FA Chapter 6 SM

advertisement

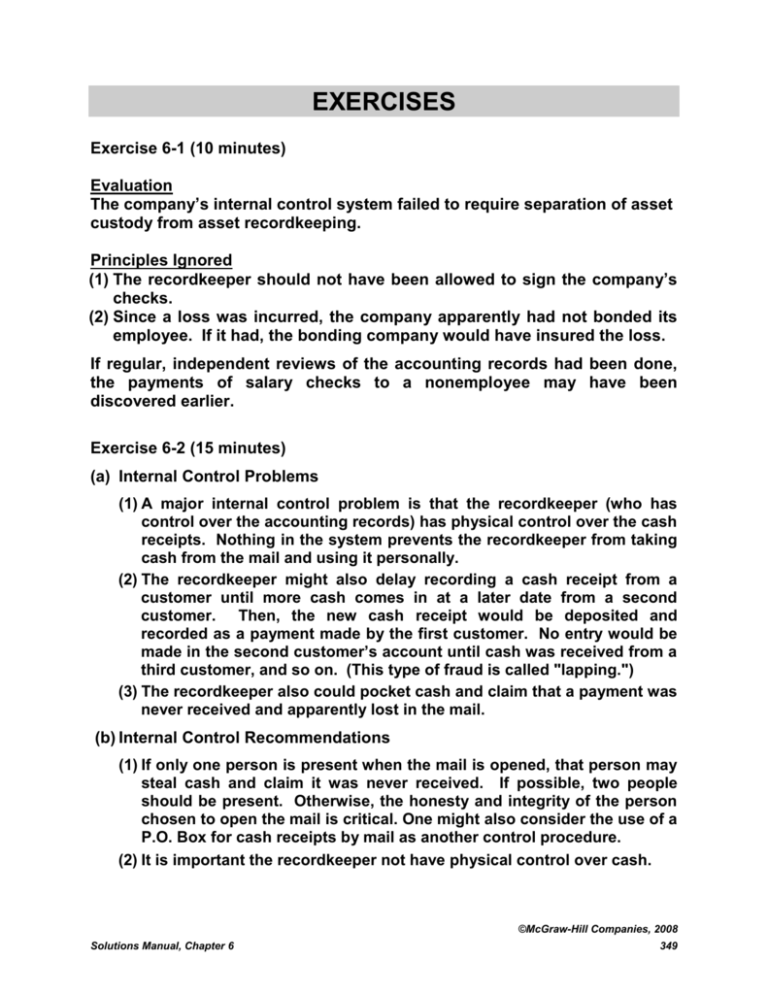

EXERCISES Exercise 6-1 (10 minutes) Evaluation The company’s internal control system failed to require separation of asset custody from asset recordkeeping. Principles Ignored (1) The recordkeeper should not have been allowed to sign the company’s checks. (2) Since a loss was incurred, the company apparently had not bonded its employee. If it had, the bonding company would have insured the loss. If regular, independent reviews of the accounting records had been done, the payments of salary checks to a nonemployee may have been discovered earlier. Exercise 6-2 (15 minutes) (a) Internal Control Problems (1) A major internal control problem is that the recordkeeper (who has control over the accounting records) has physical control over the cash receipts. Nothing in the system prevents the recordkeeper from taking cash from the mail and using it personally. (2) The recordkeeper might also delay recording a cash receipt from a customer until more cash comes in at a later date from a second customer. Then, the new cash receipt would be deposited and recorded as a payment made by the first customer. No entry would be made in the second customer’s account until cash was received from a third customer, and so on. (This type of fraud is called "lapping.") (3) The recordkeeper also could pocket cash and claim that a payment was never received and apparently lost in the mail. (b) Internal Control Recommendations (1) If only one person is present when the mail is opened, that person may steal cash and claim it was never received. If possible, two people should be present. Otherwise, the honesty and integrity of the person chosen to open the mail is critical. One might also consider the use of a P.O. Box for cash receipts by mail as another control procedure. (2) It is important the recordkeeper not have physical control over cash. ©McGraw-Hill Companies, 2008 Solutions Manual, Chapter 6 349 Exercise 6-3 (15 minutes) 1. A cash register (with a locked record) should be used at the sales stand— it should also be anchored to the stand. If a cash register cannot be used, the total sales value of the sunscreen, shirts, and sunglasses given to the employee each day should be calculated. The employee should sign a receipt for the merchandise and the amount of cash that he or she has been given. At the end of each day, the employee should be required to return cash plus remaining sunscreen, shirts, and sunglasses equal to the amount taken to the stand—possibly consider one or two return trips if the amounts are large. 2. The employee should sign a receipt for the total amount of cash he or she is given each weekend. Each time the employee makes a purchase, he or she should obtain a signed sales receipt for the payment. The sales receipt should list the items purchased and the prices paid. When the employee returns to the store, the total value of the signed sales receipts plus any remaining cash should equal the amount of cash originally given to the employee. Also, the merchandise brought back by the employee should be the same as the items listed on the signed sales receipts. ©McGraw-Hill Companies, 2008 350 Financial Accounting, 4th Edition Exercise 6-4 (20 minutes) 1. Jan. 1 Petty Cash ............................................................... Cash ................................................................... 200 200 To establish a petty cash fund. 2. Jan. 8 Postage Expense .................................................... Merchandise Inventory* ......................................... Delivery Expense .................................................... Miscellaneous Expenses ....................................... Cash ................................................................... 74 29 16 43 162 To reimburse the petty cash fund. * Transportation-in costs are included in Merchandise Inventory under a perpetual system. 