附件1 理论课程教学大纲样本

advertisement

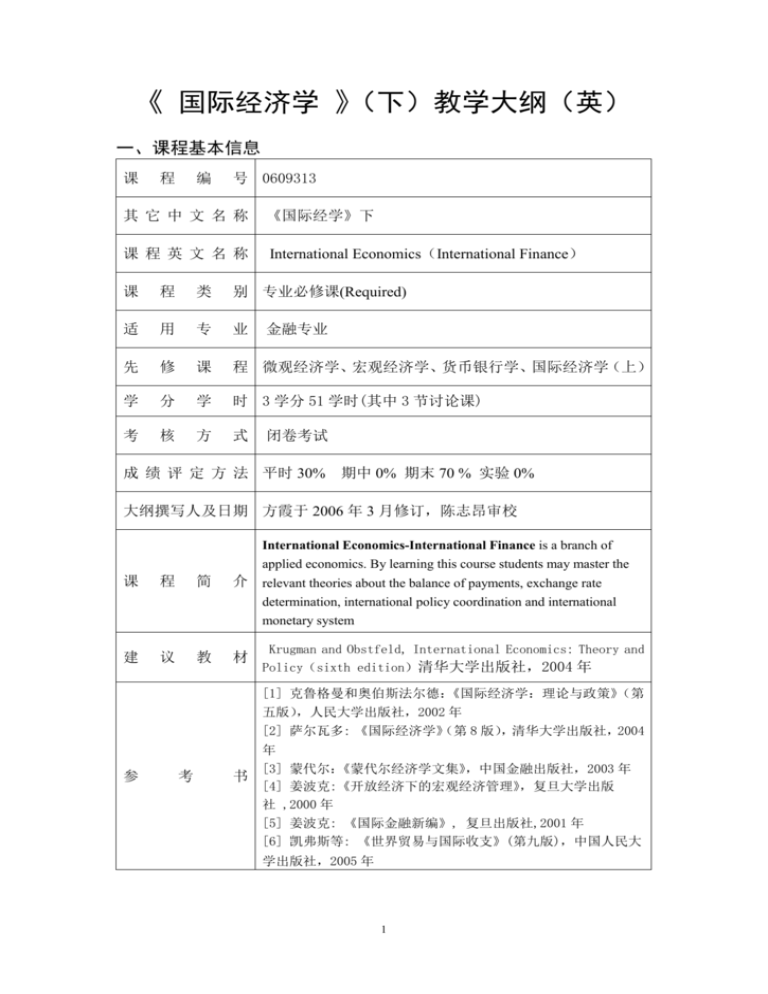

《 国际经济学 》 (下)教学大纲(英) 一、课程基本信息 课 程 编 号 0609313 其 它 中 文 名 称 《国际经学》下 课 程 英 文 名 称 International Economics(International Finance) 课 程 类 别 专业必修课(Required) 适 用 专 业 先 修 课 程 微观经济学、宏观经济学、货币银行学、国际经济学(上) 学 分 学 时 3 学分 51 学时(其中 3 节讨论课) 考 核 方 式 金融专业 闭卷考试 成 绩 评 定 方 法 平时 30% 期中 0% 期末 70 % 实验 0% 大纲撰写人及日期 方霞于 2006 年 3 月修订,陈志昂审校 International Economics-International Finance is a branch of applied economics. By learning this course students may master the 课 程 简 介 relevant theories about the balance of payments, exchange rate determination, international policy coordination and international monetary system 建 议 教 材 Krugman and Obstfeld, International Economics: Theory and Policy(sixth edition)清华大学出版社,2004 年 [1] 克鲁格曼和奥伯斯法尔德:《国际经济学:理论与政策》(第 五版) ,人民大学出版社,2002 年 [2] 萨尔瓦多: 《国际经济学》 (第 8 版) ,清华大学出版社,2004 年 参 考 书 [3] 蒙代尔: 《蒙代尔经济学文集》 ,中国金融出版社,2003 年 [4] 姜波克:《开放经济下的宏观经济管理》,复旦大学出版 社 ,2000 年 [5] 姜波克: 《国际金融新编》, 复旦出版社,2001 年 [6] 凯弗斯等: 《世界贸易与国际收支》(第九版),中国人民大 学出版社,2005 年 1 二、课程的对象和性质 课程对象:本课程适用于全日制金融专业本科生,拟于大三第一学期授课。 课程性质:本课程属于专业必修课。 三、Teaching purpose and requirements Grasping the theory and practice of international finance can give us a global perspective to the whole economy. The course’s basic goal is to make students set up the consciousness of international economical events, grasp the basic concepts and models of open-economy macroeconomics. The study of the theory of international economics generates an understanding of many key events that shape our domestic and international environment. In recent history, these events include the causes and consequences of the large current account deficits of the United States and the large current account surplus of the China; the dramatic appreciation of the dollar during the first half of the 1980s followed by its rapid depreciation in the second half of the 1980s; the Latin American debt crisis of the 1980s and the Mexico crisis in late 1994. Most recently, the financial crisis that began in East Asia in 1997 and spread to many countries around the globe and the Economic and Monetary Union in Europe have highlighted the way in which various national economies are linked and how important it is for us to understand these connections. The text material will enable students to understand the economic context in which such events occur. 四、Teaching methods 1. Case sduty: This course adopts two kinds of cases, firstly, logic case, be used in the course of giving lessons for stating the principle of International Finance; Secondly, comprehensive case, offer students independent research or panel discussion and finish the analysis report of the case. 2. Multimedia teaching: This course adopts multimedia teaching, is furnished with PPT courseware and audio-video teaching materials. 3. Reading, Write and Discussion: This course would offer students some material to read. Students should write 3 papers according these material and discuss together. 五、理论教学内容与基本要求(含学时分配) Chapter 12 National Income Accounting and the Balance of Payments 课时安排(Class hour):5 教学要求(teaching requirements of this chapter):This chapter begins with a brief discussion of international macroeconomics. Students should master concepts such as the Current Account, the Financial Account, the Capital Account, the Statistical Discrepancy, Official Reserve Transactions and the relationships between those accounts. At this chapter, students should be familiar with national income accounting theory and balance of payments accounting theory, and know well about the double-entry bookkeeping aspect of balance of payments accounting. A solid understanding of these topics proves useful in other parts of this course when students should understand important and timely issues such as the U.S. trade deficit, the China trade 2 surplus, global current account deficit and should frame a policy debate in the context of the accounting relationships presented in the chapter. 教学重点和难点(The key content and problem of this chapter) :The core of this chapter is a presentation of national income accounting theory and balance of payments accounting theory. The relationship between the current account, savings, investment, and the government budget deficit should be emphasized. 