Calculating Estimates at Completion

advertisement

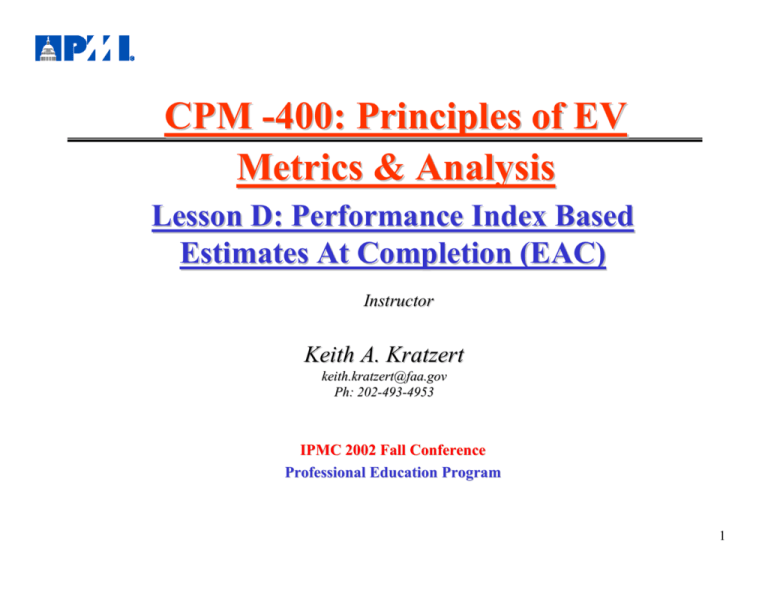

CPM -400: Principles of EV Metrics & Analysis Lesson D: Performance Index Based Estimates At Completion (EAC) Instructor Keith A. Kratzert keith. keith.kratzert@ kratzert@faa. faa.gov Ph: 202202-493493-4953 IPMC 2002 Fall Conference Professional Education Program 1 The Question • Ask any four EVM analysts for a point estimate for the contract cost at completion and you will get four different answers. • They will all be wrong! 2 Outline • What is an EAC? • How do we arrive at a number(s)? • How do we know whether the estimates are reasonable? • What does it look like graphically? • Summary 3 Questions Answered Past Present Are Arewe weon onschedule? schedule? Are Arewe weon oncost? cost? What Whatare arethe thesignificant significantvariances? variances? Why Whydo dowe wehave havevariances? variances? Who is responsible? Who is responsible? What Whatisisthe thetrend trendto todate? date? Future When Whenwill willwe wefinish? finish? What Whatwill willititcost costat atthe theend? end? How Howcan canwe wecontrol controlthe thetrend? trend? We analyze the past performance………to help us control the future 4 Basic Terminology R B I SV line Contract Budget Base $ PM eli s Ba 40 ne 60 15 25 Time WBS 30 C A E VAC BC WP Bas e M CA BAC BC WS P W AC t Con 30 t n u o cc A l ro CV 5 What is an EAC? 6 EAC Definitions • Actual direct costs, plus indirect costs allocable to the contract, plus the estimate of costs (direct and indirect) for authorized work remaining. (EVMIG) • The current estimated total cost for program authorized work. It equals actual cost to a point in time plus the estimated costs to completion. (ANSI-EIA-748) • The expected total cost of an activity, a group of activities, or the project when the defined scope of work has been completed. Most techniques for forecasting EAC include some adjustment to the original estimate based on project performance to date. (PMBOK® Guide 2000) 7 Where does an EAC come from? Estimate at Completion (EAC) – defined as actual cost to date + estimated cost of work remaining – contractor develops comprehensive EAC at least annually • reported by WBS in cost performance report – should examine on monthly basis – consider the following in EAC generation • performance to date • impact of approved corrective action plans • known/anticipated downstream problems • best estimate of the cost to complete remaining work – also called latest revised estimate (LRE), indicated final cost, etc. 8 EAC Reporting • Cost Performance Report (CPR) – Normal method of reporting EVM information • Cost/Schedule Status Report (C/SSR) – Alternative for smaller programs • OMB Exhibit 300 – New requirement for FY04 budget preparation 9 CPR Format 1 10 C/SSR 11 OMB Exhibit 300 12 Snake Chart Element: 2200 400.0 Complete Time Now Dollars In Thousands 1992 MEGA HERZ ELEC & VEN F04695-86-C-0050 RDPR FPI Cumulative Element Performance Name: SYS ENGINEERING 1993 300.0 200.0 100.0 0.0 BCWS BCWP ACWP/ETC 234.6 241.0 267.4 BAC LRE 283.4 283.4 13 Calculating an EAC 14 EAC Formula Basis EAC = Actual Costs Accrued to Date + Estimate of Costs to Complete 15 Contract Performance At Completion Index-Based Formula • EAC = ACWPcum + (BAC - BCWPcum)/Performance Index – ACWPcum = Actual Costs to Date – BAC - BCWPcum represents remaining work to be performed – Performance Index is used to adjust remaining work upwards/downwards since actual costs to date usually do not exactly equal budgets 16 EAC Formulas METHOD 1. CPI FORMULA BAC CPIC 2. Cumulative CPI * ACWPC + BAC - BCWPCum CPICum 3. Composite * ACWPC + BAC - BCWPCum CPICum X SPICum 4. Weighted 1 ACWPC + BAC - BCWPCum .8 CPICum + .2 SPICum 5. Weighted 2 ACWPC + BAC - BCWPCum .5 CPICum + .5 SPICum * The two equations defined by OMB for inclusion in Exhibit 300 17 Contract Performance At Completion Four types of Performance Indices: • Cost Performance Index (CPI) = BCWP/ACWP • Schedule Performance Index (SPI) = BCWP/BCWS • Schedule Cost Index (SCI) = SPI * CPI • Composite Index = W1 * SPI + W2 * CPI • Can be based on monthly, cumulative or averaged data 18 Calculating an EAC • Given a project that has BCWS = $2,080M, BCWP = $1,491M, ACWP = $1,950M, BAC of $4,046M, CPI of 0.76 and SPI of 0.72, calculate the EAC using each of the formulas that we have covered. Formula Result BAC/CPICum ACWPC + (BAC – BCWPCum/ CPICum) ACWPC + (BAC – BCWPCum/ CPICum X SPICum) ACWPC + (BAC – BCWPCum/ .8 CPICum + .2 SPICum) ACWPC + (BAC – BCWPCum/.5 CPICum + .5 SPICum) 19 Formula Applications EAC Formulas vs. Contract Stages Early & Middle EAC = ACWP + BCWR† EAC = BAC/CPI EAC = ACWPcum + BCWR / CPI * SPI * EAC = ACWPcum + BCWR / CPI(last 3 mos) Late EACcum = ACWPcum + BCWR / CPI * EACcum = ACWPcum + BCWR / CPI(last 3 mos avg) BCWR = Budgeted Cost of Work Remaining = BAC - BCWP *The two equations defined by OMB for inclusion in Exhibit 300 † 20 Assessing EAC realism 21 Reasonableness of EACs Assessing Reasonableness of Contractor’s EAC To-Complete Performance Index: TCPI to BAC TCPIBAC = (BAC - BCWPcum ) / (BAC - ACWPcum ) • Reveals level of efficiency required to complete remaining work within budgetary goal (BAC) • If TCPI > CPI more than 10%, and contract is more than 20% complete, then budgetary goal too optimistic 22 Reasonableness of EACs (Cont) Assessing Reasonableness of Contractor’s EAC (Con’t) To-Complete Performance Index - TCPI to EAC TCPIEAC = (BAC - BCWPcum ) / (EAC - ACWPcum ) • Reveals level of efficiency required to complete remaining work within EAC goal • If TCPI > CPIcum more than 10%, and contract is more than 20% complete, then contractor’s EAC goal too optimistic 23 Variance at Completion (VAC) ($) B AC E AC what the total job is supposed to cost what the total job is expected to cost VARIANCE thedifference differencebetween betweenwhat whatthe thetotal total VARIANCEAT ATCOMPLETION COMPLETIONisisthe job jobisissupposed supposedtotocost costand andwhat whatthe thetotal totaljob jobisisnow nowexpected expectedtotocost. cost. FORMULA: FORMULA: VAC VAC$$==BAC BAC--EAC EAC Example: Example: VAC VAC$$==$4,000 $4,000--$4,500 $4,500 VAC VAC$$==--$500 $500 (negative (negative==projected projectedoverrun) overrun) 24 Variance at Completion (VAC) (%) Convert ConvertVARIANCE VARIANCEAT ATCOMPLETION COMPLETIONtotoaapercentage: percentage: FORMULA: FORMULA: VAC VAC% %==BAC BAC--EAC EAC == VAC VAC BAC BAC BAC BAC Example: Example: VAC -13% VAC% %== -$500 -$500 == -13% $4,000 $4,000 The Thecomputer computerhas hasaaVAC VACofof-$500, -$500, which