a registered medical practitioner and supported by medical evidence with the necessary laboratory, clinical, radiological, and histological evidence. Prior to implementing the policy for dread disease cover, the insurer will request that the client discloses information regarding his/her health and habits. This is done in the form of a questionnaire. Should any detail on the questionnaire(s) reveal that the client has suffered or shows signs of suffering any of the identified diseases, the insurer reserves the right to call for further medical evidence, load the rates, and, finally, refuse cover if the risk is too high. The most common dread diseases are mentioned below. The list is not exhaustive, and the criteria for each condition may differ from company to company. Heart attack Payment will be made on the basis of supporting evidence in view of a part of the heart muscle dying due to the blood supply not being adequate. The medical documentation must include an electrocardiogram (ECG) showing evidence of acute myocardial infarction. Open heart surgery Payment will only be effected on proof of coronary angiography that the surgery was necessary. All other surgery is excluded. Kidney failure Payment is effected on failure of both kidneys where renal dialysis is required. Paraplegia Payment is made on the loss of the use of both legs or both arms. Blindness Payment is made on diagnosis of the loss of vision in both eyes. Major organ transplant Transplant of vital organs, that is, heart, lungs, liver, pancreas, or kidneys, must have been made. A bone marrow transplant is also considered for payment of this benefit. Stroke Payment is dependent on producing medical evidence that proves a neurological deficit has occurred, lasting longer than 24 hours. Conclusion It must be noted that dread diseases and requirements for these diseases are subject to the policy contract issued by the insurer. Therefore, the same claim may be repudiated by one insurer and paid by another. It is important that anyone buying or selling dread disease products is fully acquainted with them. Version 1 2016/03/06 11 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management 1.4 Dread disease events which would not be covered are identified from a specific policy document and an indication is given of why such events are excluded from the policy (AC1.4) Introduction All of the events as documented under Assessment Criterion 1.3 will be covered, provided that the policyholder meets the policy specifications in terms of the qualifying and medical criteria as specified above. There are diseases that are not covered, for example, HIV/Aids contracted by means other than a blood transfusion. Criteria laid down by the insurers are different, and it is important to study the terms and conditions of the policy. However, there are reasons why payment may be repudiated. Non-payment can be as a result of the following: A pre-existing condition not disclosed at the time of taking out the policy Maximum cover already paid Exclusions Maximum age Concurrent disability cover Pre-existing condition No benefit will be payable if the policyholder claims immediately 24 months after taking out the policy if the condition or similar condition was diagnosed 24 months prior to becoming a dread disease policyholder. Maximum cover If payment is made for the same illness by another insurer or if the maximum benefit has already been paid, no further payment will be considered. Exclusions The following will not be considered: Version 1 2016/03/06 Claims arising directly or indirectly through war, whether declared or not Participation in aviation other than as a passenger travelling between two airfields in an aircraft flown by a duly licensed pilot Participation in any hazardous sport or pursuit Exposure to risks beyond the borders of South Africa that are not generally found or are more severe than corresponding risks in South Africa Any act of the member or spouse that is a wilful and material violation of any law 12 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management The use of nuclear, biological, or chemical weapons or attacks on, or sabotage of, facilities and storage depots, whether direct or remotely initiated, which lead to the release of radioactivity or nuclear, biological, or chemical warfare agents Maximum age Dread disease cover cannot extend beyond the age of 65. Concurrent disability cover Should the policyholder receive a disability benefit due to a medical condition that also forms part of the dread disease category, payment may not be made. Answer the following self-test questions. Compare your answers to the ones provided at the end of this study guide. Self-test 1 1. Briefly explain the reasons for insurers including dread disease benefits in insurance packages. 2. How do accelerated benefits affect group life cover? 3. What are the conditions of reinstatement? 4. List the generic names for risk benefits. 5. Name the factors that are considered when a claim is made. 6. Briefly explain the reasons for repudiating a claim. Competency Competency check and progress indication Version 1 2016/03/06 Check SO1 I can explain the concept of dread disease and give examples. AC1.1 I can identify the different terminology used to describe dread disease for three different insurers. AC1.2 I can name and explain the various medical conditions that are covered by dread disease products and give an indication when the insurer would pay out for each condition. AC1.3 I can identify dread disease events that would not be covered from a specific policy document and give an indication why such events are excluded for the policy. AC1.4 13 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management UNIT 2 Dread disease products offered by different financial services institutions (SO2) After completing this unit, you should be able to do the following: Outcomes for this unit Compare and identify dread disease products offered by three insurers in the following terms (AC2.1): o Contracts o Benefits o Exclusions o When benefits are payable Compare the rate charged by three insurers, and indicate the policy best suited to a specific client (AC2.2). Study the material for each sub-unit before moving on to the activities. 