教学内容(Chapter Content): The National Income Accounts National Product and National Income Capital Depreciation, International Transfers, and Indirect Business Taxes Gross Domestic Product National Income Accounting in a Closed Economy Consumption Investment Government Purchases The National Income Identity for an Open Economy An Imaginary Open Economy The Current Account and Foreign Indebtedness Saving and the Current Account Private and Government Savings The Balance of Payments Accounts Examples of Paired Transactions The Fundamental Balance of Payments Identity The Current Account, Once Again The Financial Account The Capital Account The Statistical Discrepancy Official Reserve Transactions Chapter 13 Exchange Rates and the Foreign Exchange Market: An Asset Approach 课时安排(Class hour):4 教学要求(teaching requirement of this chapter):The purpose of this chapter is to show the importance of the exchange rate in translating foreign prices into domestic values as well as to begin the presentation of exchange-rate determination. Students should master concepts such as the Quotation, Basic Rate, Cross Rate, Arbitrage, Spot Rates, Forward Rates, Foreign Exchange Swaps and the relationships between these definitions. Students should know the uncovered interest parity and covered interest parity well. At this chapter, students should be familiar with the determination of the level of the exchange rate which is modeled in the context of the exchange rate's role as the relative price of foreign and domestic currencies, using the uncovered interest parity relationship. From this chapter, students should know the effect of changing current exchange rate on the expected returns, 3 the effect of changing interest rates on the current exchange rate, the effect of changing expectations on the current exchange rate. A solid understanding of those topics proves useful in other parts of this course when students should understand that Forward foreign-exchange trading, foreign-exchange futures contracts and foreign-exchange options play an important part in currency market activity and the use of these financial instruments to eliminate short-run exchange-rate risk is described. The text presents exercises on the effects of changes in interest rates and of changes in expectations of the future exchange rate. These exercises can help students understand that the initial result of a rise in U.S. interest rates is a higher demand for dollar-denominated assets and thus an increase in the price of the dollar. This dollar appreciation is large enough that the subsequent expected dollar depreciation just equalizes the expected return on foreign-currency assets (measured in dollar terms) and the higher dollar interest rate. 教学重点和难点(The key content and problem of this chapter):The core of this chapter is uncovered interest parity relationship and covered interest parity relationship. The effect of changing current exchange rate on the expected returns, the effect of changing interest rates on the current exchange rate, the effect of changing expectations on the current exchange rate should be emphasized. 教学内容(Chapter Content): Exchange Rates and International Transactions Definition and Quotation Basic Rate and Cross Rate The role of arbitrage The Foreign Exchange Market The Actors Characteristics of the Market Spot Rates and Forward Rates Foreign Exchange Swaps The Demand for Foreign Currency Assets Assets and Asset Returns Risk and Liquidity Interest Rates Exchange Rates and Asset Returns A Simple Rule Return, Risk, and Liquidity in the Foreign Exchange Market Equilibrium in the Foreign Exchange Market Interest Parity: The Basic Equilibrium Condition How Changes in the Current Exchange Rate Affect Expected Returns The Equilibrium Exchange Rate Interest Rates, Expectations, and Equilibrium The Effect of Changing Interest Rates on the Current Exchange Rate The Effect of Changing Expectations on the Current Exchange Rate Case study: The Perils of Forecasting Exchange Rates Chapter 14 Money, Interest Rates, and Exchange Rates 4 课时安排(Class hour): 5 教学要求(teaching requirement of this chapter):This chapter combines the foreign-exchange market model of the previous chapter with an analysis of the demand for and supply of money to provide a more complete analysis of exchange rate determination in the short run. Students should master concepts such as the long-run neutrality of money, nominal money supply, real