Acct 6331

advertisement

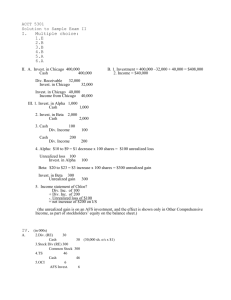

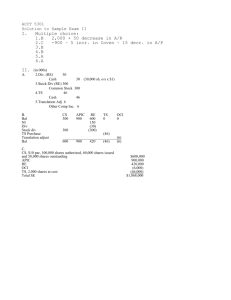

ACCT 5301 Solution to Sample Exam II I. Multiple choice: 1.B 2,000 + 50 decrease in A/R 2.C -900 – 5 incr. in Inven – 15 decr. in A/P 3.B 4.B 5.A 6.A II. (in 000s) A. 2.Div. (RE) 30 Cash 30 (30,000 sh. o/s x $1) 3.Stock Div (RE) 300 Common Stock 300 4.TS 46 Cash 46 5.Other Comp Inc. 6 Investment 6 B. (not required) Bal NI Div Stock div TS Purchase AFS Invest. adjust Bal CS 300 APIC 900 300 RE 600 150 (30) (300) TS 0 OCI 0 (46) 600 900 420 (6) (6) (46) C. CS, $10 par, 100,000 shares authorized, 60,000 shares issued and 58,000 shares outstanding APIC RE OCI TS, 2,000 shares at cost Total SE $600,000 900,000 420,000 (6,000) (46,000) $1,868,000 1 III. Pensions A. Pension expense: Service cost $ 30,000 Interest cost 20,000 Expected return -18,000 Amortization of PSC 2,000 Amortization of gain - 750 Total pension expense $ 33,250 B. C. Journal entry for 2008: Pension expense 33,250 Pension A/L (plug) Cash 13,250 20,000 Adjustment to OCI and Pension A/L OCI 38,750 Pension A/L for 2008 38,750 (see below) Pension A/L 25,000 13,250 Entry B 38,750 Entry C (to get to Liab. balance) ====== 27,000 Balance in OCI? Liab.: Beginning: Beginning: Change: Balance: + - 285,000 - 258,000 20,000 30,000 38,750 28,750 DR decrease (cost) CR increase (benefit) DR decrease (entry C) DR Balance in Pension A/L: $27,000 Liability 2 IV. Leases A. Capital Lease A. PV of MLP = PV of Rent + PV of BPO Factors for PV: n = 5, i = 6% PVOA Adj.*to adjust to annuity due PVAD = 5,000 (4.21236)(1.06) = $22,326 PV1 PV1 = 1,000 (.74726) = Total present value = B. 1. 2. 3. 747 $23,073 Equipment 23,073 Lease Liability 23,073 Lease Liability Cash 5,000 Interest expense Lease liability Cash 1,084 3,916 5,000 18,073 x .06 plug 5,000 Depreciation expense 2,884 Accumulated Depr. 2,884 (Calc: (23,073 - 0)/8 = 2,884) B. Operating lease PV,6% n=1 43 x .9434 n=2 28 x .89 n=3 22 x .83962 n=4 18 x .79209 n=5 16 x .74726 *n=6 16 x .70496 *n=7 16 x .66506 Total = $ 40.56 = 24.92 = 18.47 = 14.26 = 11.96 = 11.28 = 10.64 $ 132.8 million *since approx. 2 payments at $16 each, just do 2 more PV1 calculations. Alt: PVOA of 2 pmts back to time 0: 2 pmts back to time 0 16(PVOA, 6%, 2)(PV1, 6%,5) = 16 x (1.83339) x (.74726) = $21.92 V. Essays – from class discussions 3 VI. Statement of Cash Flows (analysis in red) Given the following income statement and comparative balance sheets for North (all amounts are in thousands). Note that earliest year is presented first. Comparative Balance Sheets 12/31/06 12/31/07 $ 15 -6 $ 9 17 23 +6 SUBTRACT(OP) 7 14 +7 SUBTRACT (OP) 38 28 50 73 ( 18) ( 24) 37 37 $ 146 $ 160 Cash Accounts receivable Inventory Land Equip Less: Accumulated depr. Investment. Total assets Accounts payable Unearned Revenues Notes payable (long-term) Bonds payable (long-term) Add: Premium Common stock Retained earnings Total Liab. & Eq. $ Income Statement for 2006 Sales revenue Service revenue Gain on sale of land Cost of goods sold Depreciation expense - equipment Interest expense Other operating expenses (all cash) Income tax expense Net income 13 7 18 50 8 34 16 146 $ 15 +2 ADD (OP) 5 10 50 5 –3 OP 55 20 160 $ 120 30 3 –3 OP (82) ( 6)+6 OP ( 6) (11) (13) $ 35 TOP LINE OP Additional information for 2006: FOR INVESTING AND FINANCING 1. The only activities in retained earnings were for income and dividends. BRE + NI – DIV = ERE 16+35-DIV=20 DIV=31 –31 FINANCING 2. Equip. was purchased for $8 cash. –8 INVEST 3. Equip. was purchased with a N/P of $15. SUPP SCHEDULE 4. Land with a cost of $10 was sold at a gain of $3 . +13 INVEST 5. Payment made on N/P for $23. –23 FINANCING 6. The change in common stock was due to the issue of stock for cash. +21 FIN Required: On the next page, prepare the Statement of Cash Flows, including Indirect method fo Operating Section. 