2.1 Version 1 2016/03/06 Dread disease products offered by three insurers are identified and compared in terms of the contracts, benefits, exclusions and when benefits are payable (AC2.1) 14 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Benefit name Survival period Maximum cover Events Version 1 2016/03/06 Old Mutual Severe Illness Benefit 30 days R2.5 m Core version: Cancer Heart attack Stroke Comprehensive version: All core-version benefits Open heart surgery Aortic surgery Heart transplant Cardiomyopathy Multiple sclerosis Motor neuron disease Accidental brain damage Dementia (including Alzheimer’s) Parkinson’s disease Bacterial meningitis Benign brain tumour Coma Liver transplant Pancreas transplant Chronic liver failure Kidney transplant Kidney failure Rheumatoid arthritis Paralysis Muscular dystrophy Accidental HIV via blood transfusion Accidental HIV for medical, dental, or nurse practitioners Liberty Living Lifestyle Trauma and paraplegia/quadriplegia 14 days and all other 30 days R2 m Includes 14 categories as per the American Medical Association (AMA): Life-threatening cancer Respiratory failure Blindness Loss of hearing Advanced Aids Multiple sclerosis Parkinson’s disease Benign brain tumour Coma Renal failure Paraplegia/quadriplegia Cardiovascular: Heart attack Cardiomyopathy Coronary artery disease Heart valve Cerebrovascular incident Heart transplant Trauma: Head injury Major burns Discovery Severe Illness Benefit By condition R2 m Cancer Heart and artery Gastrointestinal Connective tissue disease Urogenital tract and kidney Respiratory disease Advanced Aids/Accidental Musculoskeletal Eye Ear, nose, and throat Endocrine and metabolic diseases 15 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Type of benefit Accidental HIV via organ transplant Bone marrow transplant Severe aplastic anaemia Paid as a lump sum benefit Available as a standalone or accelerator of death benefits Cannot claim twice for the same event or related events, for example, heart attack and open heart surgery Accelerator and non-accelerator benefits offered Termination of benefit Benefit ceases in the event of the following: The life covered dies The benefit term ends The full cover amount is paid The benefit lapses For standalone, if illness has been removed Paid as tiered benefit, for example, firststage cancer amounts to, for example, 20% of R400 000. Should the member’s condition worsen to stage 2, 50% of the benefit will be paid, etc. Cannot claim twice for the same event or related events, for example, heart attack and open heart surgery Claims dealt with in different stages of severity Accelerator and non-accelerator benefits offered Expires at age 65 Whole of life where payment of premiums is until death Pays according to seven severity levels Client qualifies for multiple claims across body systems Subsequent claims not related to the same body system will be treated independent of previous claims Expires at age 65 Whole of life where payment of premiums is until death Note: the table reflects the comparison between similar benefits. Additional benefits are offered by the above insurers. Version 1 2016/03/06 16 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management 2.2 Introduction Example The rates charged by the three insurers are compared and an indication is given of the policy best suited to a specific client (AC2.2) Rates charged by insurers are related to different benefits, target markets, and also the image of the company in terms of its customer service and track record. Discovery offers their Body IQ product as a benefit to ensure that the client has membership of a gymnasium and, when using these facilities, will benefit in terms of the products and premiums charged. Liberty offers its benefits and capitalises on its world-class service to promote its products. Differences in the products Examples It must be noted that there are obvious and subtle differences in the products that affect their price range. Old Mutual’s Greenlight benefits pay for a coma on condition that the beneficiary is off life support. Liberty pays for the benefit whether the beneficiary is on or off life support. A trauma benefit is included in the basic dread disease cover at Liberty. Trauma is costed separately as an additional benefit at Discovery Health. Comparison The quotes below are based on the dread disease product and the life cover offered by three insurers. Study the following (Addendum 1): Study Version 1 2016/03/06 Quotation 1 – Discovery Life Quotation 2 – Old Mutual Quotation 3 – Liberty Life Quotation 4 – Momentum 17 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Answer the following self-test questions. Compare your answers to the ones provided at the end of this study guide. Self-test 2 Mr Frail has a Living Assurance benefit with Liberty Life. He has life cover of R1 million and dread disease cover of R500 000 taken out on the accelerator basis. He suffers from stage 1 cancer. 1. Calculate the benefit Mr Frail will receive as his first claim. 2. Mr Frail’s condition worsens to a point where he receives 100% of his dread disease benefit. What will Mr Frail’s life cover look like when he dies? 3. How, in your opinion, would Old Mutual have paid the benefit on diagnosis of Mr Frail’s condition? Competency Competency check and progress indication SO2 AC2.1 AC 2.2 I can compare and identify dread disease products offered by three insurers in the following terms: Contracts Benefits Exclusions When benefits are payable I can compare the rate charged by three insurers, and indicate the policy best suited to a specific client. Version 1 2016/03/06 Check 18 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management UNIT 3 The legal framework for dread disease (SO3) After completing this unit, you should be able to do the following: Outcomes for this unit Identify the legislation relating to dread disease, and indicate how the Acts impact on the sale of dread disease policies (AC3.1). Explain the tax implications for the dread disease policies in terms of the following (AC3.2): o Reference to tax on receipt of the benefit o The deductibility of premiums Research the demarcation between medical aid schemes and insurance with reference to the following (AC3.3): o Dread disease o Healthcare products Study the material for each sub-unit before moving on to the activities. 3.1 Legislation relating to dread disease is identified and an indication is given of how the Acts impact on the sale of dread disease policies (AC3.1) Introduction Most laws have an indirect effect on dread disease. We will attempt to document whether legislation affects dread disease and, if so, how it impacts on the benefit, premium, and sale thereof. Long-term Insurance Act 52 of 1998 Dread disease forms part of six classes of long-term business: Version 1 2016/03/06 Assistance policy (these are policies with a small amount of life cover, for example, funeral benefits) Disability policy Fund policy Health policy Life policy Sinking fund policy 19 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Dread disease is affected by Part I of the Long-Term Insurance Act that deals primarily with the administration of the Act, the role of the Registrar for Long-Term Insurance and the Advisory Committee. Part 4 of the Regulation to the Long-Term Insurance Act determines, along with the general principles of taxation, the structure of policies such as dread disease. Policyholder Protector Rules (PPR) The purpose of the PPR is to enable policyholders to make decisions regarding their longterm policies and ensure that intermediaries and long-term insurers