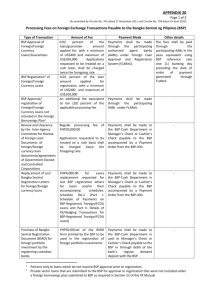

Manual of Regulations on Foreign Exchange Transactions

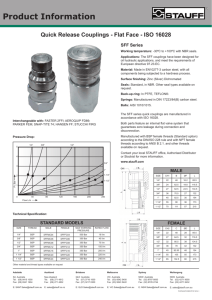

advertisement