equates to -13% which equates to -13% 25 Assess EAC Realism? • Compare various statistical forecast for the current month, EACs range from 6,157K to 7,040K • Contractor’s EAC was 5,988K PAST SIX MONTHS From 6 period summary report Statistical and Independent Forecasts 3 PER AVG 6467.8 6 PER AVG 6329.8 CUM CPI 6329.8 CUR CPI 7053.4 COST & SCH 5652.6 LINEAR REG 6383.8 PERF FACTOR 5699.8 USER EAC 0.0 CPI*SPI 6202.1 MICOM EAC 5470.0 5777.2 5800.6 5800.6 5024.3 5376.4 5934.1 5671.9 0.0 5581.9 5470.0 6719.3 6539.2 6484.3 9009.5 5455.8 6314.3 5761.5 5455.8 5767.1 5815.1 7971.4 7663.2 7568.9 9271.7 6554.9 7339.1 6322.3 0.0 7522.7 7616.3 7171.6 6883.9 6840.9 5687.4 6302.1 7056.1 6267.5 0.0 6872.5 6915.7 6603.8 6833.0 6822.4 6156.9 6446.5 7039.5 6508.7 6822.4 6855.3 6866.0 26 EAC Realism Element: 3600 Dollars In Millions 8.0 1992 APR MEGA HERZ ELEC & VEN F04695-86-C-0050 RDPR FPI Estimates at Completion MAY JUN JUL AUG SEP OCT NOV DEC 1993 JAN Name: PCC Shows changes in BAC and EAC. Compares budget vs. contractor’s EAC. Software calculates EAC based on cum CPI. Compare this to the EAC. 7.0 Analysis: contractor increased the budget for this element twice. Contractor also increased the EAC twice, but NOT AS MUCH as the BAC. Based on past performance as reflected in the Cum CPI forecast for EAC, the contractor’s EAC is UNREALISTIC. 6.0 5.0 BAC LRE CUM CPI 5.1 5.4 5.1 5.1 5.4 5.7 5.1 5.4 5.9 5.1 5.4 6.0 5.1 5.5 6.3 5.1 5.5 5.8 5.1 5.5 6.5 5.5 5.7 7.6 5.5 5.7 6.8 5.8 6.0 6.8 27 How can you assess EAC realism? • Method 1: look at trend chart – compare BAC vs. EAC vs. Cum CPI forecast – portrays size of gap between contractor’s projected performance and past performance Element: 3600 Dollars In Millions 8.0 1992 APR MEGA HERZ ELEC & VEN F04695-86-C-0050 RDPR FPI Estimates at Completion MAY JUN JUL AUG SEP OCT NOV DEC 1993 JAN Name: PCC Calculated EAC where’s the miracle? 7.0 6.0 Contractor’s Estimate 5.0 BAC LRE CUM CPI 5.1 5.4 5.1 5.1 5.4 5.7 5.1 5.4 5.9 5.1 5.4 6.0 5.1 5.5 6.3 5.1 5.5 5.8 5.1 5.5 6.5 5.5 5.7 7.6 5.5 5.7 6.8 5.8 6.0 6.8 28 Compare CV to VAC Example 1: CV VAC -6% -13% Example 2: CV VAC -15% -8% Example 3: CV VAC -12% -12% I project that performance will get worse and result in a bigger overrun I project that performance will get better. I’ll have better cost efficiencies in the future than I do now. I project that performance will stay the same 29 How can you assess EAC Realism? • Method 2: compare following data CPIcum (past cost efficiency) TCPI-EAC (projected efficiency needed to come in at EAC) RULE OF THUMB EAC Realism View DESCRIPTION % Compl CV VAC VAC BAC LRE EAC (CPI) CPI TCPI-LRE CPI to LRE 1 SYS ENGINEERING 85.04 ↓ ↔ 0.0 283.4 283.4 314.4 0.901 2.650 -1.749 2 ENG DATA 38.51 ↓ ↔ 0.0 32.2 32.2 44.1 0.729 1.303 -0.573 3 DATA 72.60 ↓ ↔ -16.0 127.0 143.0 151.5 0.838 1.055 -0.216 4 COMMUNICATIONS 34.63 ↓ ↔ -87.0 2,043.0 2,130.0 2,420.8 0.844 1.034 -0.190 5 PCC 28.99 ↑ ↔ -187.2 5,800.6 5,987.8 6,822.4 0.850 1.027 -0.177 6 PROJ MANAGEMENT 62.79 ↓ ↔ -34.0 1,384.6 1,418.6 1,482.1 0.934 1.056 -0.122 CPI and TCPI should be within 10% of each other 30 How can you assess EAC Realism? • Method 3: Compare various statistical forecasts PAST SIX MONTHS From 6 period summary report Statistical and Independent Forecasts 3 PER AVG 