GAAP – Monetary Measurement This discussion focuses on the

advertisement

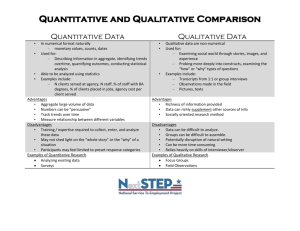

GAAP – Monetary Measurement This discussion focuses on the objectives, description and application of this principle. Examples will be given to strengthen the understanding and capability to apply this principle at real situation. Objective: To distinguish the qualitative and quantitative transactions which have to be recorded in the financial statements. Furthermore, the concept stated that the monetary unit is presumed to be stable over time. Description: - Only financial transactions are recorded - Money is the common denominator of economic activity - Non financial data are ignored - Qualitative data are ignored - No allowance for changing prices - Ignore some important economic information Application: For recording, accountants must be clear which transaction is qualitative and quantitative so that it may not have bias in the full picture of the report. Since investors, managers, government and general public take the financial statement as a reference in analyzing the performance of company, all the quantitative transactions should be included in order to fulfill the reliability of the financial statement. Example 1: A company has confirmed to issue 100,000 shares at $50 per share since they will have a joint-project with Venetian and the company expected to invest $5 million in the project. All the preparations have been finished but the issuance of the stock can only be carried out in Feburary next year. If you are the manager, should you include this ‘qualitative’ transaction in your financial statement at the end of this year? Ans: No. Explanation: If you include this transaction, you will make the following entry: Dr Cash $5m Cr Common stock $5m In your financial statements, it will show an increase in both cash and common stock of $5m. Investors of your company will be misled by this information and they may make wrong decision on their investment. Therefore, instead of considering it as a quantitative transaction, full disclosure should be attached that the $5m issuance of stock will only be taken place in the following year. In this way, the investors can have a clear idea about the future prospect and development of the company and they can make their own choice on whether they should make their investment now or buy the newly issued shares of the company in February. Example 2: A new manager might improve employee morale and the improved morale might improve the performance of the business. Should this attitude be recorded in the financial statement? Ans: No Explanation: Unlike the purchase of a new asset, the improved morale cannot be accurately expressed in monetary terms and therefore will not be recorded in the financial statements. The key thing is that accountants only record and measure financial transactions, even though there are many other things that are happening in a company that are important. Example 3 This principle also assumes the unit of measure is stable in which changes in its general purchasing power are not considered sufficiently important to require adjustments to the basic financial statements. In other words, it ignores the time value of money. A piece of land which was worth $500,000 was bought last year. The value of the land has increased 20%. What adjustment has to be made in the Statement of Financial Position? Ans: The cost of land is still $500,000. Explanation: With the concept of ‘a dollar today is worth more than a dollar tomorrow’ (to be learnt in the Financial Management Course in Year 2), we can have the following assumptions: a. In not recording the new value (still using the historical cost) which means there is no adjustment in inflation or deflation, the current market value cannot be revealed in the financial statements. b. Since there is no adjustment in inflation or deflation if you base on the monetary measurement concept. Therefore, the market value of the company can be greater or less than the amount of equity at different economic situations. Final Comments: If it is the matter of market value of short term investment, Fair Value Accounting can be applied. In dealing with the qualitative transactions, disclosure documents can be attached for reference. In general, application of this concept depends on the even more basic assumption that quantitative data are useful in communicating economic information and in making rational economic decisions. Note 1: Fair Value Accounting: Fair Value Accounting can be applied in the valuation of short-term investments. Shortterm investments are adjusted to current market value at the end of each financial period. 'Unrealized Gain (Loss) on Investment' is recorded under stockholders' equity in the Balance Sheet. Since income tax has to be levied on gains and losses, therefore, the gain/loss will only be appeared in the Income Statement when the investments are sold. In the meantime, the gain/loss which has not been confirmed should still be placed in the stockholders' equity.