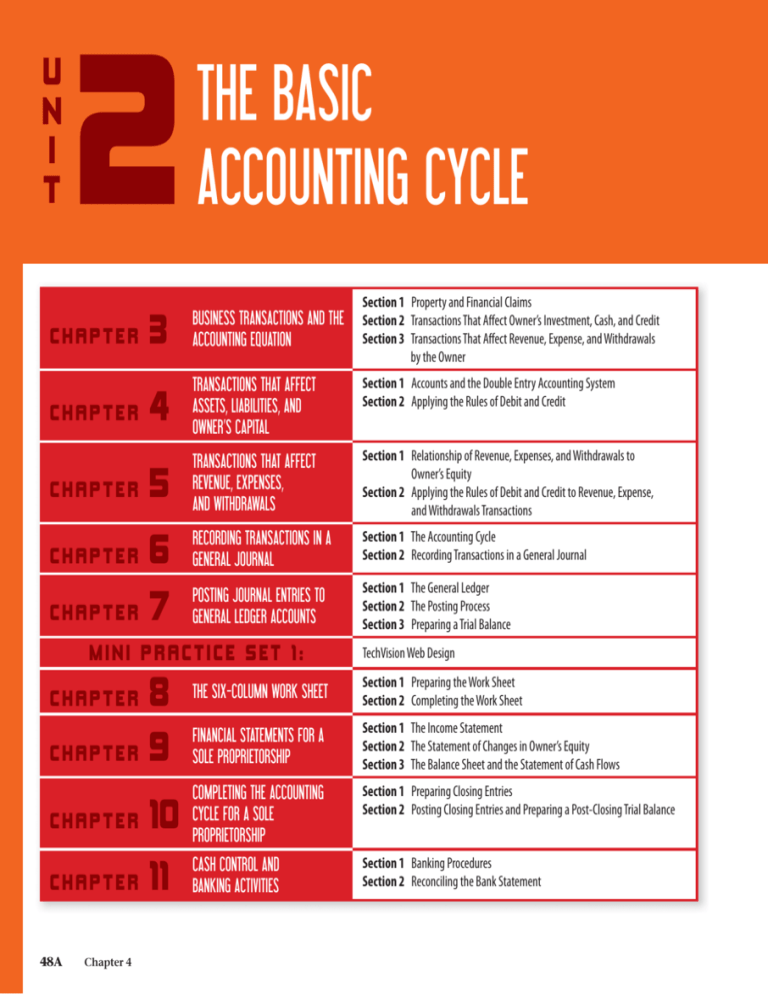

the basic accounting cycle

advertisement