Exam 1 - Solutions

advertisement

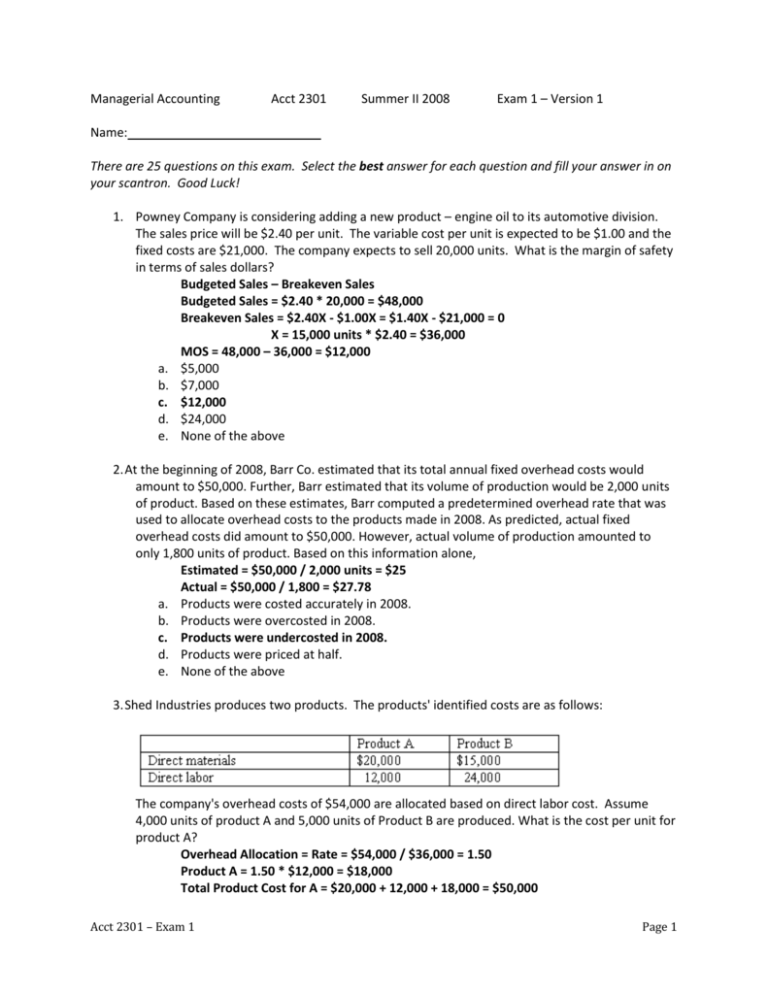

Managerial Accounting Name: Acct 2301 Summer II 2008 Exam 1 – Version 1 ‘ There are 25 questions on this exam. Select the best answer for each question and fill your answer in on your scantron. Good Luck! 1. Powney Company is considering adding a new product – engine oil to its automotive division. The sales price will be $2.40 per unit. The variable cost per unit is expected to be $1.00 and the fixed costs are $21,000. The company expects to sell 20,000 units. What is the margin of safety in terms of sales dollars? Budgeted Sales – Breakeven Sales Budgeted Sales = $2.40 * 20,000 = $48,000 Breakeven Sales = $2.40X - $1.00X = $1.40X - $21,000 = 0 X = 15,000 units * $2.40 = $36,000 MOS = 48,000 – 36,000 = $12,000 a. $5,000 b. $7,000 c. $12,000 d. $24,000 e. None of the above 2. At the beginning of 2008, Barr Co. estimated that its total annual fixed overhead costs would amount to $50,000. Further, Barr estimated that its volume of production would be 2,000 units of product. Based on these estimates, Barr computed a predetermined overhead rate that was used to allocate overhead costs to the products made in 2008. As predicted, actual fixed overhead costs did amount to $50,000. However, actual volume of production amounted to only 1,800 units of product. Based on this information alone, Estimated = $50,000 / 2,000 units = $25 Actual = $50,000 / 1,800 = $27.78 a. Products were costed accurately in 2008. b. Products were overcosted in 2008. c. Products were undercosted in 2008. d. Products were priced at half. e. None of the above 3. Shed Industries produces two products. The products' identified costs are as follows: The company's overhead costs of $54,000 are allocated based on direct labor cost. Assume 4,000 units of product A and 5,000 units of Product B are produced. What is the cost per unit for product A? Overhead Allocation = Rate = $54,000 / $36,000 = 1.50 Product A = 1.50 * $12,000 = $18,000 Total Product Cost for A = $20,000 + 12,000 + 18,000 = $50,000 Acct 2301 – Exam 1 Page 1 Cost per Unit = $50,000 / 4,000 = $12.50 a. b. c. d. e. $12.50 $17.00 $14.75 $10.25 None of the above 4. Which of the following should be recorded as an asset? a. Paid for a new product advertising campaign b. Paid rent on the warehouse used to store finished goods c. Paid for research and development costs d. Paid for raw materials to be used in production e. None of the above 5. What is the effect on the financial statement model of making cash sales of inventory to customers (assuming the product is sold at a profit)? (Ignore the effect on cash flow.) Assets = Liab. + Equity Rev. - Exp. = Net Inc. Cash Flow A) n/a n/a n/a B) + n/a + + + + + OA C) n/a n/a n/a n/a - OA D) + n/a + n/a + n/a a. Item A b. Item B c. Item C d. Item D e. None of the above 6. During her first year with the company, Tiffany mistakenly accumulated some of the company’s period costs in ending inventory. Which of the following indicates how this error affects the company’s financial statements assuming production exceeded sales during the period? a. Cash flows from operations are understated. b. Gross margin is understated. c. Net income is understated. d. Inventory is overstated. e. None of the above 7. Medlock Company is analyzing whether its new product will be profitable. The following data are provided for analysis. Expected variable cost of manufacturing $30 per unit Expected fixed manufacturing costs $48,000 per year Expected sales commission $ 6 per unit Expected fixed administrative costs $12,000 per year Medlock has decided to