College Accounting

advertisement

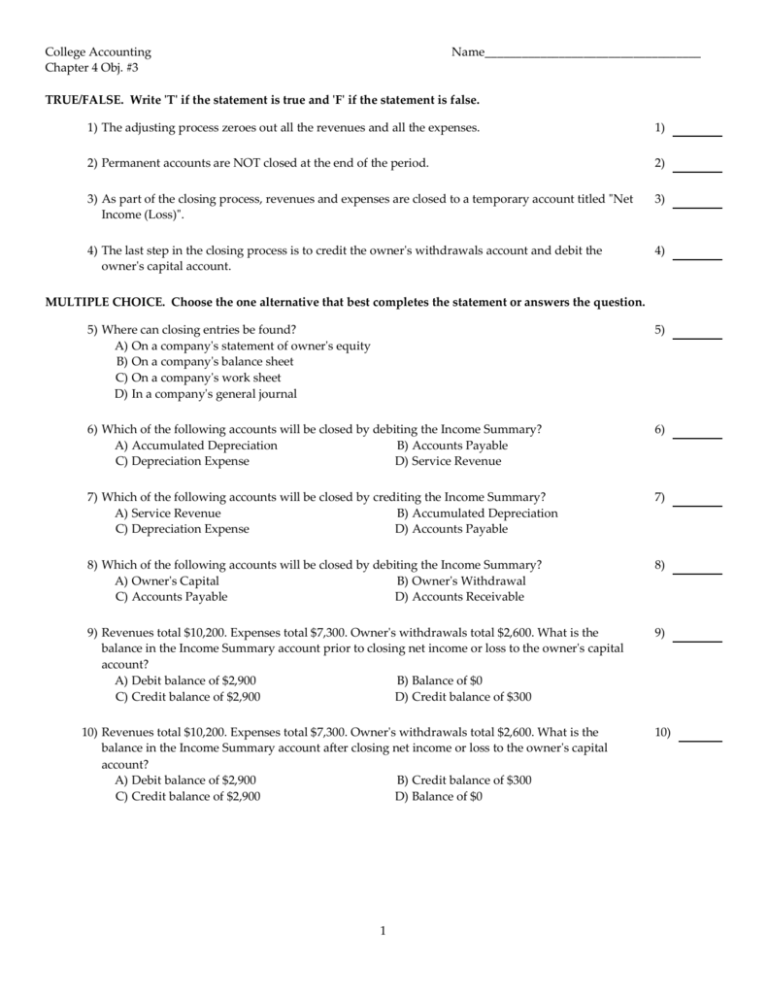

College Accounting Chapter 4 Obj. #3 Name___________________________________ TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1) The adjusting process zeroes out all the revenues and all the expenses. 1) 2) Permanent accounts are NOT closed at the end of the period. 2) 3) As part of the closing process, revenues and expenses are closed to a temporary account titled "Net Income (Loss)". 3) 4) The last step in the closing process is to credit the owner's withdrawals account and debit the owner's capital account. 4) MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 5) Where can closing entries be found? A) On a company's statement of owner's equity B) On a company's balance sheet C) On a company's work sheet D) In a company's general journal 5) 6) Which of the following accounts will be closed by debiting the Income Summary? A) Accumulated Depreciation B) Accounts Payable C) Depreciation Expense D) Service Revenue 6) 7) Which of the following accounts will be closed by crediting the Income Summary? A) Service Revenue B) Accumulated Depreciation C) Depreciation Expense D) Accounts Payable 7) 8) Which of the following accounts will be closed by debiting the Income Summary? A) Owner's Capital B) Owner's Withdrawal C) Accounts Payable D) Accounts Receivable 8) 9) Revenues total $10,200. Expenses total $7,300. Owner's withdrawals total $2,600. What is the balance in the Income Summary account prior to closing net income or loss to the owner's capital account? A) Debit balance of $2,900 B) Balance of $0 C) Credit balance of $2,900 D) Credit balance of $300 9) 10) Revenues total $10,200. Expenses total $7,300. Owner's withdrawals total $2,600. What is the balance in the Income Summary account after closing net income or loss to the owner's capital account? A) Debit balance of $2,900 B) Credit balance of $300 C) Credit balance of $2,900 D) Balance of $0 1 10) 11) Which of the following accounts are temporary accounts that must be closed at the end of the year? A) Assets, liabilities and owner's equity B) Revenues, expenses and owner's withdrawals C) Assets, liabilities and owner's withdrawals D) Revenues, expenses and owner's capital 11) 12) To what account is the balance in the Income Summary closed? A) The Income Summary is closed to the net income account. B) The Income Summary is closed to the owner's withdrawals account. C) The Income Summary is closed to the owner's capital or Retained Earnings account. D) None of the above. 12) 13) To what account is the balance in the owner's withdrawals account closed? A) The owner's withdrawals account is closed to the owner's capital account. B) The owner's withdrawals account is closed to the net income account. C) The owner's withdrawals account is closed to the cash account. D) The owner's withdrawals account is closed to the income summary account. 13) 14) Which account has a balance equal to net income immediately before it is closed? A) The Owner's Capital account B) The Income Summary account C) The Net Income account D) The Owner's Withdrawal account 14) 15) Which of the following entries will be necessary to close the appropriate insurance account at the end of the year? A) Debit Insurance Expense and credit Income Summary. B) Debit Income Summary and credit Insurance Expense. C) Debit Income Summary and credit Prepaid Insurance. D) Debit Prepaid Insurance and credit Income Summary. 15) 2 Answer Key Testname: CH4OBJ3 BELL RINGERS 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) FALSE TRUE FALSE TRUE D C A B C D B C A B B 3