3. Jan. 8 Postage Expense .................................................... Merchandise Inventory .......................................... Delivery Expense .................................................... Miscellaneous Expenses ....................................... Cash ................................................................... 74 29 16 43 162 To reimburse the petty cash fund.* Jan. 8 Petty Cash ............................................................... Cash ................................................................... 250 250 To increase the petty cash fund.* * The two January 8 entries can be combined into one entry. ©McGraw-Hill Companies, 2008 Solutions Manual, Chapter 6 351 Exercise 6-5 (20 minutes) 1. Sept. 9 Petty Cash ............................................................... Cash ................................................................... 350 350 To establish a $350 petty cash fund. 2. Sept. 30 Merchandise Inventory* ......................................... Postage Expenses .................................................. Miscellaneous Expenses ....................................... Cash Short and Over .............................................. Cash ................................................................... 40 123 80 3 246 To reimburse the petty cash fund. * Transportation-in costs are included in Merchandise Inventory under a perpetual system. 3. Oct. 1 Petty Cash ............................................................... Cash ................................................................... 50 50 To increase the petty cash fund to $400. ©McGraw-Hill Companies, 2008 352 Financial Accounting, 4th Edition Exercise 6-6 (20 minutes) Bank Balance Add Deduct Add 1. NSF check from customer returned on Sept. 25 but not recorded by this company. Book Balance Not Shown on Deduct Adjust Reconciliation x 2. Interest earned on the account. x Cr. Dr. 3. Deposit made on September 5 and processed by bank on September 6. 4. Check written by another depositor but charged against this company's account. x x 5. Bank service charge. x Cr. 6. Checks outstanding on August 31 that cleared the bank in September. x 7. Check written against the company account and cleared by the bank; erroneously not recorded by the company recordkeeper. x 8. Principal and interest on a note receivable to this company is collected by the bank but not yet recorded by the company. 9. Checks written and mailed to payees on October 2. 10. Checks written by the company and mailed to payees on September 30. 11. Deposit made on September 30 after the bank closed. 12. Special bank charge for collection of note in No. 8 on company's behalf. Cr. x Dr. x Dr. x x x Cr. Exercise 6-7 (10 minutes) 1. The voucher system of control establishes procedures for: (a) Verifying, approving, and recording obligations for eventual cash disbursements, and (b) Issuing checks for payment of verified, approved, and recorded obligations. 2. All expenditures should be overseen by a voucher system of control (not only the purchase of merchandise). 3. The voucher is initially prepared by the accounting department when it receives the purchase requisition from the department making the request or when it receives reliable evidence that an obligation has been incurred. ©McGraw-Hill Companies, 2008 Solutions Manual, Chapter 6 353 Exercise 6-8 (25 minutes) DEL GATO CLINIC Bank Reconciliation June 30, 2008 Bank statement balance ........ Add Deposit of June 30 ................ Deduct Outstanding checks............. Adjusted bank balance .......... $10,555 2,856 13,411 1,829 $11,582 Book balance................................................................................. $11,589 Add Error on Ck. No. 919.................................................................. 9 11,598 Deduct Bank service charge................................................................. 