advertise the product heavily and has set the sales price at $54. If sales are 9,000 units, how much can Medlock spend on advertising and still breakeven? Sales – VC = CM – FC = Profit Acct 2301 – Exam 1 Page 2 a. b. c. d. e. $54(9,000) - $30(9,000) - $6(9,000) = $162,000 - $48,000 - $12,000 – X = 0 X = $102,000 $114,000 $102,000 $168,000 $156,000 None of the above 8. Perry Copies Company provides professional copying services to customers through the 20 copy stores it operates in the southwestern United States. Each store employs a manager and four assistants. The manager earns $3,500 per month plus a bonus of 3 percent of sales. The assistants earn hourly wages. Each copy store costs $3,000 per month to lease. The company spends $5,000 per month on corporate-level advertising and promotion. What type of cost is the store manager’s salary relative to the number of copies made for customers? a. Fixed b. Variable c. Mixed d. Inverse e. None of the above 9. Craw Company incurs annual fixed costs of $140,000. The company’s contribution margin is 40%. The company would like to earn a profit of $40,000. What amount of sales dollars would be needed in order to achieve the desired profit? Sales – VC = CM – FC = Profit 0.40S - $140,000 = $40,000 0.40S = $180,000 $180,000 / .40 S = $450,000 a. $450,000 b. $180,000 c. $300,000 d. $150,000 e. There is not enough information available. 10. Vanity Chairs Corporation produces ergonomically designed chairs favored by architects. The company normally produces and sells from 5,000 to 8,000 chairs per year. The following cost data apply to various production levels. No. of chairs 5,000 Total Costs Incurred Fixed $ 84,000 Variable 60,000 Total Costs $144,000 What would be the company’s total cost if 7,000 chairs were produced? FC + VC = Total Cost FC = $84,000 For VC = $60,000 / 5,000 = $12 VC per Unit VC = $12 * 7,000 = $84,000 Acct 2301 – Exam 1 Page 3 $84,000 + $84,000 = $168,000 a. b. c. d. e. $201,600 $177,600 $144,000 $168,000 None of the above 11. Dade Company manufactures CD players. According to the company’s records, the variable costs, including direct labor and direct materials, are $50 per unit. Factory depreciation and other fixed manufacturing costs are $192,000. Dade pays its salespeople a commission of $18 per unit. Annual fixed selling and administrative costs are $128,000. Dade has determined they will be able to sell 10,000 units. At what price will Dade have to sell the players in order to breakeven? Sales – VC = CM – FC = Profit 10,000X - $50(10,000) - $18(10,000) - $192,000 - $128,000 = 0 10,000X = $1,000,000 $1,000,000 / 10,000 X = $100 a. $300 b. $200 c. $100 d. $ 69 e. None of the above 12. The following are the costs for the Palmer Company for 2008: Wages paid to workers in a manufacturing plant - $50,000 Salary of the receptionist working the sales department - $20,000 Supplies used in the sales department - $8,000 Wages of janitors who clean the factory floor - $30,000 Salary of the company president - $80,000 Depreciation on administrative buildings - $3,000 Depreciation on manufacturing equipment - $5,000 Salary of an engineer who maintains all manufacturing plant equipment - $40,000 What is the company’s total product cost for 2008? $50,000 + 30,000 + 5,000 + 40,000 = $125,000 a. b. c. d. e. $125,000 $205,000 $120,000 $50,000 None of the above 13. In reviewing Quartey Company’s September accounting records, Ken Helm, the chief accountant, noted the following depreciation costs. Factory buildings - $25,000 Computers used in manufacturing - $4,000 Acct 2301 – Exam 1 Page 4 A building used to display finished