conduct business fairly, with due care and diligence. The policyholder is covered by the Statutory Notice in that it provides the policyholder with the following rights: Financial Advisory and Intermediary Services (FAIS) Act 37 of 2002 Income Tax Act 58 of 1962 Right to certain information from the intermediary at the earliest reasonable opportunity Right to know the impact of the decision he/she elects to make Right, when being advised, to replace an existing policy Right to be informed by the insurer Right to cancel the transaction within a specified period (that is, 30 days) Dread disease policyholders have the assurance that the FAIS Act is there to protect them as consumers, ensure that they are provided with adequate information in order to enable them to make informed decisions, and regulate the selling and advice-giving activities of financial planners. Individuals pay tax on their taxable income in the year of assessment at specified rates of tax laid down in the Schedule of Taxation. Tax is paid on a taxpayer’s taxable income earned over a period of a year, which is called the year of assessment. Employees’ tax is a withholding tax that is deducted from an employee’s remuneration on a regular (usually monthly) basis. The deduction is made by the employer and is determined by using tables issued by Inland Revenue. Version 1 2016/03/06 20 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management When a client takes out cover for a policy, the premium paid on that policy is normally paid with after-tax monies. Therefore, premiums paid for this kind of policy and the benefits received will be free of tax. Life Offices’ Association Regulations The Life Offices’ Association (LOA) is a body set up by the industry stakeholders to regulate industry practices. The code of the LOA regulates dealings on dread disease benefits. It determines that benefits are payable solely on the occurrence of certain objectively determinable medical conditions, including, but not limited to, heart attacks, strokes, and cancer. All dread disease claims, like other claims, are regarded as “notifiable” and recorded in the LOA Claims Register. “Notifiable” claims include claims being investigated, fraudulent or repudiated claims, dread disease or overseas claims, Aids-related claims, permanent health claims, and where the beneficiary is not a family member or the beneficiary is an intermediary. The LOA also subscribes to the Promotion of Equality and Prevention of Unfair Discrimination Act 4 of 2000 and will condone non-payment only, based on sound actuarial, statistical, or medical data or opinion that substantiates such action. Impact of legislation The impact of legislation on dread disease is twofold: 1. From an intermediary or insurer’s point of view, sales can be limited or restricted due to the repercussions of not complying with legislation. Indirectly, the insurer will need to employ legal experts to interpret and advise its staff, and this will raise the running costs of the product. 2. From a consumer’s point of view, legislation can provide peace of mind: the consumer feels secure in entering into a dread disease contract, as legislation will ensure that he/she is treated equitably and fairly and that the benefit is paid on criteria generally applied by all insurers. Intermediaries must bear in mind that dread disease benefits are sold to target markets in a variety of ways, which could be confusing for the client. The intermediary must ensure that all aspects of the benefits are thoroughly explained to ensure that the client makes an informed decision. Version 1 2016/03/06 21 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management 3.2 The tax implications for dread disease policies are explained with reference to tax on receipt of the benefit and deductibility of premiums (AC3.2) The general principles of taxation specify that the proceeds of a life policy constitute capital. As such, proceeds of a life policy are tax-free. Payment of premiums made by the policyholder is normally made after tax has been deducted. Therefore, the proceeds from a dread disease policy, or any benefits received at any stage, constitute capital and will be tax-free. 3.3 Introduction The demarcation debate between medical schemes and insurance is researched with reference to dread disease and healthcare products (AC3.3) There are two main bodies under which organisations that provide insurance, medical and other, operate: The Financial Services Board The Council for Medical Schemes Medical insurance has historically been dealt with under the auspices of the Medical Schemes Council. When South Africa became part of the global village and started aligning its business practices according to world standards, insurance organisations started incorporating the medical insurance concept into their mainstream business. The Financial Services Board (FSB) The purpose of the FSB is to supervise the activities of all financial institutions (excluding the banking sector), for example: Pension funds, including provident and retirement annuity (RA) funds Unit trust schemes Trust companies Stock exchanges Insurers Friendly societies Short-term brokers Compliance with certain Acts is monitored by the FSB. One of the Acts is the Long-Term Insurance Act, which determines how dread disease products are managed. Version 1 2016/03/06 22 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management The Council for Medical Schemes Basis of conflict The Council for Medical Schemes is an autonomous body, established by Parliament, to provide supervision over medical schemes. The council determines overall policy and its main objectives include the following: To protect the interests of medical schemes and their members To monitor the financial soundness of medical schemes To investigate complaints and settle disputes in relation to the affairs of medical schemes To make rules that are in line with the Medical Schemes Act 131 of 1998, with regard to its own functions and powers Demarcation between medical schemes and insurance providing medical cover has presented itself as an ongoing debate and cause of confusion. There are two main reasons: 1. Guidelines on what constitutes a medical scheme and its provisions are outlined in the Medical Schemes Act, which was passed in 1998 and came into operation on 1 February 1999. Some of the clauses in the Act were found to be open to interpretation. 