Annual Report 2014 - 7

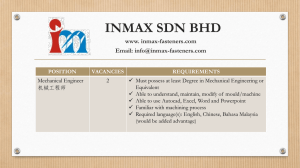

advertisement