goods - $8,000 Trucks used to deliver merchandise to customers - $14,000 Forklifts used in the factory - $22,000 Furniture used in the president’s office - $9,000 Elevators in administrative buildings - $6,000 Factory machinery - $9,000 Assume that Quartey manufactured 3,000 units of product and sold 2,000 units of product during the month of September. Determine the amount of depreciation cost that would be included in cost of goods sold for September. $25,000 + 4,000 + 22,000 + 9,000 = $60,000 $60,000 / 3,000 = $20 * 2,000 = $40,000 a. b. c. d. e. $0 $40,000 $60,000 $46,000 None of the above 14. Qazi Manufacturing Company was started on January 1, 2007, when it acquired $134,000 cash by issuing common stock. The company paid $14,000 for salaries of administrative personnel and $18,000 for wages of production personnel. The company paid $24,000 for raw materials that were used to make inventory. Finally, the company paid $13,000 for factory overhead. All inventory was started and completed during the year. Qazi completed production of 5,500 units of product and sold 5,000 units. What was the company’s average production cost per unit? $18,000 + 24,000 + 13,000 = $55,000 / 5,500 = $10 a. $10.00 b. $12.55 c. $ 7.64 d. $24.36 e. None of the above 15. Long Electronics Company experienced the following events during its first accounting period. 1. Received $200,000 cash by issuing common stock. 2. Paid $30,000 cash for wages to production workers. 3. Paid $20,000 for salaries to administrative staff. 4. Purchased for cash and used $17,000 of raw materials. 5. Recognized $2,000 of depreciation on administrative offices. 6. Recognized $3,000 of depreciation on manufacturing equipment. 7. Started and completed 5,000 units of product. 8. Sold 4,000 units at a price of $20 each. What is the amount of Long’s net income? Sales – COGS – S, G & A = Net Income Sales = 4,000 * $20 = $80,000 Total Product Cost = $30,000 + 17,000 + 3,000 = $50,000 Acct 2301 – Exam 1 Page 5 Cost per unit = $50,000 / 5,000 = $10 COGS = $10 * 4,000 = $40,000 S, G & A = $20,000 + 2,000 = $22,000 a. b. c. d. e. $80,000 – 40,000 – 22,000 = $18,000 $40,000 $20,000 $18,000 $10,000 None of the above 16. The Rockmart Construction Company delivers dirt and stone from local quarries to its construction sites. A new truck that was purchased for a cost of $117,000 at the beginning of the year was expected to deliver 200,000 tons over its useful life. The following is a breakdown of the tons delivered during the year to each construction site: How much truck cost should be allocated to Site D? (round to the nearest dollar) Rate = $117,000 / 200,000 = 0.585 D = 0.585 * 1,500 = $877.50 a. b. c. d. e. $15,955 $878 $1,170 $2,048 None of the above 17. Ziegler Construction Company builds warehouses that range in size from 12,000 to 100,000 square feet. Which of the following would not be a rational base for allocating overhead costs to the warehouses? a. Labor hours b. Number of warehouses completed c. Direct materials cost d. Sizes of the warehouses. e. None of the above 18. Hamby Company expects to incur overhead costs of $10,000 per month and direct production costs of $125 per unit. The estimated production activity for the upcoming year is 1,200 units. If the company desires to earn a gross profit of $50 per unit, the sales price per unit would be which of the following amounts? $10,000 * 12 = $120,000 / 1,200 = $100 SP - $100 - $125 = $50 SP = $275 a. $283 b. $175 Acct 2301 – Exam 1 Page 6 c. $130 d. $275 e. None of the above 19. The activity director for Cedar Grove Hotel is planning an activity. She is considering