AGB WorldTraveler brochure

advertisement

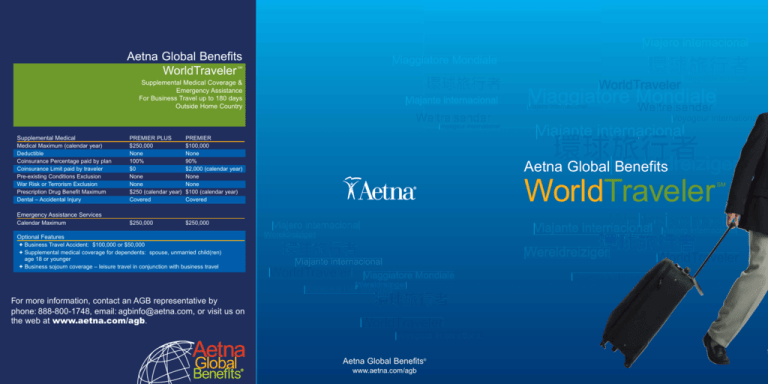

Aetna Global Benefits WorldTraveler SM Supplemental Medical Coverage & Emergency Assistance For Business Travel up to 180 days Outside Home Country Supplemental Medical Medical Maximum (calendar year) Deductible Coinsurance Percentage paid by plan Coinsurance Limit paid by traveler Pre-existing Conditions Exclusion War Risk or Terrorism Exclusion Prescription Drug Benefit Maximum Dental – Accidental Injury PREMIER PLUS $250,000 None 100% $0 None None $250 (calendar year) Covered PREMIER $100,000 None 90% $2,000 (calendar year) None None $100 (calendar year) Covered $250,000 $250,000 Aetna Global Benefits WorldTraveler Emergency Assistance Services Calendar Maximum Optional Features + Business Travel Accident: $100,000 or $50,000 + Supplemental medical coverage for dependents: spouse, unmarried child(ren) age 18 or younger + Business sojourn coverage – leisure travel in conjunction with business travel For more information, contact an AGB representative by phone: 888-800-1748, email: agbinfo@aetna.com, or visit us on the web at www.aetna.com/agb. Aetna Global Benefits® www.aetna.com/agb SM Aetna Global Benefits WorldTraveler A worldwide operations executive from U.S. Headquarters is sent on a 3-month assignment to oversee his company’s joint venture with a major Chinese manufacturer. If a health situation arises, what will his U.S.-based medical insurance cover? All urgent health situations? Just emergency care? Or is there no coverage outside the U.S.? State-of-the-art member services available to AGB WorldTraveler members: International Service Center While traveling to Brazil for a week-long series of meetings, a German businessman experiences chest pains. Upon arriving in Sao Paulo, he is rushed to the hospital. Is he covered by his German national insurance plan? International business travel is a routine component of today’s global economy; and with Aetna Global Benefits (AGB) WorldTraveler, your employees can depend on a global insurance solution for peace of mind when they travel internationally. What is AGB WorldTraveler? Designed to supplement the medical benefits plan in an employee’s home country, AGB WorldTraveler provides short-term medical coverage and emergency assistance as well as access to AGB’s state-of-the-art member services that includes the 24x7 International Service Center and industry-leading online health and security tools. At any time of the day or night, AGB WorldTraveler participants can contact representatives in the AGB International Member Service Center via toll-free phone, fax or email for assistance with a variety of claims, benefits and health-related issues. Our multilingual, multicultural staff has the ability to translate virtually any language in real-time, as well as initiate claim payments in multiple currencies, ensuring that communication and international benefit payment transactions are handled in a professional manner. Global Provider Community AGB WorldTraveler allows you to choose from two plan designs for business travel of up to 6 months: Premier Plus and Premier, both of which provide: • Optional Features, including: supplemental coverage for dependents, sojourn coverage for employees and dependents when connected with business travel, and business travel accident coverage AGB WorldTraveler also provides access to industry-leading Internet-based services that can help your employees obtain important information for both planning their trips or short-term assignments and locating and managing health care while away from home, including: + Global doctor/hospital search engine (more than 3,000 providers in over 500 international destinations; more than 518,000 physicians and 3,300 hospitals in the United States) + Health and security information for over 200 countries • Supplemental Medical coverage • Emergency Assistance, 24 hours a day, 365 days a year—be it medical or otherwise, AGB’s emergency assistance component gives your employees the comfort of knowing that there is help for virtually any situation, including: + Emergency medical evacuations + Medical provider referrals + Translation services + Legal referrals + Assistance with lost or stolen travel documents + Repatriation, and more Web Tools & Information AGB has established relationships with leading hospitals and health networks throughout the world to help members easily access and pay for global health care. AGB works both independently and with customers and members to identify hospitals and facilities in order to establish direct pay arrangements, making it easier for members to concentrate on their assignment during a business trip outside their home country. Who is Aetna Global Benefits? + Translation guides for drug and medical terms in multiple languages + Global news and feature stories + U.S. health information from Harvard Medical School + Claim forms + Answers to frequently asked questions + Contact phone numbers and email addresses Aetna Global Benefits (AGB), the international health and group benefits business of Aetna Inc., has more than 30 years experience in the global marketplace, offering innovative solutions for an international workforce. Providing worldwide medical, dental, vision, life, disability and related coverage and emergency assistance for global employees, AGB products are tailored to meet the unique needs of global members, helping multinational employers attract and retain qualified employees for international assignments.