4 Cash Flow from Operating Activity Net Income Add Depreciation Subtract Premium amort. Subtract gain Less increase in A/R Less increase in Inventory Add increase in A/Pay Less decrease in U. Rev $35 6 (3) (3) ( 6) (7) 2 (2) Net cash from operating activity $ 22 Cash Flow from Investing Activity Cash paid for equip Cash received from land $(8) 13 Net cash from investing 5 Cash Flow from Financing Activity Cash paid for dividends Cash paid on N/P Cash received from stock $ (31) (23) 21 Net cash used for financing (33) Net decrease in cash $(6) (Confirm: cash from $15 to $9) ________________________________________________ Supplementary schedule of non-cash activities: Equip purchased with N/P $15 Part 2: Operating section using direct method Sales revenue Service income Gain on sale of land COGS Depr exp Other Interest exp Income tax expense $120 30 3 -82 -6 -11 - 6 -13 - 6 = $ -2 = - 3 = -7 +2 = +6 = 114 28 0 (87) 0 (11) ( 9) adjust out prem. amort (13) -3 = = Cash from operations $22 5 (same as indirect method) VII. A. Record "cash equivalent price" which is the PV of future cash flows, single sum, discounted 3 years at 5% (ignore appraisal): PV1 = $20,000 (.86384) = $17,277 Land 17,277 Discount on N/P 2,723 N/P 20,000 B. Int exp. = CV x Disc. Rate = 17,277 x .05 = 864 Int. Expense 864 Discount on N/P 864 C. Zero coupon bond promises to pay face value at maturity, but does NOT make any interest payments. Calculation of issue price is similar to that for the noninterest bearing note in Part A. The entire difference between face and PV is the "deep discount", and it contains all of the interest to be recognized each year. In comparison, traditional bonds do promise a cash interest payment each year, and the discount (or premium) account contains and adjustment to the cash payment. The two components together contain the interest expense to be recognized. VIII. Part 1 A. The factors for discounting are i = 4% and n = 10 years PV1 = $100,000 (.67556) = $ 67,556 PVOA = $5,000 (8.1109) = 40,554 Total price of bond $108,110 (rounded) B(Omit amortiztaion table) C. Cash 108,110 Premium on B/P 8,110 Bonds Payable 100,000 D. Interest Expense 4,324 Premium on B/P 676 Cash 5,000 Part 2 A. The factors for discounting are i = 5% and n = 10 years PV1 = $100,000 (.61391) = $ 61,391 PVOA = $4,000 (7.72173) = 30,887 Total price of bond $ 92,277 (rounded) B. Omit amortization table C. Cash 92,277 Disc. on B/P 7,723 Bonds Payable 100,000 D. Interest Expense 4,614 Disc. on B/P Cash 614 4,000 Part 3: in the first case, the company is offering 5%, and the market yield elsewhere for the same level of risk is only 4%, so investors pay extra for the extra cash flow. In the second case, the company is offering 4% and the investors can get 5% elsewhere in the market. They will only buy the bonds, if they can pay less than face value (a discount), then receive face value at maturity. In either case, the bonds are issued to yield the investors their desired return. 6 Part IX. Classification 1. D 2. B 3. B 4. A Part X Schedule Pretax financial income (loss) Future Deductible: Warranties Subscription Revenues Future Taxable: Depreciation 2008 IT Pay 100,000 DIT 8,000 15,000 (8,000) (15,000) (800) Taxable (deductible) amount Tax rate 800 122,200 30% Income tax payable DIT - liab (asset) (22,200) 30% 36,660 (6,660) DIT 0 6,660 6,660 Journal entry: Income tax expense (plug) DIT Income tax payable 0 30,000 6,660 36,660 7