alternative ways to set up the activity’s cost structure. Select the incorrect statement from the following. a. If the director expects a low turnout, she should use a fixed cost structure. b. If the director expects a large turnout, she should attempt to convert variable costs into fixed costs. c. If the director shifts the cost structure from fixed to variable, the level of risk decreases. d. If the director shifts the cost structure from fixed to variable, the potential for profits will be reduced. e. None of the above 20. Alcott Company has a contribution margin ratio of 20%. The company is considering a proposal that will increase sales by $200,000. What increase in profit can be expected assuming total fixed costs increase by $30,000? Sales – VC = CM – FC = Profit 20%($200,000) - $30,000 = $10,000 a. $40,000 b. $30,000 c. $10,000 d. $0 e. None of the above 21. Payne Ice Cream Company produces various ice cream products for which demand is highly seasonal. The company sells more ice cream in warmer months and less in colder ones. Last year, the high point in production activity occurred in August when Payne produced 45,000 gallons of ice cream at a total cost of $36,000. The low point in production activity occurred in February when the company produced 21,000 gallons of ice cream at a total cost of $30,000. What is Payne’s estimated monthly fixed cost using the high-low method? ($36,000 – 30,000) / (45,000 – 21,000) = 0.25 VC per Unit FC + VC = TC FC + (0.25 * 45,000) = $36,000 FC = $24,750 a. $25,000 b. $11,250 c. $ 5,250 d. $24,750 e. None of the above 22. Duncan Company incurred $30,000 of fixed cost and $40,000 of variable cost when 2,000 units of product were made and sold. If volume doubles, the company’s average cost per unit will Current cost per unit = $70,000 / 2,000 units = $35 per unit If volume doubles = FC = $30,000 + VC = $80,000 = $110,000 / 4,000 = $27.50 per unit a. Stay the same b. Double Acct 2301 – Exam 1 Page 7 c. Increase but will not double d. Decrease e. None of the above 23. Peak Company, a merchandising firm, reported the following operating results. Income Statement Sales Revenue (8,000 units * $100) $ 800,000 Cost of Goods Sold (8,000 units * $60) (480,000) Gross Margin Sales Commission (10% of Sales) Administrative Salaries Expense Advertising Expense Depreciation Expense Shipping & Handling (8,000 units * $1) $ 320,000 (80,000) (60,000) (75,000) (68,000) (8,000) Net Income $ 29,000 What is Peak Company’s contribution margin for the year? Sales – VC = CM $800,000 – 480,000 – 80,000 – 8,000 = $232,000 a. $320,000 b. $240,000 c. $172,000 d. $232,000 e. None of the above 24. Michelle Welch has invested in three start-up companies. At the end of the first year, she asks you to evaluate their operating performance. The following operating data apply to the first year. Hardy Lavoy Kyle Variable cost per unit $24 $12 $18 Sales revenue (25,000 * $32) 800,000 800,000 800,000 Variable cost (25,000 units) (600,000) (300,000) (450,000) Fixed cost (100,000) (400,000) (250,000) 100,000 5 100,000 3.5 Net income 100,000 OL = CM / NI 2 Which company is the most highly leveraged? a. Hardy b. Lavoy c. Kyle d. Michelle e. None of the above Acct 2301 – Exam 1 Page 8 25. Hunt Corporation manufactures products that have variable costs of $6 per unit and fixed costs that total $75,000. The company sells the product for $9 each. How many units will the company have to sell in order to breakeven? Sales – VC = CM – FC = Profit $9X - $6X = $3X - $75,000 = 0 $75,000 / 3 = a. 20,000 b. 25,000 c. 8,333 d. 12,500 e. None of the above Acct 2301 – Exam 1 Page 9