2. Certain insurance products, such as hospital plans, where the benefit is not coupled to a healthcare service and/or the cost of such service, are not controlled by the Medical Schemes Act, but fall under the jurisdiction of the FSB. Dread disease versus healthcare products Dread disease products, as offered, do not replace healthcare products offered by medical schemes. They do, instead, enhance the benefits. Medical healthcare provides assistance in a variety of ways for a variety of illnesses, most of which are not considered serious or terminal. The following table is a comparison of dread disease and the medical aid product: Healthcare Regulated by Dread disease Medical Schemes Council FSB Cover Covers daily illnesses, from a common cold treated by a medical practitioner to hospitalisation Covers specific dread diseases, for example, cancer, stroke, and blindness Payment Made on individual treatment as long as client is a member of the scheme Once-off payment as a lump sum or a percentage of the prescribed lump sum until lump sum is depleted Version 1 2016/03/06 23 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Purpose 1. To assist the client with daily unexpected expenses (small amounts) 2. To cover hospitalisation costs To provide financially for nearfatal or fatal diseases in order to 1. maintain existing lifestyle, 2. cover medical expenses, and 3. provide additional income during recuperation Medical Schemes Council versus Liberty The Medical Lifestyle product issued by Liberty raised some of the issues regarding demarcation between insured medical policies and medical schemes. Read the following article: Version 1 2016/03/06 24 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Medical Schemes Council, Liberty reach agreement on healthcare product GUIDELINES drawn up by the Life Offices’ Association (LOA) have ended a longrunning dispute between Liberty Healthcare and the Council for Medical Schemes over Liberty’s health insurance product. In a compromise agreement, Liberty Healthcare has agreed to stop selling the product, Medical Lifestyle Plus, and the council has agreed to let the product continue, under an exemption from the Medical Schemes Act, for the benefit of the 77 000 existing policyholders. The Council for Medical Schemes, which regulates medical schemes, was of the view that Medical Lifestyle Plus did the business of a medical scheme, and because it was not registered as medical scheme, was therefore illegal. Liberty Healthcare disagreed. The matter was heading for court, but then the LOA, which represents life assurers and of which Liberty is a member, decided to draw up its own guidelines on what constitutes health insurance and what should be regarded as illegal in terms of the Medical Schemes Act, for the benefit of life assurers who set up new health insurance business. Steven Maasch, the divisional director of healthcare for Liberty Personal Benefits, says although Liberty is still of the view that the product is legal, the LOA had almost finalised guidelines on what constituted health insurance and Liberty’s product did not comply with these draft guidelines. Liberty Healthcare had then engaged with the Council for Medical Schemes to secure the rights of the existing policyholders, he says. Maasch says Medical Lifestyle Plus is sustainable without new business, because the product has been priced in terms of each policyholder’s risk. Pat Sidley, the council’s spokesperson, says the agreement was a compromise reached by both parties to protect existing policyholders, and to avoid a clash that could have gone to court. Sidley says the agreement is also a natural progression of the demarcation agreement on what constitutes a health insurance and what is the business of a medical scheme. The demarcation agreement was drawn up between the Council for Medical Schemes and the Financial Services Board, which regulates insurance products, in an attempt to clear up confusion about the line between the products. Version 1 2016/03/06 25 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management The Medical Schemes Act regulates medical schemes. In terms of this Act, they have to provide certain benefits and may not charge contribution rates that are based on a member’s age or state of health. Insurance products are regulated by the insurance acts, do not have to provide certain minimum benefits and can charge premiums based on the risk a policyholder poses to the insurer. However, there have been disagreements about the interpretation of the demarcation agreement since it was drawn up. About 18 months ago, the council first took exception to Liberty Healthcare’s original health insurance product, Medical Lifestyle, which among other things, paid a daily hospital benefit. The product was closed to new business in December 2002, and Liberty Healthcare launched Medical Lifestyle Plus in January last year. The modified product pays benefits at a percentage of a sum assured, based on the diagnosis of certain conditions. Policyholders can choose between two levels of cover – one with a R75 000 sum assured and one with a R25 000 sum assured. Depending on the condition you are diagnosed with, how long you spend in hospital, the level of care and other factors, you would be paid a percentage of that R75 000 or R25 000. The cover also includes a monthly benefit for chronic conditions. The council was still unhappy with this product, saying it regarded products that offered a payout linked to the number of days spent in hospital as doing the business of a medical scheme. This week’s compromise is expected to put the matter to rest. Version 1 2016/03/06 26 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Answer the following self-test questions. Compare your answers to the ones provided at the end of this study guide. Self-test 3 1. List the Acts that have an impact on dread disease. 2. Explain how legislation impacts on dread disease. 3. Name the two main bodies under which insurance and medical operate. 4. How compatible are dread disease and healthcare products? Competency Competency check and progress indication I can identify the legislation relating to dread disease and indicate how the Acts impact on the sale of dread disease policies. Check SO3 AC3.1 AC3.2 AC3.3 I can explain the tax implications for the dread disease policies in terms of the following: Reference to tax on receipt of the benefit The deductibility of premiums I can research the demarcation between medical aid schemes and insurance with reference to the following: Version 1 2016/03/06 Dread disease Healthcare products 27 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management UNIT 4 Dread disease as part of holistic wealth management (SO4) After completing this unit, you should be able to do the following: Outcomes for this unit Explain reasons why a client may require dread disease insurance, and provide examples (AC4.1). Explain the difference between dread disease cover and disability insurance in terms of the following (AC4.2): o Benefits o Contributions o Tax deductions o When benefits are payable Explain the role of dread disease in a holistic financial plan with reference to the specific needs of three different clients (AC4.3). Study the material for each sub-unit before moving on to the activities. 