money supply, overshooting model. Students should know money-market equilibrium and exchange-market equilibrium well. At this chapter, students should be familiar with how the domestic interest rate, determined in the domestic money market, affects the exchange rate through the interest parity mechanism in short-run. Students also should know the long-run effects of money supply changes and the combination of the long-run effects with the short-run static model. A solid understanding of those topics proves useful in other parts of this course when students should understand two cases: inflation and money supply growth in Latin America , money supply growth and hyperinflation in Bolivia . 教学重点和难点(The key content and problem of this chapter) :The core of this chapter is money-market equilibrium and exchange-market equilibrium in short-run and in long-run. The effect of changing money supply on the exchange rate in short-run and long-run and the combination of the long-run effects with the short-run static mode should be emphasized. The difficult part of this chapter is overshooting model. 教学内容(Chapter Content): Money Defined: A Brief Review Money as a Medium of Exchange Money as a Unit of Account Money as a Store of Value What is Money? How the Money Supply is Determined The Demand for Money by Individuals Expected Return Risk Liquidity Aggregate Money Demand The Equilibrium Interest Rate: The Interaction of Money Supply and Demand Equilibrium in the Money Market Interest Rates and the Money Supply Output and the Interest Rate The Money Supply and the Exchange Rate in the Short Run Linking Money, the Interest Rate, and the Exchange Rate U.S. Money Supply and the Dollar/Euro Exchange Rate Europe’s Money Supply and the Dollar/Euro Exchange Rate Money, the Price Level, and the Exchange Rate in the Long Run Money and Money Prices The Long-Run Effects of Money Supply Changes Empirical Evidence on Money Supplies and Price Levels Case study: Inflation and Money Supply Growth in Latin America 5 Money and the Exchange Rate in the Long Run Inflation and Exchange Rate Dynamics Short-Run Price Rigidity versus Long-Run Price Flexibility Case study: Money Supply Growth and Hyperinflation in Bolivia Permanent Money Supply Changes and the Exchange Rate Portfolio Balance Approach to the Exchange Rate Determination Stock versus Flow Analysis Exchange Rate Overshooting Chapter 15 Price Levels and the Exchange Rate in the Long Run 课时安排(Class hour):7 教学要求(teaching requirement of this chapter):The time frame of the analysis of exchange rate determination shifts to the long run in this chapter. Students should master concepts such as the law of one price, absolute PPP, relative PPP, real exchange rate and the relationship between these concepts. Students also should master the concept of the Fisher Effect and master how to calculate real exchange rate. At this chapter, students should be familiar with the long-run exchange-rate model based on PPP and the general model of long-run exchange rates beyond PPP. Students also should know the portfolio balance approach to the exchange rate determination. The model in this chapter provides an example of an increase in the interest rate associated with exchange rate depreciation. In contrast, the short-run analysis in chapter 14 provides an example of an increase in the domestic interest rate associated with an appreciation of the currency. Students should understand the different relationship between the exchange rate and the interest rate reflect different causes for the rise in the interest rate as well as different assumptions concerning price rigidity. Students also should understand why empirical evidence presented in the chapter suggests that both absolute and relative PPP perform poorly for the period since 1971 教学重点和难点(The key content and problem of this chapter) :The emphases of this chapter are the long-run exchange-rate model based on PPP and the general model of long-run exchange rates beyond PPP. The real interest parity and the portfolio balance approach to the exchange rate determination should be emphasized. The difficulty of this chapter is how to understand why an increase in the interest rate associates with exchange rate depreciation in this chapter, and associates with an appreciation of the currency in chapter 14. 