16 Adjusted book balance .............................................................. $11,582 Exercise 6-9 (10 minutes) June 30 Cash .................................................................... Utilities Expense .......................................... 9 9 To correct a journal entry error. 30 Miscellaneous Expenses .................................. Cash .............................................................. 16 16 To record bank service charge. Exercise 6-10 (15 minutes) (a) Days' sales uncollected on December 31, 2007: $61,000 $665,000 x 365 = 33.5 days Days' sales uncollected on December 31, 2008: $93,000 $747,000 x 365 = 45.4 days (b) Evaluation: The change from 33.5 to 45.4 days' sales uncollected indicates that the receivables have become less liquid. While the accounts receivable were, on average, collected in about one month at the end of 2007, this has increased by about 12 days in Year 2008. The company needs to follow up to identify the reasons for this change. ©McGraw-Hill Companies, 2008 354 Financial Accounting, 4th Edition Exercise 6-11A (10 minutes) 1. E 3. A 5. D 2. C 4. F 6. B Exercise 6-12B (25 minutes) a. Recording inventory at gross amounts Oct. 2 Merchandise Inventory ................................................ 3,000 Accounts Payable .................................................. 3,000 To record merchandise purchases. 10 Accounts Payable ........................................................ 500 Merchandise Inventory ......................................... 500 To record credit memo for returns. 17 Merchandise Inventory ................................................ 5,400 Accounts Payable .................................................. 5,400 To record merchandise purchases. 26 Accounts Payable ........................................................ 5,400 Merchandise Inventory* ........................................ Cash ........................................................................ 108 5,292 To record payment for merchandise less the discount. *($5,400 x .02) 31 Accounts Payable ........................................................ 2,500 Cash ........................................................................ 2,500 To record payment for merchandise less the returns ($3,000 - $500). ©McGraw-Hill Companies, 2008 Solutions Manual, Chapter 6 355 Exercise 6-12B (Concluded) b. Recording inventory at net amounts Oct. 2 Merchandise Inventory ................................................ 2,940 Accounts Payable .................................................. 2,940 To record merchandise purchases less discount [$3,000 - ($3,000 x .02) = $2,940]. 10 Accounts Payable ........................................................ 490 Merchandise Inventory .......................................... 490 To record credit memo for returns [$500 - ($500 x .02)]. *13 Discounts Lost ............................................................. Accounts Payable .................................................. 50 50 To record the discount lost [($3,000 - $500) x.02]. 17 Merchandise Inventory ................................................ 5,292 Accounts Payable .................................................. 5,292 To record merchandise purchases less discount [$5,400 - ($5,400 x .02) = $5,292]. 26 Accounts Payable ........................................................ 5,292 Cash ........................................................................ 5,292 To record payment for merchandise. 31 Accounts Payable ........................................................ 2,500 Cash ........................................................................ 2,500 To record payment for merchandise less returns ($2,940 - $490 + $50). * This entry could alternatively be recorded on October 31 when the cash payment is made (this is likely since the invoice was filed incorrectly). ©McGraw-Hill Companies, 2008 356 Financial Accounting, 4th Edition ©McGraw-Hill Companies, 2008 Solutions Manual, Chapter 6 357