4.1 Reasons why a client may require dread disease insurance are explained with examples (AC4.1) Introduction Dread disease benefits have been implemented to accommodate the current trend of diseases. Individuals can depend on the new structure of benefits in a variety of ways: Financial planning Version 1 2016/03/06 The individual has the finances to recuperate. The additional payout can cover medical costs. The individual does not have to lower his/her standard of living. The cover is offered to compensate for the change in lifestyle that may be required. Financial planning is a process based on a constructive plan to meet the client’s income needs during the client’s lifetime. The following diagram depicts what needs are generally looked at and how they complement one another: 28 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Client needs As indicated above, dread disease forms an important component of sound financial planning. The client’s lifestyle and income potential will be threatened if he/she does not take out cover for dread disease. The client can invest money towards retirement by means of a pension, provident, preserver, or retirement annuity fund to ensure that he/she is financially secure after retirement. The client can pay a premium for life cover in the event of death. His/her beneficiaries will be financially independent if the client arranges for ample cover. The client can pay premiums towards disability cover in the event of disablement, whether it is total and permanent or temporary disablement. However, disability offered by most insurers does not cover dread disease. Premium protection is available should the client be unable to continue payment of his/her premiums in the event of illness, job loss, etc. It is clear, however, that should the client contract an illness, for example, cancer, no provision has been made. The employer (that is, if the client is not self-employed) may pay the client’s salary for a limited period, but what happens in the event of prolonged illness? Version 1 2016/03/06 29 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management What assistance is available for enormous medical bills? What if the client needs nursing assistance? What about additional costs incurred by not having an able-bodied person fulfilling his/her role? Example Mary works for XYZ Ltd. She is 45 years old and unmarried without any children. Her provident fund has made provision for her retirement, life cover, and a lump sum disability. In addition, Mary has a retirement annuity. She is satisfied that, in the event of her retirement, death, or disablement, she is fully covered. Mary becomes very ill, and her doctor diagnoses her with renal failure. Analysis of possible scenarios: 1. Mary has to depend on her employer to pay her a salary as long as she is able to work. XYZ is unable to pay Mary for an indefinite period, as they need someone to do Mary’s work. 2. Mary needs financial assistance, as the medical aid she belongs to only pays a portion of her benefits. 3. Mary is unable to maintain her lifestyle, as she has to employ someone to drive her to hospital for dialysis and assist her with daily chores and a nurse to help administer the necessary drugs. 4.2 The difference between dread disease cover and disability insurance is explained in terms of benefits, contributions, tax deductions and when benefits are payable (AC4.2) Introduction It is important to note that the lines between dread disease and disability have become blurred with the introduction of impairment benefits. Impairment benefits are normally offered as disability benefits. Some insurers offer impairment benefits that cover similar diseases to those covered under dread disease. Examples of cover offered: 1. Liberty offers impairment using the AMA guide’s definition of whole person impairment (WPI), based on the following categories: Version 1 2016/03/06 Aplastic anaemia Benign brain tumour Cancer Cardiovascular Chronic liver failure 30 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Renal failure Respiratory failure Multiple sclerosis Parkinson’s disease Trauma Paraplegia Blindness Loss of hearing Advanced Aids Note: the dread disease benefits they offer are also based on WPI (see Assessment Criterion 2.1). 2. Old Mutual offers functional impairment benefits based on the following categories: Mobility and balance Upper-limb function Senses Effort tolerance Well-being Mental functioning Serious psychiatric illness Note: Old Mutual’s dread disease cover consists of a range of different diseases (see Assessment Criterion 2.1). The following table is a comparison of the main features of dread disease and disability cover. Version 1 2016/03/06 31 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Dread disease cover Lump sum disability cover Income disability Purpose Cover provided in case of dread disease to assist with medical bills, maintain lifestyle, and offer financial assistance during recovery Compensation for loss of earning capacity in the event of total and permanent disablement Compensation for loss of earning capacity in the event of temporary or permanent disablement Benefits Paid as a lump sum and tiered according to severity, depending on the insurer’s offerings Paid as a lump sum and/or tiered benefits for impairment Paid as an annuity Contributions Generally more expensive than lump sum disability Less expensive than dread disease Generally more expensive than lump sum disability and dread disease Tax deductions No tax deductions No tax deductions Subject to marginal rate of tax When payable On diagnosis of illness as specified by the insurer (see Specific Outcome 2) On total and permanent disablement as verified by medical reports On temporary or permanent disablement as verified by medical reports 4.3 The role of dread disease in a holistic financial plan is explained with reference to the specific needs of three different clients (AC4.3) Client’s needs A financial plan is a structured plan to meet the client’s investment needs over a specific period of time during the client’s lifetime. These needs relate to the following: Version 1 2016/03/06 32 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Retirement planning Retirement planning, including provision, should the client live “too” long, relates to outliving your ability to support yourself financially. The products that are recommended provide income on retirement and also allow certain tax advantages during contribution years and, then, on receiving the benefit. Examples of these products are retirement annuities and retirement preservers. Becoming disabled or suffering a dread disease Becoming disabled or suffering a dread disease, which deprives you of earning an income, means you will need additional money to pay for medical costs incurred, maintain your existing lifestyle, and perhaps get additional assistance while recuperating. Examples of these benefits are capital disability (lump sum), monthly disability income, accidental disability, dread disease, and impairment benefits. These policies will pay out