教学内容(Chapter Content): The Law of One Price Purchasing Power Parity The Relationship Between PPP and the Law of One Price Absolute PPP and Relative PPP A Long-Run Exchange-Rate Model Based on PPP The Fundamental Equation of the Monetary Approach Ongoing Inflation, Interest Parity, and PPP The Fisher Effect Empirical Evidence on PPP and the Law of One Price Case study: Some Meaty Evidence on the Law of One Price 6 Explaining the Problems with PPP Trade Barriers and Nontradables Departures from Free Competition Case study: Hong Kong’s Surprisingly High Inflation International Differences in Price Level Measurement PPP in the Short Run and in the Long Run Case study Sticky Prices and the Law of One Price: Evidence From Scandinavian Duty-free Shops Case Study: Why Price Levels are Lower in Poorer Countries Beyond Purchasing Power Parity: A General Model of Long-Run Exchange Rates The Real Exchange Rate Demand, Supply, and the Long-Run Real Exchange Rate Nominal and Real Exchange Rates in Long-Run Equilibrium Case Study: Why Has the Yen Keep Rising? International Interest Rate Differences and the Real Exchange Rate Real Interest Parity Chapter 16 Output and the Exchange Rate in the Short Run 课时安排(Class hour):10 教学要求(teaching requirement of this chapter):This chapter integrates the previous analysis of exchange rate determination with a model of short-run output determination in an open economy. Students should master concepts such as Marshall-Lerner condition and the J-Curve, exchange-rate pass-through. Students also should know factors that shift the DD schedule and factors that shift the DD schedule well. At this chapter, students should be familiar with the output market equilibrium and asset market equilibrium in the Short Run, also should know short-run equilibrium for the economy. The effects of temporary policies as well as the short-run and long-run effects of permanent policies which can be studied in the context of the DD-AA model should be familiarized. A solid understanding of those topics proves useful in other parts of this course when students should understand the combination of the long-run analysis of a permanent monetary change in this chapter and the well-known Dornbusch overshooting. Students should understand the IS-LM model in open economy and the distinction between DD-AA model and IS-LM model. 教学重点和难点(The key content and problem of this chapter) :The emphases of this chapter are the effects of temporary policies and the short-run and long-run effects of permanent policies. The distinction between temporary and permanent, on the one hand, and between short run and long run, on the other, should be emphasized. 教学内容(Chapter Content): Determinants of Aggregate Demand in an Open Economy Determinants of Consumption Demand Determinants of the Current Account How Real Exchange Rate Changes Affect the Current Account How Disposable Income Changes Affect the Current Account The Equation of Aggregate Demand 7 The Real Exchange Rate and Aggregate Demand Real Income and Aggregate Demand How Output is Determined in the Short Run Output Market Equilibrium in the Short Run: The DD Schedule Output, the Exchange Rate, and Output Market Equilibrium Deriving the DD Schedule Factors that Shift the DD Schedule Asset Market Equilibrium in the Short Run: The AA Schedule Output, the Exchange Rate, and Asset Market Equilibrium Deriving the AA Schedule Factors that Shift the AA Schedule Short-Run Equilibrium for the Economy: Putting the DD and AA Schedules Together Temporary Changes in Monetary and Fiscal Policy Monetary Policy Fiscal Policy Policies to Maintain Full Employment Inflation Bias and Other Problems of Policy Formulation Permanent Shifts in Monetary and Fiscal Policy A Permanent Increase in the Money Supply Adjustment to a Permanent Increase in the Money Supply A Permanent Fiscal Expansion Case study: The Dollar Exchange Rate and the U.S. Economic Slowdown of 2000-1 Macroeconomic Policies and the Current Account Marshall-Lerner condition Gradual Trade Adjustment and Current Account Dynamics The J-Curve Exchange-Rate Pass-Through and Inflation The IS-LM and the DD-AA Model CHAPTER 17 Fixed Exchange Rates and Foreign Exchange Intervention 课时安排(Class hour):5 教学要求(teaching requirement of this chapter):Open-economy macroeconomic analysis under fixed exchange rates is dual to the analysis of