6467.8 6 PER AVG 6329.8 CUM CPI 6329.8 CUR CPI 7053.4 COST & SCH 5652.6 LINEAR REG 6 383.8 PERF FACTOR 5699.8 USER EAC 0.0 CPI*SPI 6202.1 MICOM EAC 5470.0 5777.2 5800.6 5800.6 5024.3 5376.4 5934.1 5671.9 0.0 5581.9 5470.0 6719.3 6539.2 6484.3 9009.5 5455.8 6314.3 5761.5 5455.8 5767.1 5815.1 7971.4 7663.2 7568.9 9271.7 6554.9 7339.1 6322.3 0.0 7522.7 7616.3 7171.6 6883.9 6840.9 5687.4 6302.1 7056.1 6267.5 0.0 6872.5 6915.7 6603.8 6833.0 6822.4 6156.9 6446.5 7039.5 6508.7 6822.4 6855.3 6866.0 31 Evaluating an EAC • Given a project that has BCWS = $2,080M, BCWP = $1,491M, ACWP = $1,950M, BAC of $4,046M, CPI of 0.76 and SPI of 0.72, calculate the EAC using each of the formulas that we have covered. Formula Result BAC/CPICum ACWPC + (BAC – BCWPCum/ CPICum) ACWPC + (BAC – BCWPCum/ CPICum X SPICum) ACWPC + (BAC – BCWPCum/ .8 CPICum + .2 SPICum) ACWPC + (BAC – BCWPCum/.5 CPICum + .5 SPICum) • From our previous exercise – add one additional factor: contractor’s EAC = $4,400M 32 Estimates at Completion • Given: Contract more than 15% complete -– Overrun at completion will not be less than overrun incurred to date – Percent overrun at completion will be greater than percent overrun incurred to date • Conclusion: You can’t recover; but you can mitigate further damage!! • Why: If you underestimated in the near term, there is little hope you did better on the far term planning 33 Survey Says….. • over 800 programs show that .… no program has ever improved performance better than the following EAC calculation EAC = BAC / CPI at 15% complete point in program no one pays enough attention in the early stages! 34 EAC Graphics 1 Element: 1000 MEGA HERZ ELEC & VEN F04695-86-C-0050 RDPR FPI EAC Dollars In Millions 1992 APR MAY JUN JUL AUG SEP OCT NOV DEC 1993 JAN 17.0 LRE CUM CPI 15.0 COST SCH 16.0 CPI*SPI 15.0 17.0 16.4 19.4 22.8 17.0 17.3 18.0 18.9 17.0 17.4 17.8 18.4 17.1 18.6 18.2 19.1 17.1 17.0 17.1 17.1 17.1 19.0 17.5 17.7 17.3 20.0 19.9 21.7 19.4 21.2 21.2 22.1 20.8 22.3 22.2 23.2 24.0 Name: MOH-2 23.0 22.0 21.0 20.0 19.0 18.0 17.0 16.0 15.0 14.0 35 EAC Graphics 2 Element: 3 Dollars In Millions 24.0 2001 AUG Sensis Corporation DTFA01-01-C-0001 RDTE CPIF EAC 2002 SEP OCT NOV DEC JAN FEB MAR APR MAY JUN JUL 17.8 18.5 18.7 19.2 23.0 21.6 21.5 21.7 22.8 22.3 22.1 22.4 23.0 22.9 22.7 23.0 Name: ASDE-X 23.0 22.0 21.0 20.0 19.0 18.0 17.0 17.5 LRE CUM CPI 18.5 COST SCH 18.7 CPI*SPI 19.2 17.8 18.5 18.6 18.9 19.0 19.5 19.5 19.8 20.0 20.1 20.2 20.4 20.7 20.3 20.3 20.6 21.2 21.1 21.0 21.4 21.3 21.4 21.2 21.6 22.2 21.8 21.6 21.9 36 EAC Graphics 3 Element: 3.5 Dollars In Millions 6.0 2001 AUG Sensis Corporation DTFA01-01-C-0001 RDTE CPIF EAC 2002 FEB MAR APR SEP OCT NOV DEC JAN Name: Test & Eval MAY JUN JUL 4.5 4.7 4.4 4.9 4.7 5.0 4.7 5.3 4.8 5.0 4.8 5.2 5.0 4.0 3.0 2.0 LRE CUM CPI COST SCH CPI*SPI 2.0 2.8 2.7 3.5 2.0 2.9 3.0 4.3 2.2 2.9 3.0 4.2 2.7 3.1 3.2 4.1 2.8 3.1 3.1 3.6 3.2 3.7 3.7 4.6 3.4 4.4 4.2 5.3 3.5 4.3 4.0 4.6 4.0 4.2 4.0 4.4 37 Summary 38 Summary • No single equation gives the correct answer • Need to evaluate a range of EACs • Need to consider – – – – Actuals to date Performance to date Cost and Schedule Variances Organizational Culture • In evaluating EACs – Look at trend charts – Compare data (CV, VAC, TCPI) – Compare statistical forecasts 39