in accordance with the terms and conditions of the contract at claim stage. Medical expenses Paying for medical expenses resulting from illness, hospitalisation, or surgery, for example, medical schemes. Income protection Income protection prevents investments from being eroded by tax and inflation. Examples are automatic contribution increase benefits, which allow clients to increase the contract contribution to counteract inflation. Other products offer the possibility to the client to increase his/her contribution with the consumer price index, thus allowing the contract to retain monetary value. Retirement annuity contracts offer tax advantages to their members who contribute towards retirement. Life cycles Clients are in different stages of their life cycles, and therefore, dread disease will be more important for some than for others. Each client will also have a different set of circumstances that will determine his/her specific needs. Answer the following self-test questions. Compare your answers to the ones provided at the end of this study guide. Self-test 4 Version 1 2016/03/06 1. List the reasons why an individual requires dread disease insurance cover. 2. In which areas of a client’s life does dread disease play a major role? 33 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Competency Competency check and progress indication I can explain reasons why a client may require dread disease insurance and provide examples. Check SO4 AC4.1 AC4.2 AC4.3 I can explain the difference between dread disease cover and disability insurance in terms of the following: Benefits Contributions Tax deductions When benefits are payable I can explain the role of dread disease in a holistic financial plan with reference to the specific needs of three different clients. Version 1 2016/03/06 34 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Answers to Self-tests UNIT 1 Dread disease products as an insurance product (SO1) Compare your answers to the ones suggested below. Answers: Self-test 1 1. Depending on the client’s needs, a combination of risk products had to be used to supplement one another and provide for potential lifestyle changes and loss of income. 2. If dread disease is linked to life cover and once a claim has been paid, the group life cover is reduced by the amount of the dread disease claim. 3. The policy holder must go back to work and continue with payments after a period stipulated by the insurer. 4. Generic list for risk benefits: Life cover Disability Dread disease Premium protection. 5. When a claim is made, the following factors are considered: The status of the policyholder in terms of the policy document and whether the policyholder is entitled to the benefit Diagnosis of the condition must be made by a registered medical practitioner and supported by medical evidence with the necessary laboratory, clinical, radiological, and histological evidence. 6. Reasons for repudiating a claim: Version 1 2016/03/06 A pre-existing condition not disclosed at the time of taking out the policy Maximum cover already paid Exclusions Maximum age 35 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management UNIT 2 Dread disease product offered by different financial services institutions (SO2) Compare your answers to the ones suggested below. Answers: Self-test 2 Mr Frail has a Living Assurance benefit with Liberty Life. He has life cover of R1 million and dread disease cover of R500 000 taken out on the accelerator basis. He suffers form stage 1 cancer. 1. R1 000 000 2. R500 000 3. Old Mutual would have paid the full dread disease benefit as lump sum. UNIT 3 The legal framework for dread disease (SO3) Compare your answers to the ones suggested below. Answers: Self-test 3 1. Legislation that has impact on dread disease: Long-Term Insurance Act 52 of 1998 Policyholder Protector Rules (PPR) Financial Advisory and Intermediary Services Act 37 of 200 Income Tax Act 58 of 1962 Life Offices’ Association 2. The impact of legislation on dread disease is twofold. From an intermediary or insurer’s point of view, sales can be limited or restricted due to the repercussions of not complying with legislation. Indirectly, the insurer will need to employ legal experts to interpret and advise its staff, and this will raise the running costs of the product. From a consumer’s point of view, legislation can provide peace of mind: the consumer feels secure in entering into a dread disease contract, as legislation will ensure that he/she is treated equitably and fairly and that the benefit is paid on criteria generally applied by all insurers. 3. Two main bodies under which insurance and medical operate: Version 1 2016/03/06 The Financial Services Board The Council for Medical Schemes 36 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management 4. Dread disease does not replace healthcare products offered by medical schemes, but it enhances benefits. Medical healthcare provides assistance in terms of illnesses that are mostly not considered serious or terminal. UNIT 4 Dread disease as part of holistic wealth management (SO4) Compare your answers to the ones suggested below. Answers: Self-test 4 1. In case of a major illness, an individual can rely on the following: The individual has finances to recuperate. The additional payout can cover medical costs. There is no need to lower the standard of living. The cover compensates for the change of lifestyle that may be necessary. 2. The role that dread disease plays in a client’s life: Version 1 2016/03/06 Retirement planning Disability or suffering from dread disease Medical expenses Income protection Life cycles 37 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Addendum 1 QUOTE 1 DISCOVERY LIFE LIFE PRODUCT QUOTATION Prepared for: A Client Fund type: LIFE FUND Prepared by: Francis Plan type: Integrated SupeRater Description: A Client – Quote Socio-economic class: Class 1 Quote number: 277 Date of commencement: 2004/10/01 Discovery Health Plan: Comprehensive OWNER DETAILS Owner type Natural person Owner tax status Non-conforming PERSONAL DETAILS OF THE LIVES ASSURED Principal Name A Client Date of birth 1965/01/01 Age next 40 Gender Male Smoker status Non-smoker Educational qualification 3-year diploma Gross annual income R480 000 Gross monthly income R40 000 Occupation IT – Consultant Hazardous activities None selected Version 1 2016/03/06 38 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management BENEFIT AND PREMIUM DETAILS Monthly Principal life’s benefit Risk cat. Percen tage of Benefit amount in fund rands Benefit expiry age premium (incl. loadings) in rands Life Cover A1 100.00 1 000 000 Whole life 157.61 Severe Illness Benefit Comprehensive Plus A1 100.00 1 000 000 Whole life 326.41 Capital Disability Benefit A1 100.00 1 000 000 Age 65 110.69 Comprehensive Plus Total For Principal’s Benefits R594.71 The recommended Minimum Protected Fund benefit has been removed from this quotation. TOTAL INITIAL MONTHLY PREMIUM R594.71 TOTAL PREMIUM FOR A NON-INTEGRATED LIFE PLAN R699.65 PREMIUM INCREASE DETAILS AUTOMATIC ANNUAL PREMIUM INCREASES AT 10% P.A. AS WELL AS BY AN ADDITIONAL 20% IN YEAR 10 AND EVERY 10 YEARS THEREAFTER FOR WHOLE OF LIFE BENEFITS. ADDITIONAL ANNUAL PREMIUM INCREASES MAY OCCUR AS A RESULT OF THE PERSONAL HEALTH MATRIX ON CERTAIN BENEFIT PREMIUMS. 