flexible exchange rates. Students should master concepts such as Sterilized Intervention, Fixed Exchange Rate, Signaling Effect, Balance of Payments Crises , master foreign exchange market equilibrium and money market equilibrium under a fixed exchange rate At this chapter, students should be familiar with the short-run and long-run effects of devaluation and revaluation and different explanations of currency crises. The distinction between effects of sterilized intervention with perfect asset substitutability and with imperfect asset substitutability, under these two models how foreign exchange market get to equilibrium should be familiarized. Students should understand the reserve-currency systems and the gold standards and the key distinction between these systems, the pros and cons of the gold standard and the gold-exchange 8 standard, two cases in this chapter. 教学重点和难点(The key content and problem of this chapter) :The emphases of this chapter is the distinction between effects of sterilized intervention with perfect asset substitutability and with imperfect asset substitutability. Different explanations of currency crises also should be emphasized. 教学内容(Chapter Content): Why Study Fixed Exchange Rates? Central Bank Intervention and the Money Supply The Central Bank Balance Sheet and the Money Supply Foreign Exchange Intervention and the Money Supply Sterilization The Balance of Payments and the Money Supply How the Central Bank Fixes the Exchange Rate Foreign Exchange Market Equilibrium Under a Fixed Exchange Rate Money Market Equilibrium Under a Fixed Exchange Rate A Diagrammatic Analysis Stabilization Policies With a Fixed Exchange Rate Monetary Policy Fiscal Policy Changes in the Exchange Rate Adjustment to Fiscal Policy and Exchange Rate Changes Case Study: Fixing the Exchange Rate to Escape From a Liquidity Trap Balance of Payments Crises and Capital Flight Case: Mexico’s 1994 Balance of Payments Crisis Managed Floating and Sterilized Intervention Perfect Asset Substitutability and the Ineffectiveness of Sterilized Intervention Foreign Exchange Market Equilibrium Under Imperfect Asset Substitutability The Effects of Sterilized Intervention with Imperfect Asset Substitutability Evidence on the Effects of Sterilized Intervention The Signaling Effect of Intervention CHAPTER 18 The International Monetary System, 1870-1973 课时安排(Class hour):6 periods 教学要求(teaching requirement of this chapter):In this chapters students should master the concepts such as Internal Balance, External Balance, the Gold Standard, the Price-Specie-Flow Mechanism, Expenditure-Switching , Expenditure Changing-Policies, master how to get external balance and internal balance under the Gold Standard, under the Bretton Woods System. At this chapter, students should be familiar with the Price-Specie-Flow Mechanism and the Automatic Balance-of -Payments Adjustments under fixed exchange rates, using Expenditure-Changing and Expenditure-Switching policies to maintain internal balance and external balance. Students should understand why the Bretton Woods system, with its emphasis on infrequent 9 adjustment of fixed parities, restricted the use of expenditure-switching policies, and how the Bretton Woods system forced countries to "import" inflation from the United States and shows that the breakdown of the system occurred when countries were no longer willing to accept this burden. 教学重点和难点(The key content and problem of this chapter) :The emphases of this chapter are automatic balance-of-payments adjustments under the Gold Standard and under the Bretton Woods System. How to use Expenditure-Changing and Expenditure-Switching policies to maintain internal balance and external balance should be emphasized. 