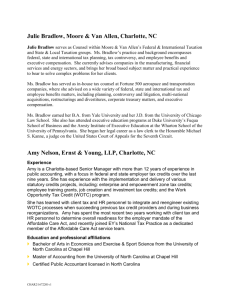

Presentation - Ivins, Phillips & Barker

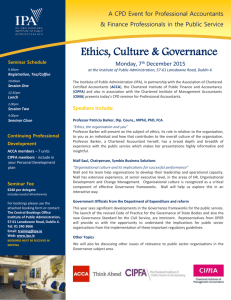

advertisement