01/10/2004 01/10/2005 01/10/2006 01/10/2007 594.71 654.18 719.60 791.56 01/10/2012 01/10/2013 01/10/2014 01/10/2015 1 274.81 1 402.30 1 793.61 2 888.63 01/10/2008 01/10/2009 01/10/2010 01/10/2011 870.71 957.79 1 053.57 1 158.92 01/10/2016 01/10/2017 01/10/2018 01/10/2019 5 433.66 8 750.96 16 525.92 50 434.83 Version 1 2016/03/06 39 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management PREMIUM INCREASE NOTES Premiums for the Global Health Protector, Global Education Protector, and Health Plan Protector will increase annually at a rate different to that of the other benefits on the Plan. Premium projections illustrated above do not include the Vitality premium and increases attributable to the Personal Health Matrix. PREMIUM INCREASES FOR SUPERATER AND MODERATOR PLANS In addition to the automatic annual premium increase selected on the plan, the risk premiums for benefits that received the SupeRater/ModeRator discounts at inception (that is, whole-of-life benefits only) will increase by a further 20% at the end of the first 10 years and every 10 years thereafter. This applies whether the plan is integrated or not. Version 1 2016/03/06 40 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management QUOTE 2 OLD MUTUAL GREENLIGHT QUOTATION Prepared by Code Quotation date OmuQuote version Quote reference number Distribution channel Start date of the contract Old Mutual Contracting party Date of birth Gender Mr A Client 01/01/1965 Male 07/09/2004 6.02 QR00003 Broker 01/10/2004 Greenlight offers a choice of flexible, modular benefits that can be added or subtracted from your contract as your needs change, making it the comprehensive risk management plan for life. This quotation is valid (provided it has been produced by the current Old Mutual approved version of Omuquote) for 21 days from 07/09/2004 until 28/09/2004 and is subject to underwriting. Version 1 2016/03/06 41 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management BENEFIT COVER AND PREMIUM DETAILS Comp. Life covered Initial cover Initial pre- amount mium annual pre- Scheduled annual Cover end End of guar. mium in- cover increase date (anb) term (years) For life 01/10/2 009 (5) crease Risk benefit(s) No. Name 5.00% in Death Benefit 1 1 Mr A R1 000 000 Client R620 5.00% in October October each year p.m. each – start year 2005 Accelerator(s) as % of parent cover amount Comprehensive Disability Benefit (100%) Severe Illness R1 000 000 (Comprehensive) Benefit (100%) 01/10/2 029 (65) For life R1 000 000 Total contractual regular premium via debit order R620 p.m. RISK BENEFIT COVER AND PREMIUM PROJECTIONS Death Benefit 1 (Mr A Client) – CAPI at 5.00% and SACI at 5.00% p.a. At the start of year 1 2 3 4 5 Cover R1 000 000 R1 050 000 R1 102 500 R1 157 625 R1 215 507 Illustrative premium R620 R684 R756 R836 R925 The illustrative premiums above include accelerators, but exclude riders. Notes: Compulsory annual premium increases are contractual. If you are unable to maintain your contractual obligation, you must make alternative arrangements with the Greenlight Service Centre. The premium projections are based on Old Mutual’s current premium basis, but this basis may change in future. Version 1 2016/03/06 42 N/A N/A Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management QUOTE 3 LIBERTY LIFE LIFESTYLE PROTECTOR Please read this document carefully, as it contains important information that you need to consider before applying for the product concerned. The information provided is a summary of the main features of the product and does not constitute an offer by Liberty Life. You may be asked to sign this document – your signature is simply proof of receipt and is not an acceptance of the contents of this document. Prepared for: A Client Prepared by: Francis – AAA Insurance Brokers Date of commencement: 01/10/2004 Contribution type: Age-rated Contribution frequency: Monthly Annual benefit increase: 7% p.a. Annual contribution increase: this will increase each year with age. Details of the lives assured Principal life Name A Client Date of birth 01/01/1965 Age next birthday 40 Gender Male Smoker status Non-smoker Educational qualification 3- or 4-year Technikon or Teachers’ College Diploma Annual income R480 000.00 Rating category 1 Occupation Computer consultant Percentage duties Admin 100% Manual 0% Supervisory 0% Travel 0% Occupation category Version 1 2016/03/06 1 43 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Benefit and contribution details Principal life’s benefits Benefit amount Benefit term/cease age R1 000 000 Whole of life Initial monthly contribution Life Protection Life Cover 184.00 Loss-of-Income Protection Capital Disability Plus (OD) R1 000 000 Contract anniversary preceding age 65 R109.00 Lifestyle Protection Living Lifestyle Plus (whole life) R1 000 000 Whole of life Total contribution for principal life’s benefits R381.00 R674.00 Monthly policy fee 15.00 Total monthly contribution 689.00 Annual contribution increases will result in the following future contributions: Contribution effective date Total monthly contributions 01/10/2004 01/10/2005 689.00 781.12 Version 1 2016/03/06 44 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management QUOTE 4 MOMENTUM Myriad quotation Underwritten by Momentum Group Limited trading as Momentum This quotation is subject to underwriting. Booked policy number: Prepared for: A Client Tax status: Natural person 2004/10/01 Myriad policy starting on: Premium frequency: Prepared by: Francis AAA INSURANCE BROKERS CC Monthly BENEFIT AND PREMIUM SUMMARY Benefit details Benefit Initial benefit amount Premium details Bene- Premium fit term pattern Mr A Client Death Benefit R1 000 000 Whole Compul- Comprehensive Disability R1 000 000 life sory R1 000 000 Benefit Comprehensive Critical to age 65 Illness Benefit Premium guarantee term Benefit Loading con-tract premium premium 11 R185.29 R135.29 R294.84 Whole life Policy fee R15.00 Total contractual premium R630.42 Total premium R630.42 Version 1 2016/03/06 45 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management Addendum 2 All qualifications and unit standards registered on the National Qualifications Framework are public property. Thus the only payment that can be made for them is for service and reproduction. It is illegal to sell this material for profit. If the material is reproduced or quoted, the South African Qualifications Authority (SAQA) should be acknowledged as the source. SOUTH AFRICAN QUALIFICATIONS AUTHORITY REGISTERED UNIT STANDARD: Investigate dread disease products and their place in wealth