教学内容(Chapter Content): Macroeconomic Policy Goals in an Open Economy Internal Balance: Full Employment and Price-Level Stability External Balance: The Optimal Level of the Current Account The basic definition and content of International Monetary System The basic definition and content Gold standard and reserve standard International Macroeconomic Policy Under the Gold Standard, 1870-1914 Origins of the Gold Standard External Balance Under the Gold Standard The Price-Specie-Flow Mechanism The Gold Standard "Rules of the Game": Myth and Reality Internal Balance Under the Gold Standard The Interwar Years, 1918-1939 The German Hyperinflation The Fleeting Return to Gold International Economic Disintegration Case Study: The International Gold Standard and the Great Depression The Bretton Woods System and the International Monetary Fund Goals and Structure of the IMF Convertibility Internal and External Balance under the Bretton Woods System The Automatic Balance-of -Payments Adjustments under Fixed Exchange Rates Analyzing Policy Options under the Bretton Woods System Maintaining Internal Balance Maintaining External Balance Expenditure-Changing and Expenditure-Switching Policies CHAPTER 19 Macroeconomic Policy and Coordination under Floating Exchange Rates 课时安排(Class hour):3 教学要求(teaching requirement of this chapter):The floating exchange rate system in place since 1973 was not, in contrast with the Bretton Woods system, well planned before its inception. Students should master theoretical arguments for and against floating exchange rates discussed in this chapter. 10 At this chapter, students should be familiar with how to use the DD-AA model first presented in Chapter 16 to demonstrate that money-market shocks are less disruptive under a fixed exchange-rate regime than under a floating regime while output-market shocks are less disruptive under a floating exchange rate regime. A solid understanding of those topics proves useful in other parts of this course when students should understand two cases in this chapter, and why international policy-coordination fails. 教学重点和难点(The key content and problem of this chapter) :The emphases of this chapter are theoretical arguments for and against floating exchange rates, how to use the DD-AA model to demonstrate that money-market shocks are less disruptive under a fixed exchange-rate regime than under a floating regime. 教学内容(Chapter Content): The International Monetary System after the Bretton Woods system The Case For Floating Exchange Rates Monetary Policy Autonomy Symmetry Exchange Rates as Automatic Stabilizers The Case Against Floating Exchange Rates Discipline Destabilizing Speculation and Money Market Disturbances Injury to International Trade and Investment Uncoordinated Economic Policies The Illusion of Greater Autonomy Macroeconomic Interdependence Under a Floating Rate Case Study: Disinflation, Growth, Crisis, and Recession 1980 - 2001 Disinflation and the 1981 - 1983 Recession Fiscal Policies, the Current Account, and the Resurgence of Protectionism From the Plaza to the Louvre and Beyond: Trying to Manage Exchange Rates Global Slump Once Again, Recovery, Crisis, and Slowdown What Has Been Learned Since 1973? Monetary Policy Autonomy Symmetry The Exchange Rate as an Automatic Stabilizer Discipline Destabilizing Speculation International Trade and Investment Policy Coordination Are Fixed Exchange Rates Even an Option for Most Countries ? Directions for Reform CHAPTER 20 Optimum Currency Areas and the European Experience 课时安排(Class hour):3 periods 教学要求(teaching requirement of this chapter):The establishment of a common European currency and the debate over its possible benefits and costs was one of the key 11 economic topics of the 1990s. Students should master the idea of an optimum currency area, the GG Schedule, the LL Schedule. Students should be familiar with the decision to join a currency area. Students needed to understand the historical and institutional background of euro. 教学重点和难点(The key content and problem of this chapter) :The emphases of this chapter are the theory of optimum currency areas and using the GG-LL framework to analyze whether one economy should join a currency area. 教学内容(Chapter Content): How the European Single Currency Evolved European Currency Reform Initiatives, 1969-1978 The European Monetary System: 1979 to 1998 Germany Monetary Dominance and the Credibility Theory of the EMS The EU 1992 Initiative European Economic and Monetary Union The Euro and Economic Policy in the Euro Zone The Theory of Optimum Currency Areas Economic Integration and the Benefits of a Fixed Exchange Rate Area: The GG Schedule Economic Integration and the Costs of a Fixed Exchange Rate Area: The LL Schedule The Decision to Join a Currency Area: Putting the GG and LL Schedules Together What is an Optimum Currency Area? The Extent of Intra-European Trade The Future of EMU Discussion: 3 hours are distributed in the teaching period 12