management SAQA US ID UNIT STANDARD TITLE 113913 Investigate dread disease products and their place in wealth management SGB NAME ABET BAND SGB Financial Services PROVIDER NAME Undefined FIELD DESCRIPTION SUBFIELD DESCRIPTION Business, Commerce and Management Studies UNIT STANDARD UNIT STANDARD CODE TYPE Finance, Economics and Accounting NQF LEVEL CREDITS Regular Level 4 2 REGISTRATION START DATE REGISTRATION END DATE REGISTRATION NUMBER SAQA DECISION NUMBER 2004-02-11 2007-02-11 113913 SAQA 1852/04 BUS-FEA-0-SGB FinS Version 1 2016/03/06 46 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management PURPOSE OF THE UNIT STANDARD This Unit Standard is intended for learners in a financial services environment. It will add value to financial planners, intermediaries financial advisers, healthcare intermediaries, product developers, co-coordinators of medical schemes, financial call centre agents and trustees of medical schemes and retirement funds. It views dread disease insurance as an integral part of holistic financial planning that is not necessarily part of life cover. The qualifying learner is capable of: Explaining dread disease as an insurance product. Investigating dread disease products offered by different financial services institutions. Explaining the legal framework for dread disease. Describing dread disease as part of holistic wealth management. LEARNING ASSUMED TO BE IN PLACE There is open access to this Unit Standard. Learners should be competent in Communication, Mathematical Literacy and Financial Literacy at Level 3. UNIT STANDARD RANGE The typical scope of this Unit Standard is: Dread disease includes, but is not limited to, cancer, heart attack, coronary artery surgery, stroke, kidney failure, paraplegia and blindness. Events that would not be covered include, but are not limited to, events resulting from war, terrorist attack, civil commotion, riots, rebellion, breaking of the law, failure to disclose information, self inflicted injury, under the influence of alcohol or drugs and avocation related risks. Legislation includes, but is not limited to, the Long Term Act, FAIS, FICA, Medical Schemes Act, Pension Funds Act, Income Tax Act and CGT. UNIT STANDARD OUTCOME HEADER N/A Specific Outcomes and Assessment Criteria: SPECIFIC OUTCOME 1 Explain dread disease as an insurance product. ASSESSMENT CRITERIA Version 1 2016/03/06 47 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management ASSESSMENT CRITERION 1 1. The concept of dread disease is explained with examples. ASSESSMENT CRITERION 2 2. Different terminology used to describe dread disease is identified for three different insurers. ASSESSMENT CRITERION 3 3. The various medical conditions covered by dread disease products are named and explained and an indication is given of when the insurer would pay out for each condition. ASSESSMENT CRITERION 4 4. Dread disease events which would not be covered are identified from a specific policy document and an indication is given of why such events are excluded from the policy. SPECIFIC OUTCOME 2 Investigate dread disease products offered by different financial services institutions. ASSESSMENT CRITERIA Version 1 2016/03/06 48 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management ASSESSMENT CRITERION 1 1. Dread disease products offered by three insurers are identified and compared in terms of the contracts, benefits, exclusions and when benefits are payable. ASSESSMENT CRITERION 2 2. The rates charged by the three insurers are compared and an indication is given of the policy best suited to a specific client. SPECIFIC OUTCOME 3 Explain the legal framework for dread disease. ASSESSMENT CRITERIA ASSESSMENT CRITERION 1 1. Legislation relating to dread disease is identified and an indication is given of how the Acts impact of the sale of dread disease policies. ASSESSMENT CRITERION 2 2. The tax implications for dread disease policies are explained with reference to tax on receipt of the benefit and deductibility of premiums. ASSESSMENT CRITERION 3 3. The demarcation debate between medical schemes and insurance is researched with reference to dread disease and healthcare products. SPECIFIC OUTCOME 4 Describe dread disease as part of holistic wealth management. ASSESSMENT CRITERIA ASSESSMENT CRITERION 1 1. Reasons why a client may require dread disease insurance are explained with examples. ASSESSMENT CRITERION 2 2. The difference between dread disease cover and disability insurance is explained in terms of benefits, contributions, tax deductions and when benefits are payable. Version 1 2016/03/06 49 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management ASSESSMENT CRITERION 3 3. The role of dread disease in a holistic financial plan is explained with reference to the specific needs of three different clients. UNIT STANDARD ACCREDITATION AND MODERATION OPTIONS Accreditation for this Unit Standard shall be obtained from the relevant Education and Training Quality Assurance Body, through summative and formative assessment by a registered assessor. Assessors must be registered as an Assessor with the relevant ETQA Moderators must be registered as assessors with the relevant ETQA, or with an ETQA that has a Memorandum of Agreement with the relevant ETQA. Training providers must be accredited by the relevant ETQA. Moderation should include both internal and external moderation where applicable. UNIT STANDARD DEVELOPMENTAL OUTCOME N/A UNIT STANDARD LINKAGES N/A Critical Cross-field Outcomes (CCFO): UNIT STANDARD CCFO IDENTIFYING Learners are capable of identifying and solving problems and making decisions is explaining the role of dread disease cover in a holistic financial plan. UNIT STANDARD CCFO COLLECTING Learners are capable of collecting, organising and critically evaluate information in comparing dread disease policies from different insurers and selecting the policy best suited to a particular client. UNIT STANDARD CCFO COMMUNICATING Learners are capable of communicating effectively in explaining concepts relating to dread disease cover and the legal framework for dread disease. UNIT STANDARD CCFO DEMONSTRATING Learners are capable of demonstrating an understanding of the world as a set of related systems by identifying events that would or would not lead to payout of Version 1 2016/03/06 50 Unit Standard SAQA 113913 – Investigate dread disease products and their place in wealth management benefits. UNIT STANDARD ASSESSOR CRITERIA N/A UNIT STANDARD NOTES Comment on this unit standard should reach SAQA no later than 15 December 2003. All qualifications and unit standards registered on the National Qualifications Framework are public property. Thus the only payment that can be made for them is for service and reproduction. It is illegal to sell this material for profit. If the material is reproduced or quoted, the South African Qualifications Authority (SAQA) should be acknowledged as the source. Version 1 2016/03/06 51